Answered step by step

Verified Expert Solution

Question

1 Approved Answer

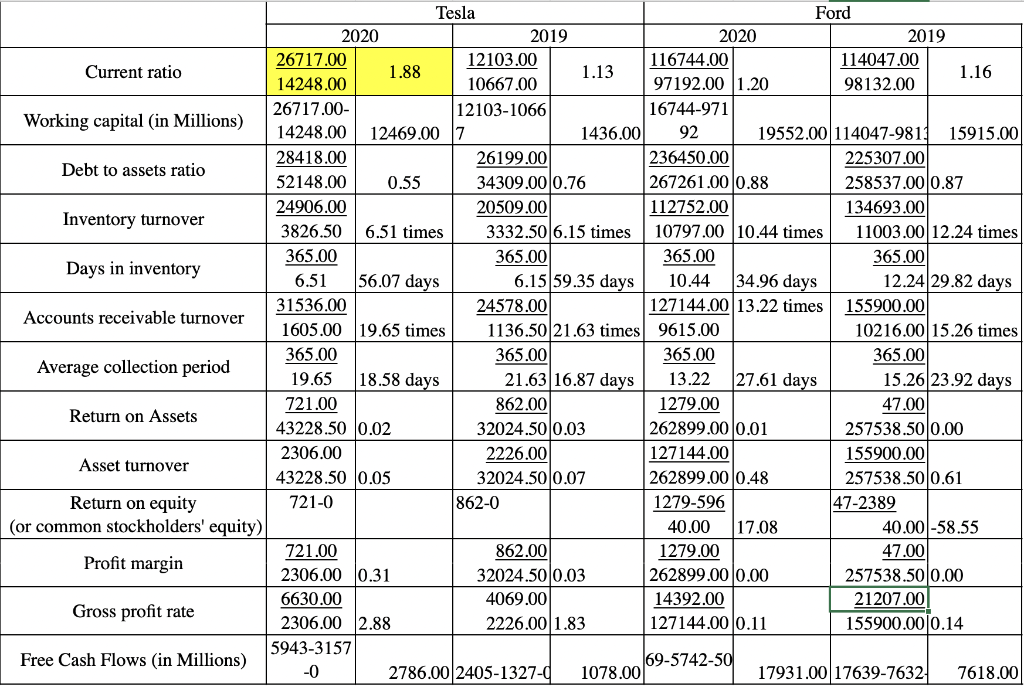

Based on the ratios calculated in the excel sheet, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency,

Based on the ratios calculated in the excel sheet, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency, operational efficiency, and profitability. Ensure to choose right ratios to discuss a specific part. -Find the relationships among ratios and trends over the two years compared. Also, compare these relationships and trends with those of Ford.

Please make sure to explain a little bit about the four discussion parts.

Tesla Ford 2020 2019 2020 2019 26717.00 12103.00 116744.00 114047.00 Current ratio 1.88 1.13 1.16 14248.00 10667.00 97192.00 1.20 98132.00 26717.00- 12103-1066 16744-971 Working capital (in Millions) 14248.00 12469.00 7 1436.00 92 19552.00 114047-9811 15915.00 28418.00 26199.00 236450.00 225307.00 Debt to assets ratio 52148.00 0.55 34309.00 0.76 267261.000.88 258537.00 0.87 24906.00 20509.00 112752.00 134693.00 Inventory turnover 3826.50 6.51 times 3332.50 6.15 times 10797.00 10.44 times 11003.00 12.24 times 365.00 365.00 365.00 365.00 Days in inventory 6.51 56.07 days 6.15 59.35 days 10.44 34.96 days 12.24 29.82 days 31536.00 24578.00 127144.00 13.22 times 155900.00 Accounts receivable turnover 1605.00 19.65 times 1136.50 21.63 times 9615.00 10216.00 15.26 times 365.00 365.00 365.00 365.00 Average collection period 19.65 18.58 days 21.63|16.87 days 13.22 27.61 days 15.2623.92 days 721.00 862.00 1279.00 47.00 Return on Assets 43228.50 0.02 32024.50 0.03 262899.000.01 257538.500.00 2306.00 2226.00 127144.00 155900.00 Asset turnover 43228.50 0.05 32024.500.07 262899.000.48 257538.50 0.61 Return on equity 721-0 862-0 1279-596 47-2389 (or common stockholders' equity) 40.00 17.08 40.00 -58.55 721.00 862.00 1279.00 47.00 Profit margin 2306.00 0.31 32024.50 0.03 262899.000.00 257538.500.00 6630.00 4069.00 14392.00 21207.00 Gross profit rate 2306.00 2.88 2226.00 1.83 127144.000.11 155900.000.14 5943-3157 Free Cash Flows (in Millions) 69-5742-50 -0 2786.00 2405-1327-0 1078.00 17931.00 17639-7632 7618.00 Tesla Ford 2020 2019 2020 2019 26717.00 12103.00 116744.00 114047.00 Current ratio 1.88 1.13 1.16 14248.00 10667.00 97192.00 1.20 98132.00 26717.00- 12103-1066 16744-971 Working capital (in Millions) 14248.00 12469.00 7 1436.00 92 19552.00 114047-9811 15915.00 28418.00 26199.00 236450.00 225307.00 Debt to assets ratio 52148.00 0.55 34309.00 0.76 267261.000.88 258537.00 0.87 24906.00 20509.00 112752.00 134693.00 Inventory turnover 3826.50 6.51 times 3332.50 6.15 times 10797.00 10.44 times 11003.00 12.24 times 365.00 365.00 365.00 365.00 Days in inventory 6.51 56.07 days 6.15 59.35 days 10.44 34.96 days 12.24 29.82 days 31536.00 24578.00 127144.00 13.22 times 155900.00 Accounts receivable turnover 1605.00 19.65 times 1136.50 21.63 times 9615.00 10216.00 15.26 times 365.00 365.00 365.00 365.00 Average collection period 19.65 18.58 days 21.63|16.87 days 13.22 27.61 days 15.2623.92 days 721.00 862.00 1279.00 47.00 Return on Assets 43228.50 0.02 32024.50 0.03 262899.000.01 257538.500.00 2306.00 2226.00 127144.00 155900.00 Asset turnover 43228.50 0.05 32024.500.07 262899.000.48 257538.50 0.61 Return on equity 721-0 862-0 1279-596 47-2389 (or common stockholders' equity) 40.00 17.08 40.00 -58.55 721.00 862.00 1279.00 47.00 Profit margin 2306.00 0.31 32024.50 0.03 262899.000.00 257538.500.00 6630.00 4069.00 14392.00 21207.00 Gross profit rate 2306.00 2.88 2226.00 1.83 127144.000.11 155900.000.14 5943-3157 Free Cash Flows (in Millions) 69-5742-50 -0 2786.00 2405-1327-0 1078.00 17931.00 17639-7632 7618.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started