Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the ratios provided, discuss trends in the company's liquidity position, including its ability to pay current liabilities, and trends in its ability to

Based on the ratios provided, discuss trends in the company's liquidity position, including its ability to pay current liabilities, and trends in its ability to pay long-term debts.

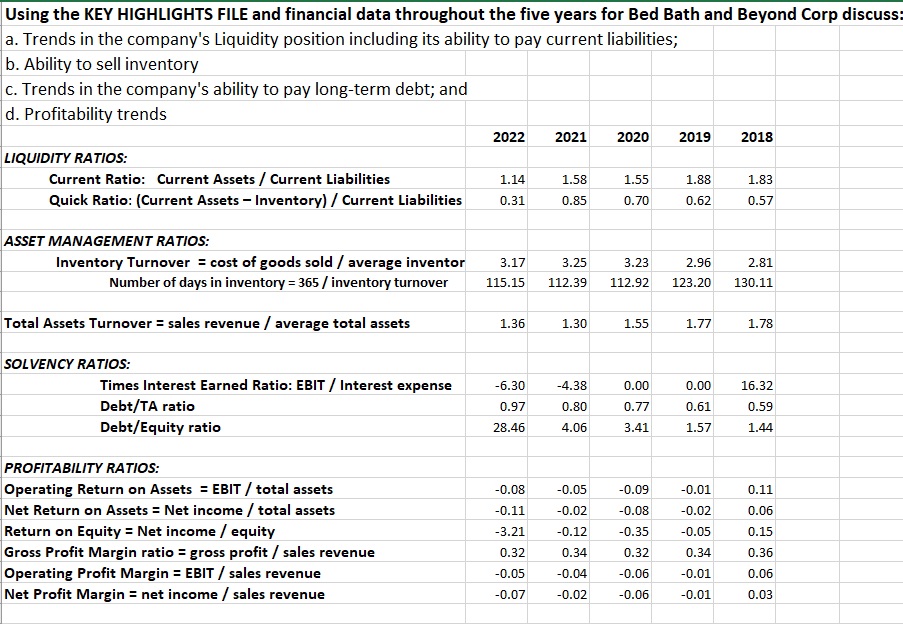

Using the KEY HIGHLIGHTS FILE and financial data throughout the five years for Bed Bath and Beyond Corp discuss: a. Trends in the company's Liquidity position including its ability to pay current liabilities; b. Ability to sell inventory c. Trends in the company's ability to pay long-term debt; and d. Profitability trends 2022 2021 2020 2019 2018 LIQUIDITY RATIOS: Current Ratio: Current Assets / Current Liabilities 1.14 1.58 1.55 1.88 1.83 Quick Ratio: (Current Assets - Inventory) / Current Liabilities 0.31 0.85 0.70 0.62 0.57 ASSET MANAGEMENT RATIOS: Inventory Turnover = cost of goods sold / average inventor Number of days in inventory = 365/ inventory turnover Total Assets Turnover = sales revenue/ average total assets 3.17 3.25 3.23 2.96 2.81 115.15 112.39 112.92 123.20 130.11 1.36 1.30 1.55 1.77 1.78 SOLVENCY RATIOS: Times Interest Earned Ratio: EBIT / Interest expense Debt/TA ratio -6.30 -4.38 0.00 0.00 16.32 0.97 0.80 0.77 0.61 0.59 Debt/Equity ratio 28.46 4.06 3.41 1.57 1.44 PROFITABILITY RATIOS: Operating Return on Assets = EBIT / total assets -0.08 -0.05 -0.09 -0.01 0.11 Net Return on Assets = Net income / total assets -0.11 -0.02 -0.08 -0.02 0.06 Return on Equity = Net income / equity -3.21 -0.12 -0.35 -0.05 0.15 Gross Profit Margin ratio = gross profit / sales revenue 0.32 0.34 0.32 0.34 0.36 Operating Profit Margin = EBIT / sales revenue -0.05 -0.04 -0.06 -0.01 0.06 Net Profit Margin = net income / sales revenue -0.07 -0.02 -0.06 -0.01 0.03

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started