Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the recent increase in residential property prices in Dublin a company has decided to diverse its investment portfolio and invest in property.

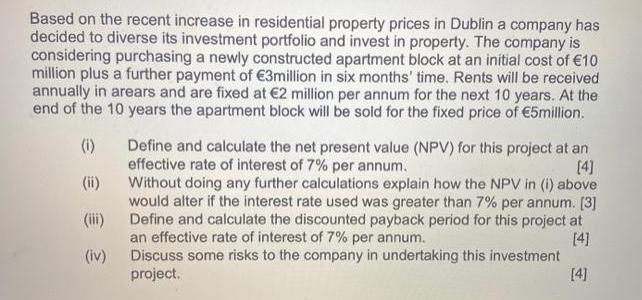

Based on the recent increase in residential property prices in Dublin a company has decided to diverse its investment portfolio and invest in property. The company is considering purchasing a newly constructed apartment block at an initial cost of 10 million plus a further payment of 3million in six months' time. Rents will be received annually in arears and are fixed at 2 million per annum for the next 10 years. At the end of the 10 years the apartment block will be sold for the fixed price of 5million. (i) (ii) (iii) (iv) Define and calculate the net present value (NPV) for this project at an effective rate of interest of 7% per annum. [4] Without doing any further calculations explain how the NPV in (i) above would alter if the interest rate used was greater than 7% per annum. [3] Define and calculate the discounted payback period for this project at an effective rate of interest of 7% per annum. [4] Discuss some risks to the company in undertaking this investment project. [4]

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started