Answered step by step

Verified Expert Solution

Question

1 Approved Answer

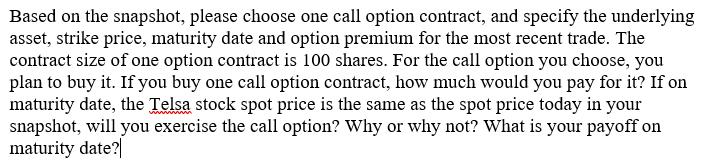

Based on the snapshot, please choose one call option contract, and specify the underlying asset, strike price, maturity date and option premium for the

Based on the snapshot, please choose one call option contract, and specify the underlying asset, strike price, maturity date and option premium for the most recent trade. The contract size of one option contract is 100 shares. For the call option you choose, you plan to buy it. If you buy one call option contract, how much would you pay for it? If on maturity date, the Telsa stock spot price is the same as the spot price today in your snapshot, will you exercise the call option? Why or why not? What is your payoff on maturity date? Contract Name TSLA210129C00200000 Last Trade Date 2021-01-21 11:59AM EST TSLA210129C00350000 2021-01-20 12:42PM EST TSLA210129C00360000 2021-01-22 2:19PM EST TSLA210129C00370000 2021-01-22 10:23AM EST TSLA210129C00390000 2021-01-219:49AM EST TSLA210129C00410000 2021-01-21 10:14AM EST 2021-01-22 12:08PM EST 2021-01-19 12:20PM EST TSLA210129C00430000 TSLA210129C00440000 2021-01-21 3:46PM EST TSLA210129C00450000 2021-01-22 3:34PM EST TSLA210129C00460000 2021-01-19 9:46AM EST 2021-01-19 11:38AM EST TSLA210129C00480000 2021-01-19 3:36PM EST TSLA210129C00400000 TSLA210129C00470000 TSLA210129C00490000 2021-01-21 3:49PM EST TSLA210129C00500000 2021-01-22 3:57PM EST TSLA210129C00510000 2021-01-19 2:32PM EST Strike 200.00 350.00 360.00 370.00 390.00 400.00 410.00 430.00 440.00 450.00 460.00 470.00 480.00 490.00 500,00 510.00 Last Price Bid Ask Change Change Volume 647.35 633.60 634.85 0.00 499.30 495.95 497.30 0.00 478.40 472.20 473.00 -6.75 466.35 475.95 477.30 9.40 455.50 455.95 457.30 0.00 448.45 445.95 447.30 0.00 426 60 435.95 437.30 -8.65 361.565 366.00 367.35 409.41 415.95 417.30 0.00 406.21 406.00 407.30 0.00 395.33 396.00 397.30 -1.33 -0.34% 388.75 386.00 387.35 0.00 369.40 376.00 377.35 0.00 -1.39% -1.98% 0.00 -1.99% 355.72 356.00 357.40 0.00 347.50 346.05 347.40 +0,13 +0.04% 0.00 329.60 336.05 337.45 2 2 1 3 1 2 7 1 6 2 " 7 4 14 8 Open Interest 0 6 0 7 5 6 4 10 10 46 5 5 9 14 67 14 implied Volatility 0.00% 294,43% 0.00% 277.15% 260.84% 252.93% 245.22% 230.37% 150.00% 143.75% 153.91% 149.22% 143.75% 145.70% 145.31% 143.75%

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Based on the snapshot provided I would choose the call option contract with the following det...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started