Answered step by step

Verified Expert Solution

Question

1 Approved Answer

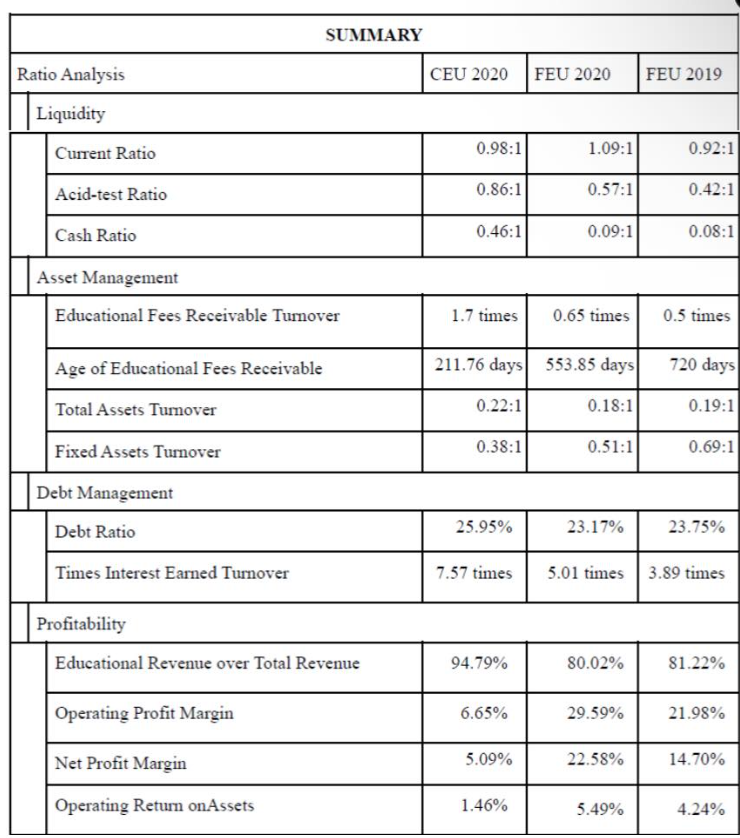

based on the summary, which institution is performing better? FEU or CEU? kindly answer for debt management and profitability SUMMARY Ratio Analysis CEU 2020 FEU

based on the summary, which institution is performing better? FEU or CEU?

kindly answer for debt management and profitability

SUMMARY Ratio Analysis CEU 2020 FEU 2020 FEU 2019 Liquidity Current Ratio 0.98:1 1.09:1 0.92:1 Acid-test Ratio 0.86:1 0.57:1 0.42:1 Cash Ratio 0.46:1 0.09:1 0.08:1 Asset Management Educational Fees Receivable Turnover 1.7 times 0.65 times 0.5 times Age of Educational Fees Receivable 211.76 days 553.85 days 720 days Total Assets Turnover 0.22:1 0.18:1 0.19:1 Fixed Assets Turnover 0.38:1 0.51:1 0.69:1 Debt Management Debt Ratio 25.95% 23.17% 23.75% Times Interest Earned Turnover 7.57 times 5.01 times 3.89 times Profitability Educational Revenue over Total Revenue 94.79% 80.02% 81.22% Operating Profit Margin 6.65% 29.59% 21.98% Net Profit Margin 5.09% 22.58% 14.70% Operating Return onAssets 1.46% 5.49% 4.24%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started