Answered step by step

Verified Expert Solution

Question

1 Approved Answer

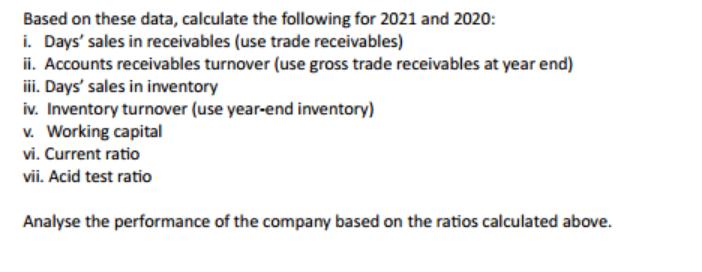

Based on these data, calculate the following for 2021 and 2020: i. Days' sales in receivables (use trade receivables) ii. Accounts receivables turnover (use

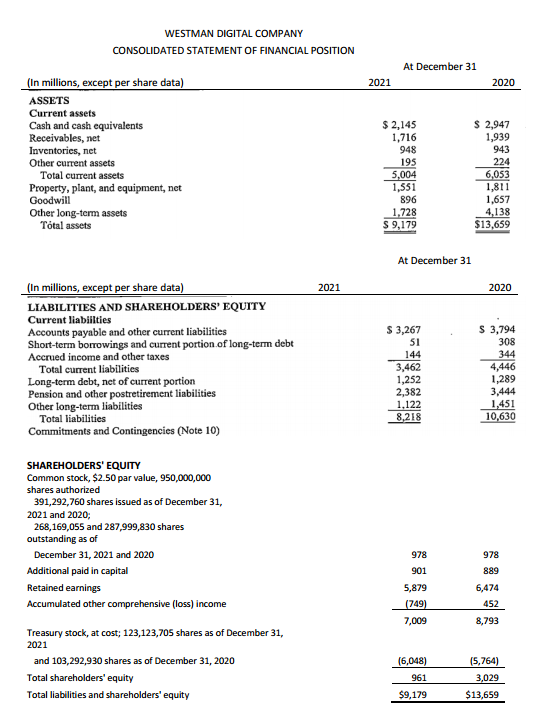

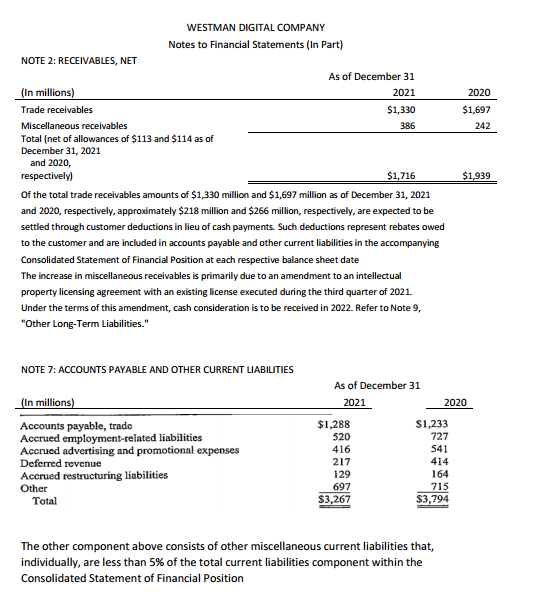

Based on these data, calculate the following for 2021 and 2020: i. Days' sales in receivables (use trade receivables) ii. Accounts receivables turnover (use gross trade receivables at year end) iii. Days' sales in inventory iv. Inventory turnover (use year-end inventory) v. Working capital vi. Current ratio vii. Acid test ratio Analyse the performance of the company based on the ratios calculated above. WESTMAN DIGITAL COMPANY CONSOLIDATED STATEMENT OF FINANCIAL POSITION (In millions, except per share data) ASSETS Current assets Cash and cash equivalents Receivables, net Inventories, net Other current assets Total current assets Property, plant, and equipment, net Goodwill Other long-term assets Total assets (In millions, except per share data) LIABILITIES AND SHAREHOLDERS' EQUITY Current liabiilties Accounts payable and other current liabilities Short-term borrowings and current portion of long-term debt Accrued income and other taxes Total current liabilities Long-term debt, net of current portion Pension and other postretirement liabilities Other long-term liabilities Total liabilities Commitments and Contingencies (Note 10) SHAREHOLDERS' EQUITY Common stock, $2.50 par value, 950,000,000 shares authorized 391,292,760 shares issued as of December 31, 2021 and 2020; 268,169,055 and 287,999,830 shares outstanding as of December 31, 2021 and 2020 Additional paid in capital Retained earnings Accumulated other comprehensive (loss) income Treasury stock, at cost; 123,123,705 shares as of December 31, 2021 and 103,292,930 shares as of December 31, 2020 Total shareholders' equity Total liabilities and shareholders' equity 2021 2021 At December 31 $ 2,145 1,716 948 195 5,004 1,551 896 1,728 $9,179 At December 31 $ 3,267 51 144 3,462 1,252 2,382 1,122 8,218 978 901 5,879 (749) 7,009 (6,048) 961 $9,179 2020 $ 2,947 1,939 943 224 6,053 1,811 1,657 4,138 $13,659 2020 $ 3,794 308 344 4,446 1,289 3,444 1,451 10,630 978 889 6,474 452 8,793 (5,764) 3,029 $13,659 NOTE 2: RECEIVABLES, NET (In millions) Trade receivables WESTMAN DIGITAL COMPANY Notes to Financial Statements (In Part) Miscellaneous receivables Total (net of allowances of $113 and $114 as of December 31, 2021 and 2020, respectively) NOTE 7: ACCOUNTS PAYABLE AND OTHER CURRENT LIABILITIES $1,716 Of the total trade receivables amounts of $1,330 million and $1,697 million as of December 31, 2021 and 2020, respectively, approximately $218 million and $266 million, respectively, are expected to be settled through customer deductions in lieu of cash payments. Such deductions represent rebates owed to the customer and are included in accounts payable and other current liabilities in the accompanying Consolidated Statement of Financial Position at each respective balance sheet date The increase in miscellaneous receivables is primarily due to an amendment to an intellectual property licensing agreement with an existing license executed during the third quarter of 2021. Under the terms of this amendment, cash consideration is to be received in 2022. Refer to Note 9, "Other Long-Term Liabilities." (In millions) Accounts payable, trade Accrued employment-related liabilities Accrued advertising and promotional expenses Deferred revenue Accrued restructuring liabilities Other Total As of December 31 2021 $1,330 386 As of December 31 2021 $1,288 520 416 217 129 697 $3,267 $1,233 727 541 414 164 715 $3,794 The other component above consists of other miscellaneous current liabilities that, individually, are less than 5% of the total current liabilities component within the Consolidated Statement of Financial Position 2020 $1,697 242 2020 $1,939

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the ratios requested i Days sales in receivables 2021 Trade receivable...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started