Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on these images, please prepare a tax return, including all necessary forms. Appendix E Practice Set Assignments Comprehensive Tax Return Problems PROBLEM 1 Steven

Based on these images, please prepare a tax return, including all necessary forms.

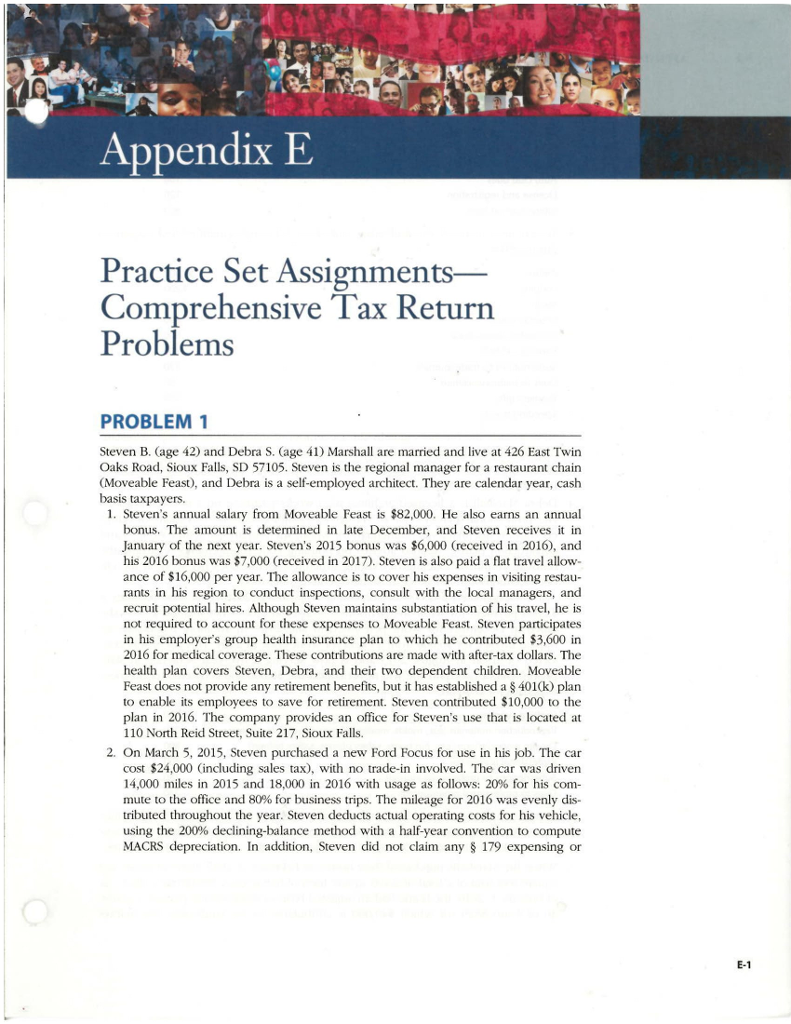

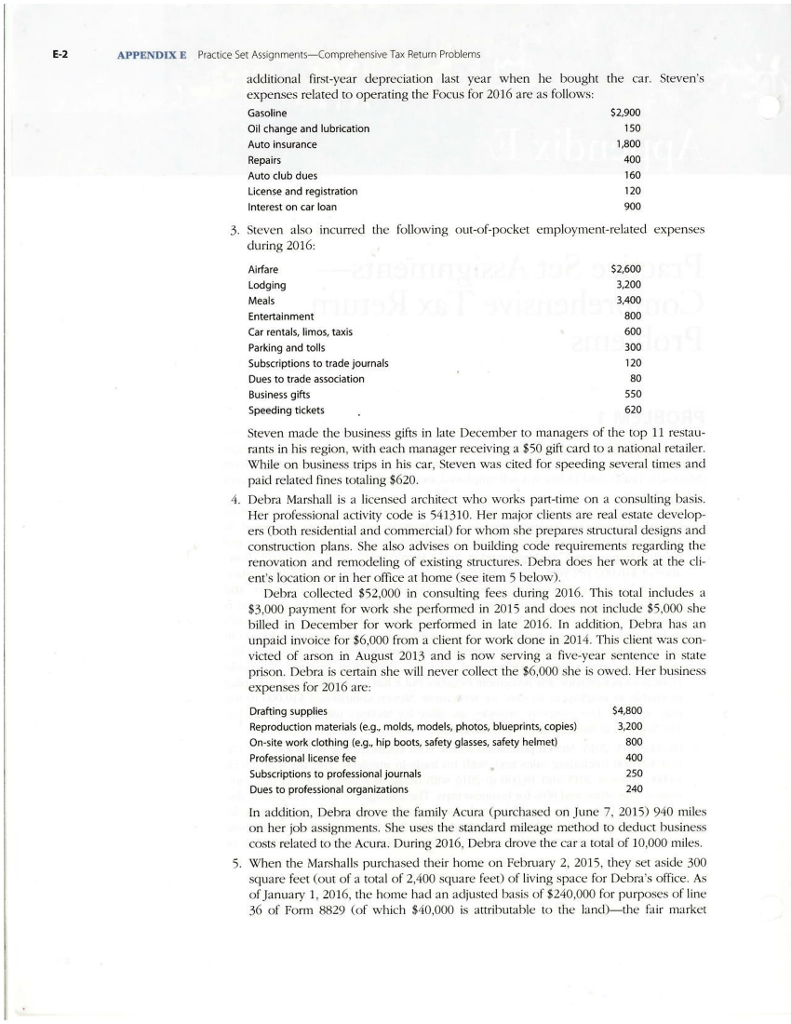

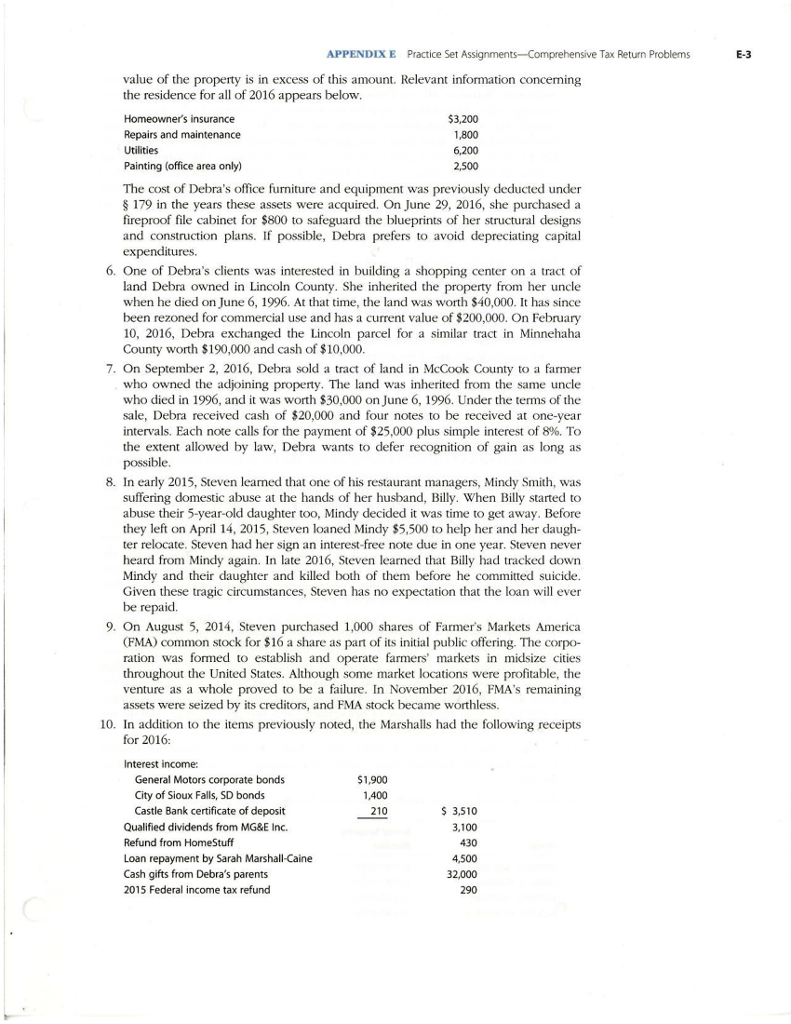

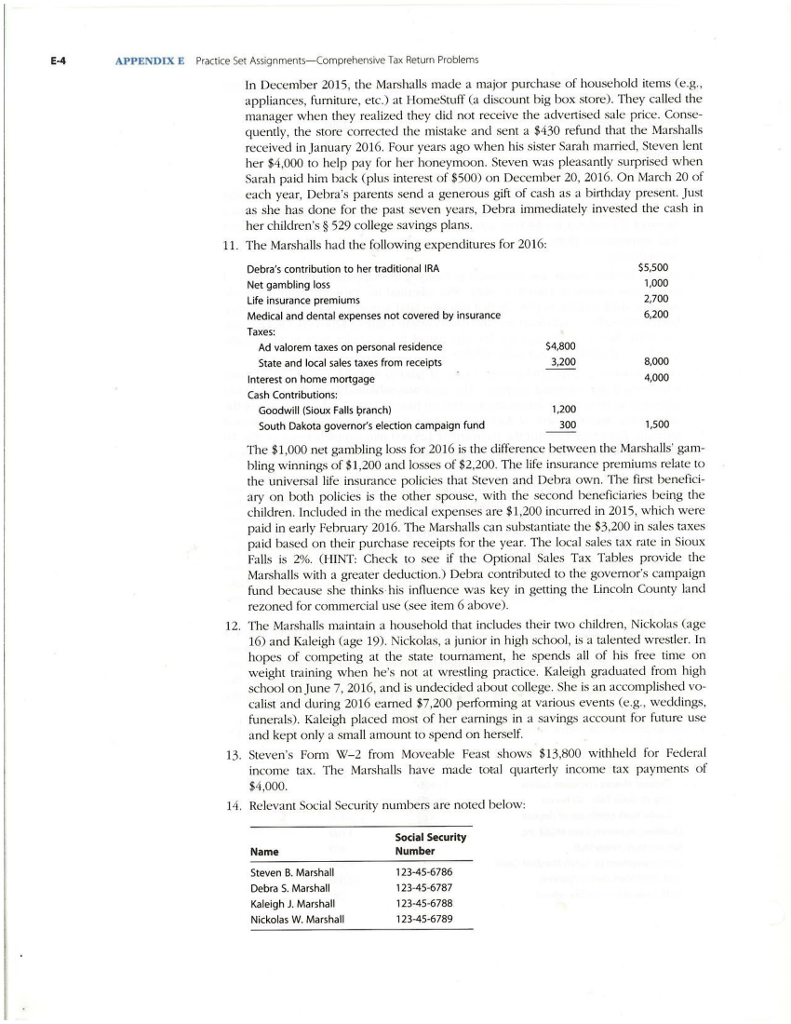

Appendix E Practice Set Assignments Comprehensive Tax Return Problems PROBLEM 1 Steven B. (age 42) and Debra S. (age 41) Marshall are married and live at 426 East Twin Oaks Road, Sioux Falls, SD 57105. Steven is the regional manager for a restaurant chairn Moveable Feast), and Debra is a self-employed architect. They are calendar year, cash basis taxpayers. 1. Steven's annual salary from Moveable Feast is $82,000. He also earns an annual bonus. The amount is determined in late December, and Steven receives it in January of the next year. Steven's 2015 bonus was $6,000 Creceived in 2016), and his 2016 bonus was $7,000 (received in 2017). Steven is also paid a flat travel allow ance of $16,000 per year. The allowance is to cover his expenses in visiting restau- rants in his region to conduct inspections, consult with the local managers, and recruit potential hires. Although Steven maintains substantiation of his travel, he is not required to account for these expenses to Moveable Feast. Steven participates in his employer's group health insurance plan to which he contributed $3,600 in 2016 for medical coverage. These contributions are made with after-tax dollars. The health plan covers Steven, Debra, and their two dependent children. Moveable Feast does not provide any retirement benefits, but it has established a 401(k) plan to enable its employees to save for retirement. Steven contributed $10,000 to the plan in 2016. The company provides an office for Steven's use that is located at 110 North Reid Street, Suite 217, Sioux Falls 2. On March 5, 2015, Steven purchased a new Ford Focus for use in his job. The car cost $24,000 (including sales tax), with no trade-in involved. The car was driven 14,000 miles in 2015 and 18,000 in 2016 with usage as follows: 20% for his com- mute to the office and 80% for business trips. The mileage for 2016 was evenly dis- tributed throughout the year. Steven deducts actual operating costs for his vehicle using the 200% declining-balance method with a half-year convention to compute MACRS depreciation. In addition, Steven did not claim any 179 expensing or Appendix E Practice Set Assignments Comprehensive Tax Return Problems PROBLEM 1 Steven B. (age 42) and Debra S. (age 41) Marshall are married and live at 426 East Twin Oaks Road, Sioux Falls, SD 57105. Steven is the regional manager for a restaurant chairn Moveable Feast), and Debra is a self-employed architect. They are calendar year, cash basis taxpayers. 1. Steven's annual salary from Moveable Feast is $82,000. He also earns an annual bonus. The amount is determined in late December, and Steven receives it in January of the next year. Steven's 2015 bonus was $6,000 Creceived in 2016), and his 2016 bonus was $7,000 (received in 2017). Steven is also paid a flat travel allow ance of $16,000 per year. The allowance is to cover his expenses in visiting restau- rants in his region to conduct inspections, consult with the local managers, and recruit potential hires. Although Steven maintains substantiation of his travel, he is not required to account for these expenses to Moveable Feast. Steven participates in his employer's group health insurance plan to which he contributed $3,600 in 2016 for medical coverage. These contributions are made with after-tax dollars. The health plan covers Steven, Debra, and their two dependent children. Moveable Feast does not provide any retirement benefits, but it has established a 401(k) plan to enable its employees to save for retirement. Steven contributed $10,000 to the plan in 2016. The company provides an office for Steven's use that is located at 110 North Reid Street, Suite 217, Sioux Falls 2. On March 5, 2015, Steven purchased a new Ford Focus for use in his job. The car cost $24,000 (including sales tax), with no trade-in involved. The car was driven 14,000 miles in 2015 and 18,000 in 2016 with usage as follows: 20% for his com- mute to the office and 80% for business trips. The mileage for 2016 was evenly dis- tributed throughout the year. Steven deducts actual operating costs for his vehicle using the 200% declining-balance method with a half-year convention to compute MACRS depreciation. In addition, Steven did not claim any 179 expensing orStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started