Answered step by step

Verified Expert Solution

Question

1 Approved Answer

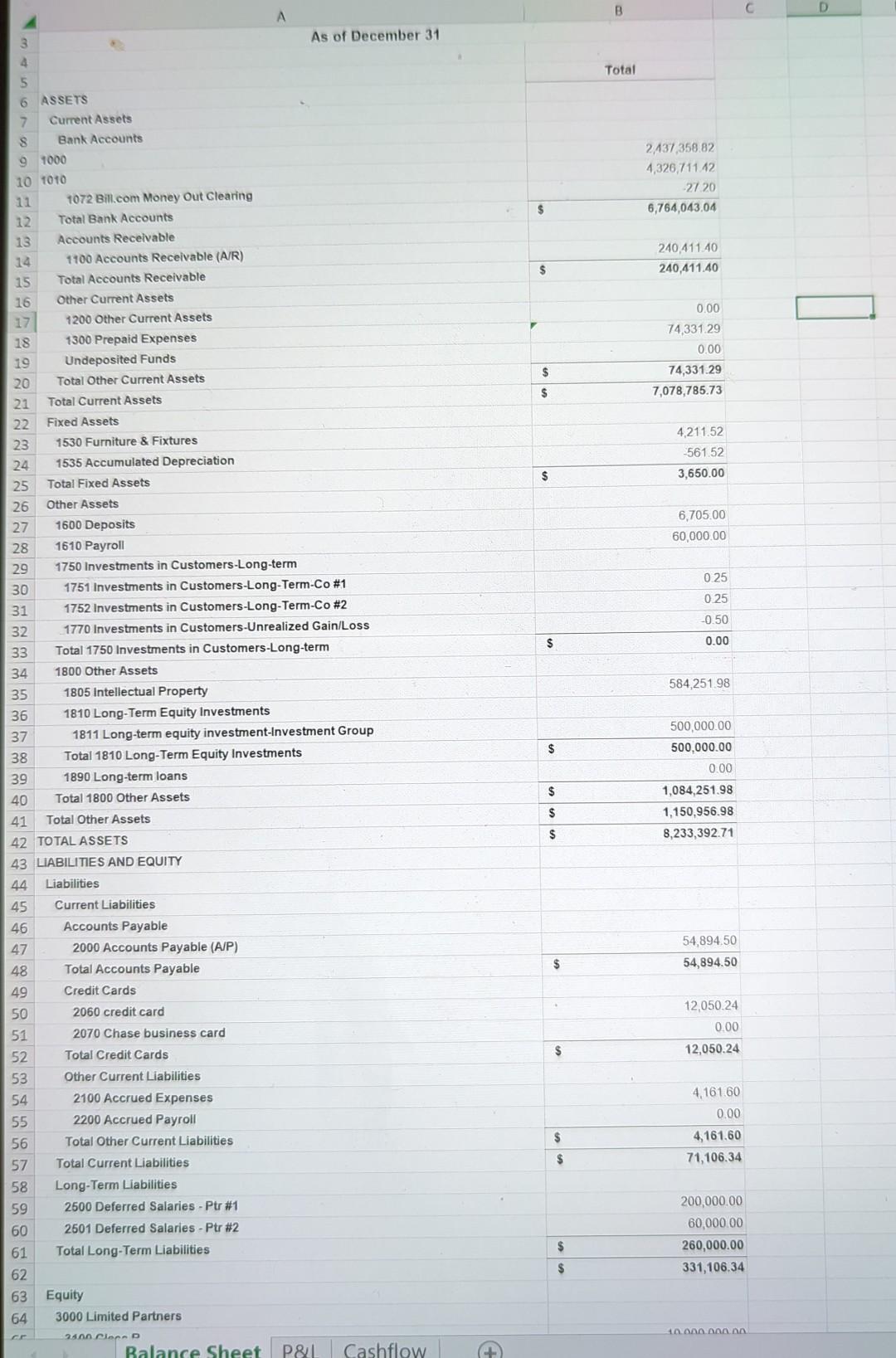

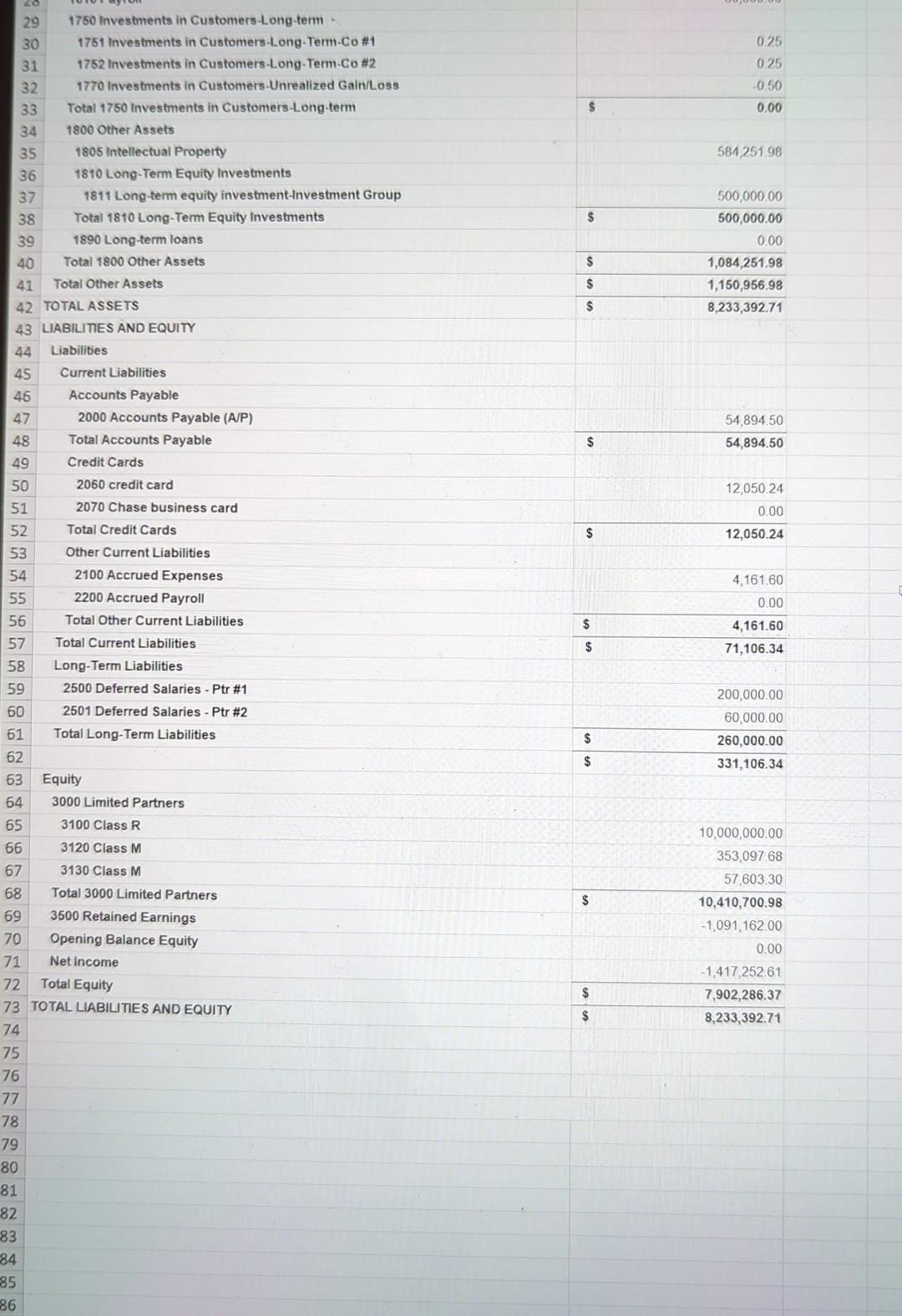

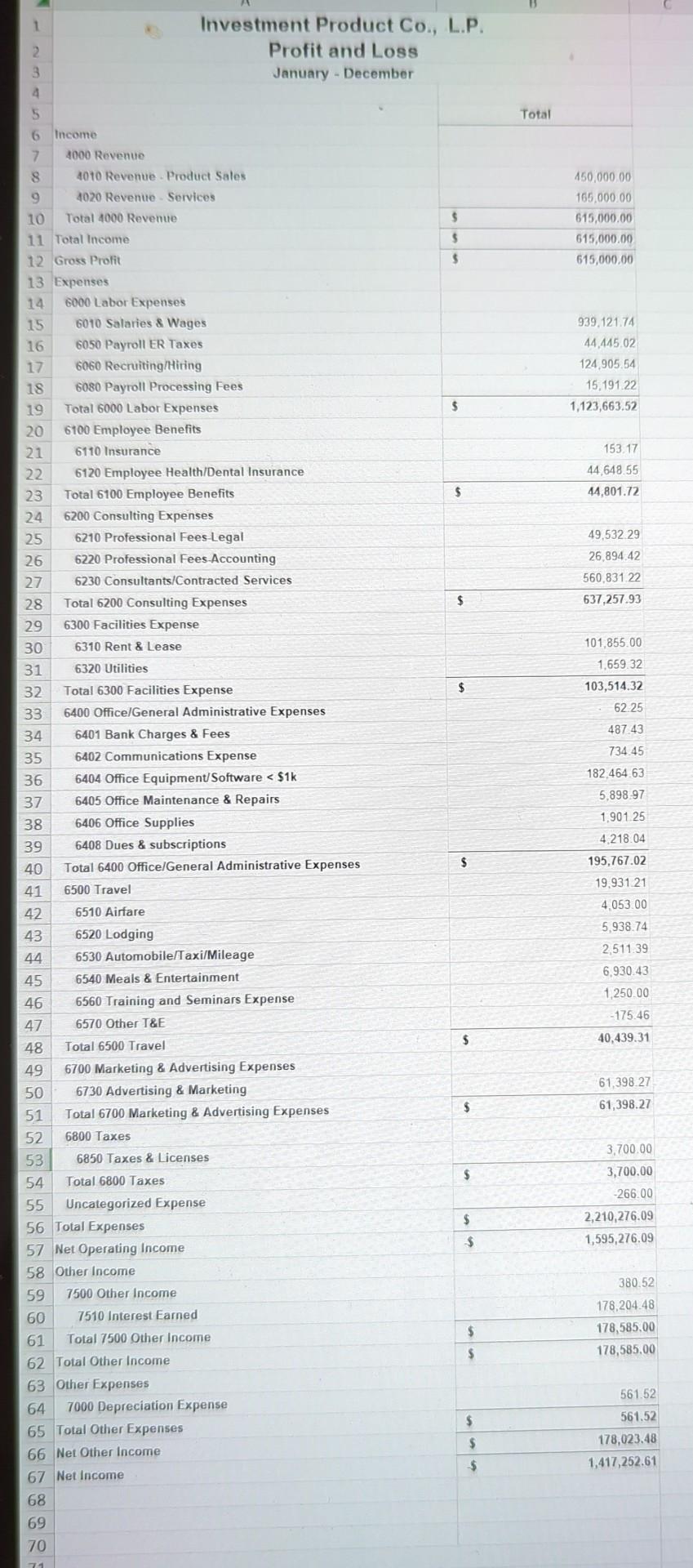

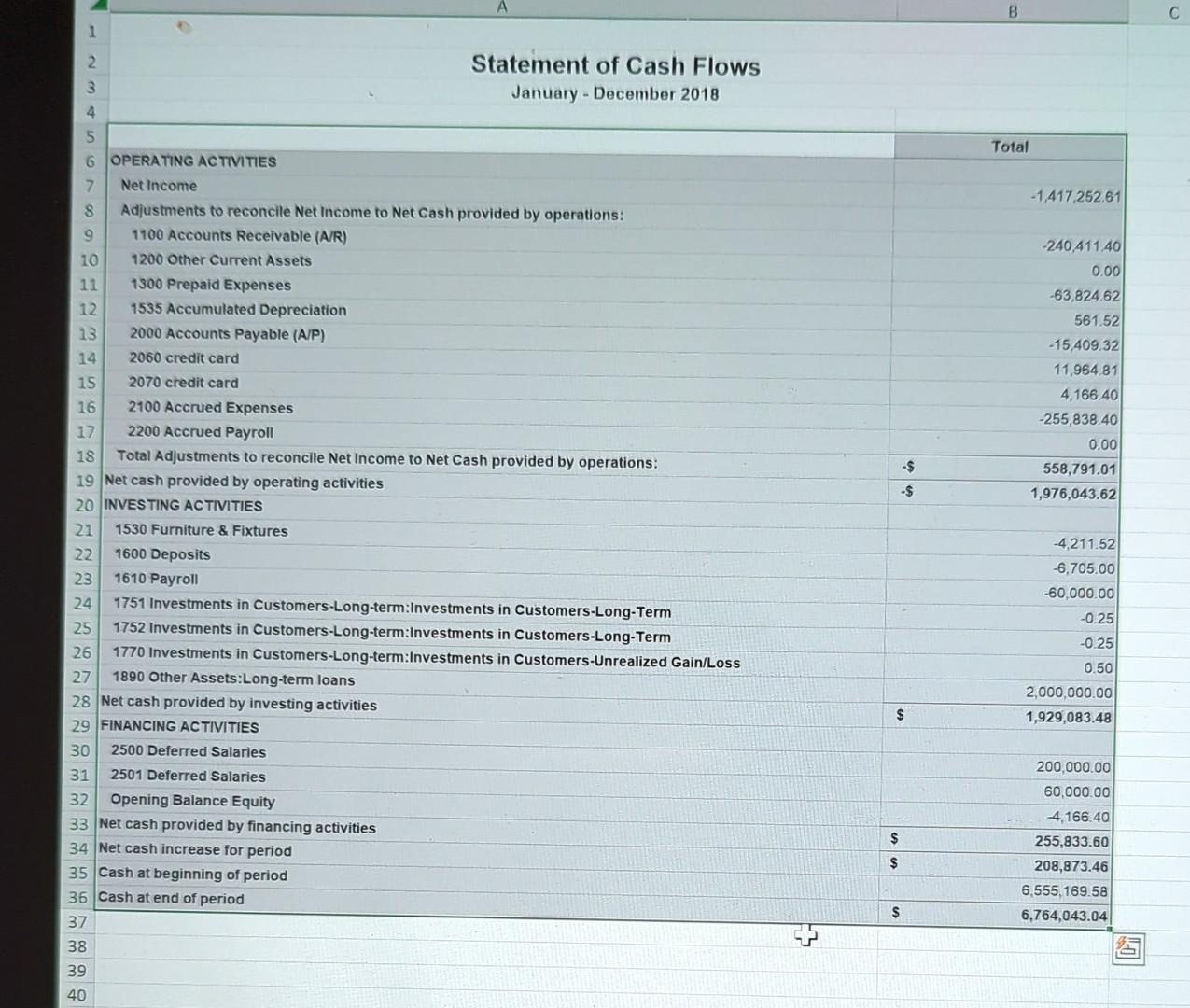

based on these. would it be a good investment idea. explain analysis on all statements 1760 Investments in Customers-Long-term . 43 LIABILITIES AND EQUITY 44

based on these. would it be a good investment idea. explain analysis on all statements

1760 Investments in Customers-Long-term . 43 LIABILITIES AND EQUITY 44 Liabilities Equity 3000 Limited Partners Statement of Cash Flows January - December 2018 OPERATING ACTIVITES Net Income Adjustments to reconcile Net Income to Net Cash provided by operations: 1100 Accounts Receivable (ARR) 1200 Other Current Assets 1300 Prepaid Expenses 1535 Accumulated Depreciation 2000 Accounts Payable (A/P) 2060 credit card 2070 credit card 2100 Accrued Expenses 2200 Accrued Payroll Total Adjustments to reconcile Net Income to Net Cash provided by operations: Net cash provided by operating activities INVES TING ACTIVITIES Total 1530 Furniture \& Fixtures 1600 Deposits 1610 Payroll 1751 Investments in Customers-Long-term:Investments in Customers-Long-Term 1752 Investments in Customers-Long-term:Investments in Customers-Long-Term 1770 Investments in Customers-Long-term:Investments in Customers-Unrealized Gain/Loss 1890 Other Assets:Long-term loans Net cash provided by investing activities FINANCING ACTIVITIES 2500 Deferred Salaries 2501 Deferred Salaries Opening Balance Equity Net cash provided by financing activities Net cash increase for period Cash at beginning of period Cash at end of period 37 38 4039Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started