Answered step by step

Verified Expert Solution

Question

1 Approved Answer

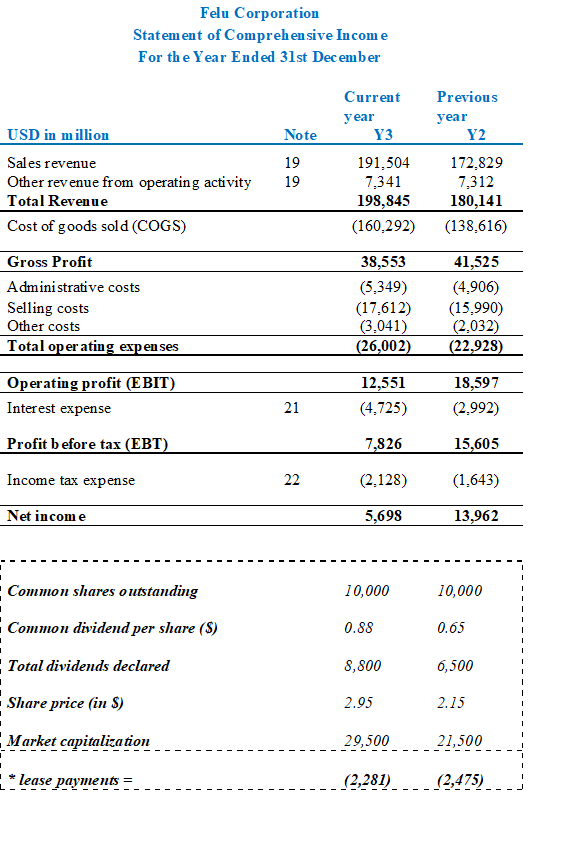

Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporation's ability? Felu Corporation Statement of

Based on your above ratio analysis, please comment on the reason for changes in ROE, other profitability and Felu Corporation's ability?

Felu Corporation Statement of Comprehensive Income For the Year Ended 31st December Previous Current year Y3 year Y2 USD in million Sales revenue Other revenue from operating activity Total Revenue Cost of goods sold (COGS) Note 19 19 191,504 7,341 198,845 (160,292) 172.829 7,312 180,141 (138.616) Gross Profit Administrative costs Selling costs Other costs Total operating expenses 38,553 (5.349) (17,612) (3.041) (26,002) 41,525 (4.906) (15.990) (2,032) (22,928) Operating profit (EBIT) Interest expense 12,551 (4.725) 18,597 (2.992) 21 Profit before tax (EBT) 7,826 15,605 Income tax expense 22 (2.128) (1,643) Net income 5,698 13,962 10,000 10,000 Common shares outstanding Common dividend per share (S) 0.88 0.65 8,800 6,500 Total dividends declared Share price (in $) 2.95 2.15 Market capitalization 29,500 21,500 ** lease payments = (2,281) (2,475)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started