Answered step by step

Verified Expert Solution

Question

1 Approved Answer

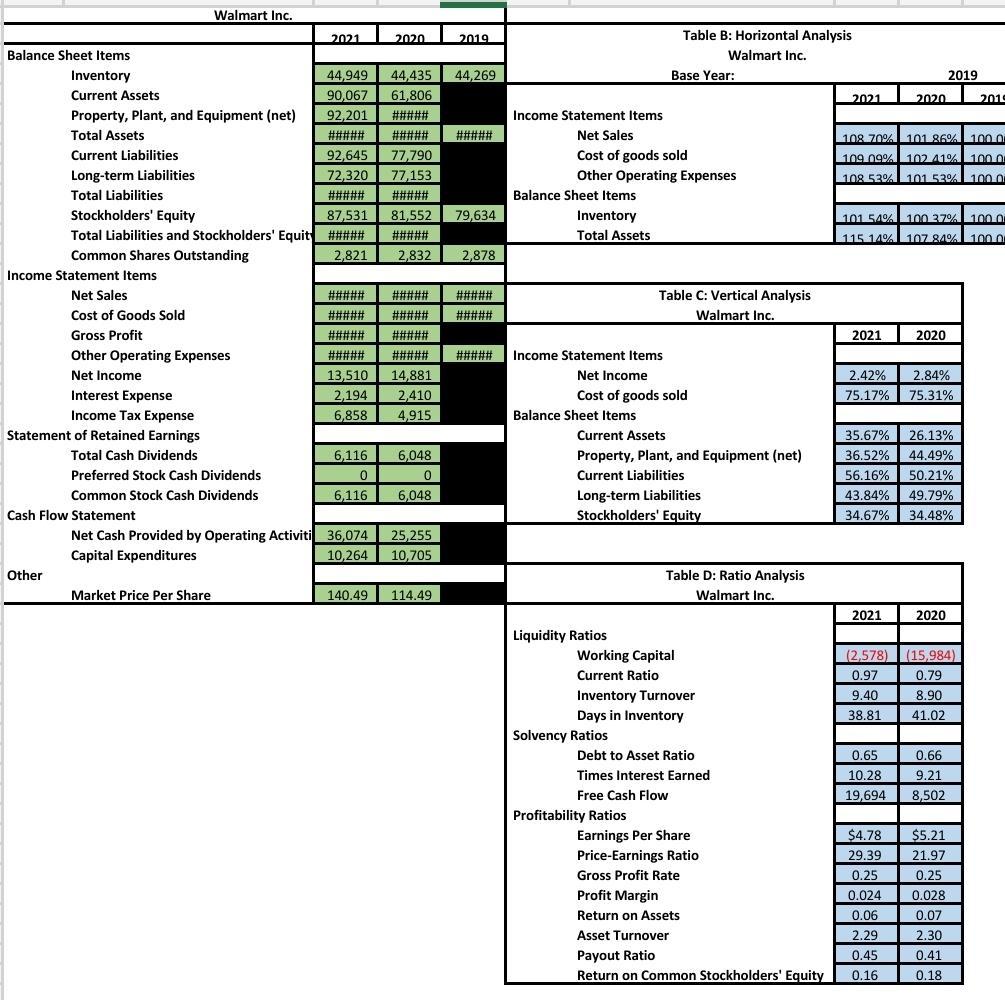

Based on your analysis of the company (everything youve evaluated up to this point) , provide recommendations for whether: Walmart (as of January 31, 2021)

Based on your analysis of the company (everything you’ve evaluated up to this point), provide recommendations for whether: Walmart (as of January 31, 2021)

- Creditors should loan money to this company in the short-term

- Creditors should loan money to this company in the long-term

- Investors should buy, hold, or sell the stock (use the competitor as a baseline and be sure to consider the current price of the stock)

Walmart Inc. 2021 2020 2019 Table B: Horizontal Analysis Balance Sheet Items Walmart Inc. Inventory 44,949 44,435 44,269 Base Year: 2019 Current Assets 90,067 61,806 2020 2010 2021 Property, Plant, and Equipment (net) 92,201 ##### Income Statement Items Total Assets ##### ##### ##### Net Sales 108 70% 101 86% 100 0 Current Liabilities 92,645 77,790 Cost of goods sold 109.09% 102 41% 10o o 77,153 ##### Long-term Liabilities 72,320 Other Operating Expenses 108 53% 101 53% 100 o Total Liabilities ##### Balance Sheet Items 79,634 Stockholders' Equity Total Liabilities and Stockholders' Equit #### Common Shares Outstanding 87,531 81,552 Inventory 101 54% 100 37% 100 0 ##### Total Assets 115 14% 107.84% 100 2,821 2,832 2,878 Income Statement Items Net Sales ##### ##### ##### Table C: Vertical Analysis Cost of Goods Sold ##### ##### ##### Walmart Inc. Gross Profit ##### ##### 2021 2020 Other Operating Expenses ##### ##### ##### Income Statement Items Net Income 13,510 14,881 Net Income 2.42% 2.84% Interest Expense 2,194 2,410 Cost of goods sold 75.17% 75.31% Income Tax Expense 6,858 4,915 Balance Sheet Items Statement of Retained Earnings Current Assets 35.67% 26.13% Total Cash Dividends 6,116 6,048 Property, Plant, and Equipment (net) 36.52% 44.49% 56.16% 50.21% 43.84% 49.79% Preferred Stock Cash Dividends Current Liabilities Long-term Liabilities Stockholders' Equity Common Stock Cash Dividends 6,116 6,048 Cash Flow Statement 34.67% 34.48% Net Cash Provided by Operating Activiti 36,074 25,255 Capital Expenditures 10,264 10.705 Other Table D: Ratio Analysis Market Price Per Share 140.49 114.49 Walmart Inc. 2021 2020 Liquidity Ratios (2,578) (15,984) Working Capital Current Ratio 0.97 0.79 Inventory Turnover 9.40 8.90 Days in Inventory 38.81 41.02 Solvency Ratios Debt to Asset Ratio 0.65 0.66 Times Interest Earned 10.28 9.21 Free Cash Flow 19,694 8,502 Profitability Ratios Earnings Per Share $4.78 $5.21 Price-Earnings Ratio 29.39 21.97 Gross Profit Rate 0.25 0.25 Profit Margin 0.024 0.028 Return on Assets 0.06 0.07 Asset Turnover 2.29 2.30 Payout Ratio 0.45 0.41 Return on Common Stockholders' Equity 0.16 0.18

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Creditor should not loan money to this company in the short term as the current rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started