Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on your income statement, report on the sales mix of this property. 2 List each of the sales mix dollars and corresponding sales

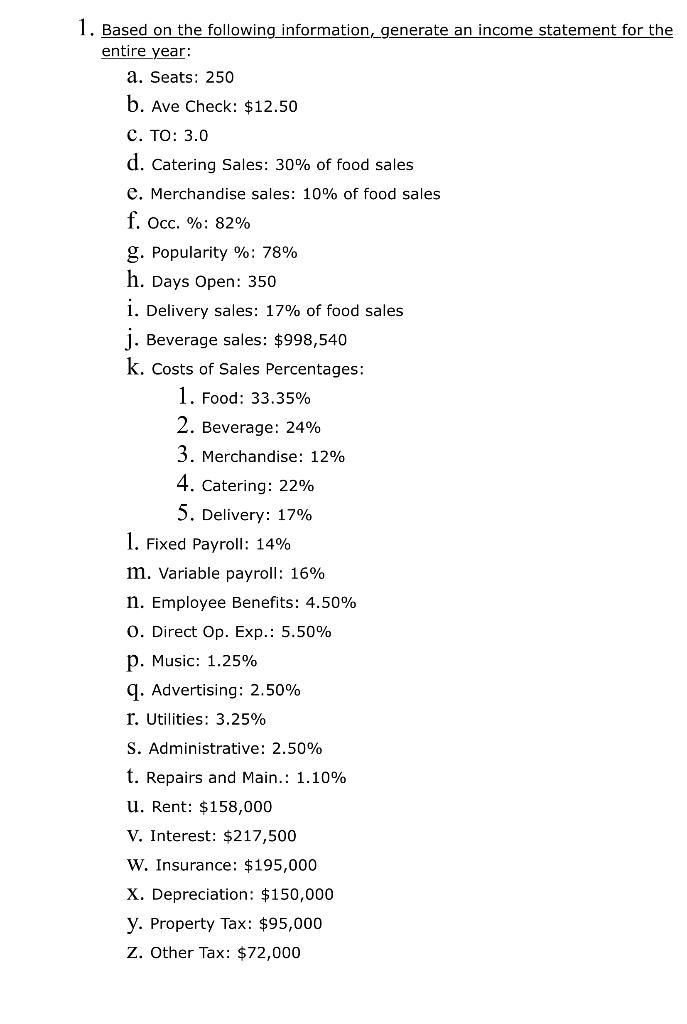

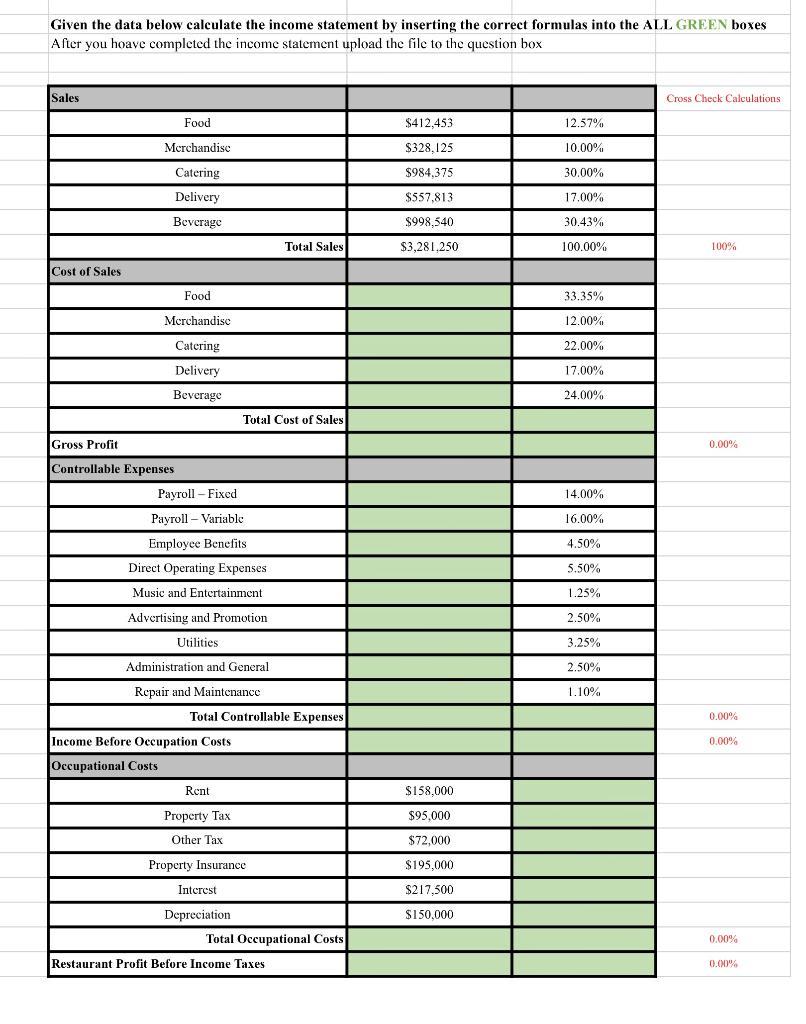

Based on your income statement, report on the sales mix of this property. 2 List each of the sales mix dollars and corresponding sales mix percentages. 1. Based on the following information, generate an income statement for the entire year: a. Seats: 250 b. Ave Check: $12.50 C. TO: 3.0 d. Catering Sales: 30% of food sales e. Merchandise sales: 10% of food sales f. Occ. %: 82% g. Popularity %: 78% h. Days Open: 350 i. Delivery sales: 17% of food sales j. Beverage sales: $998,540 k. Costs of Sales Percentages: 1. Food: 33.35% 2. Beverage: 24% 3. Merchandise: 12% 4. Catering: 22% 5. Delivery: 17% 1. Fixed Payroll: 14% m. Variable payroll: 16% n. Employee Benefits: 4.50% O. Direct Op. Exp.: 5.50% p. Music: 1.25% q. Advertising: 2.50% r. Utilities: 3.25% S. Administrative: 2.50% t. Repairs and Main.: 1.10% U. Rent: $158,000 V. Interest: $217,500 W. Insurance: $195,000 X. Depreciation: $150,000 y. Property Tax: $95,000 Z. Other Tax: $72,000 Given the data below calculate the income statement by inserting the correct formulas into the ALL GREEN boxes After you hoave completed the income statement upload the file to the question box Sales Cost of Sales Food Merchandise Catering Delivery Beverage Food Merchandise Catering Delivery Beverage Gross Profit Controllable Expenses Payroll - Fixed Payroll - Variable Employee Benefits Direct Operating Expenses Music and Entertainment Total Cost of Sales Advertising and Promotion Utilities: Administration and General Repair and Maintenance Income Before Occupation Costs Occupational Costs. Total Controllable Expenses Rent Property Tax Other Tax Property Insurance Interest Depreciation Total Sales Total Occupational Costs Restaurant Profit Before Income Taxes $412,453 $328,125 $984,375 $557,813 $998,540 $3,281,250 $158,000 $95,000 $72,000 $195,000 $217,500 $150,000 12.57% 10.00% 30.00% 17.00% 30.43% 100.00% 33.35% 12.00% 22.00% 17.00% 24.00% 14.00% 16.00% 4.50% 5.50% 1.25% 2.50% 3.25% 2.50% 1.10% Cross Check Calculations : 100% 0.00% 0.00% 0.00% 0.00% 0.00%

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Steps for solving 1 Cost of Sales We have five categories of revenue Food Merchandise Catering Deliv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started