- Based upon all information available, please present a Vertical Analysis Income Statement for the Saxton Company.

- Based upon all information available, please present a Vertical Analysis Balance Sheet for Saxton Company.

- Based upon all information available, please provide financial ratio analysis based on each of the four (4) key categories of financial ratios discussed in class. Then provide DuPont Analysis as appropriate, including both ways by which DuPont analysis can be done for ROE.

- Based upon all information available, please compute the Weighted Average Cost of Capital for the Saxton Company.

- Please describe what your WACC figure means.

- If a potential investment has an Expected Rate of Return of 16%, would this potential investment be pursued using ROE as a % Required Rate of Return ? Why or why not ?

- If a potential investment has an Expected Rate of Return of 16%, should this investment be pursued using WACC as a % Required Rate of Return ? Why or why not ?

- Using Net Income as a Perpetuity, please determine a value for the entity (a.) based on your WACC, then (b.) based on your ROE.

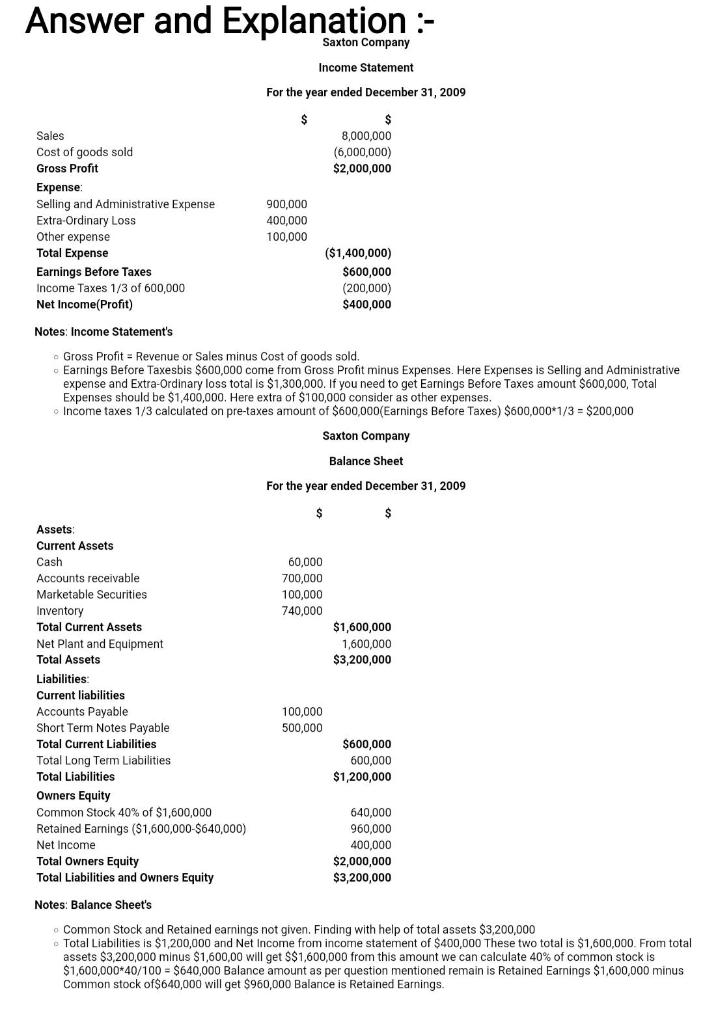

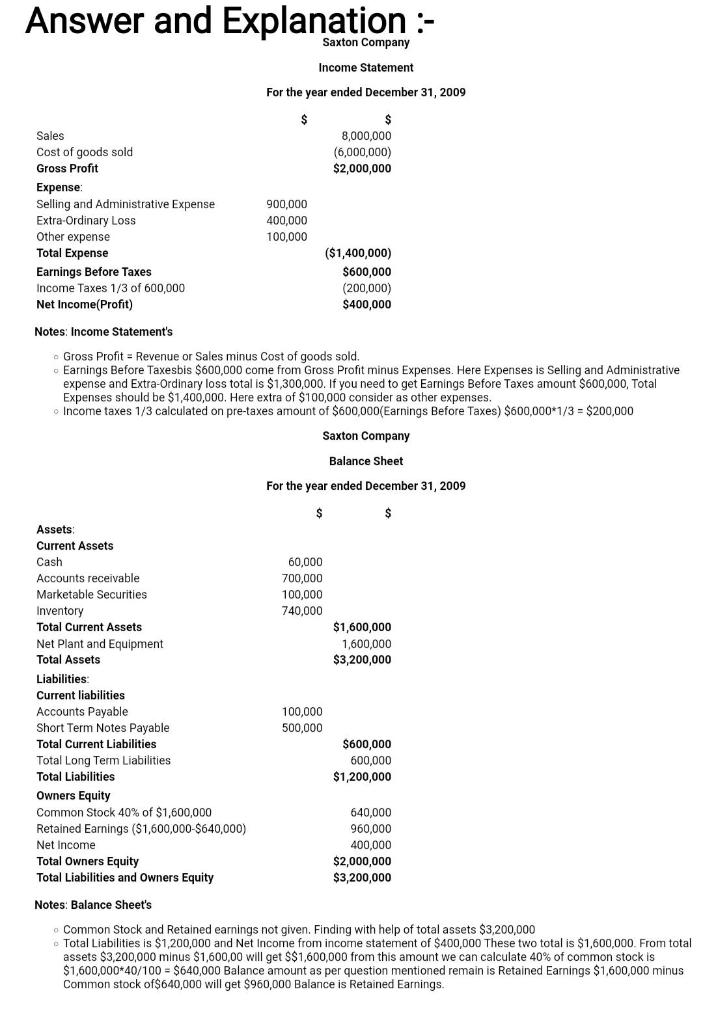

Answer and Explanation :- Saxton Company Income Statement For the year ended December 31, 2009 $ $ 8,000,000 (6,000,000) $2,000,000 Sales Cost of goods sold Gross Profit Expense: Selling and Administrative Expense Extra-Ordinary Loss Other expense Total Expense Earnings Before Taxes Income Taxes 1/3 of 600,000 Net Income (Profit) 900.000 400,000 100,000 ($1,400,000) $600,000 (200,000) $400,000 Notes: Income Statement's Gross Profit = Revenue or Sales minus Cost of goods sold. Earnings Before Taxesbis $600,000 come from Gross Profit minus Expenses. Here Expenses is Selling and Administrative expense and Extra-Ordinary loss total is $1,300,000. If you need to get Earnings Before Taxes amount $600,000, Total Expenses should be $1,400,000. Here extra of $100,000 consider as other expenses. Income taxes 1/3 calculated on pre-taxes amount of $600,000(Earnings Before Taxes) $600,000*1/3 = $200,000 Saxton Company Balance Sheet For the year ended December 31, 2009 $ $ 60,000 700,000 100,000 740,000 $1,600,000 1,600,000 $3,200,000 Assets Current Assets Cash Accounts receivable Marketable Securities Inventory Total Current Assets Net Plant and Equipment Total Assets Liabilities: Current liabilities Accounts Payable Short Term Notes Payable Total Current Liabilities Total Long Term Liabilities Total Liabilities Owners Equity Common Stock 40% of $1,600,000 Retained Earnings ($1,600,000-$640,000) Net Income Total Owners Equity Total Liabilities and Owners Equity 100,000 500,000 $600,000 600,000 $1,200,000 640,000 960,000 400,000 $2,000,000 $3,200,000 Notes: Balance Sheet's Common Stock and Retained earnings not given. Finding with help of total assets $3,200,000 Total Liabilities is $1,200,000 and Net Income from income statement of $400,000 These two total is $1,600,000. From total assets $3,200,000 minus $1,600,00 will get $$1,600,000 from this amount we can calculate 40% of common stock is $1,600,000*40/100 = $640,000 Balance amount as per question mentioned remain is Retained Earnings $1,600,000 minus Common stock of$640,000 will get $960,000 Balance is Retained Earnings. Answer and Explanation :- Saxton Company Income Statement For the year ended December 31, 2009 $ $ 8,000,000 (6,000,000) $2,000,000 Sales Cost of goods sold Gross Profit Expense: Selling and Administrative Expense Extra-Ordinary Loss Other expense Total Expense Earnings Before Taxes Income Taxes 1/3 of 600,000 Net Income (Profit) 900.000 400,000 100,000 ($1,400,000) $600,000 (200,000) $400,000 Notes: Income Statement's Gross Profit = Revenue or Sales minus Cost of goods sold. Earnings Before Taxesbis $600,000 come from Gross Profit minus Expenses. Here Expenses is Selling and Administrative expense and Extra-Ordinary loss total is $1,300,000. If you need to get Earnings Before Taxes amount $600,000, Total Expenses should be $1,400,000. Here extra of $100,000 consider as other expenses. Income taxes 1/3 calculated on pre-taxes amount of $600,000(Earnings Before Taxes) $600,000*1/3 = $200,000 Saxton Company Balance Sheet For the year ended December 31, 2009 $ $ 60,000 700,000 100,000 740,000 $1,600,000 1,600,000 $3,200,000 Assets Current Assets Cash Accounts receivable Marketable Securities Inventory Total Current Assets Net Plant and Equipment Total Assets Liabilities: Current liabilities Accounts Payable Short Term Notes Payable Total Current Liabilities Total Long Term Liabilities Total Liabilities Owners Equity Common Stock 40% of $1,600,000 Retained Earnings ($1,600,000-$640,000) Net Income Total Owners Equity Total Liabilities and Owners Equity 100,000 500,000 $600,000 600,000 $1,200,000 640,000 960,000 400,000 $2,000,000 $3,200,000 Notes: Balance Sheet's Common Stock and Retained earnings not given. Finding with help of total assets $3,200,000 Total Liabilities is $1,200,000 and Net Income from income statement of $400,000 These two total is $1,600,000. From total assets $3,200,000 minus $1,600,00 will get $$1,600,000 from this amount we can calculate 40% of common stock is $1,600,000*40/100 = $640,000 Balance amount as per question mentioned remain is Retained Earnings $1,600,000 minus Common stock of$640,000 will get $960,000 Balance is Retained Earnings