Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baseline - assume the firm is currently not paying for emissions (same as handout) and is emitting 50 tons per year. Scenario 1: Give

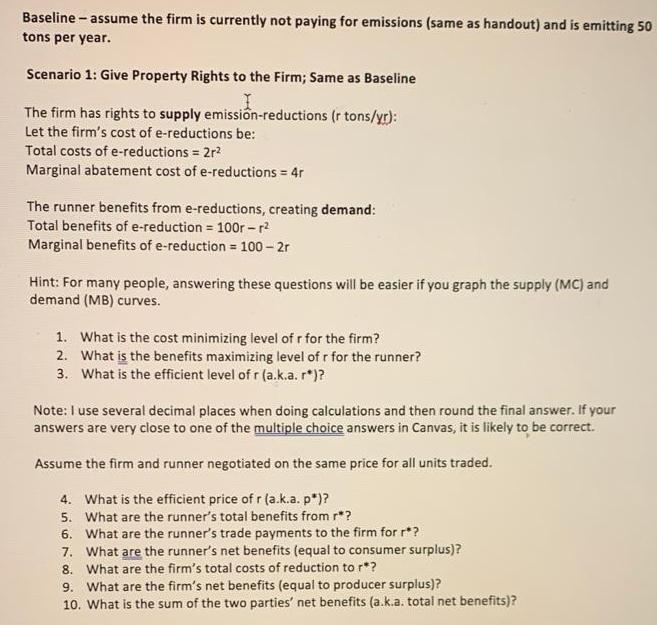

Baseline - assume the firm is currently not paying for emissions (same as handout) and is emitting 50 tons per year. Scenario 1: Give Property Rights to the Firm; Same as Baseline The firm has rights to supply emission-reductions (r tons/yr): Let the firm's cost of e-reductions be: Total costs of e-reductions = 2r Marginal abatement cost of e-reductions = 4r The runner benefits from e-reductions, creating demand: Total benefits of e-reduction = 100r-r Marginal benefits of e-reduction = 100-2r Hint: For many people, answering these questions will be easier if you graph the supply (MC) and demand (MB) curves. 1. What is the cost minimizing level of r for the firm? 2. What is the benefits maximizing level of r for the runner? 3. What is the efficient level of r (a.k.a. r*)? Note: I use several decimal places when doing calculations and then round the final answer. If your answers are very close to one of the multiple choice answers in Canvas, it is likely to be correct. Assume the firm and runner negotiated on the same price for all units traded. 4. What is the efficient price of r (a.k.a. p*)? 5. What are the runner's total benefits from r*? 6. What are the runner's trade payments to the firm for r*? 7. What are the runner's net benefits (equal to consumer surplus)? 8. What are the firm's total costs of reduction to r*? 9. What are the firm's net benefits (equal to producer surplus)? 10. What is the sum of the two parties' net benefits (a.k.a. total net benefits)?

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 The cost minimizing level of r for the firm is 0 2 The benefits maximizing level of r for the runner is 0 3 The efficient level of r aka r is 0 4 Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started