Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Basic Concepts of Stocks and Bonds as fellow ONE OF A KIND Directions: Solve the given problems and look for the answers in the boxes

Basic Concepts of Stocks and Bonds as fellow

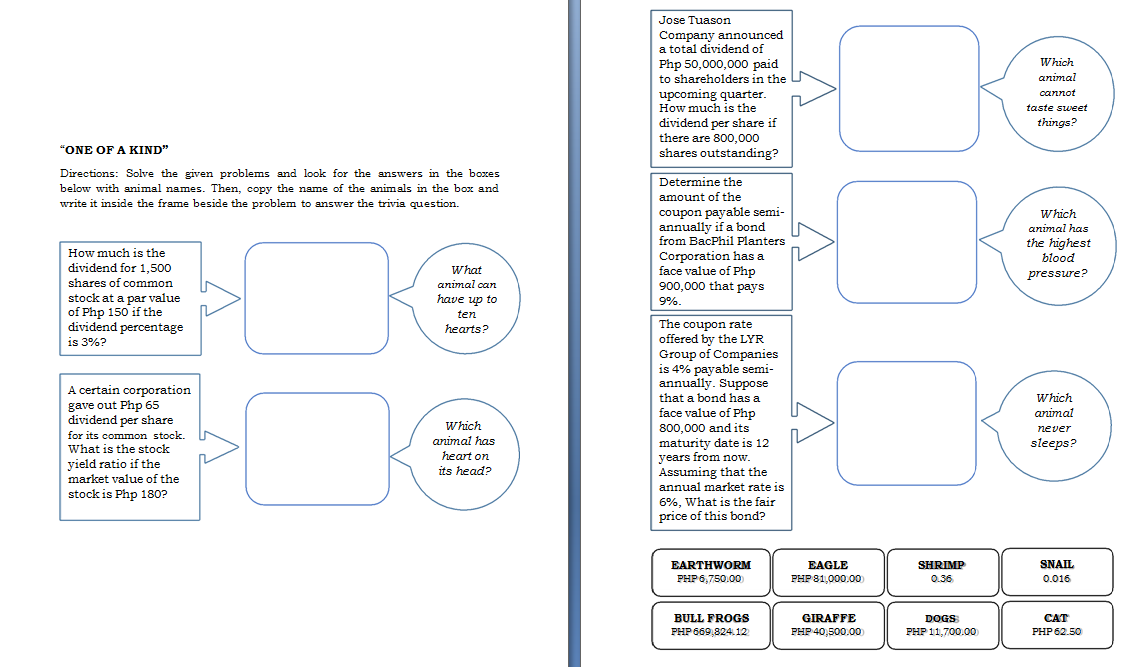

"ONE OF A KIND" Directions: Solve the given problems and look for the answers in the boxes below with animal names. Then, copy the name of the animals in the box and write it inside the frame beside the problem to answer the trivia question. How much is the dividend for 1,500 shares of common stock at a par value of Php 150 if the dividend percentage is 3%? A certain corporation gave out Php 65 dividend per share for its common stock. What is the stock yield ratio if the market value of the stock is Php 180? What animal can have up to ten hearts? Which animal has heart on its head? Jose Tuason Company announced a total dividend of Php 50,000,000 paid to shareholders in the upcoming quarter. How much is the dividend per share if there are 800,000 shares outstanding? Determine the amount of the coupon payable semi- annually if a bond from BacPhil Planters Corporation has a face value of Php 900,000 that pays 9%. The coupon rate offered by the LYR Group of Companies is 4% payable semi- annually. Suppose that a bond has a face value of Php 800,000 and its maturity date is 12 years from now. Assuming that the annual market rate is 6%, What is the fair price of this bond? Which animal cannot taste sweet things? Which animal has the highest blood pressure? Which animal never sleeps? EARTHWORM PHP 6,750.00) EAGLE PHP 81,000.00) SHRIMP 0.36 SNAIL 0.016 BULL FROGS PHP 669,824.12 GIRAFFE PHP 40,500.00) DOGS PHP 11,700.00) CAT PHP 62.50

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started