Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Basic Sound, Inc. expects variable manufacturing costs to fluctuate with direct labor hours. Management expects indirect labor costs to be $1.70 per hour, indirect

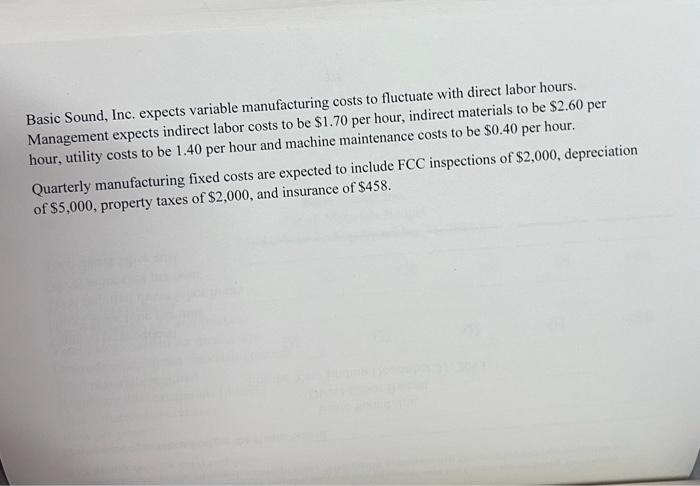

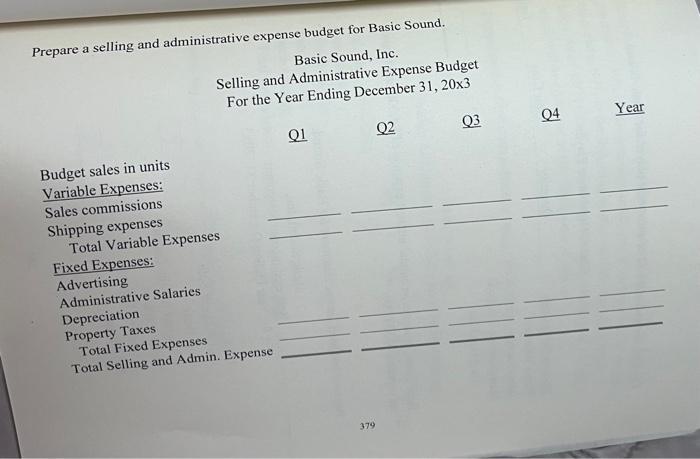

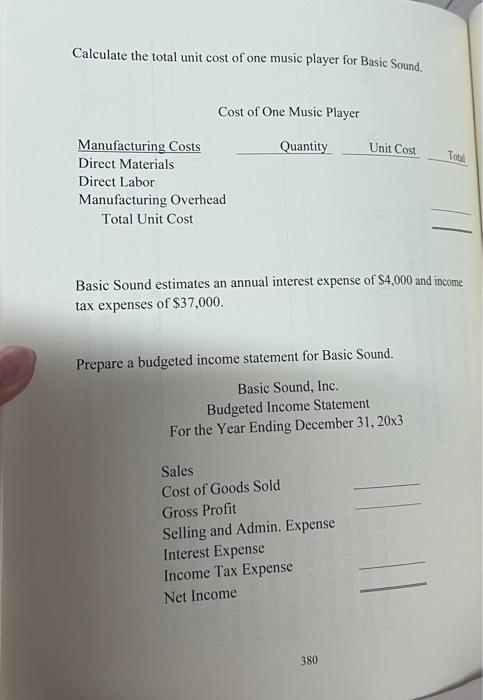

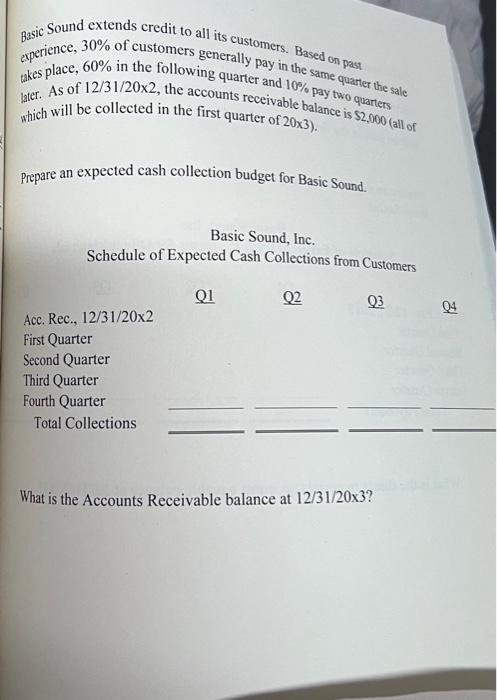

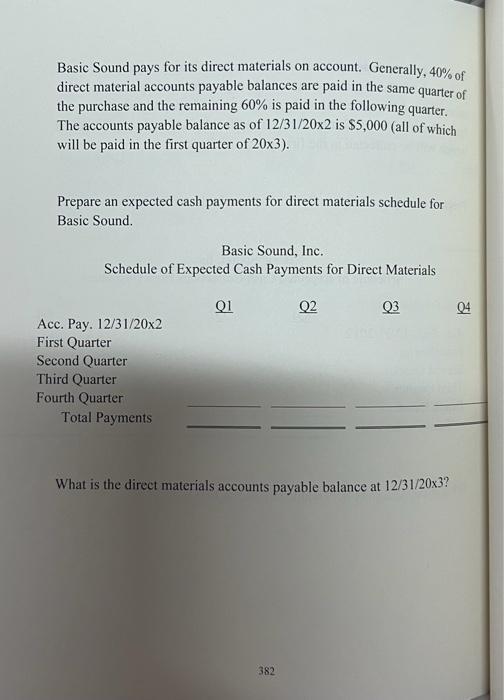

Basic Sound, Inc. expects variable manufacturing costs to fluctuate with direct labor hours. Management expects indirect labor costs to be $1.70 per hour, indirect materials to be $2.60 per hour, utility costs to be 1.40 per hour and machine maintenance costs to be $0.40 per hour. Quarterly manufacturing fixed costs are expected to include FCC inspections of $2,000, depreciation of $5,000, property taxes of $2,000, and insurance of $458. Prepare a manufacturing overhead budget for Basic Sound. Basic Sound, Inc. Manufacturing Overhead Budget For the Year Ending December 31, 20x3 Q3 Variable Costs: Indirect materials Indirect labor Utilities Maintenance Total Variable Costs Fixed Costs: Inspections Depreciation Property Taxes Insurance Total Fixed Costs Q1 02 Total Mfg. Overhead Direct labor hours. Manufacturing overhead rate per direct labor hour 377 04 Year Variable selling and administrative expenses fluctuate based on number of units sold. These include sales commission of $1 per unit, and shipping expenses of $1.50 per unit. Quarterly fixed selling and administrative expenses include advertising of $4,000, administrative salaries of $7,000, depreciation of $1,500 and property taxes of $1,000. Prepare a selling and administrative expense budget for Basic Sound. Basic Sound, Inc. Selling and Administrative Expense Budget For the Year Ending December 31, 20x3 Q1 Budget sales in units Variable Expenses: Sales commissions Shipping expenses Total Variable Expenses Fixed Expenses: Advertising Administrative Salaries Depreciation Property Taxes Total Fixed Expenses Total Selling and Admin. Expense Q2 379 Q3 Q4 Year Calculate the total unit cost of one music player for Basic Sound. Manufacturing Costs Direct Materials Direct Labor Cost of One Music Player Quantity Manufacturing Overhead Total Unit Cost Basic Sound estimates an annual interest expense of $4,000 and income tax expenses of $37,000. Prepare a budgeted income statement for Basic Sound. Basic Sound, Inc. Budgeted Income Statement For the Year Ending December 31, 20x3 Sales Cost of Goods Sold Unit Cost Gross Profit Selling and Admin. Expense Interest Expense Income Tax Expense Net Income 380 Total Basic Sound extends credit to all its customers. Based on past experience, 30% of customers generally pay in the same quarter the sale takes place, 60% in the following quarter and 10% pay two quarters later. As of 12/31/20x2, the accounts receivable balance is $2,000 (all of which will be collected in the first quarter of 20x3). Prepare an expected cash collection budget for Basic Sound. Basic Sound, Inc. Schedule of Expected Cash Collections from Customers Q1 Q2 Acc. Rec., 12/31/20x2 First Quarter Second Quarter Third Quarter Fourth Quarter Total Collections 03 What is the Accounts Receivable balance at 12/31/20x3? 04 Basic Sound pays for its direct materials on account. Generally, 40% of direct material accounts payable balances are paid in the same quarter of the purchase and the remaining 60% is paid in the following quarter. The accounts payable balance as of 12/31/20x2 is $5,000 (all of which will be paid in the first quarter of 20x3). Prepare an expected cash payments for direct materials schedule for Basic Sound. Basic Sound, Inc. Schedule of Expected Cash Payments for Direct Materials Acc. Pay. 12/31/20x2 First Quarter Second Quarter Third Quarter Fourth Quarter Total Payments Q1 Q2 382 03 What is the direct materials accounts payable balance at 12/31/20x3? 04

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Manufacturing Overhead budget for Basic Sound we need to calculate both varia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started