Basically I need someone who can do what the project says. it says the instructions on the first page.

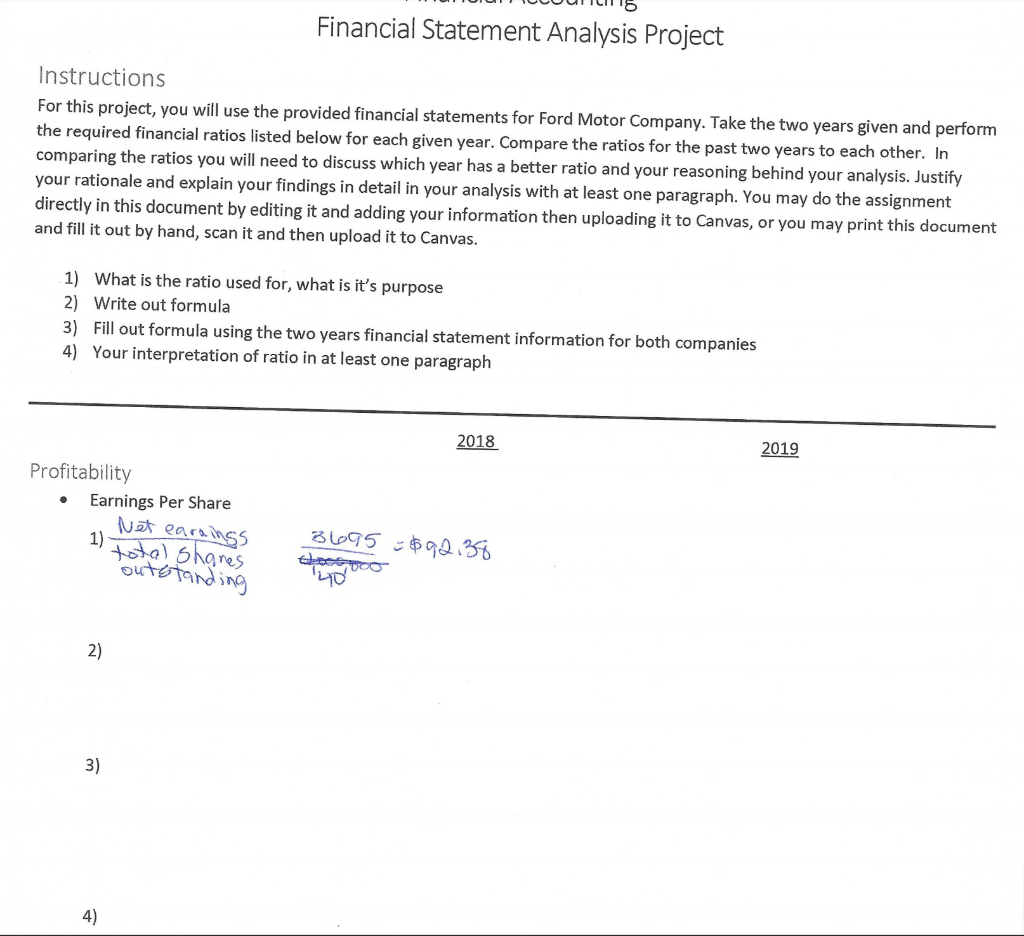

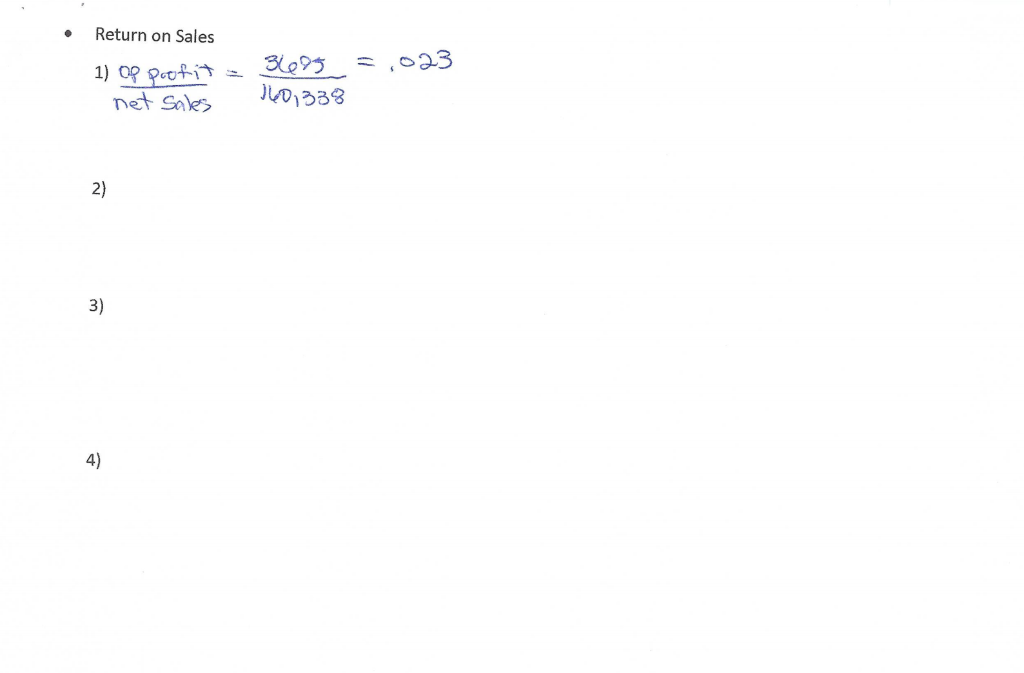

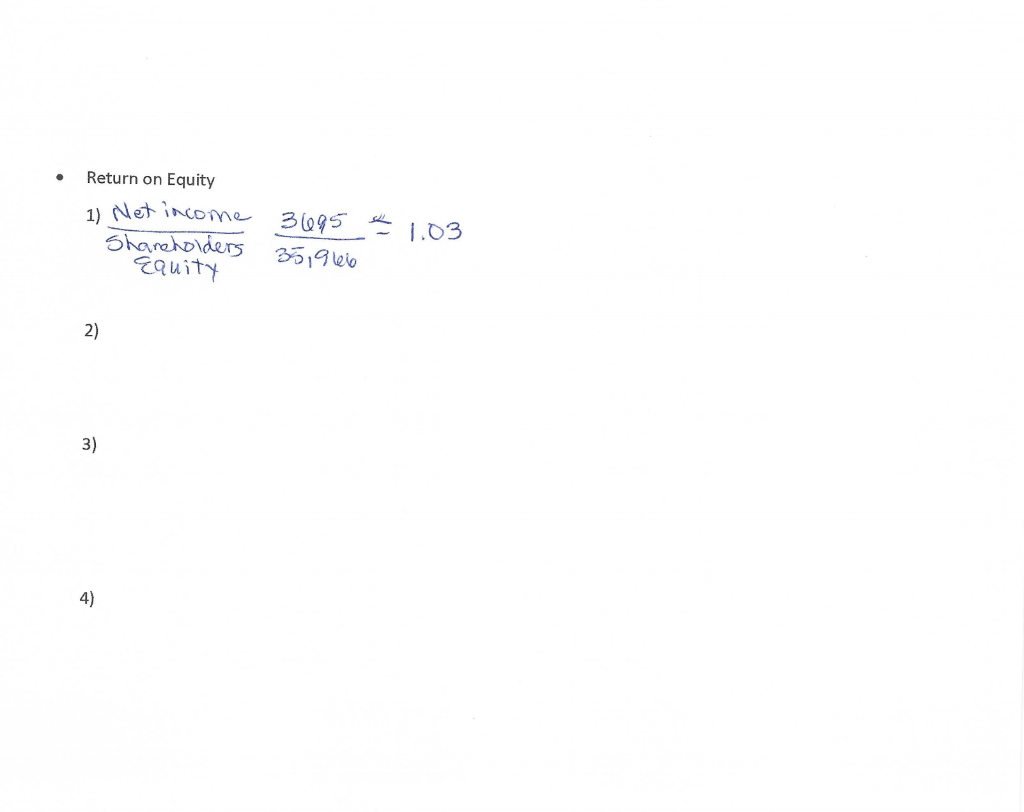

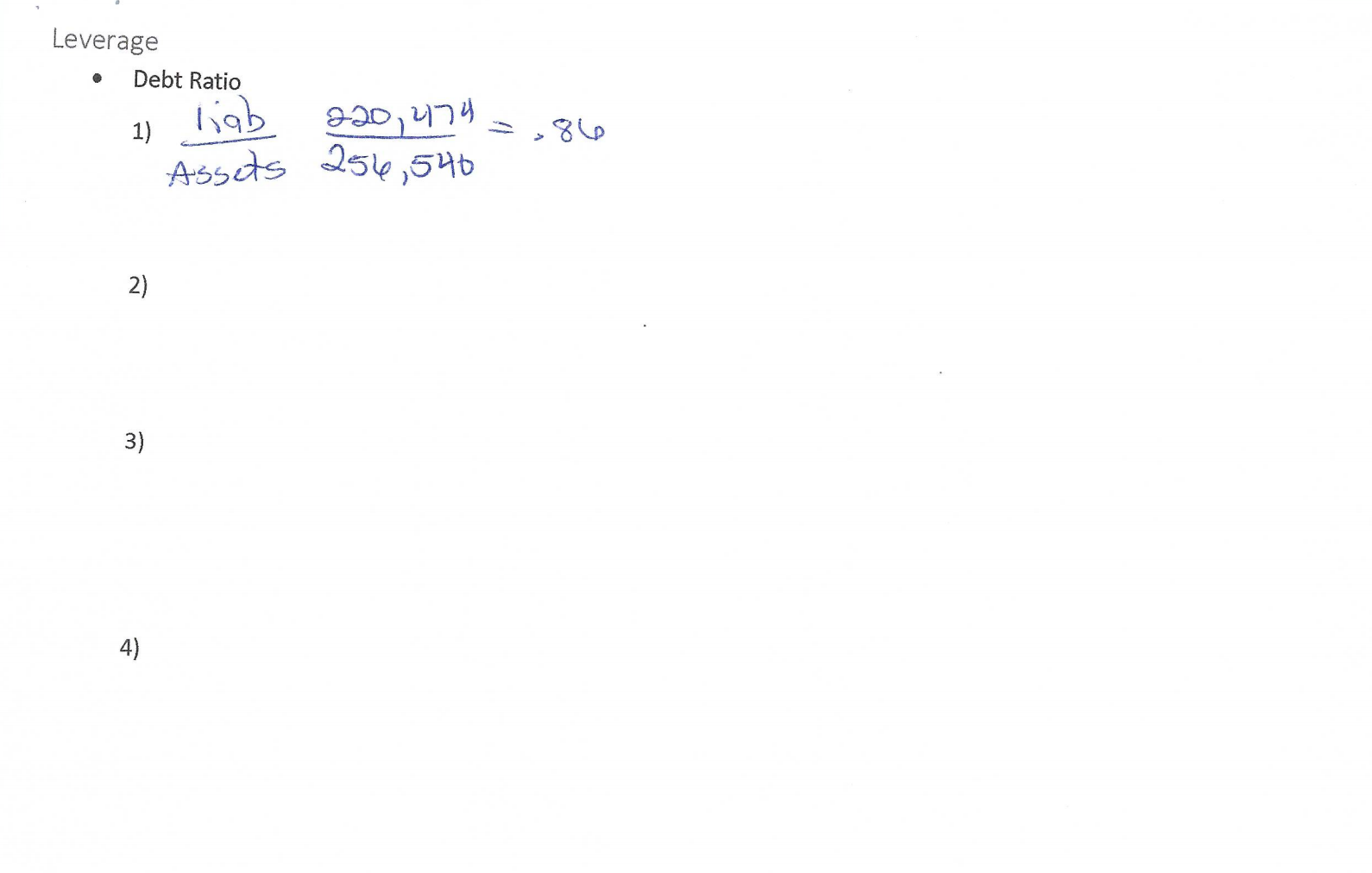

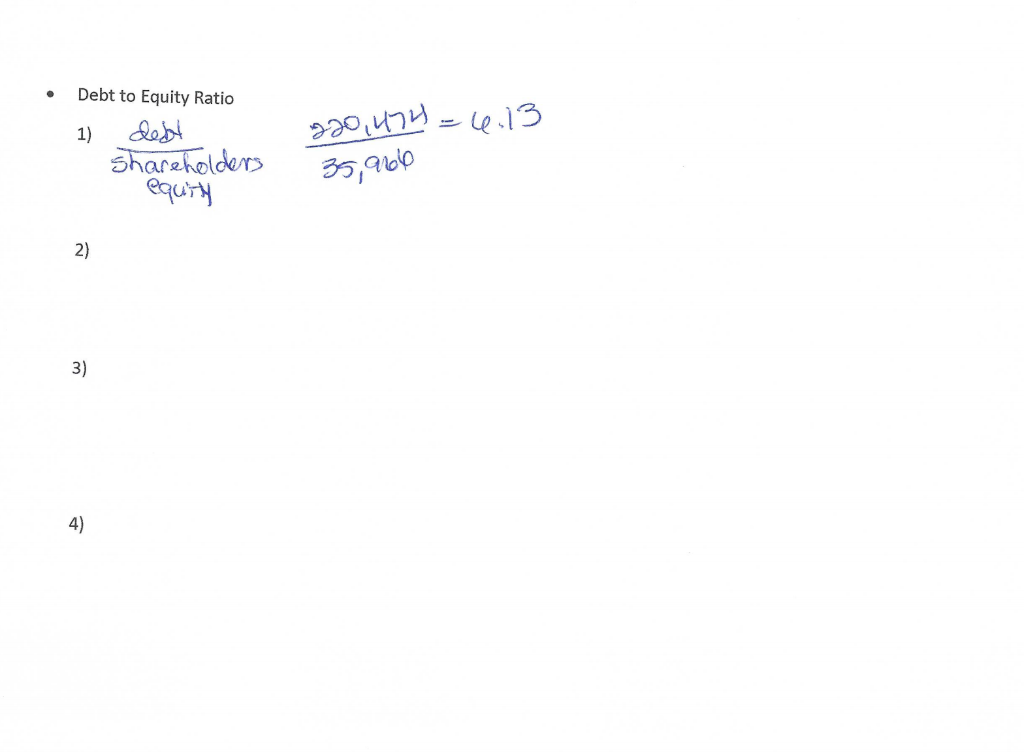

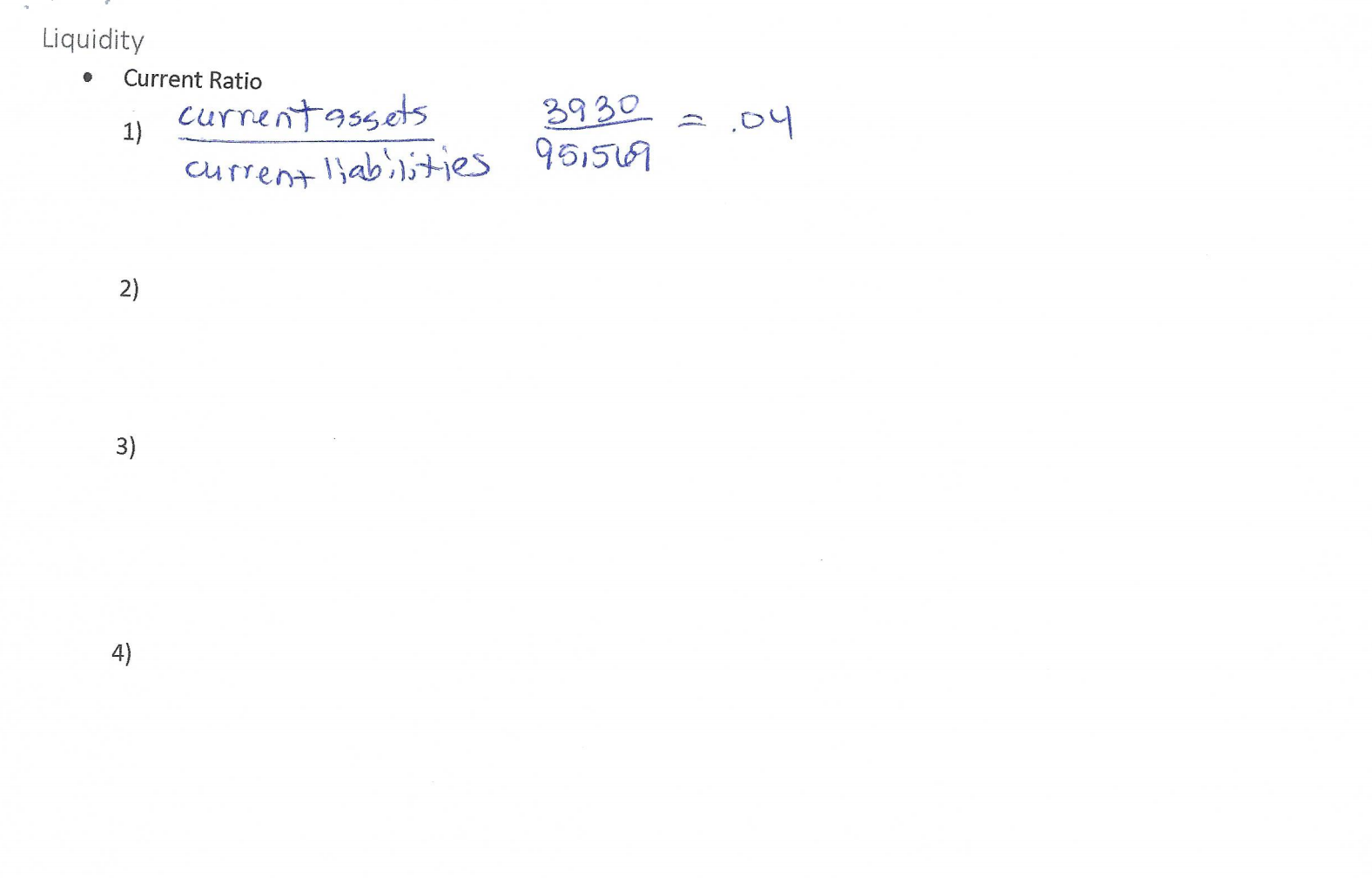

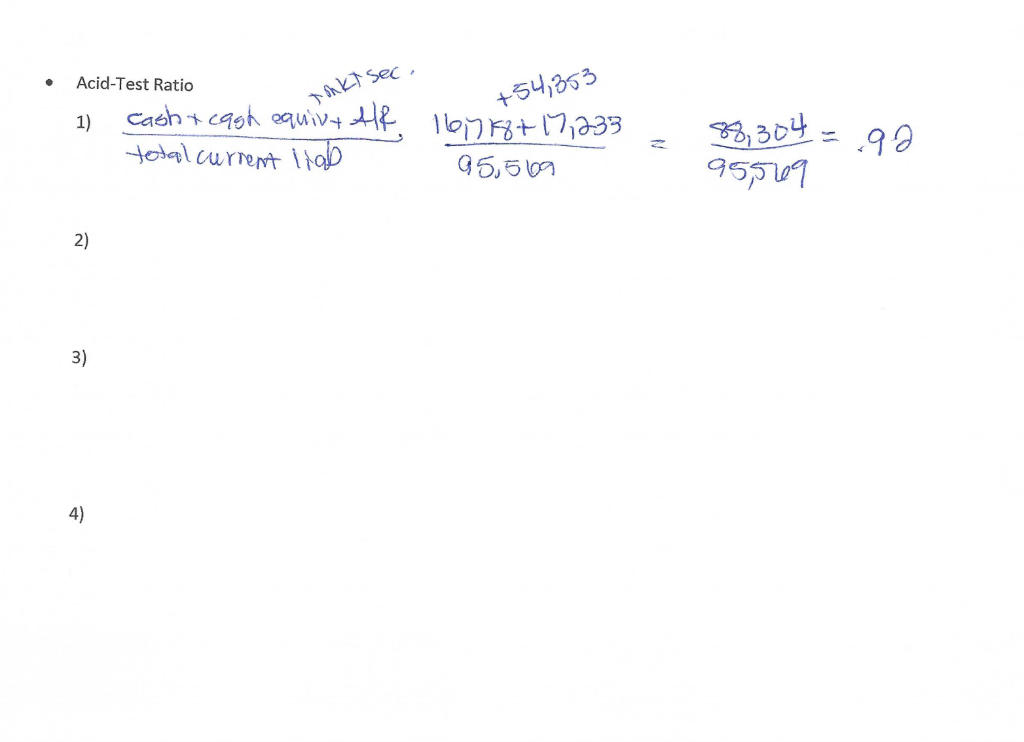

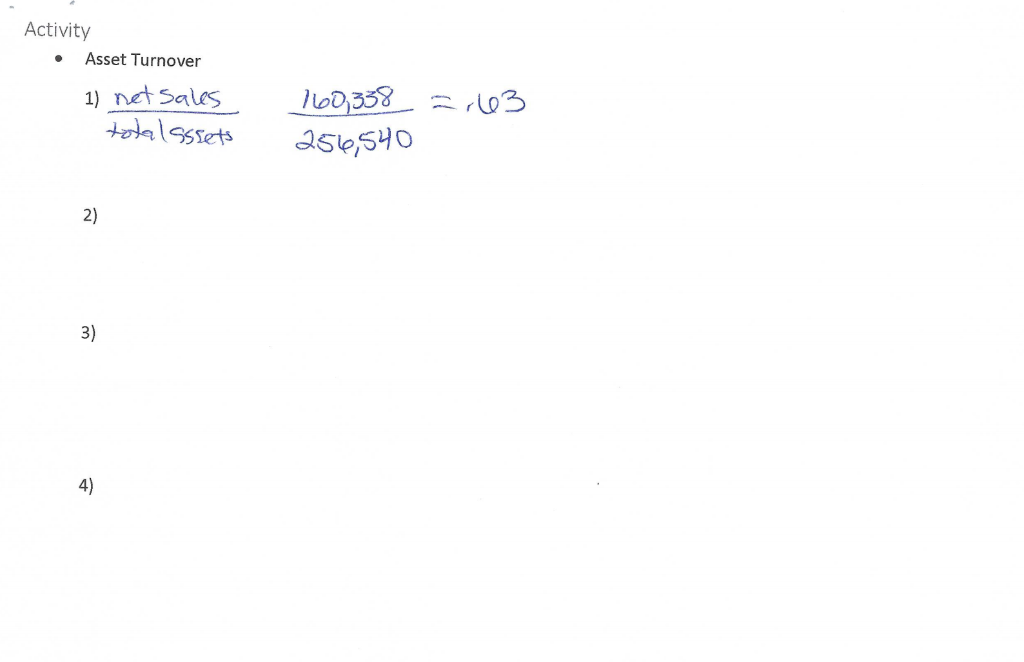

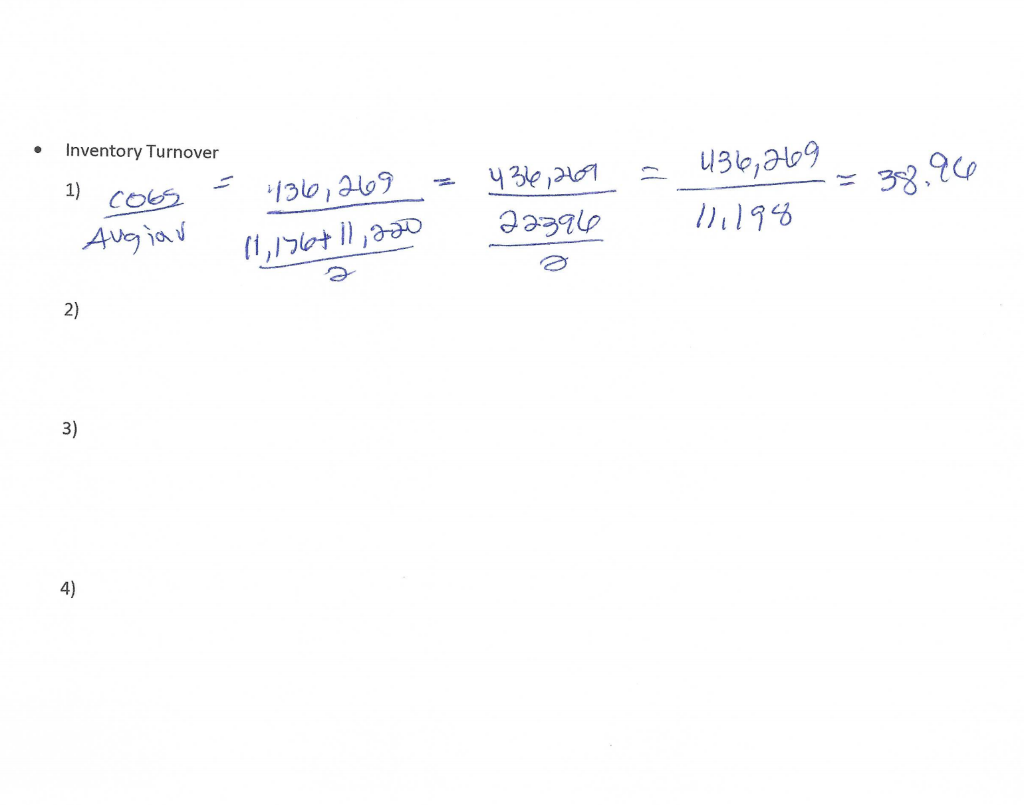

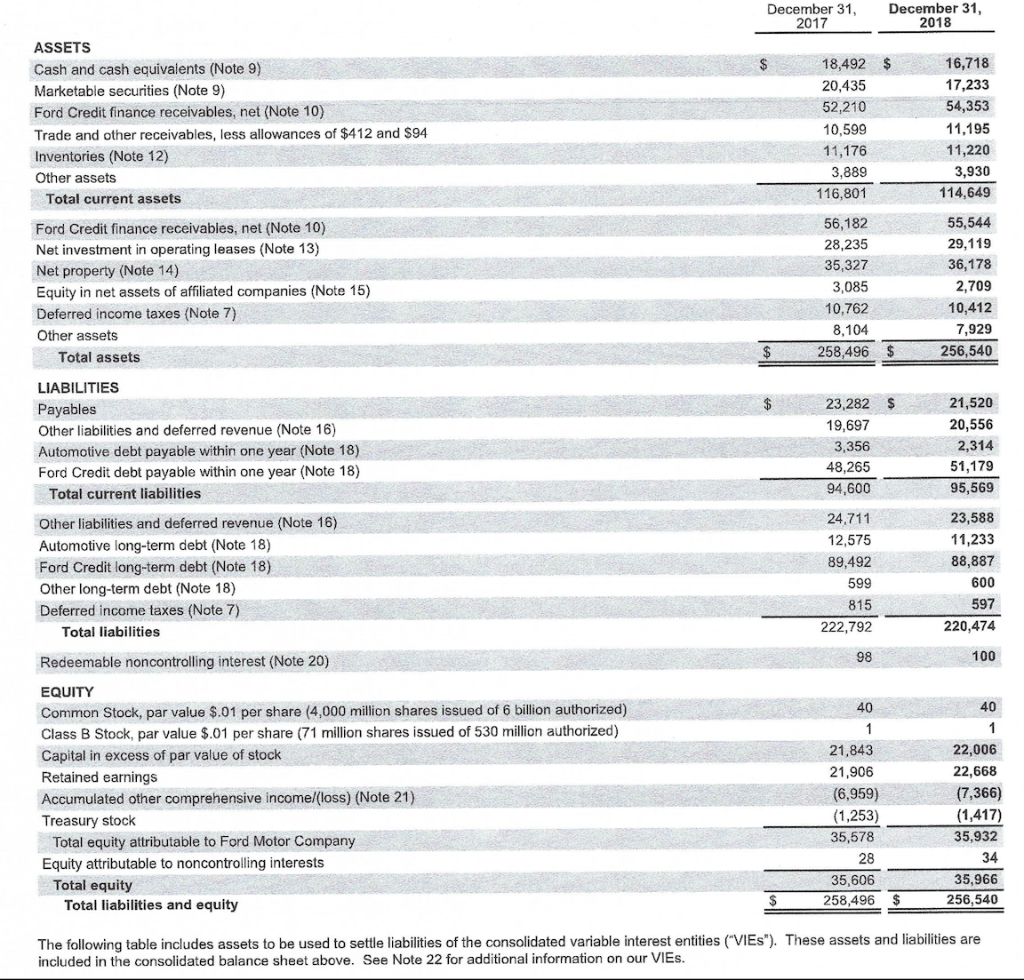

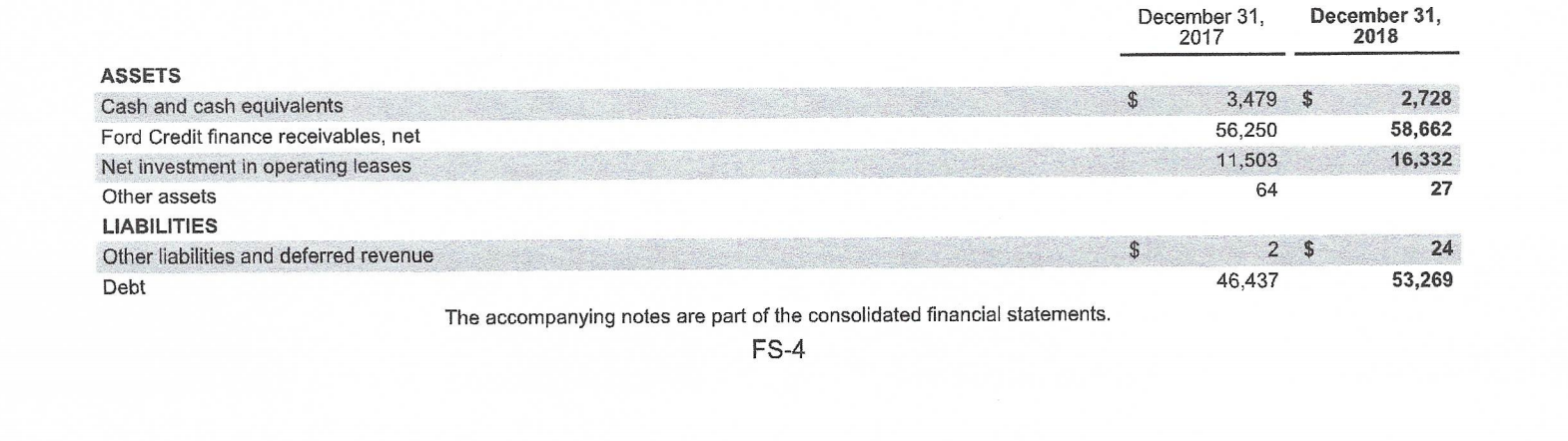

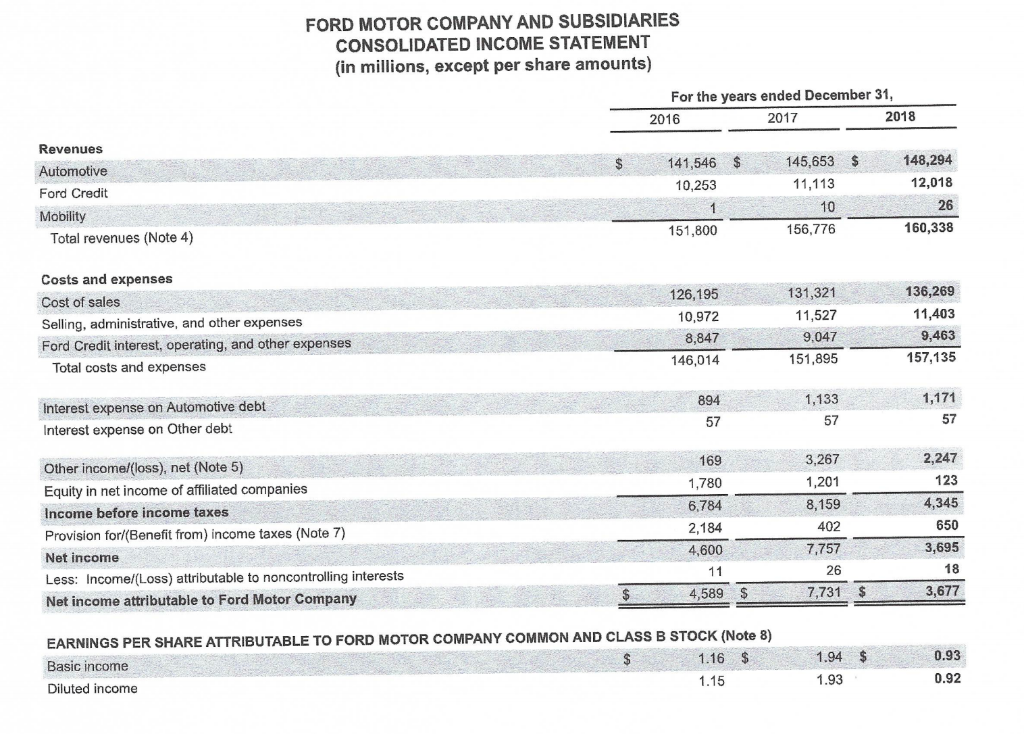

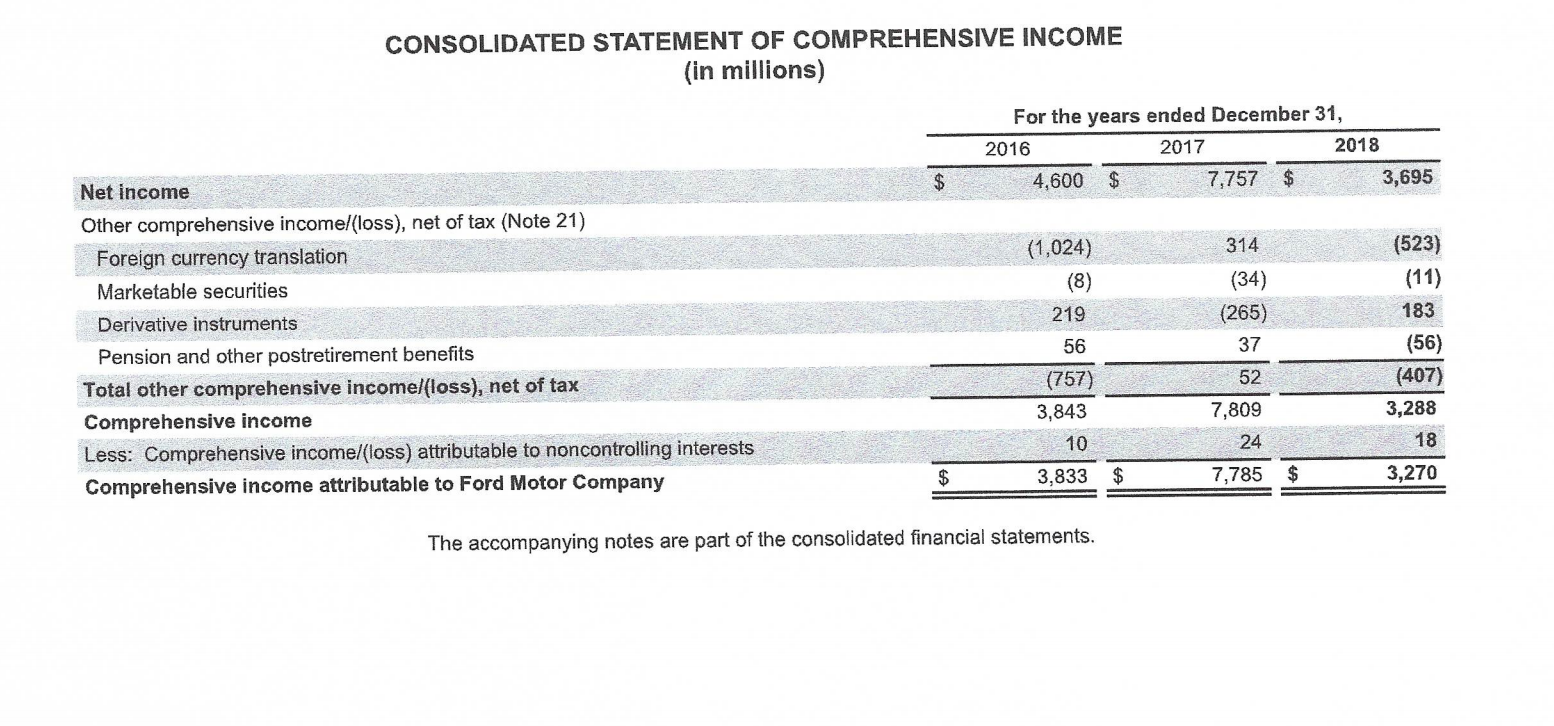

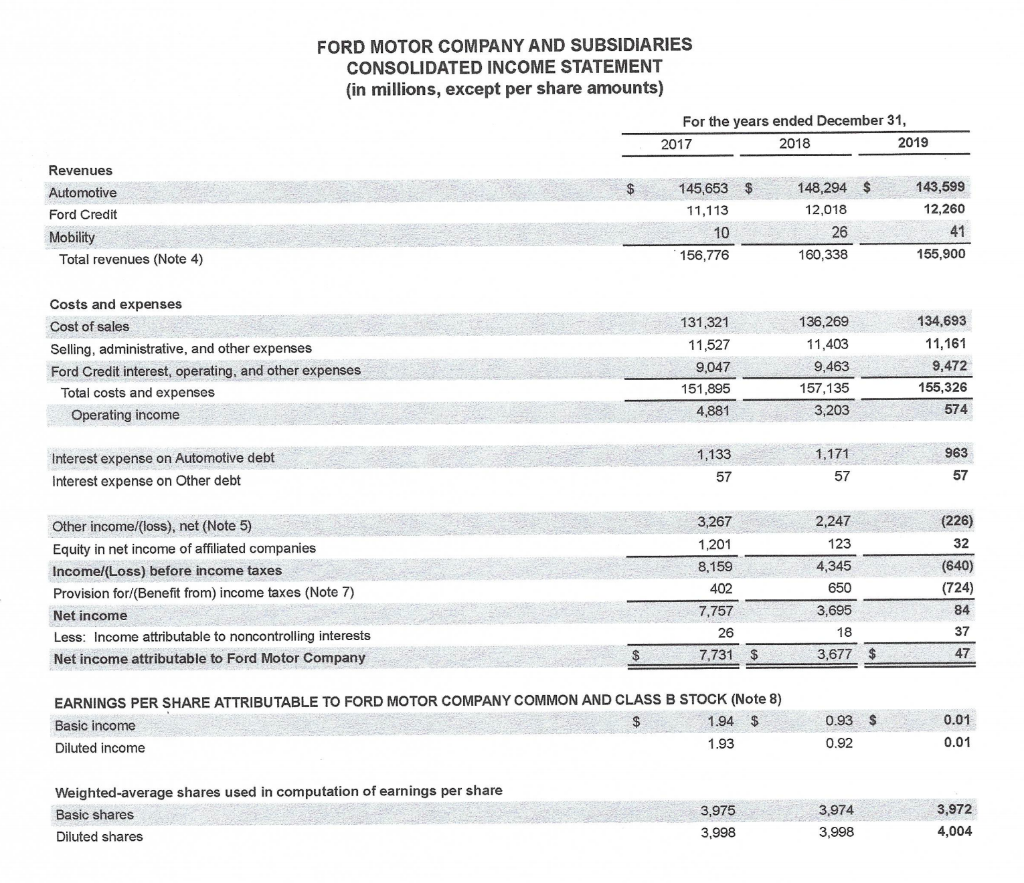

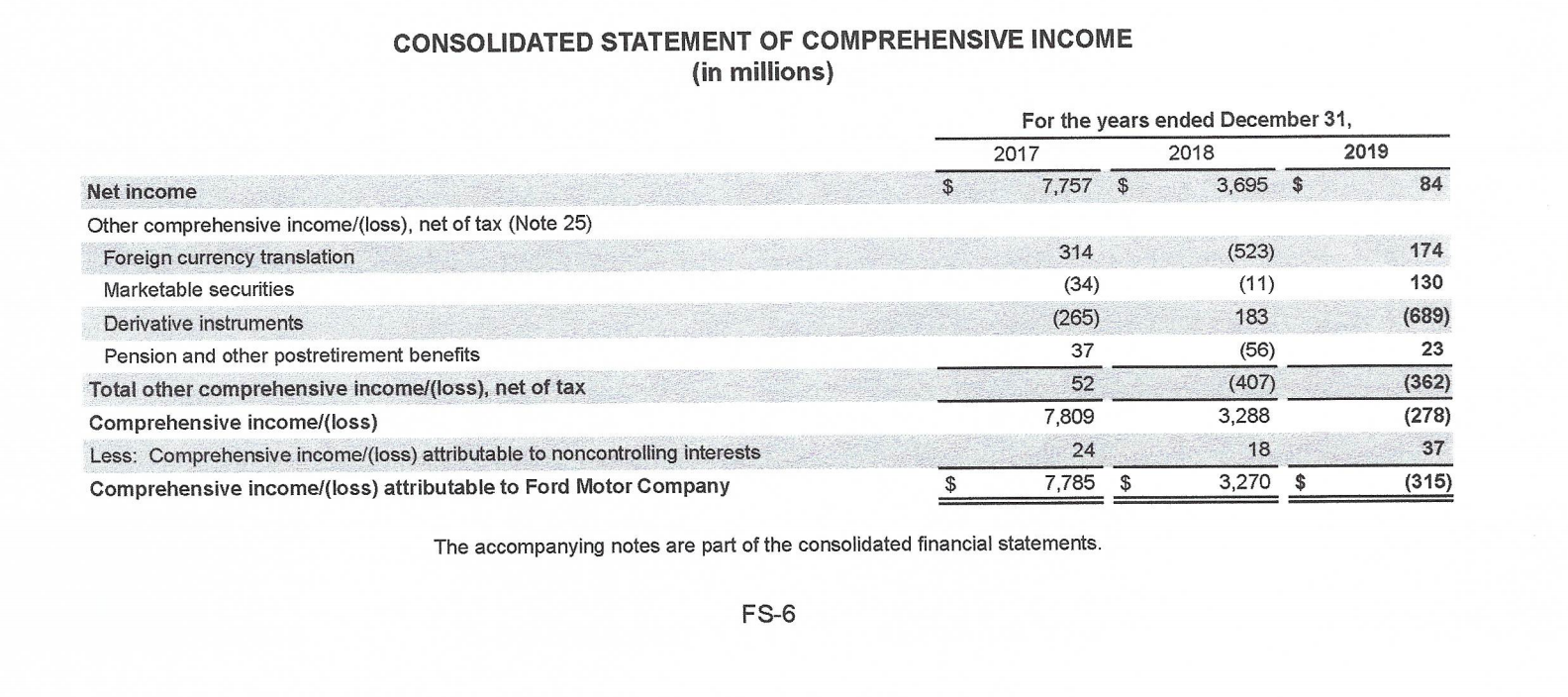

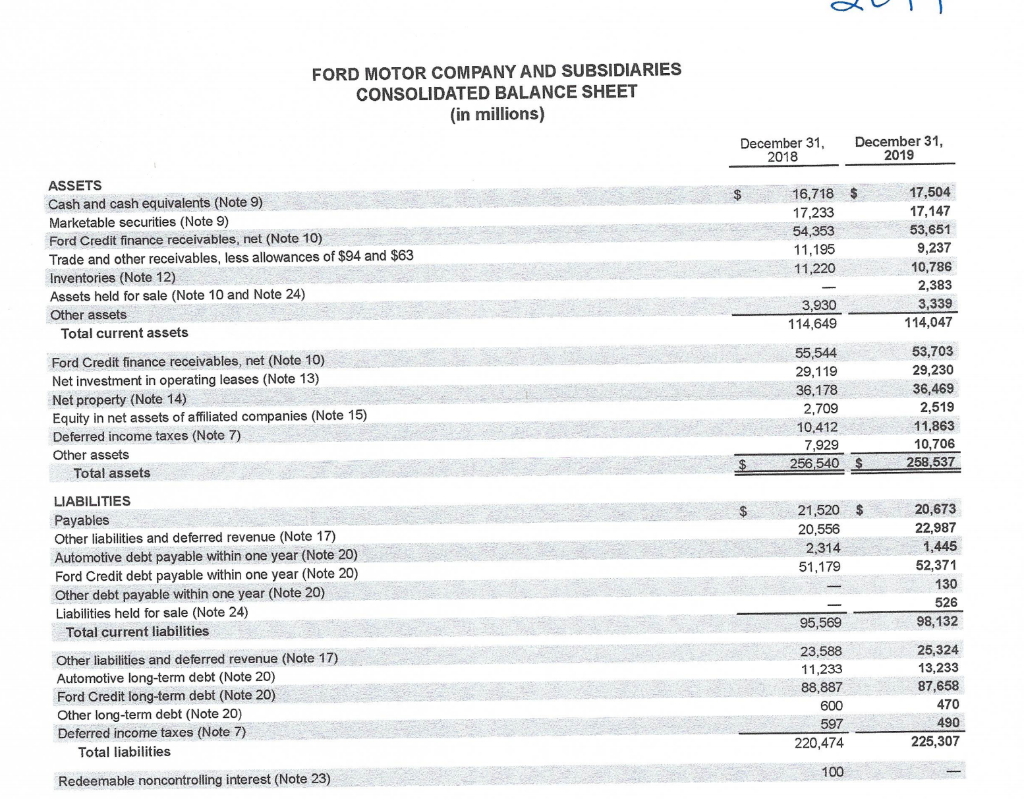

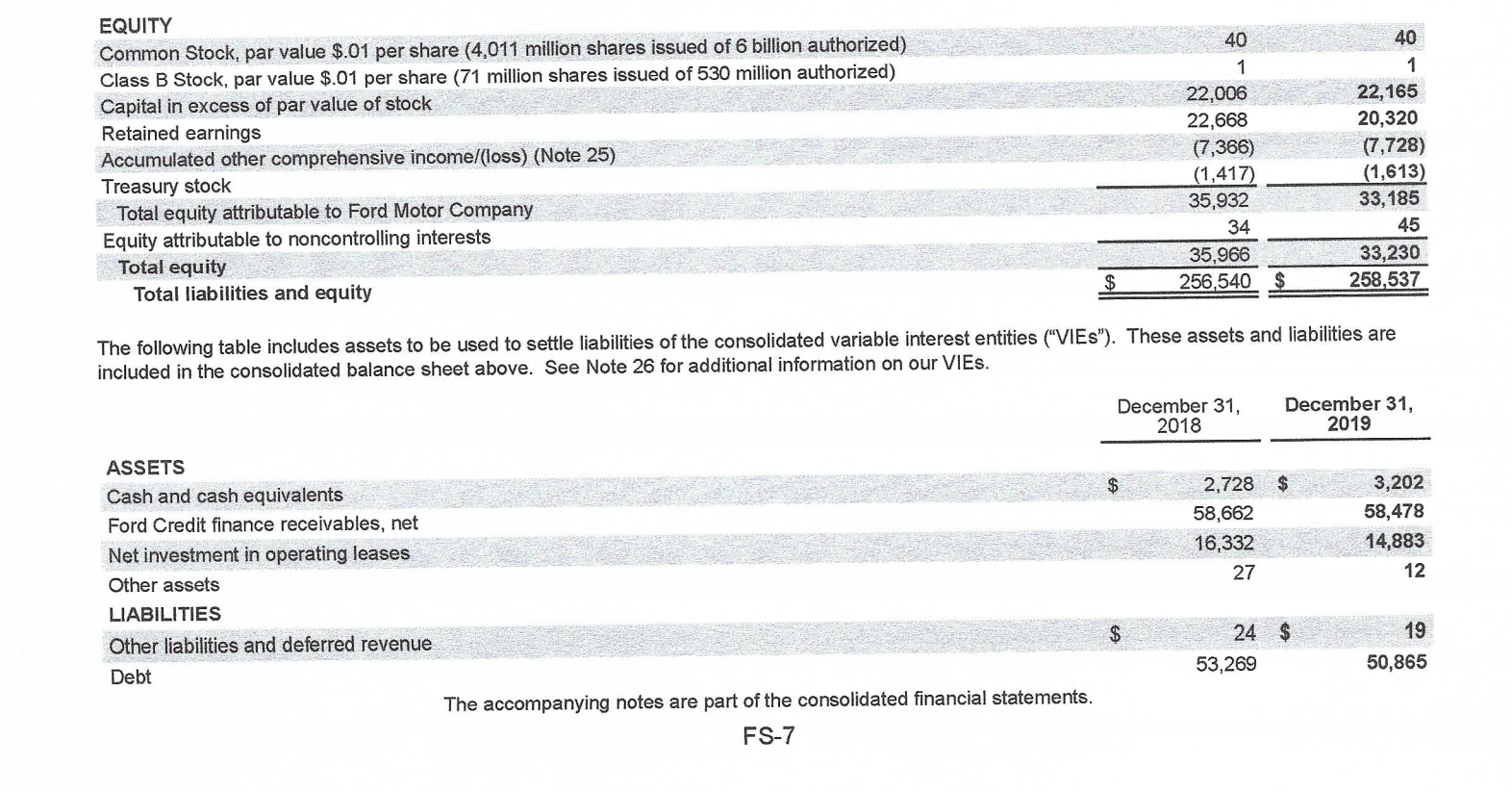

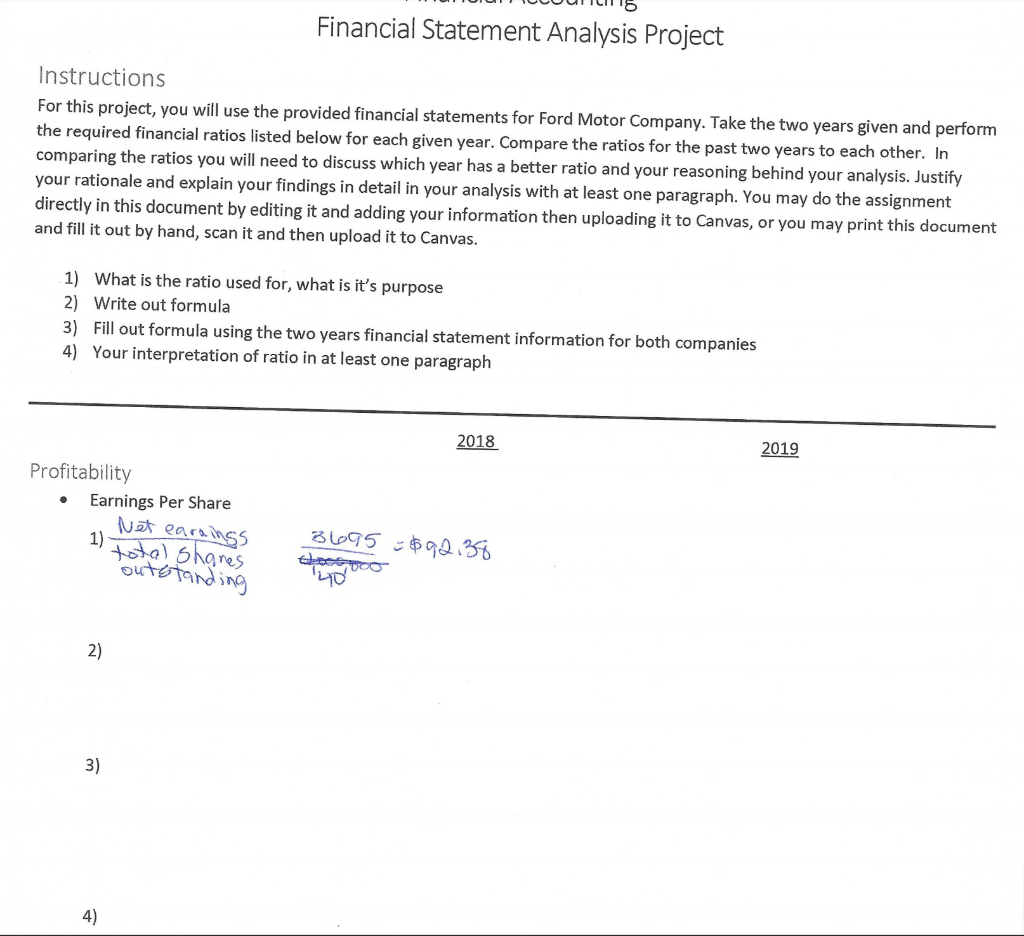

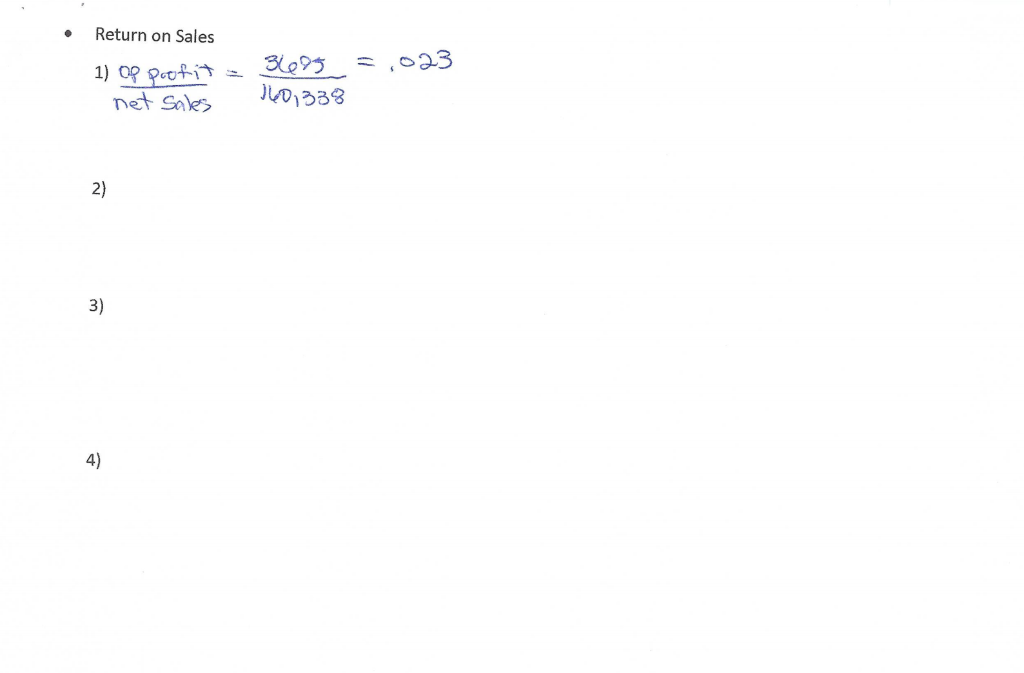

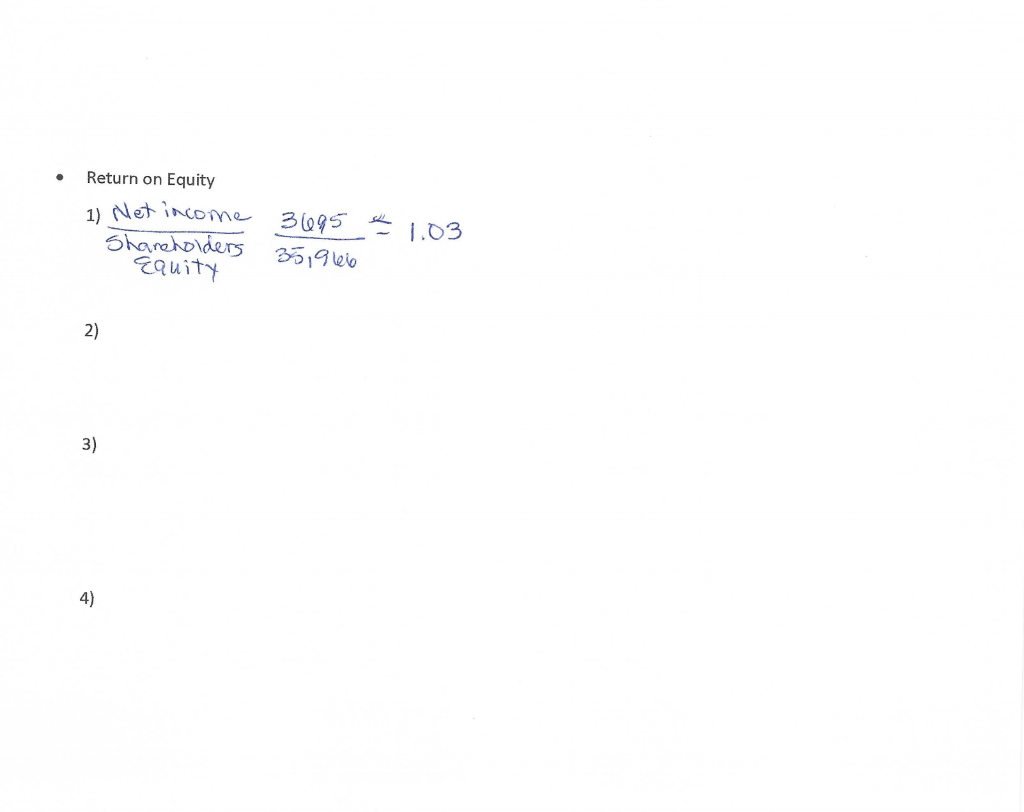

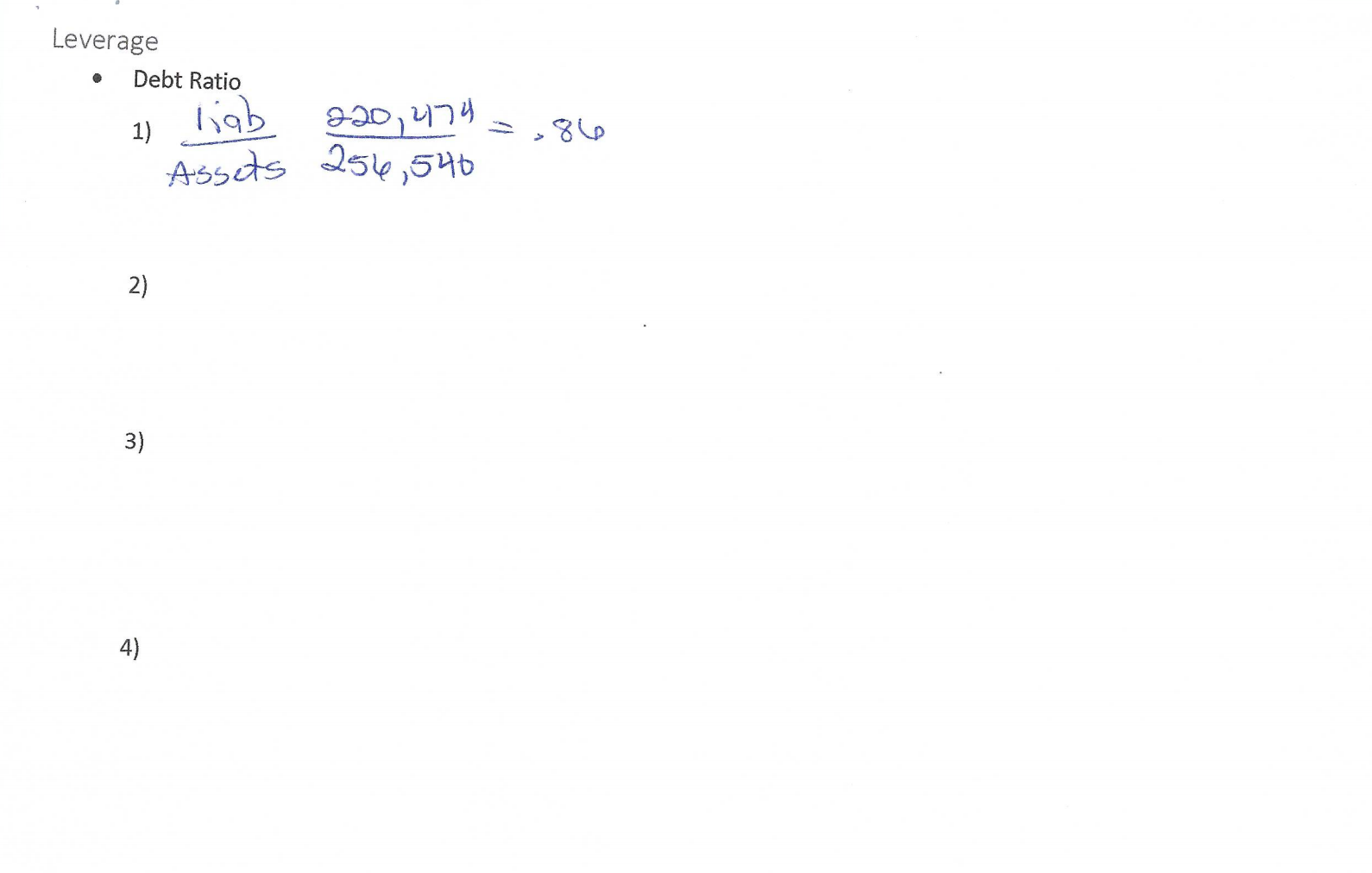

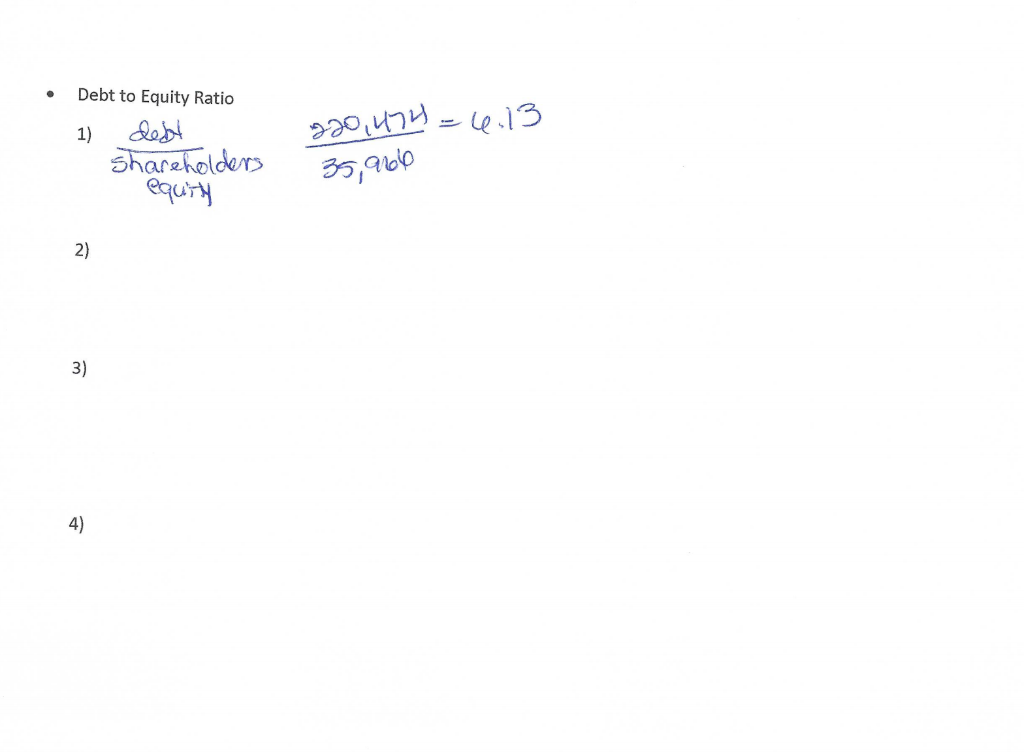

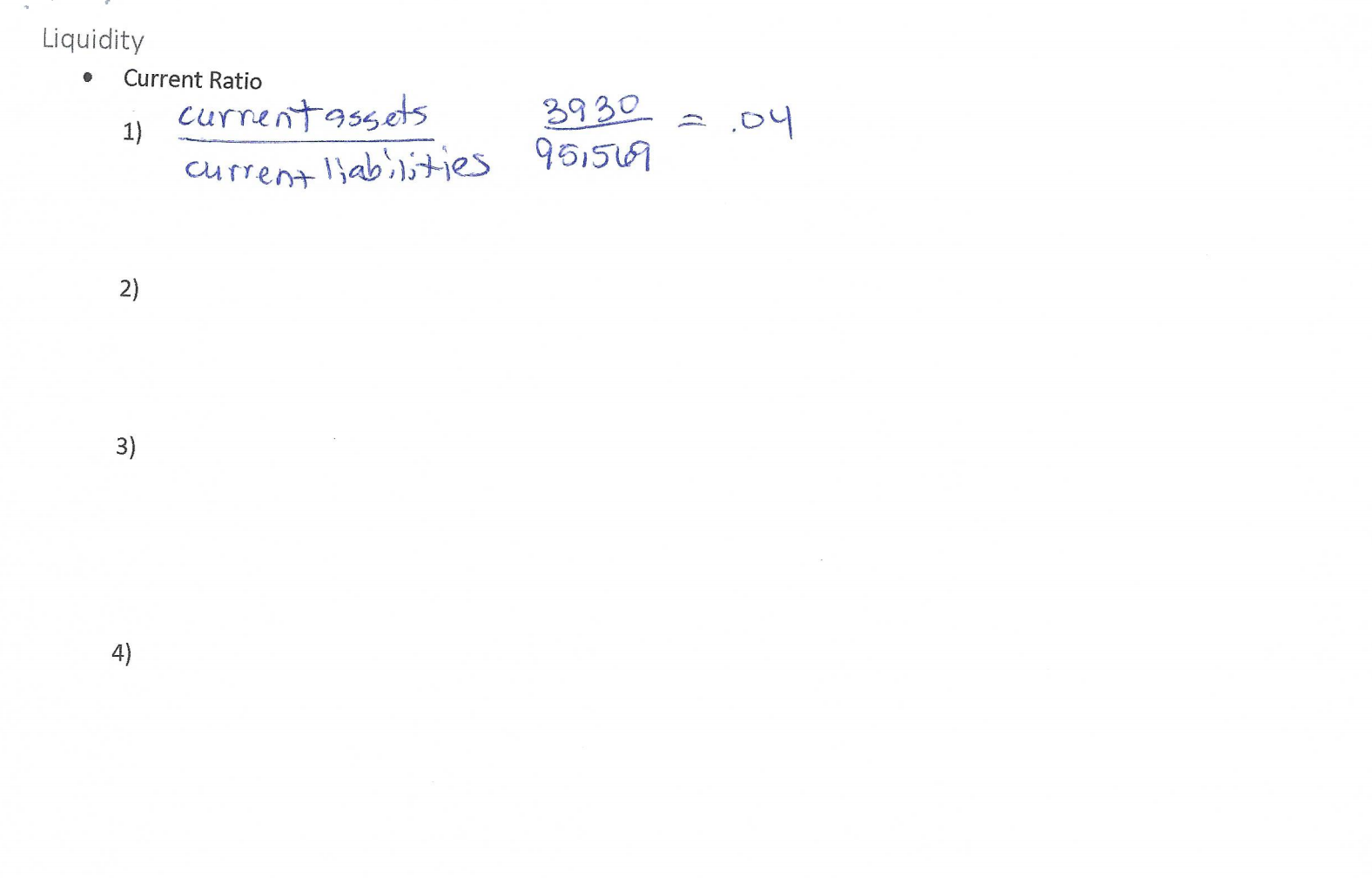

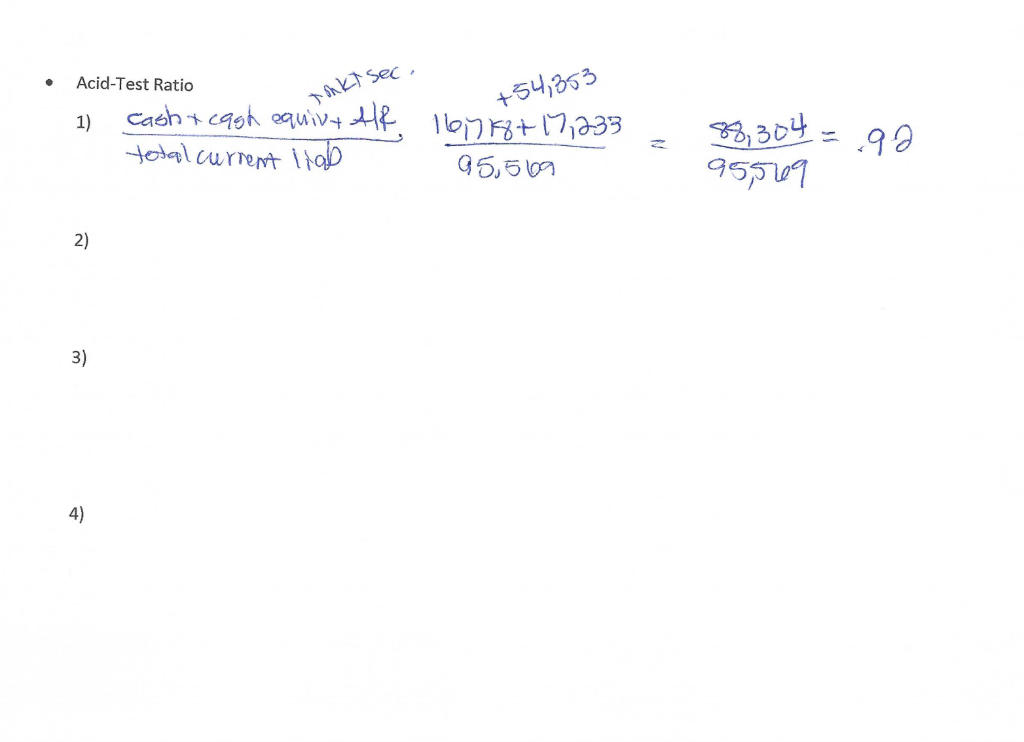

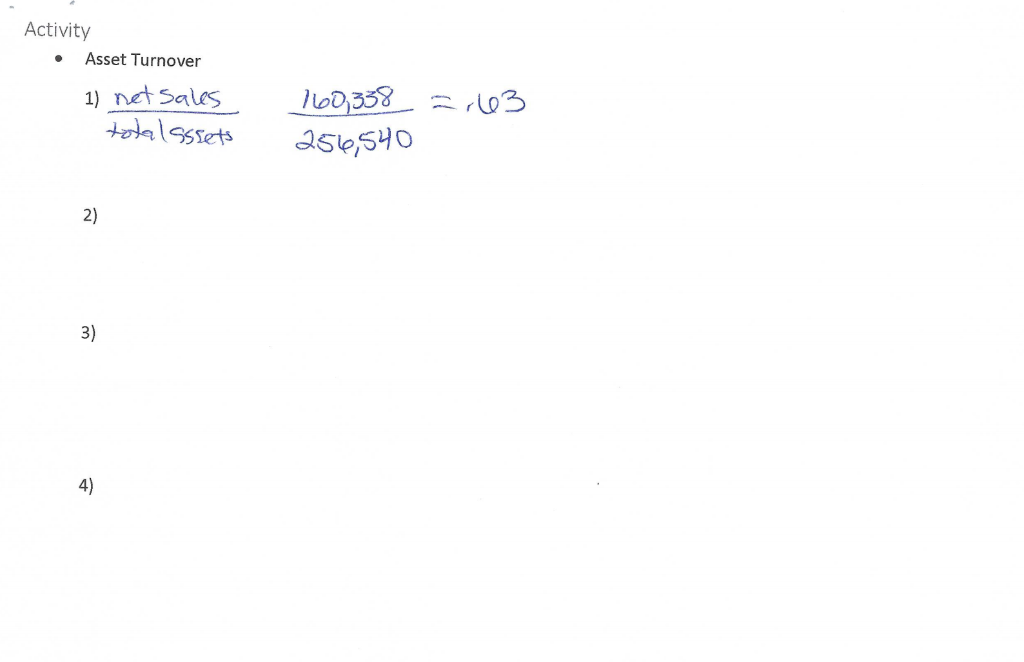

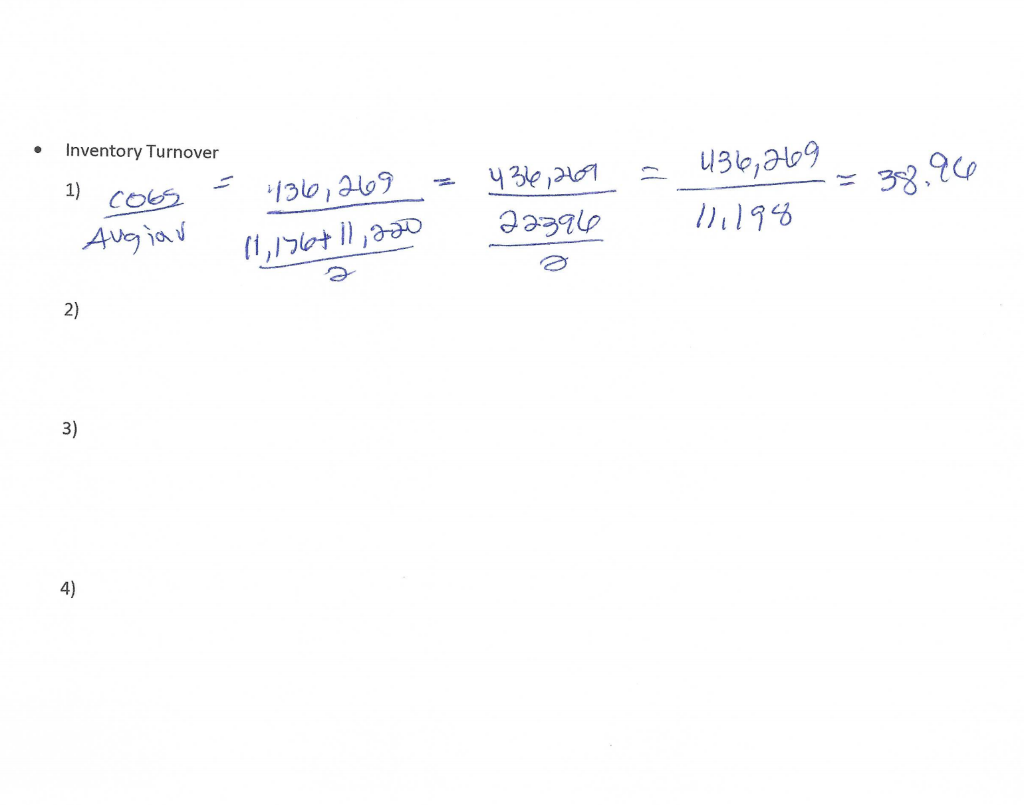

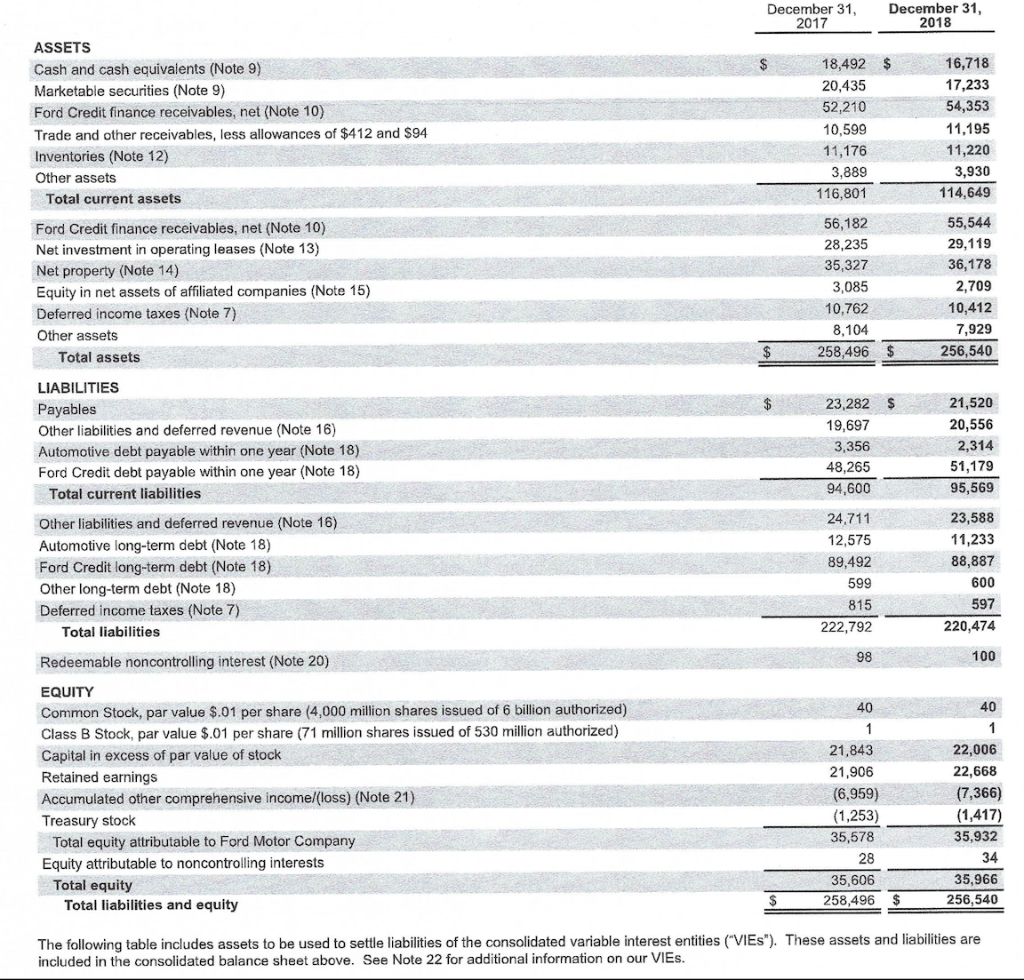

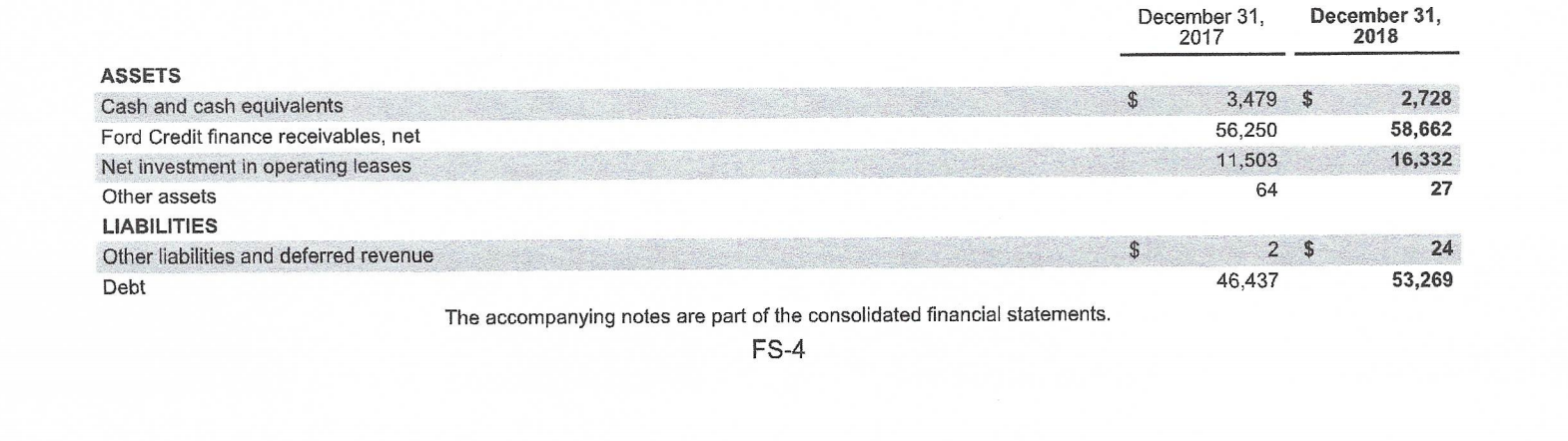

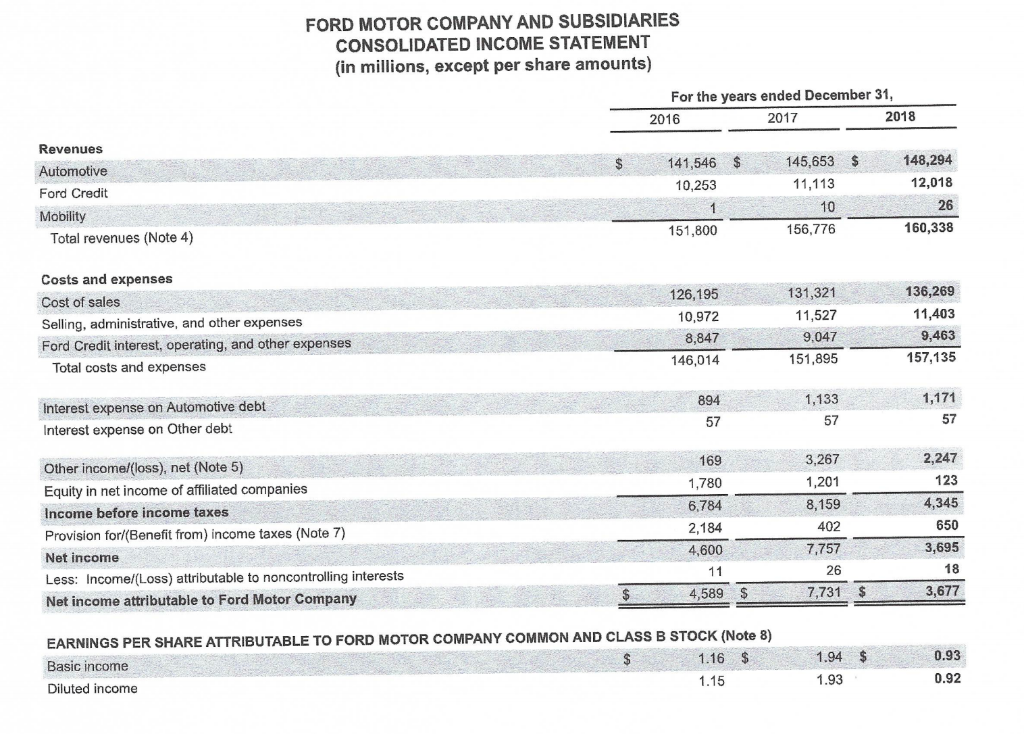

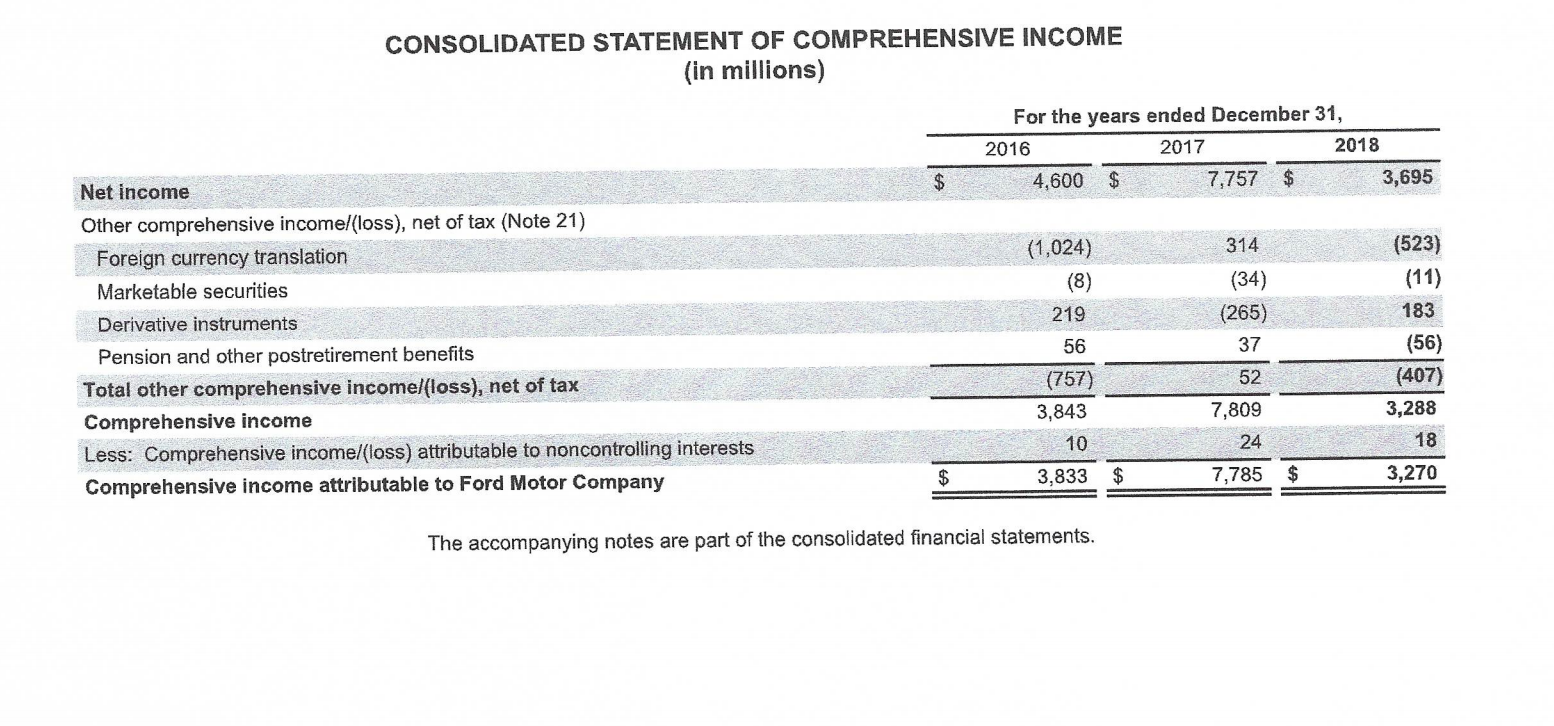

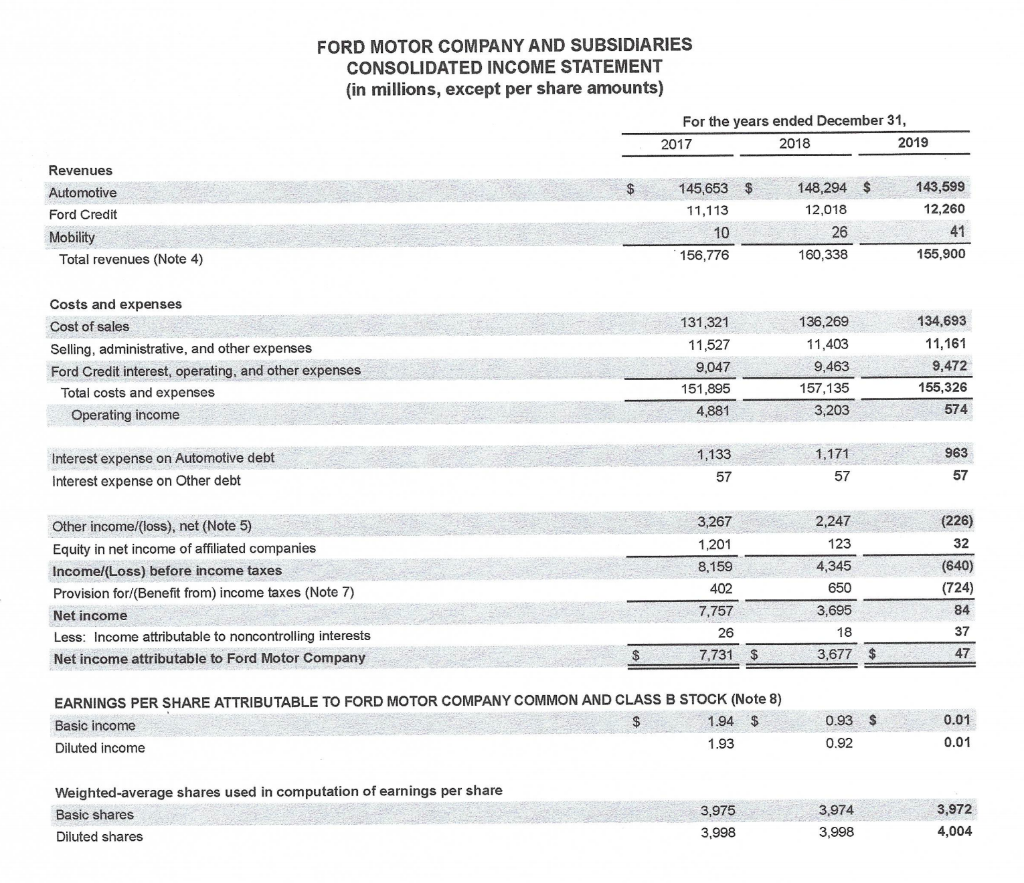

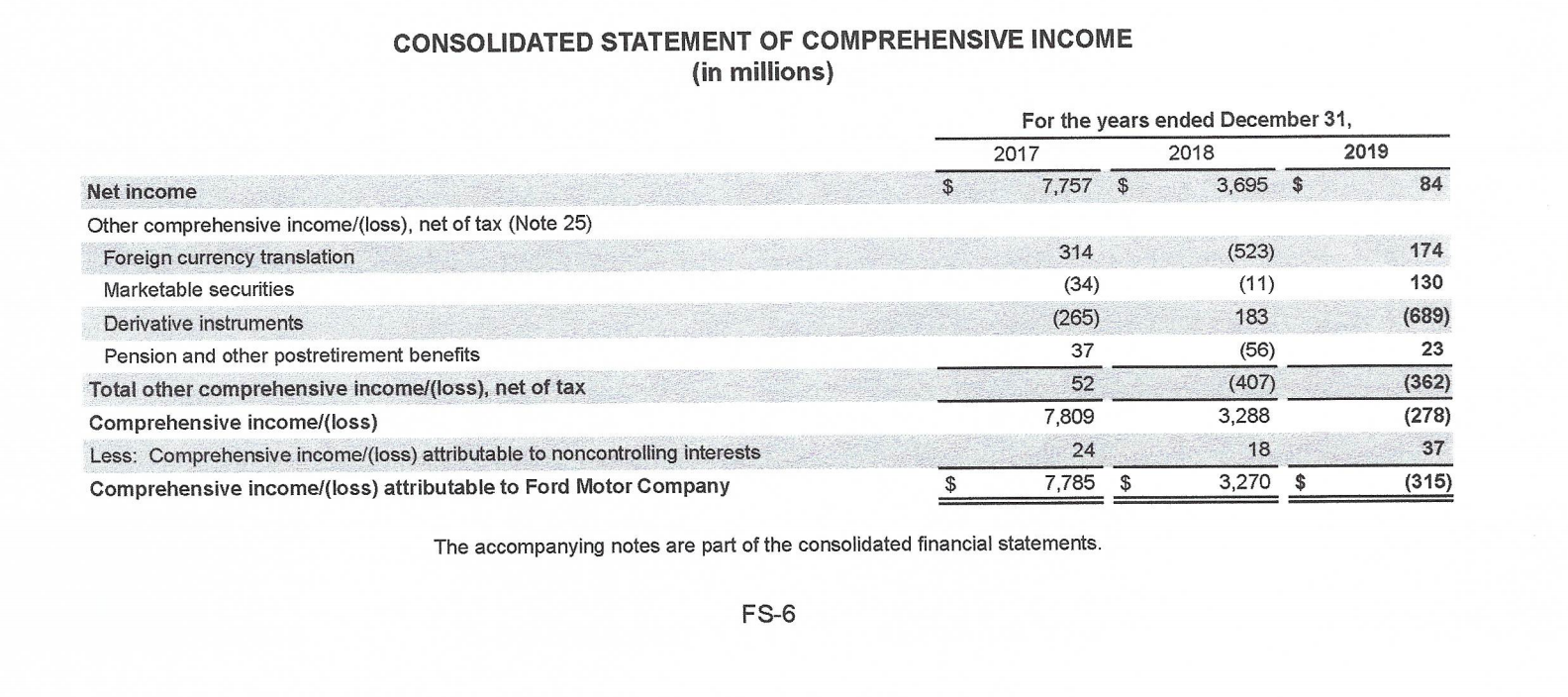

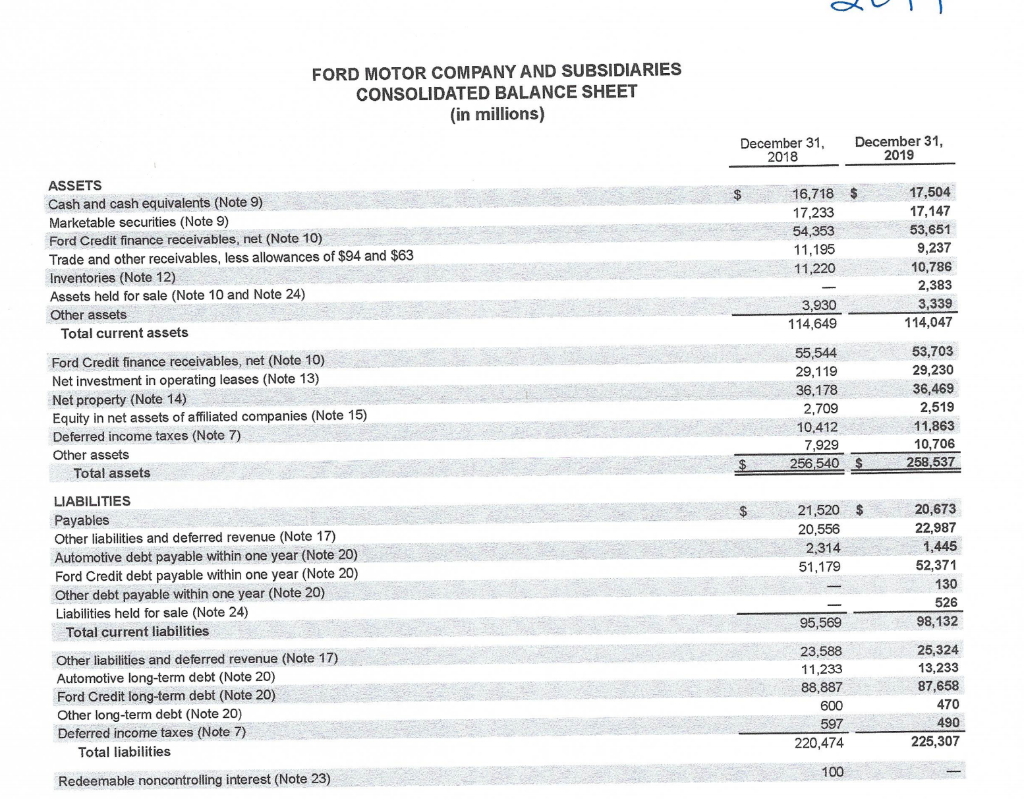

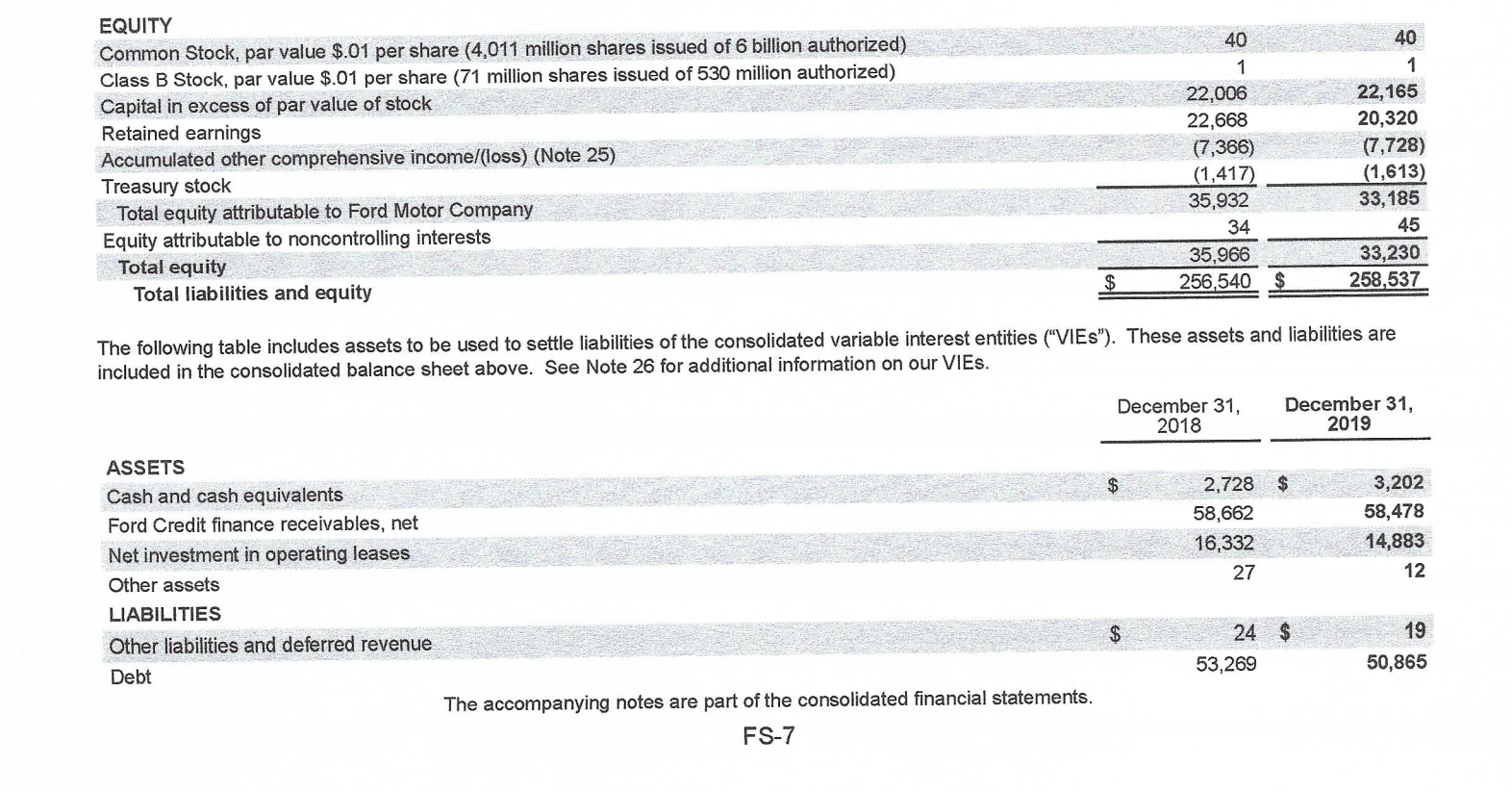

Financial Statement Analysis Project Instructions For this project, you will use the provided financial statements for Ford Motor Company. Take the two years given and perform the required financial ratios listed below for each given year. Compare the ratios for the past two years to each other. In comparing the ratios you will need to discuss which year has a better ratio and your reasoning behind your analysis. Justify your rationale and explain your findings in detail in your analysis with at least one paragraph. You may do the assignment directly in this document by editing it and adding your information then uploading it to Canvas, or you may print this document and fill it out by hand, scan it and then upload it to Canvas. 1) What is the ratio used for, what is it's purpose 2) Write out formula 3) Fill out formula using the two years financial statement information for both companies 4) Your interpretation of ratio in at least one paragraph 2018 2019 Profitability Earnings Per Share 1) 36695 $92.36 Net earaings total shares outstanding smo 2) 3) 4) Return on Sales 3605 =,023 1) Op profit net Sales 160,338 2) 3) 4) Return on Equity 1) Net income 3695 Shareholders 35194616 Equity 1.03 2) 3) 4) Leverage Debt Ratio 1) 86 liab 220, 274 Assets 256,540 2) 3) 4) . 220,474 = 6.13 Debt to Equity Ratio 1) debt shareholders equity 35,906 2) 3) 4) Liquidity Current Ratio . 1) .04 current assets 3930 current liabilities 95,569 2) 3) 4) Acid-Test Ratio Tonkt Sec. +54,353 1) cash & cash equivt All total current liab 16718+ 17,233 95,569 88,304 = 90 95,569 2) 3) 4) Activity Asset Turnover 1) net sales totalsssets Ere3 160,338 256,540 2) 3) 4) Inventory Turnover 64e'sh 1) 33.90 cobs betereh hb 130, 202 (1,77et il , 9,51101 Augiar 2) 3) 4) December 31, 2017 December 31, 2018 ASSETS Cash and cash equivalents (Note 9) Marketable securities (Note 9) Ford Credit finance receivables, net (Note 10) Trade and other receivables, less allowances of $412 and $94 Inventories (Note 12) Other assets Total current assets 18,492 $ 20,435 52,210 10,599 11,176 3,889 116,801 16,718 17,233 54,353 11,195 11,220 3,930 114,649 Ford Credit finance receivables, net (Note 10) Net investment in operating leases (Note 13) Net property (Note 14) Equity in net assets of affiliated companies (Note 15) Deferred income taxes (Note 7) Other assets Total assets 56,182 28,235 35,327 3,085 10,762 8,104 258,496 $ 55,544 29,119 36,178 2,709 10,412 7,929 256,540 $ LIABILITIES Payables Other liabilities and deferred revenue (Note 16) Automotive debt payable within one year (Note 18) Ford Credit debt payable within one year (Note 18) Total current liabilities 23,282 19,697 3,356 48,265 94,600 21,520 20,556 2,314 51,179 95,569 Other liabilities and deferred revenue (Note 16) Automotive long-term debt (Note 18) Ford Credit long-term debt (Note 18) Other long-term debt (Note 18) Deferred income taxes (Note 7) Total liabilities 24,711 12,575 89,492 599 815 222,792 23,588 11,233 88,887 600 597 220,474 Redeemable noncontrolling interest (Note 20) 98 100 40 40 1 EQUITY Common Stock, par value $.01 per share (4,000 million shares issued of 6 billion authorized) Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/loss) (Note 21) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 1 21,843 21,906 (6,959) (1,253) 35,578 28 35,606 258,496 $ 22,006 22,668 (7,366) (1,417) 35,932 34 35,966 256,540 The following table includes assets to be used to settle liabilities of the consolidated variable interest entities ("VIES"). These assets and liabilities are included in the consolidated balance sheet above. See Note 22 for additional information on our VIEs. December 31, 2017 December 31, 2018 $ $ ASSETS Cash and cash equivalents Ford Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt 3,479 56,250 11,503 64 2,728 58,662 16,332 27 2 $ 46,437 24 53,269 The accompanying notes are part of the consolidated financial statements. FS-4 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2016 2017 2018 4,600 $ 7,757 $ 3,695 314 Net income Other comprehensive income (loss), net of tax (Note 21) Foreign currency translation Marketable securities Derivative instruments Pension and other postretirement benefits Total other comprehensive incomelloss), net of tax Comprehensive income Less: Comprehensive income/(loss) attributable to noncontrolling interests Comprehensive income attributable to Ford Motor Company (1,024) (8) 219 56 (523) (11) 183 (56) (757) 3,843 10 3,833 $ (34) (265) 37 52 7,809 24 7,785 (407) 3,288 18 3,270 $ $ The accompanying notes are part of the consolidated financial statements. FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 $ Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 145,653 $ 11,113 10 156,776 148,294 12,018 26 160,338 143,599 12,260 41 155,900 136,269 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses Operating income 131,321 11,527 9,047 151,895 4,881 11,403 9,463 157,135 3,203 134,693 11,161 9,472 155,326 574 1,171 Interest expense on Automotive debt Interest expense on Other debt 1,133 57 963 57 57 3.267 1,201 8,159 Other income/(loss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision for/(Benefit from) income taxes (Note 7) Net income Less: Income attributable to noncontrolling interests Net income attributable to Ford Motor Company 402 2,247 123 4,345 650 3,695 18 3,677 $ (226) 32 (640) (724) 84 37 47 7,757 26 7,731 $ EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income 1.94 $ Diluted income 1.93 0.93 $ 0.01 0.01 0.92 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3,975 3,998 3,974 3,998 3,972 4,004 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2017 2018 2019 7,757 $ 3,695 $ Net income $ 84 Other comprehensive income/(loss), net of tax (Note 25) Foreign currency translation Marketable securities 314 174 (523) (11) 130 (34) (265) 183 37 52 Derivative instruments Pension and other postretirement benefits Total other comprehensive income (loss), net of tax Comprehensive incomel(loss) Less: Comprehensive income (loss) attributable to noncontrolling interests Comprehensive incomel(loss) attributable to Ford Motor Company (56) (407) 3,288 (689) 23 (362) (278) 37 (315) 7,809 24 7,785 $ 18 $ 3,270 $ The accompanying notes are part of the consolidated financial statements. FS-6 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, 2018 December 31, 2019 ASSETS Cash and cash equivalents (Note 9) Marketable securities (Note 9) Ford Credit finance receivables, net (Note 10) Trade and other receivables, less allowances of $94 and $63 Inventories (Note 12) Assets held for sale (Note 10 and Note 24) Other assets Total current assets 16,718 $ 17,233 54.353 11,195 11,220 17,504 17,147 53,651 9,237 10,786 2,383 3,339 114,047 3,930 114,649 Ford Credit finance receivables, net (Note 10) Net investment in operating leases (Note 13) Net property (Note 14) Equity in net assets of affiliated companies (Note 15) Deferred income taxes (Note 7) Other assets Total assets 55,544 29,119 36.178 2,709 10,412 7,929 256,540 53,703 29,230 36,469 2,519 11,863 10,706 258,537 LIABILITIES Payables Other liabilities and deferred revenue (Note 17) Automotive debt payable within one year (Note 20) Ford Credit debt payable within one year (Note 20) Other debt payable within one year (Note 20) Liabilities held for sale (Note 24) Total current liabilities 21,520 $ 20,556 2,314 51,179 20,673 22.987 1,445 52,371 130 526 98,132 95,569 Other liabilities and deferred revenue (Note 17) Automotive long-term debt (Note 20) Ford Credit long-term debt (Note 20) Other long-term debt (Note 20) Deferred income taxes (Note 7) Total liabilities 23,588 11,233 88,887 600 597 220,474 25,324 13,233 87,658 470 490 225,307 100 Redeemable noncontrolling interest (Note 23) 40 40 1 1 EQUITY Common Stock, par value $.01 per share (4,011 million shares issued of 6 billion authorized) Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/(loss) (Note 25) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 22,006 22,668 (7,366) (1,417) 35,932 34 35,966 256,540 $ 22,165 20,320 (7,728) (1,613) 33,185 45 33,230 258,537 $ The following table includes assets to be used to settle liabilities of the consolidated variable interest entities ("VIES"). These assets and liabilities are included in the consolidated balance sheet above. See Note 26 for additional information on our VIEs. December 31, 2018 December 31, 2019 $ ASSETS Cash and cash equivalents Ford Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt 2,728 58,662 16,332 27 3,202 58,478 14,883 12 24 $ 53,269 19 50,865 The accompanying notes are part of the consolidated financial statements. FS-7 Financial Statement Analysis Project Instructions For this project, you will use the provided financial statements for Ford Motor Company. Take the two years given and perform the required financial ratios listed below for each given year. Compare the ratios for the past two years to each other. In comparing the ratios you will need to discuss which year has a better ratio and your reasoning behind your analysis. Justify your rationale and explain your findings in detail in your analysis with at least one paragraph. You may do the assignment directly in this document by editing it and adding your information then uploading it to Canvas, or you may print this document and fill it out by hand, scan it and then upload it to Canvas. 1) What is the ratio used for, what is it's purpose 2) Write out formula 3) Fill out formula using the two years financial statement information for both companies 4) Your interpretation of ratio in at least one paragraph 2018 2019 Profitability Earnings Per Share 1) 36695 $92.36 Net earaings total shares outstanding smo 2) 3) 4) Return on Sales 3605 =,023 1) Op profit net Sales 160,338 2) 3) 4) Return on Equity 1) Net income 3695 Shareholders 35194616 Equity 1.03 2) 3) 4) Leverage Debt Ratio 1) 86 liab 220, 274 Assets 256,540 2) 3) 4) . 220,474 = 6.13 Debt to Equity Ratio 1) debt shareholders equity 35,906 2) 3) 4) Liquidity Current Ratio . 1) .04 current assets 3930 current liabilities 95,569 2) 3) 4) Acid-Test Ratio Tonkt Sec. +54,353 1) cash & cash equivt All total current liab 16718+ 17,233 95,569 88,304 = 90 95,569 2) 3) 4) Activity Asset Turnover 1) net sales totalsssets Ere3 160,338 256,540 2) 3) 4) Inventory Turnover 64e'sh 1) 33.90 cobs betereh hb 130, 202 (1,77et il , 9,51101 Augiar 2) 3) 4) December 31, 2017 December 31, 2018 ASSETS Cash and cash equivalents (Note 9) Marketable securities (Note 9) Ford Credit finance receivables, net (Note 10) Trade and other receivables, less allowances of $412 and $94 Inventories (Note 12) Other assets Total current assets 18,492 $ 20,435 52,210 10,599 11,176 3,889 116,801 16,718 17,233 54,353 11,195 11,220 3,930 114,649 Ford Credit finance receivables, net (Note 10) Net investment in operating leases (Note 13) Net property (Note 14) Equity in net assets of affiliated companies (Note 15) Deferred income taxes (Note 7) Other assets Total assets 56,182 28,235 35,327 3,085 10,762 8,104 258,496 $ 55,544 29,119 36,178 2,709 10,412 7,929 256,540 $ LIABILITIES Payables Other liabilities and deferred revenue (Note 16) Automotive debt payable within one year (Note 18) Ford Credit debt payable within one year (Note 18) Total current liabilities 23,282 19,697 3,356 48,265 94,600 21,520 20,556 2,314 51,179 95,569 Other liabilities and deferred revenue (Note 16) Automotive long-term debt (Note 18) Ford Credit long-term debt (Note 18) Other long-term debt (Note 18) Deferred income taxes (Note 7) Total liabilities 24,711 12,575 89,492 599 815 222,792 23,588 11,233 88,887 600 597 220,474 Redeemable noncontrolling interest (Note 20) 98 100 40 40 1 EQUITY Common Stock, par value $.01 per share (4,000 million shares issued of 6 billion authorized) Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/loss) (Note 21) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 1 21,843 21,906 (6,959) (1,253) 35,578 28 35,606 258,496 $ 22,006 22,668 (7,366) (1,417) 35,932 34 35,966 256,540 The following table includes assets to be used to settle liabilities of the consolidated variable interest entities ("VIES"). These assets and liabilities are included in the consolidated balance sheet above. See Note 22 for additional information on our VIEs. December 31, 2017 December 31, 2018 $ $ ASSETS Cash and cash equivalents Ford Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt 3,479 56,250 11,503 64 2,728 58,662 16,332 27 2 $ 46,437 24 53,269 The accompanying notes are part of the consolidated financial statements. FS-4 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2016 2017 2018 4,600 $ 7,757 $ 3,695 314 Net income Other comprehensive income (loss), net of tax (Note 21) Foreign currency translation Marketable securities Derivative instruments Pension and other postretirement benefits Total other comprehensive incomelloss), net of tax Comprehensive income Less: Comprehensive income/(loss) attributable to noncontrolling interests Comprehensive income attributable to Ford Motor Company (1,024) (8) 219 56 (523) (11) 183 (56) (757) 3,843 10 3,833 $ (34) (265) 37 52 7,809 24 7,785 (407) 3,288 18 3,270 $ $ The accompanying notes are part of the consolidated financial statements. FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 $ Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 145,653 $ 11,113 10 156,776 148,294 12,018 26 160,338 143,599 12,260 41 155,900 136,269 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses Operating income 131,321 11,527 9,047 151,895 4,881 11,403 9,463 157,135 3,203 134,693 11,161 9,472 155,326 574 1,171 Interest expense on Automotive debt Interest expense on Other debt 1,133 57 963 57 57 3.267 1,201 8,159 Other income/(loss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision for/(Benefit from) income taxes (Note 7) Net income Less: Income attributable to noncontrolling interests Net income attributable to Ford Motor Company 402 2,247 123 4,345 650 3,695 18 3,677 $ (226) 32 (640) (724) 84 37 47 7,757 26 7,731 $ EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income 1.94 $ Diluted income 1.93 0.93 $ 0.01 0.01 0.92 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3,975 3,998 3,974 3,998 3,972 4,004 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2017 2018 2019 7,757 $ 3,695 $ Net income $ 84 Other comprehensive income/(loss), net of tax (Note 25) Foreign currency translation Marketable securities 314 174 (523) (11) 130 (34) (265) 183 37 52 Derivative instruments Pension and other postretirement benefits Total other comprehensive income (loss), net of tax Comprehensive incomel(loss) Less: Comprehensive income (loss) attributable to noncontrolling interests Comprehensive incomel(loss) attributable to Ford Motor Company (56) (407) 3,288 (689) 23 (362) (278) 37 (315) 7,809 24 7,785 $ 18 $ 3,270 $ The accompanying notes are part of the consolidated financial statements. FS-6 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, 2018 December 31, 2019 ASSETS Cash and cash equivalents (Note 9) Marketable securities (Note 9) Ford Credit finance receivables, net (Note 10) Trade and other receivables, less allowances of $94 and $63 Inventories (Note 12) Assets held for sale (Note 10 and Note 24) Other assets Total current assets 16,718 $ 17,233 54.353 11,195 11,220 17,504 17,147 53,651 9,237 10,786 2,383 3,339 114,047 3,930 114,649 Ford Credit finance receivables, net (Note 10) Net investment in operating leases (Note 13) Net property (Note 14) Equity in net assets of affiliated companies (Note 15) Deferred income taxes (Note 7) Other assets Total assets 55,544 29,119 36.178 2,709 10,412 7,929 256,540 53,703 29,230 36,469 2,519 11,863 10,706 258,537 LIABILITIES Payables Other liabilities and deferred revenue (Note 17) Automotive debt payable within one year (Note 20) Ford Credit debt payable within one year (Note 20) Other debt payable within one year (Note 20) Liabilities held for sale (Note 24) Total current liabilities 21,520 $ 20,556 2,314 51,179 20,673 22.987 1,445 52,371 130 526 98,132 95,569 Other liabilities and deferred revenue (Note 17) Automotive long-term debt (Note 20) Ford Credit long-term debt (Note 20) Other long-term debt (Note 20) Deferred income taxes (Note 7) Total liabilities 23,588 11,233 88,887 600 597 220,474 25,324 13,233 87,658 470 490 225,307 100 Redeemable noncontrolling interest (Note 23) 40 40 1 1 EQUITY Common Stock, par value $.01 per share (4,011 million shares issued of 6 billion authorized) Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock Retained earnings Accumulated other comprehensive income/(loss) (Note 25) Treasury stock Total equity attributable to Ford Motor Company Equity attributable to noncontrolling interests Total equity Total liabilities and equity 22,006 22,668 (7,366) (1,417) 35,932 34 35,966 256,540 $ 22,165 20,320 (7,728) (1,613) 33,185 45 33,230 258,537 $ The following table includes assets to be used to settle liabilities of the consolidated variable interest entities ("VIES"). These assets and liabilities are included in the consolidated balance sheet above. See Note 26 for additional information on our VIEs. December 31, 2018 December 31, 2019 $ ASSETS Cash and cash equivalents Ford Credit finance receivables, net Net investment in operating leases Other assets LIABILITIES Other liabilities and deferred revenue Debt 2,728 58,662 16,332 27 3,202 58,478 14,883 12 24 $ 53,269 19 50,865 The accompanying notes are part of the consolidated financial statements. FS-7