Answered step by step

Verified Expert Solution

Question

1 Approved Answer

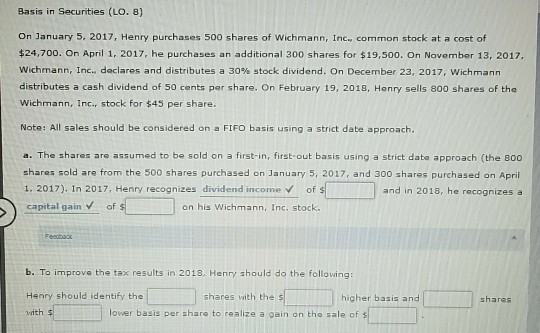

Basis in Securities (LO. 8) On January 5, 2017, Henry purchases 500 shares of Wichmann, Inc., common stock at a cost of $24,700. On April

Basis in Securities (LO. 8) On January 5, 2017, Henry purchases 500 shares of Wichmann, Inc., common stock at a cost of $24,700. On April 1, 2017, he purchases an additional 300 shares for $19,500. On November 13, 2017, Wichmann, Inc., declares and distributes a 30% stock dividend. On December 23, 2017, wich mann distributes a cash dividend of 50 cents per share. On February 19, 2018, Henry sells 800 shares of the Wichmann, Inc., stock for $45 per share. Note: All sales should be considered on a FIFO basis using a strict date approach. a. The shares aro assumed to be sold on a first-in, first-out basis using a strict dato approach (the 800 shares sold are from the 500 shares purchased on January 5, 2017, and 300 shares purchased on April 1, 2017). In 2017 Henry recognizes dividend income of s and in 2018, he recognizes a capital gain of on his Wichmann, Inc. stock Feedoack b. To improve the tax results in 2018, Henry should do the following: Henry should identify the ith $ shares with the s higher basis and shares lower basis per share to realize a gain on the sale of $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started