Answered step by step

Verified Expert Solution

Question

1 Approved Answer

basis of material consumed or as general overhead. Sometimes allocation rates are determined. (9) Transport Costs, Freight and Delivery Charges: If materials transported and handled

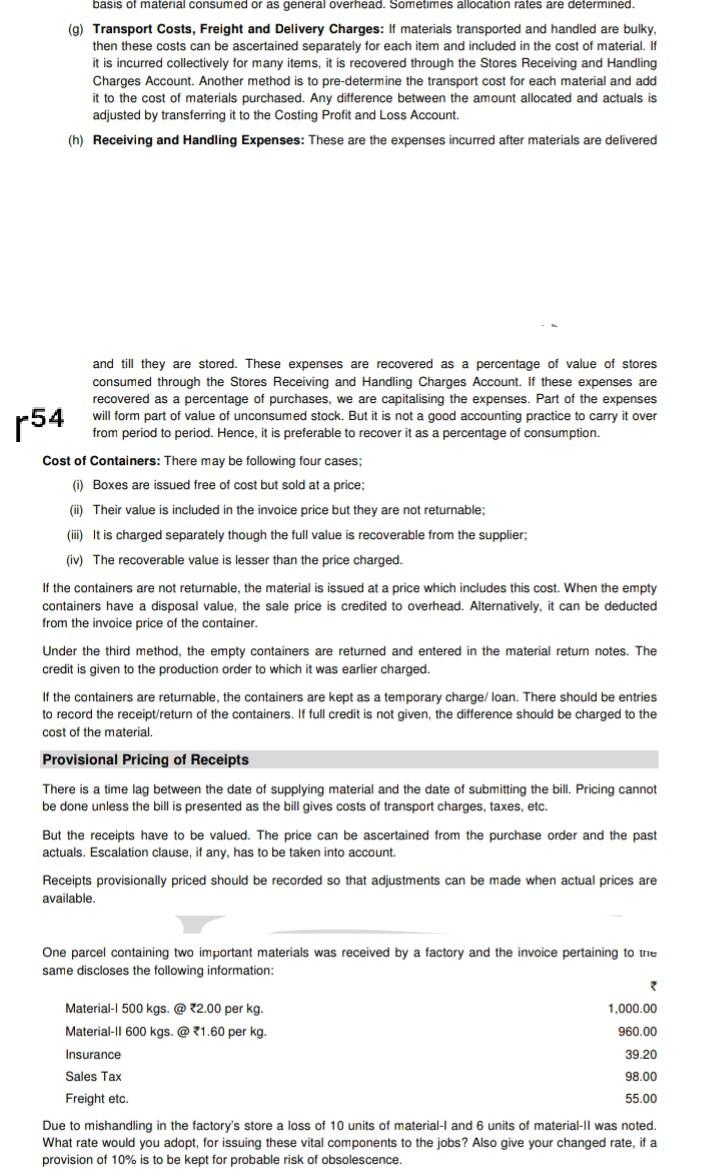

basis of material consumed or as general overhead. Sometimes allocation rates are determined. (9) Transport Costs, Freight and Delivery Charges: If materials transported and handled are bulky, then these costs can be ascertained separately for each item and included in the cost of material. If it is incurred collectively for many items, it is recovered through the Stores Receiving and Handling Charges Account. Another method is to pre-determine the transport cost for each material and add it to the cost of materials purchased. Any difference between the amount allocated and actuals is adjusted by transferring it to the Costing Profit and Loss Account. (h) Receiving and Handling Expenses: These are the expenses incurred after materials are delivered 854 and till they are stored. These expenses are recovered as a percentage of value of stores consumed through the Stores Receiving and Handling Charges Account. If these expenses are recovered as a percentage of purchases, we are capitalising the expenses. Part of the expenses will form part of value of unconsumed stock. But it is not a good accounting practice to carry it over from period to period. Hence, it is preferable to recover it as a percentage of consumption. Cost of Containers: There may be following four cases; (i) Boxes are issued free of cost but sold at a price: (i) Their value is included in the invoice price but they are not returnable; (ii) It is charged separately though the full value is recoverable from the supplier; (iv) The recoverable value is lesser than the price charged. If the containers are not returnable, the material is issued at a price which includes this cost. When the empty containers have a disposal value, the sale price is credited to overhead. Alternatively, it can be deducted from the invoice price of the container. Under the third method, the empty containers are returned and entered in the material return notes. The credit is given to the production order to which it was earlier charged. If the containers are retumable, the containers are kept as a temporary charge/ loan. There should be entries to record the receipt/return of the containers. If full credit is not given, the difference should be charged to the cost of the material Provisional Pricing of Receipts There is a time lag between the date of supplying material and the date of submitting the bill. Pricing cannot be done unless the bill is presented as the bill gives costs of transport charges, taxes, etc. But the receipts have to be valued. The price can be ascertained from the purchase order and the past actuals. Escalation clause, if any, has to be taken into account. Receipts provisionally priced should be recorded so that adjustments can be made when actual prices are available One parcel containing two important materials was received by a factory and the invoice pertaining to the same discloses the following information: Material-1 500 kgs. @ 2.00 per kg. 1.000.00 Material-II 600 kgs. @ 21.60 per kg. 960.00 Insurance 39.20 Sales Tax 98.00 Freight etc. 55.00 Due to mishandling in the factory's store loss of 10 units of material-I and 6 units of material-II was noted. What rate would you adopt, for issuing these vital components to the jobs ? Also give your changed rate, if a provision of 10% is to be kept for probable risk of obsolescence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started