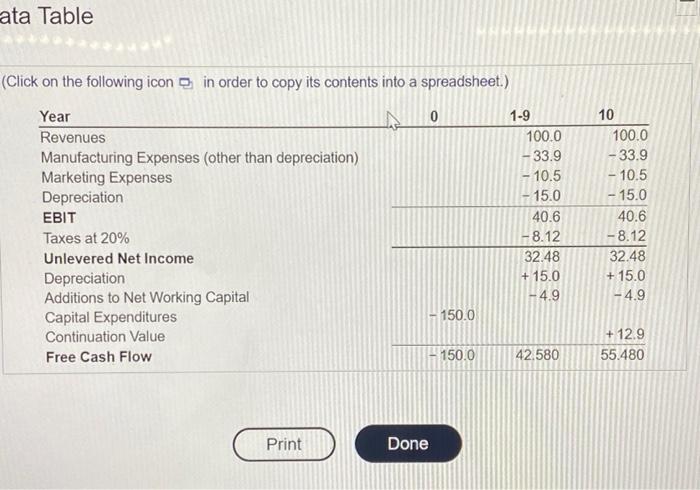

Bauer Industries in tomobile manufacturer Management is currently evaluating a proposal to build a part at wil manufacture lightweight trucks Bauer plans to use a cost of capital dl 11.0% to evaluate this Pro Based on sense research, it has prepared the following incrementare cash flow projections in millions of dolus) a. For this buse-casero what is the NPV of the plant to manufacture lightweight trucks? 6. Based on rout from the marketing department Bader is certain about to revende forecast in particular, management would like to examine the writivity of the NPV to the event options What is the NPV of spectreves rogher than forecast? What is the NPV rovers are lower than forecast c Rather than the cash flows for this projecte constantment would like to explore te fysis to possible growth in revenues and wing Specifically management would be to me that revenues, manufacturing expenses and marketing experts are given in the table for year and grow by per year every year wing in your 2 Management plans to me that the capital expenditures and therefore decide tons to working and continuation of many field in the table What the NPV of this produnder theative assumptions How does the NPV change the events and operating expenses grow by per your rather than by 37 do camine they this one can project to the couragement would to compute the NPV for fferent discounts on the discount on the sand the NPV on to you for contain ranging from 10 303 for wat vangen of decorate does the project have a positive NPV? Boco che cercano What is the NPV ar no plan to school weight cka? The NPV of the conturated free canih fiowisspinnion Road to two decimal place) b. Based on room to marketing department aver la noortan about its revenue forecast. In particula margement would be to earn in the constity of the NPV to the venue auction What the NPV por 8greer than forecast? What is the revenues Bower than forecast? The NPV of t euimatoo free carn frow is an Round to wo ooomal places) ata Table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 1-9 Revenues 100.0 Manufacturing Expenses (other than depreciation) -33.9 Marketing Expenses - 10.5 Depreciation 15.0 EBIT 40.6 Taxes at 20% - 8.12 Unlevered Net Income 32.48 Depreciation + 15.0 Additions to Net Working Capital -- 4.9 Capital Expenditures 150.0 Continuation Value Free Cash Flow 150.0 42.580 10 100.0 -33.9 - 10.5 - 15.0 40.6 -8.12 32.48 + 15.0 -4.9 + 12.9 55.480 Print Done Bauer Industries in tomobile manufacturer Management is currently evaluating a proposal to build a part at wil manufacture lightweight trucks Bauer plans to use a cost of capital dl 11.0% to evaluate this Pro Based on sense research, it has prepared the following incrementare cash flow projections in millions of dolus) a. For this buse-casero what is the NPV of the plant to manufacture lightweight trucks? 6. Based on rout from the marketing department Bader is certain about to revende forecast in particular, management would like to examine the writivity of the NPV to the event options What is the NPV of spectreves rogher than forecast? What is the NPV rovers are lower than forecast c Rather than the cash flows for this projecte constantment would like to explore te fysis to possible growth in revenues and wing Specifically management would be to me that revenues, manufacturing expenses and marketing experts are given in the table for year and grow by per year every year wing in your 2 Management plans to me that the capital expenditures and therefore decide tons to working and continuation of many field in the table What the NPV of this produnder theative assumptions How does the NPV change the events and operating expenses grow by per your rather than by 37 do camine they this one can project to the couragement would to compute the NPV for fferent discounts on the discount on the sand the NPV on to you for contain ranging from 10 303 for wat vangen of decorate does the project have a positive NPV? Boco che cercano What is the NPV ar no plan to school weight cka? The NPV of the conturated free canih fiowisspinnion Road to two decimal place) b. Based on room to marketing department aver la noortan about its revenue forecast. In particula margement would be to earn in the constity of the NPV to the venue auction What the NPV por 8greer than forecast? What is the revenues Bower than forecast? The NPV of t euimatoo free carn frow is an Round to wo ooomal places) ata Table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 1-9 Revenues 100.0 Manufacturing Expenses (other than depreciation) -33.9 Marketing Expenses - 10.5 Depreciation 15.0 EBIT 40.6 Taxes at 20% - 8.12 Unlevered Net Income 32.48 Depreciation + 15.0 Additions to Net Working Capital -- 4.9 Capital Expenditures 150.0 Continuation Value Free Cash Flow 150.0 42.580 10 100.0 -33.9 - 10.5 - 15.0 40.6 -8.12 32.48 + 15.0 -4.9 + 12.9 55.480 Print Done