Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bauer Industries is a truck manufacturer. Management is currently evaluating a proposal to develop a new truck model. The company decided to start targeting

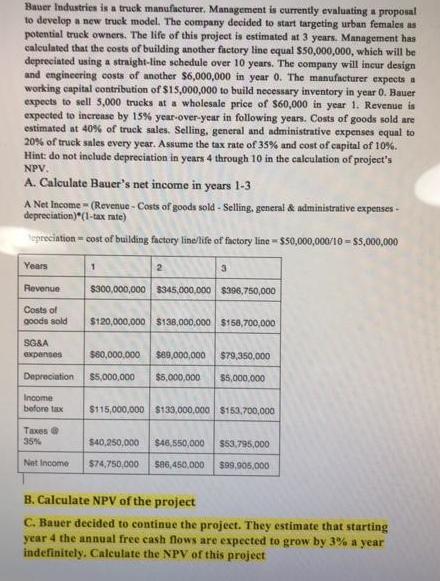

Bauer Industries is a truck manufacturer. Management is currently evaluating a proposal to develop a new truck model. The company decided to start targeting urban females as potential truck owners. The life of this project is estimated at 3 years. Management has calculated that the costs of building another factory line equal $50,000,000, which will be depreciated using a straight-line schedule over 10 years. The company will incur design and engineering costs of another $6,000,000 in year 0. The manufacturer expects a working capital contribution of $15,000,000 to build necessary inventory in year 0. Bauer expects to sell 5,000 trucks at a wholesale price of $60,000 in year 1. Revenue is expected to inerease by 15% year-over-year in following years. Costs of goods sold are estimated at 40% of truck sales. Selling, general and administrative expenses equal to 20% of truck sales every year. Assume the tax rate of 35% and cost of capital of 10%. Hint: do not include depreciation in years 4 through 10 in the calculation of project's NPV. A. Calculate Bauer's net income in years 1-3 A Net Income (Revenue - Costs of goods sold - Selling, general & administrative expenses - depreciation)"(1-tax rate) Nepreciation - cost of building factory line/life of factory line - $50,000,000/10 = 55,000,000 Years 2 Revenue $300,000,000 $345,000,000 $396,750,000 Costs of goods sold $120,000,000 $138,000,000 $158,700,000 SGA expenses $80,000.000 $89,000,000 $79,350,000 Depreciation $5,000,000 $5,000,000 $5,000.000 Income before tax $115,000,000 $133,000,000 $153,700,000 Taxes @ 35% $40,250,000 $46,550,000 $53,795,000 Net Income $74,750,000 sa6,450,000 $99,905,000 B. Calculate NPV of the project C. Bauer decided to continue the project. They estimate that starting year 4 the annual free cash flows are expected to grow by 3% a year indefinitely. Calculate the NPV of this project

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started