Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baxter Office Supplies received a bank statement showing a balance of $68,305 as of March 31, 20X1. The firm's records showed a book balance of

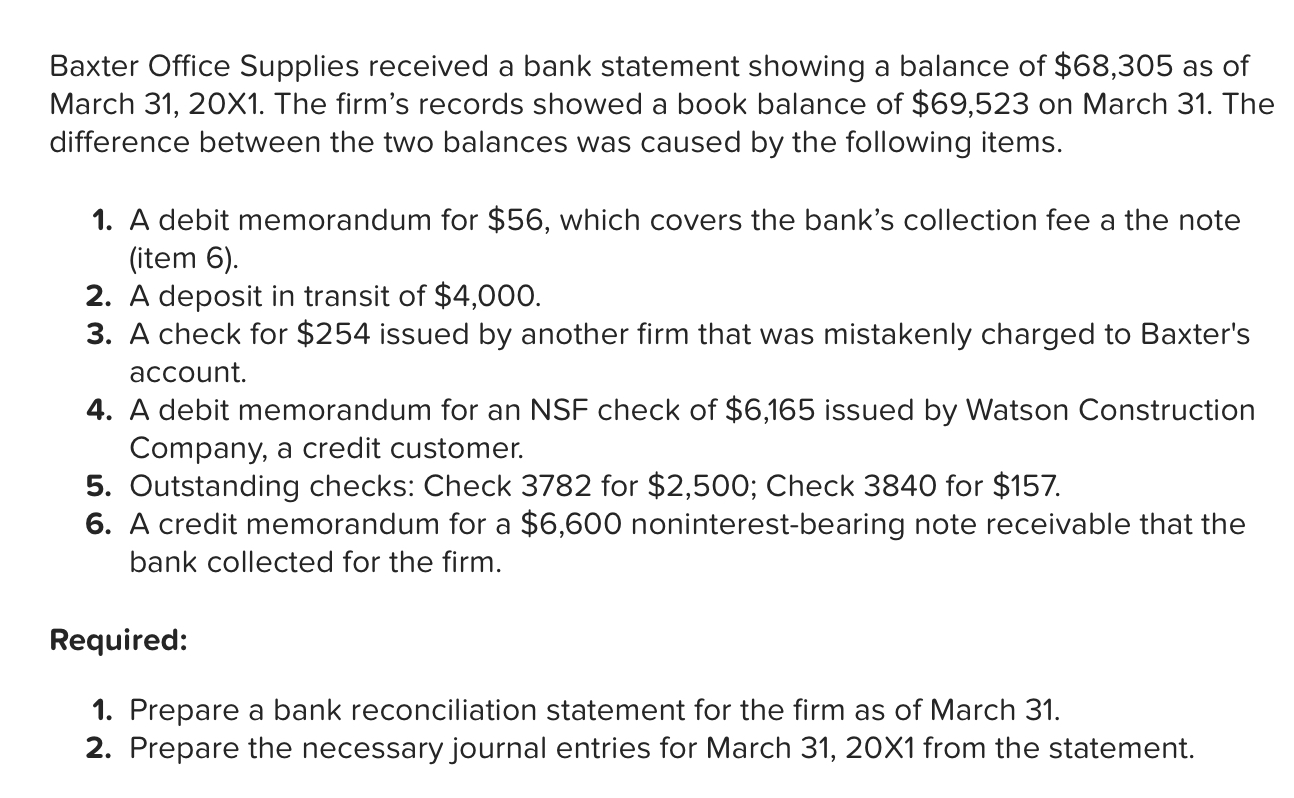

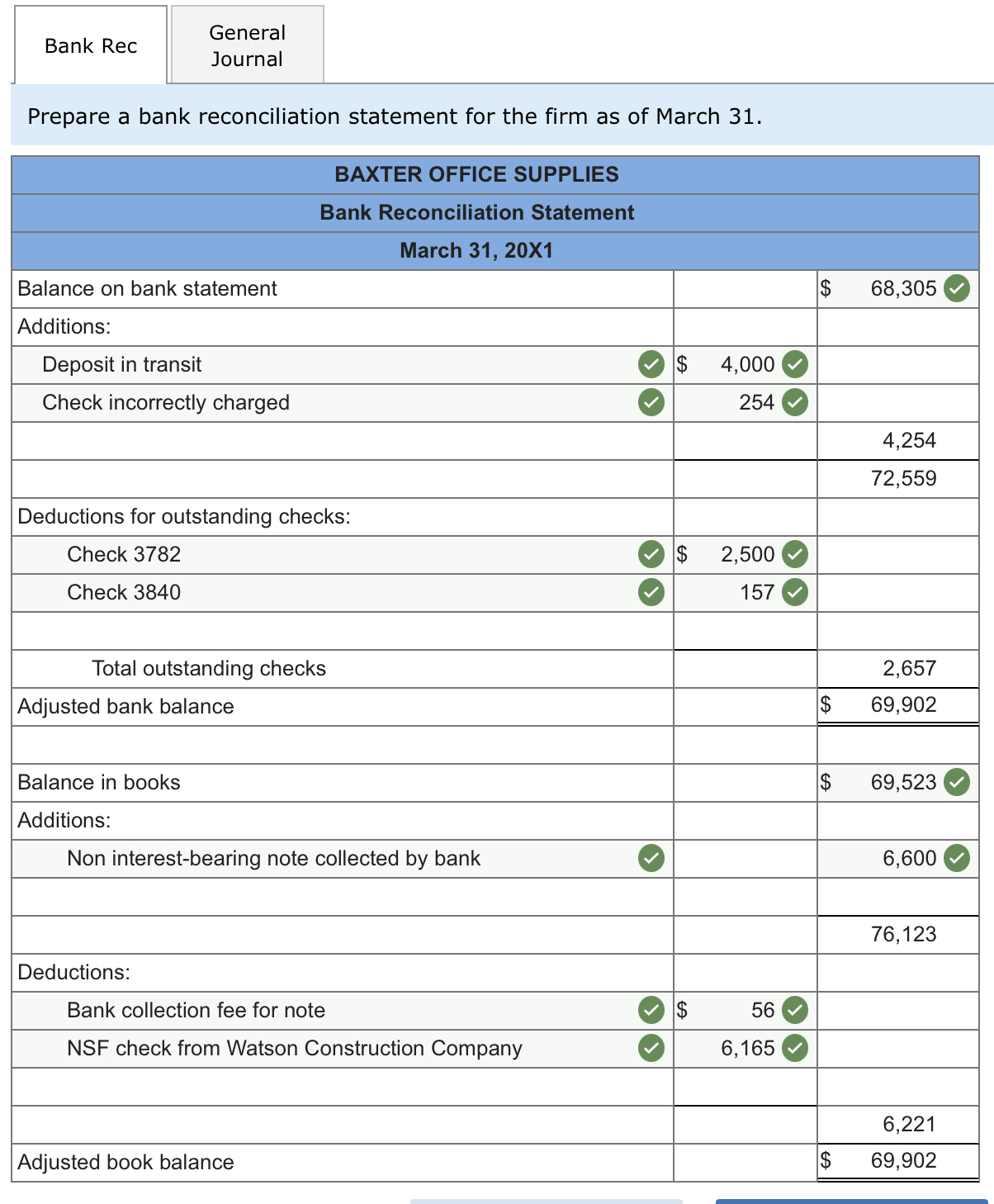

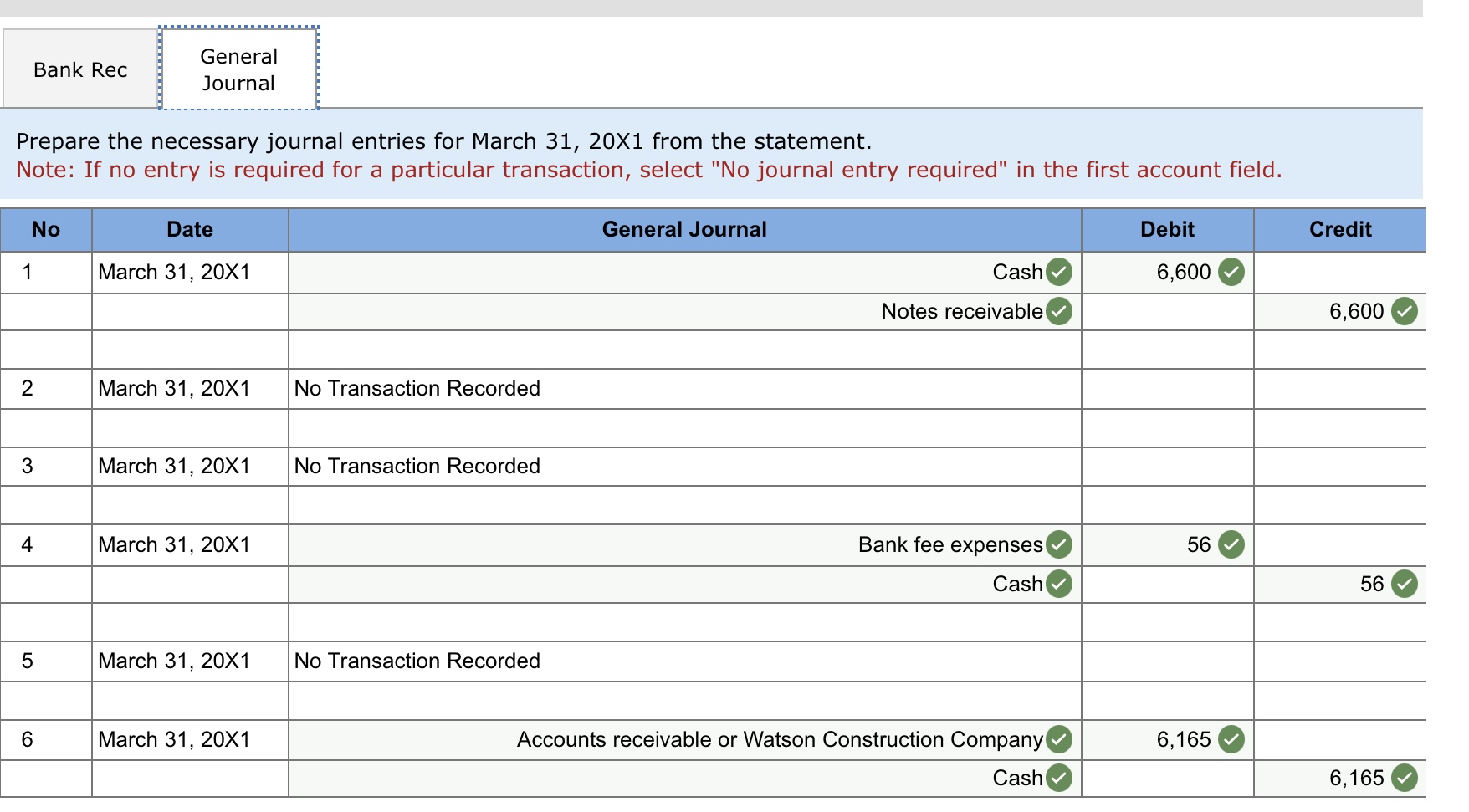

Baxter Office Supplies received a bank statement showing a balance of $68,305 as of March 31, 20X1. The firm's records showed a book balance of $69,523 on March 31. The difference between the two balances was caused by the following items. 1. A debit memorandum for $56, which covers the bank's collection fee a the note (item 6). 2. A deposit in transit of $4,000. 3. A check for $254 issued by another firm that was mistakenly charged to Baxter's account. 4. A debit memorandum for an NSF check of $6,165 issued by Watson Construction Company, a credit customer. 5. Outstanding checks: Check 3782 for $2,500; Check 3840 for $157. 6. A credit memorandum for a $6,600 noninterest-bearing note receivable that the bank collected for the firm. Required: 1. Prepare a bank reconciliation statement for the firm as of March 31. 2. Prepare the necessary journal entries for March 31, 201 from the statement. \begin{tabular}{|c|c|c|c|c|c|} \hline Bank Rec & GeneralJournal & & & & \\ \hline Prepare a & econciliation statement for the & ofMa & arch31. & & \\ \hline & BAXTER OFFICE S & & & & \\ \hline & Bank Reconciliation & & & & \\ \hline & March 31, 20 & & & & \\ \hline Balance on ba & tatement & & & $ & 68,305 \\ \hline Additions: & & & & & \\ \hline Deposit in t & t & ( $ & $4,000 & & \\ \hline Check incor & y charged & & 254 & & \\ \hline & & & & & 4,254 \\ \hline & & & & & 72,559 \\ \hline Deductions for & tanding checks: & & & & \\ \hline Check 37 & & (2)$ & $2,500 & & \\ \hline Check 38 & & & 157 & & \\ \hline Total o & anding checks & & & & 2,657 \\ \hline Adjusted bank & Ince & & & $ & 69,902 \\ \hline Balance in boc & & & & $ & 69,523 \\ \hline Additions: & & & & & \\ \hline Non inter & earing note collected by bank & & & & 6,600 \\ \hline & & & & & 76,123 \\ \hline Deductions: & & & & & \\ \hline Bank coll & fee for note & 2$ & 56 & & \\ \hline NSF che & matson Construction Company & & 6,165 & & \\ \hline & & & & & 6,221 \\ \hline Adjusted book & ince & & & $ & 69,902 \\ \hline \end{tabular} Prepare the necessary journal entries for March 31,201 from the statement. Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field

Baxter Office Supplies received a bank statement showing a balance of $68,305 as of March 31, 20X1. The firm's records showed a book balance of $69,523 on March 31. The difference between the two balances was caused by the following items. 1. A debit memorandum for $56, which covers the bank's collection fee a the note (item 6). 2. A deposit in transit of $4,000. 3. A check for $254 issued by another firm that was mistakenly charged to Baxter's account. 4. A debit memorandum for an NSF check of $6,165 issued by Watson Construction Company, a credit customer. 5. Outstanding checks: Check 3782 for $2,500; Check 3840 for $157. 6. A credit memorandum for a $6,600 noninterest-bearing note receivable that the bank collected for the firm. Required: 1. Prepare a bank reconciliation statement for the firm as of March 31. 2. Prepare the necessary journal entries for March 31, 201 from the statement. \begin{tabular}{|c|c|c|c|c|c|} \hline Bank Rec & GeneralJournal & & & & \\ \hline Prepare a & econciliation statement for the & ofMa & arch31. & & \\ \hline & BAXTER OFFICE S & & & & \\ \hline & Bank Reconciliation & & & & \\ \hline & March 31, 20 & & & & \\ \hline Balance on ba & tatement & & & $ & 68,305 \\ \hline Additions: & & & & & \\ \hline Deposit in t & t & ( $ & $4,000 & & \\ \hline Check incor & y charged & & 254 & & \\ \hline & & & & & 4,254 \\ \hline & & & & & 72,559 \\ \hline Deductions for & tanding checks: & & & & \\ \hline Check 37 & & (2)$ & $2,500 & & \\ \hline Check 38 & & & 157 & & \\ \hline Total o & anding checks & & & & 2,657 \\ \hline Adjusted bank & Ince & & & $ & 69,902 \\ \hline Balance in boc & & & & $ & 69,523 \\ \hline Additions: & & & & & \\ \hline Non inter & earing note collected by bank & & & & 6,600 \\ \hline & & & & & 76,123 \\ \hline Deductions: & & & & & \\ \hline Bank coll & fee for note & 2$ & 56 & & \\ \hline NSF che & matson Construction Company & & 6,165 & & \\ \hline & & & & & 6,221 \\ \hline Adjusted book & ince & & & $ & 69,902 \\ \hline \end{tabular} Prepare the necessary journal entries for March 31,201 from the statement. Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started