Answered step by step

Verified Expert Solution

Question

1 Approved Answer

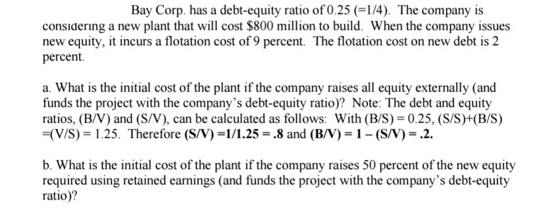

Bay Corp. has a debt-equity ratio of 0.25 (=1/4). The company is considering a new plant that will cost $800 million to build. When

Bay Corp. has a debt-equity ratio of 0.25 (=1/4). The company is considering a new plant that will cost $800 million to build. When the company issues new equity, it incurs a flotation cost of 9 percent. The flotation cost on new debt is 2 percent. a. What is the initial cost of the plant if the company raises all equity externally (and funds the project with the company's debt-equity ratio)? Note: The debt and equity ratios, (B/V) and (S/V), can be calculated as follows: With (B/S) = 0.25, (S/S)+(B/S) =(V/S) 1.25. Therefore (S/V)=1/1.25 .8 and (B/V)-1-(S/V)=.2. b. What is the initial cost of the plant if the company raises 50 percent of the new equity required using retained earnings (and funds the project with the company's debt-equity ratio)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears to be a financial study or teaching scenario involving Bay Corps new factory Heres a brea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started