Question

BAYER-MONSANTO: THE CHALLENGES OF A MEGA MERGER1 In September 2016, Werner Baumann, chief executive officer (CEO) of German multinational Bayer AG (Bayer), and Hugh Grant,

BAYER-MONSANTO: THE CHALLENGES OF A MEGA MERGER1

In September 2016, Werner Baumann, chief executive officer (CEO) of German multinational Bayer AG (Bayer), and Hugh Grant, chairman and CEO of U.S.-based Monsanto Company (Monsanto), signed a merger agreement to create the world's largest integrated pesticides and seeds company4 The combined entity would benefit from Monsanto's leadership in seeds and traits and from Bayer's crop protection products across a wide range of indications in key regions worldwide. Bayer would acquire Monsanto for $1285 per share in an all-cash transaction, a premium price of 44 per cent based on Monsanto's closing price on May 9, 2016, with a total value of $66 billion. The merger between the two giants would initiate a massive change within Bayer, and in the global agrochemical industry. Had Bayer made the right decision to diversify into agrochemicals by merging with Monsanto? In addition to the high acquisition premium with an all-cash transaction, there were antitrust concerns that could lead to subsequent divestments, and Monsanto had a negative brand image owing to its frequent involvement in controversial business operations. Would the merged entity, if approved, be able to create sufficient synergies that would actually deliver benefits to shareholders, while keeping its commitment to sustainable operations and addressing social and ethical responsibilities?

BAYER AG

The Beginning

Founded in 1863 in Barmen, Germany, Bayer initially manufactured synthetic dyestuffs. The firm quickly developed into a chemical company with international operations. Its investment in research and development (R&D) led to the creation of the popular Aspirin product in 1899. World War I halted development; however, during the mid-1920s, companies including Bayer, BASF SE (BASF), and Agfa-Gevaert N.V. entered into a merger in 1925 and established IG Farbenindustrie AG to revive German dyestuffs in the international market. In 1945, following the end of World War II, the Allied Forces confiscated the conglomerate and dissolved it into small companies. One of these became Farbenfabriken Bayer AG, in 1951. From 1951-1974, the company benefited from the economic miracle in Germany. It was affected by the oil crisis that hit Germany in 1974, but underwent a period of consolidation over the following decade. During the 1990s, the company made a major structural transformation in response to the challenge of globalization.

Recognization

To expand i t s business further, Bayer acquired Aventi s CropSci ence for ?7.25 billion 8 in 2001 to manufacture crop protection products, seeds, traits, and environmental solutions. Nevertheless, its involvement in agriculture had been rooted in the company since its beginning, as in 1951 it had launched the first systemic insecticide, Systox. Since then, Bayer had grown to understand the value of integrated biological and chemical approaches. In 2005, Bayer acquired Roche's Roche Consumer Health business, becoming one of the world's top three suppliers of non-prescription medicines. In the same year, Lanxess AG was spun off from the Bayer Group; it continued Bayer's chemicals business and parts of its polymers business. In 2006, Bayer took over German pharmaceutical company Schering AG. In 2009, Bayer CropScience completed the acquisition of privately held U.S. biotechnology company Athenix Corporation. In 2016, Baumann, who had been a member of Bayer's board of management since 2010, became the company's CEO. Prior to 2016, Baumann had managed the company's strategy and portfolio department.

The Pharmaceutical Industry

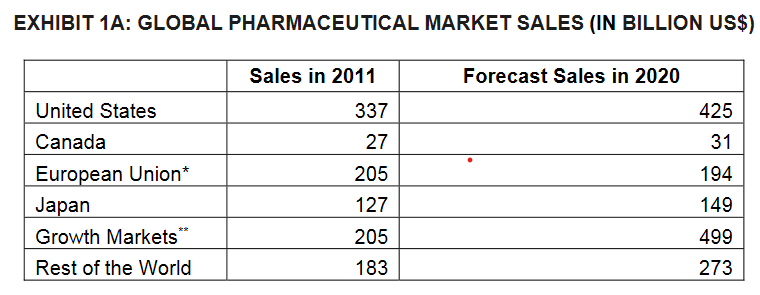

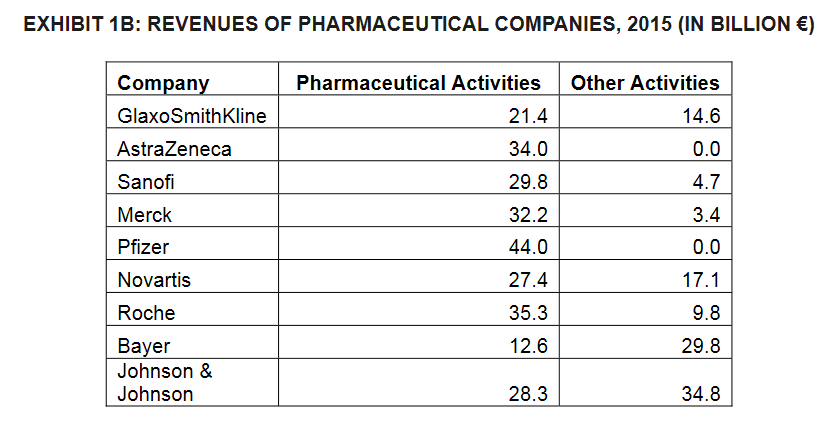

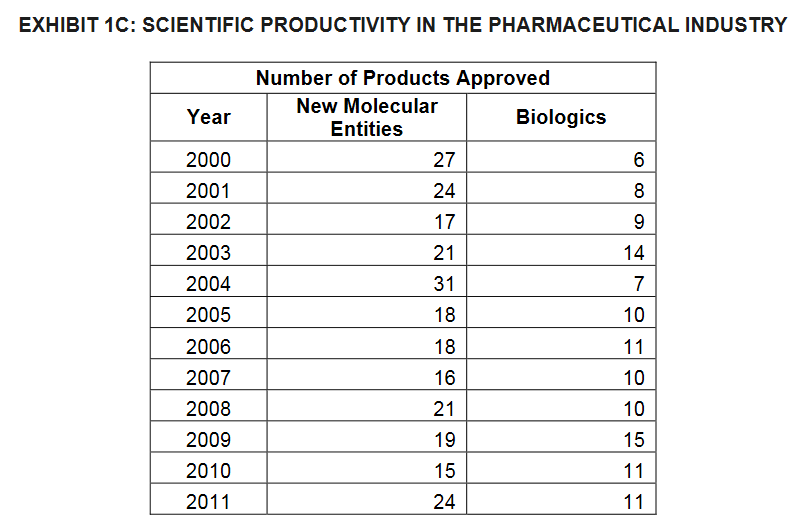

The pharmaceutical industry, at the heart of Bayer's business model, represented a huge market worth $1.1 trillion in 2016. Annual growth of 4-7 per cent was expected until 2021, when it would be worth? according to these forecasts?$1.5 trillion. The main contributors to this growth were not only emerging markets such as China, but also a growing a ging population in mature markets. The industry was one of the most R&D-intensive sectors, with a global R&D ratio of roughly 13 per cent and most of the major players having an even higher ratio?exceeding 18 per cent in 2015 (see Exhibit 1A, 1B, and 1C).

However, this lucrative industry was undergoing major regulatory reinforcements, including more prudent management of government health care budgets in mature markets. In emerging markets, the entry barrier was still high. More importantly, the industry was experiencing poorer scientific productivity due to a wave of patent expirations and the sudden appearance of generic medicines, and higher R&D costs because of increased competition. The time required for a new drug development process, from R&D, testing, and manufacturing to licensing and marketing, was about 12 years. Indeed, the "patent cliff," a potential sharp decline in revenues of a firm due to replication of its established products by competitors upon expiry of their patent, would prevent pharmaceutical firms from reaching ?132 billion revenues.13 Moreover, developing new medicines increasingly required greater investments. The Tufts Center for the Study of Drug Development estimated in March 2016 the cost of developing a prescription drug to the market at $2.6 billion, a 145 per cent increase from that in 200314 due to regulators becoming more risk-adverse, and to the industry focusing on more difficult?and thus riskier?areas of science.

Even though the industry had seen waves of consolidations, mostly led by Western companies, it was still fragmented and highly competitive. The main industry players were Jonhson & Jonhson, Bayer, Roche, Novartis, Pfizer Inc. (Pfizer), Merck & Co. Inc., AstraZeneca, GlaxoSmithKline Inc., and Sanofi. These key players were experiencing decreasing margins due to stricter regulations, the expiration of patents, and rising R&D costs. Most of the firms in this industry were pure players, deriving revenues mainly from their pharmaceutical businesses. However, the two leaders, Jonhson & Jonhson and Bayer, had diversified businesses, generating over half of their revenues from non-pharmaceutical activities.

The Company in 2016

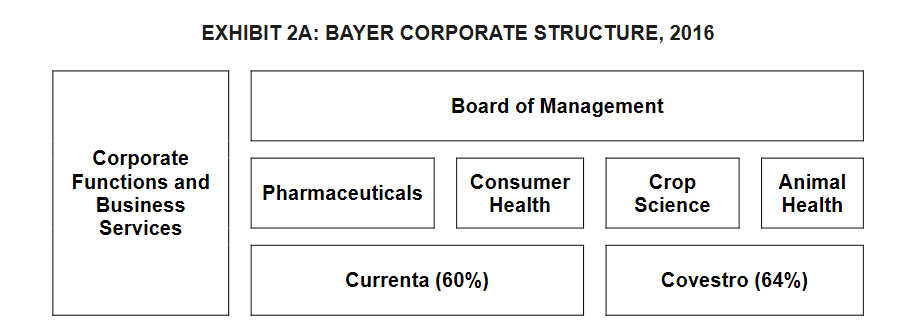

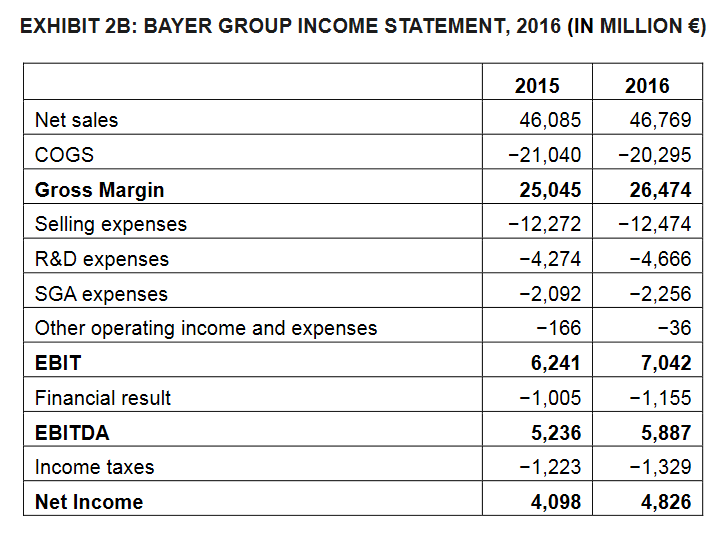

To maintain its leading market position, Bayer diversified its revenues and positioned itself as a life science company, while expanding globally. By focusing on life science, Bayer was looking for solutions to some major challenges?including a growing and aging population that demanded food supply security and improved medical care?through gaining a deep understanding of biochemical processes in living organisms. Its mission was thus "Bayer: Science for a Better Life." The core values for the company were leadership, integrity, flexibility, and efficiency (LIFE). To tackle these challenges as a life science company, Bayer reorganized its businesses into five main segments: pharmaceuticals, consumer health, crop science, Covestro, and animal health. Despite its strong positioning, revenues from Bayer's pharmaceutical business relied on 15 drugs, which accounted for 80 per cent of its sales in 2015 (see Exhibit 2A, 2B, and 2C).

The Agrochemical Industry

Bayer's agrochemical products included crop protections, such as insecticides and herbicides, and treatments of new kinds of seeds. The main goal of these products was to enhance crop yields while reducing harmful influences; therefore, the main consumers of these products were farmers.

History

Before the 20th century, farmers relied on their own cultivated seeds with limited commercialized quantities. Between 1915 and 1930, seed certification programs emerged, allowing farmers to buy seeds from traders. These suppliers were small family-owned businesses. In the early 20th century, high-yield hybrid corn varieties, which outperformed traditional open pollinated varieties, were developed. With the growing demand for corn, by 1965 over 95 per cent of American corn acreage was planted with hybrid seeds.

In 1970, the U.S. government strengthened property rights, encouraging private firms to enter the seeds market. Many mergers and acquisitions occurred during the 1970s, with over 50 seed companies being acquired by pharmaceutical, petrochemical, or food firms. Chemical firms entered the seeds market because of a decline in the agricultural chemicals market. The early 1980s saw the emergence of biotechnology, which provided incentive for companies to expand their technology into seed production. Due to high R&D costs in combining agriculture and biotechnology, the market became consolidated through mergers and acquisitions to achieve scale economies and the successful development and commercialization of more complex products.

Important Role of Research and Development

Technical development was one of the most important requirements for competing in this demanding market. While new technologies improved crop protection and productivity, pests continued to develop resistance to products, requiring companies to further invest in improving technologies. R&D thus ensured companies could continue delivering new and improved products that enhanced farmers' production. Monsanto's chief technology officer, Robert Fraley, stated, "Fifteen years ago, we spent $300 million on R&D. Today we spend $1.5 billion. That sounds like a big number but compare that against other data and life science companies like Microsoft, Apple, Pfizer, and Merck who each invest over $10 billion per year in R&D. To realize a step-change, agricultural companies will need to invest more."

Such a statement underlined the difficulty for agrochemical companies to maintain a high level of R&D investment, and helped to explain the increasing trend of consolidation in the industry. Spending on R&D was already much higher than spending on public research. Indeed, the U.S. Department of Agriculture's agricultural research arm spent around $350 million per year, while in the case of the merger between Bayer and Monsanto, their combined R&D budget would reach $2.8 billion. Gaining more patents was therefore an explanation for the common practices of forming partnerships and making acquisitions among agrochemical competitors to achieve sufficient ongoing product developments.

Competitive Situation

The agrochemicals market continued to undergo industrialization. Within 12 years during 1964 and 1976, applications of synthetic fertilizers on crops in the United States increased nearly double, while chemical pesticides increased by 143 per cent. However, the market encountered many challenges because the availability of arable lands did not keep growing, in contrast to the population, which did keep growing. The global agrochemicals market was expected to reach $308.92 billion by 2025. The industry trend was shifting toward fewer and larger firms through consolidation. Agrochemicals could be considered an oligopolistic market, with six companies accounting for over 70 per cent of the global market value, led by Monsanto, Syngenta AG (Syngenta), Bayer, and DuPont. However, even the leading firms were struggling with this new wave of mergers and acquisitions, including the merger between the Dow Chemical Company (Dow Chemical) and DuPont in December 2015, and the acquisition of Syngenta by ChemChina in February 2016. In additional to Bayer and Monsanto, other major players in the market were as follows.

Syngenta(Switzerland)

Formed in November 2000 from the merger of Novartis and AstraZeneca, Syngenta was a Swiss agribusiness company that produced agrochemicals and seeds. It was the first global group exclusively focusing on agribusiness, with annual sales in 2015 of $13.4 billion. As a biotechnology company, Syngenta conducted genomic research. The firm possessed R&D and manufacturing facilities all over the world, including Europe, China, India, and the United States. In 2014, Monsanto tried to acquire Syngenta for a reported $40 billion, but Syngenta rejected the offer. Monsanto repeated an acquisition attempt in April 2015, but the U.S. Department of the Treasury tried to stop the deal in its effort to clamp down on tax inversion. Syngenta's board of directors finally rejected an even better offer by Monsanto made in August 2015. In February 2016, ChemChina offered to purchase the company for $43 billion. The deal was accepted by Syngenta's shareholders and awaited regulatory approvals.

DuPont(United States)

Created in 1802, DuPont produced gunpowder and explosives before smoothly diversifying into the chemical and agriculture industries. In 2015, agriculture represented one of the most important segments of the company, with sales value of $9.8 billion, contributing 39 per cent of its total net sales. The company acquired a 20 per cent stake in Pioneer Hi-Bred International, one of the first commercial hybrid seed corn companies, to diversify into the agribusinesses in 1997, and the remaining 80 per cent stake in 1999. DuPont thereafter specialized in not only hybrid seeds, but also genetically modified seeds. Located mostly in the United States and Canada, the company had also reached EMEA (Europe, the Middle East, and Africa) and the Asia Pacific. The company also had production facilities in Latin America but saw relatively low revenues in this area. DuPont decided to enter a merger of equals with Dow Chemical in December 2015.

Dow Chemical(United States)

Dow Chemical was founded in 1897 in the United States. The first product it manufactured was synthetic rubber, in response to the scarcity of natural rubber resources during World Word II. Its agricultural subsidiary, Dow AgroSciences, was founded in 1997 after a joint venture with the Elanco Plant Sciences Business of Eli Lilly and Company. The company was driving innovative products to address the world's challenging problems, including the need for clean water, clean energies, and enhancing agricultural productivity. Its net sales in 2015 reached $48.8 billion, 13 per cent of which came from the agricultural science segment, which was involved in areas such as crop protection, seeds (some of which were genetically modified organisms (GMOs)), traits, and oils. The company had locations in the United States, Europe, the Middle East, Africa, and India.

BASF(Germany)

Founded in 1865, BASF achieved net sales of ?57.6 billion in 2016. The company was involved in the crop protection business, providing agricultural solutions in one of its segments. BASF's main products were fungicides, herbicides, insecticides, functional crop care products, and pest control products. One of its subsidiaries, BASF Plant Science, developed GMOs in collaboration with Monsanto. Its agricultural solutions segment represented 10 per cent of total sales and 12 per cent of earnings before interest, tax, depreciation, and amortization (EBITDA). This segment operated mostly in Europe and North America, which represented 35 per cent and 32 per cent of the segment's total sales, respectively. The Asia Pacific represented 10 per cent; South America, Africa, and the Middle East represented 23 per cent.

Controversial Issues and Challenges

The use of agrochemical products generated much criticism in the agriculture industry. Most critics pointed out the issues of unsustainability and threats to the environment posed by extended monocultures, which reduced the diversity of plants (and thus seeds); the destruction of wildlife; and the increasing dependency of local farmers on multinationals. Some activists and scholars, particularly Vandana Shiva, defended the concept of seed freedom for avoiding complete corporate control over seeds' patents, and strongly criticized how seed chemical packaging, including pesticides, jeopardized people's health and destroyed living ecosystems.

Another major dispute was over GMOs. GMOs were organisms whose genetic material had been changed by scientists. People were afraid of prevalent use of GMOs in the seeds market to improve productivity or for disease resistance because there was insufficient knowledge for predicting the consequences of GMOs on human health and on soil conditions. These genetic materials were commonly accepted in the United States but strictly prohibited in some European countries.

The future challenges for this industry thus involved the recent trend in different countries of creating new agricultural techniques to avoid the negative effects resulting from agrochemicals, such as organic farming and applying labels certifying natural protection processes. Another obvious challenge was the evolution of legislation. While the United States was mainly using these biotechnologies, Europe was still very conservative and forbid the growing of these GMO crops.

Monsanto Company

Monsanto was a leading agrochemical company. It had been a chemical company from 1901 until World War II, but entered the agriculture business in the mid-1940s with an insecticide to control corn borer and other insect pests. In 1970, Monsanto produced its most famous herbicide product, Roundup, which killed not only the leaves of weeds but also down to their roots. In 1979, aspiring to be a world-class molecular biology company, Monsanto hired professors and scientists in the field, marking the start of biotechnology in the agriculture industry. The company aimed to develop a methodology to transfer cloned genes into plant cells to generate a better plant. In 1987, the U.S. Department of Agriculture approved field tests of Monsanto's genetically modified tomatoes. From 1996 to 1998, the company conducted several mergers and acquisitions in the seed industry, including those involving Agracetus Inc., Calgene, Asgrow, Holden's Foundation Seeds, Corn States Hybrid LLC, and DeKalb Genetics Corporation. This consolidation strategy allowed Monsanto to create more synergies while enabling the resistance of its own seeds to the Roundup herbicide. Thus, Monsanto's seeds were also protected from insects.

In 2000, Monsanto pursued a massive merger that separated the company into three main businesses: agriculture, pharmaceutical, and chemicals. The former Monsanto was thereafter known as Pharmacia LLC and was a wholly owned subsidiary of Pfizer. Its chemicals business became a wholly owned subsidiary of Eastman Chemical Company. Monsanto, as it was known in 2016, operated only the agriculture business. Monsanto continued its consolidation strategy by acquiring Emergent Genetics (the third-largest cotton seed company in the United States) in 2005; Delta and Pine Land Company (a major cotton seed breeder) in 2007; a Dutch seed company, De Ruiter Seeds, in 2008; Precision Planting Inc. (which produced computer hardware and software designed to enable farmers to increase yield and productivity through more precise planting) in 2012; and in 2013, the Climate Corporation (a digital weather forecasting company helping farmers). Through these acquisitions, Monsanto thus became a leader in research not only on GMOs but also on digitalization. In 2015, Monsanto attempted?but failed?to purchase Syngenta.

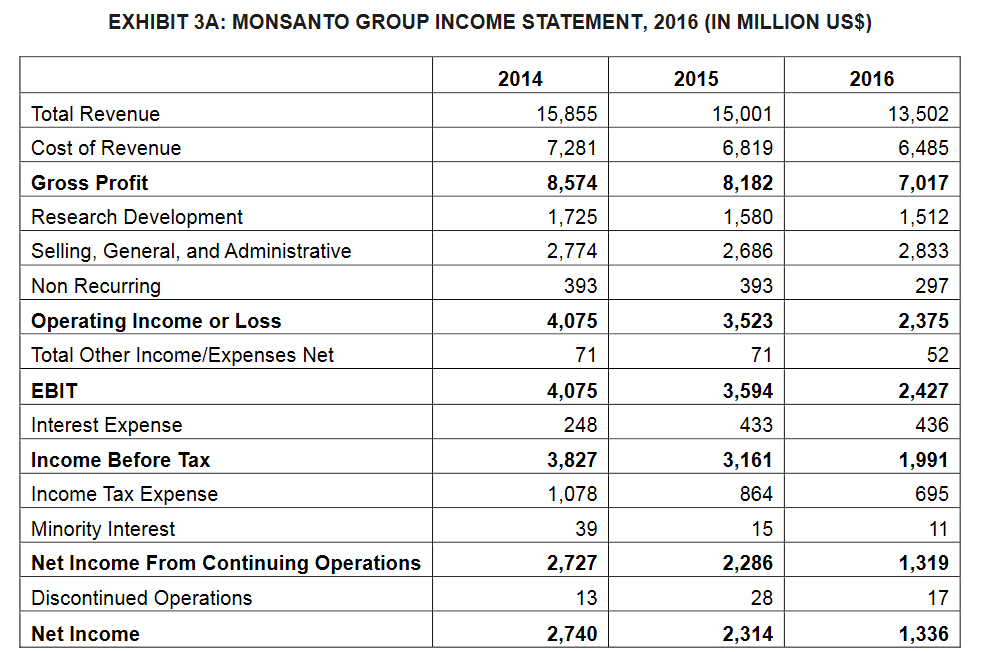

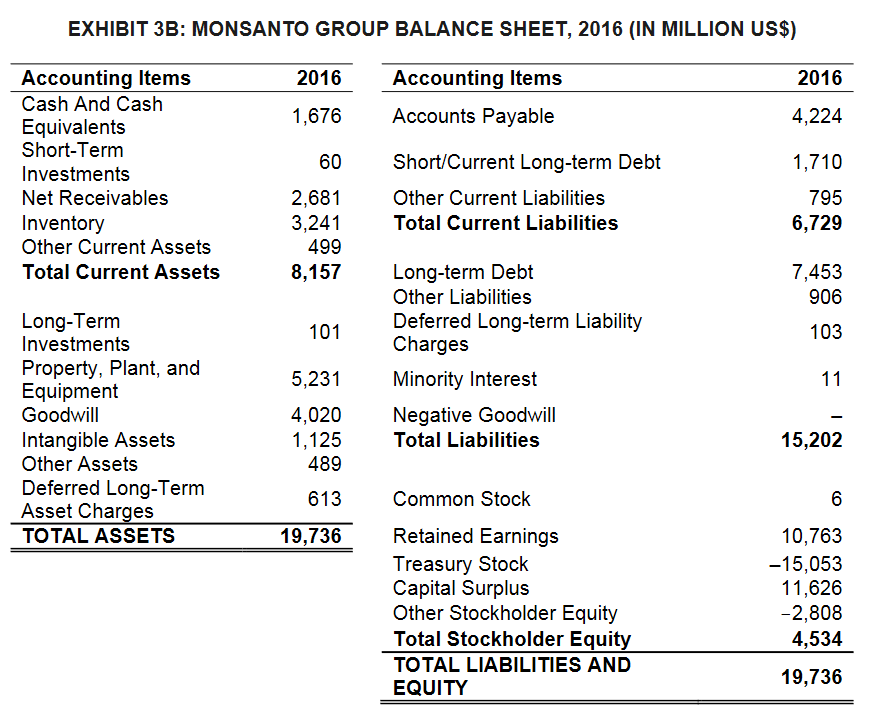

In 2016, Monsanto's product portfolio was divided into two main segments. The seeds and genomics segment represented almost 74 per cent of its total net sales, with two products: germplasm (living tissue from which new plants could be grown), which was for row crop seeds such as soybean or cotton (e.g., the DEKALB and Deltapine brands) and vegetable seeds (e.g., the De Ruiter Seeds and Seminis brands), and biotechnological traits, which enabled crop protection and decreased the need for insecticides. Some products in the Roundup series enabled tolerance of the seeds to the famous herbicide. The seeds and genomics segment mainly developed biotechnology traits that assisted farmers in controlling insects and weeds. It also provided digital agricultural tools to assist farmers in making farming decisions. The agricultural productivity segment accounted for 26 per cent of the total sales, and it manufactured Roundup and other herbicides. Monsanto developed two kinds of applications in this segment. The first type was for weed control, with Roundup as the main brand, targeting professionals and individuals. The second type was the pre-emergence control of annual grass and small-seeded broadleaf weeds, with Harness as the main brand, targeting professionals (see Exhibit 3A and 3B).

A Strategic Choice for Bayer

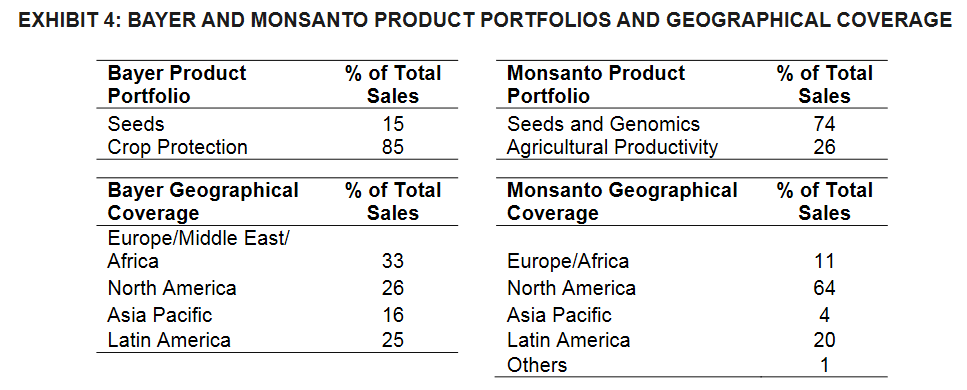

In a highly consolidated market with only a few players, Monsanto was a good acquisition choice for Bayer for several reasons. As a leader in the agrochemical industry, Monsanto had a strong R&D capability and its operations had extensive geographical coverage. Monsanto generated most of its sales, 53.3 per cent, from its home market in the United States, which perfectly complemented Bayer's deep localization in Europe. Baumann, in his letter to shareholders, expressed his view of the acquisition by saying, "...to further strengthen Bayer as a life science company and create substantial additional value in the long term for you, our stockholders, through more innovation, stronger growth and greater efficiency. The two businesses are highly complementary, both in terms of their geographical fit and their product portfolios." Furthermore, Bayer would benefit from Monsanto's strong knowledge in biotechnologies and seeds, one of Bayer's weak points in this market (see Exhibit 4). Finally, the merger between these two giants would strengthen the management of agriculture information to create new solutions for farmers.

The Acquisition

Bayer started the process of acquiring Monsanto in May 2016 with an offer of $62 billion. Monsanto rejected this first bid, looking for a higher premium price. In September 2016, the two companies finally concluded the deal at $66 billion, for which Bayer would pay Monsanto $128 per share in an all-cash transaction. Bayer would finance the deal with a combination of debt and equity. Even if Bayer had many times proven its ability to conduct large acquisitions, the acquisition of Monsanto presented the company with many different challenges, including a high premium price, antitrust issues, and polemics and protests related to Monsanto's business operations in the sensitive agrochemical industry.

High Premium Price with an All-Cash Transaction

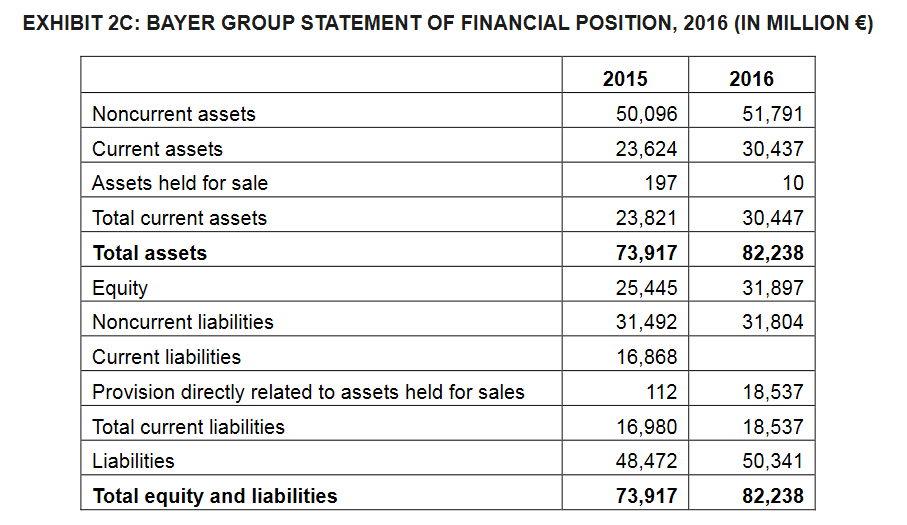

According to Bayer, the agreed acquisition price of $128 per share was a 44 per cent premium on Monsanto's share price on May 9, 2016, the day before it made its first written proposal. This price was considered overvalued when compared to Monsanto's EBITDA of $2.42 billion in August 2016. In particular, the agreed price for the deal of $66 billion was 27 times Monsanto's EBITDA, while its market capitalization was only around $51.7 billion. Moreover, the all-cash transaction could significantly increase the financial risks for Bayer. In fact, in 2016, the Standard & Poor's (S&P) Global Ratings and Moody's Investors Service assigned Bayer's long-term rating at "A-" and "A3" and its short-term rating at "A-2" and "P-2," and were reviewing the possibility of a downgrade as a result of the agreed acquisition of Monsanto, Meanwhile, Bayer continued to aim for an investment-grade credit rating and a single "A" rating for the long term, following the successful closing of the Monsanto acquisition.

It was possible that the resulting increased financial leverage would inhibit Bayer's future investments in R&D, one of the most critical success factors for companies in the agrochemical and pharmaceutical industries. These high-profile acquisition figures thus raised the question of whether the deal could indeed generate sufficient synergies and a sustainable business that would deliver economic value to shareholders.

Antitrust Issues

Even if the agreement between the two companies were signed, the acquisition was still subject to regulatory approvals in more than 30 countries. The main concerns for this mega deal would come from the European Union and the United States. Indeed, the main criticism was that the acquisition might increase barriers to entry that could lead to fewer chemical and seed choices and thus jeopardize biodiversity. Farmers might have to pay for higher-priced products from giant firms. This industry consolidation and reduced competition could also inhibit research and innovation in the field. Some activists also feared such a combination would hurt farmers, consumers, and the environment.

To ensure the protection of consumers and competition, antitrust-related bodies would carefully investigate the acquisition deal. Iowa senator Charles Grassley wrote a letter pressing the U.S. Department of Justice to be careful about the deal, while many petitions in Europe emerged to prevent approval of the deal. Diana Moss, president of the American Antitrust Institute, pointed out:

The USDA [United States Department of Agriculture] notes that the prices of farm inputs, led by crop seed, generally have risen faster over the last 20 years than the prices farmers have received for their commodities. Moreover, seed price increases have outpaced yield increases over time. Finally, the USDA has determined that increasing levels of concentration in agricultural input markets (including crop seed) are no longer generally associated with higher R&D or a permanent rise in R&D intensity.

Nevertheless, Bayer was confident that the deal would obtain regulatory approvals, as the company had committed a $2 billion reverse antitrust break fee.

As part of the acquisition, Bayer had to divest its Liberty herbicide and LibertyLink-branded seed businesses to fulfil the antitrust requirements of South Africa's Competition Commission. Sales generated by these divestitures were estimated at $2.5 billion. It was unclear how many unit divestitures Bayer would have to do to fulfil the antitrust regulations, and whether these divestitures would mitigate the potential synergies anticipated at the time of signing the acquisition agreement. Bayer would also have to be prepared for other competitive strategies if the deal was eventually not approved.

Stakeholders' Concerns and a Threatening Brand Image

Monsanto was the flagship company for GMOs, which historically had been often involved with most of the polemics and protests related to the company's agrochemical products. For example, it had produced misleading advertisements about the biodegradable herbicide Roundup. It had also been accused of endangering health with its GMOs and of buying scientists to produce fake news in academic journals to promote its products. However, despite these controversies, Monsanto's share price had continued to perform well. The acquisition deal could jeopardize Bayer's brand image because of Monsanto's past controversial issues in its business operations and practices. The announcement of the deal had generated concerns from many stakeholders at different levels, including farmers, consumers, shareholders, and employees.

In the pharmaceutical industry, Bayer was still a respectable brand, mostly known for Aspirin. However, following the acquisition, Anton Hofreiter, a German biologist and head of the opposition Green Party grouping in the German parliament, strongly criticized the deal: "Monsanto represents so much of what's wrong with agribusiness. At the same time people are becoming more skeptical about the agricultural industry; Bayer turns around and invests in this consumer and environmentally hostile direction." Hofreiter was expressing his concern that the deal would reinforce starvation in the world and that the high price paid by Bayer would eventually be transferred to farmers and consumers. Moreover, the acquisition deal led to a surge of protestation all over the world, resulting in petitions and the formation of political movements, especially in Europe where citizens were afraid of the introduction of GMOs to their lands.

Some shareholders also protested the strategic move. For instance, Bayer shareholder J. Gruber stated, "As a financial advisor, I oppose this merger because it centralizes food and prescription drugs so intensely that neither Bayer nor Monsanto will be good incubators for new ideas. It will be too big of a company and is likely to stagnate. That's bad for my profits." Others were worried about the sustainability of the deal and the dilution of shareholder value.

As the agreement could also weaken the internal corporate image, Bayer's employees, especially those at home in Europe, might be unwilling to work with one of the most hated companies in the world. On top of this hurdle, the German employees might find it difficult and uncomfortable to work with a company with a culture, practice, and vision so different from their own. Further, mergers and acquisitions were often seen as a threat to employees' job security, so Bayer might not receive sufficient co-operation from its employees.

THE BEGINNING OF A LONG JOURNEY

The merger agreement of September 14, 2016 was just the beginning of a long journey for Bayer; the company still had to secure regulatory approval from several countries, which was not likely in light of antitrust issues. With the high acquisition premium and the divestment pressure, in addition to antitrust concerns, would the deal create sufficient synergies that actually increased shareholder value? Given Monsanto's negative brand image, Bayer also had to reassure its shareholders, employees, and customers that this strategic decision was a good choice and was relevant for them. Baumann had clearly stated that pharmaceuticals and agrochemicals would become Bayer's two main businesses, and that they would produce integrated solutions enabling both businesses to face the competitive markets. However, was this bold strategic move the right decision for Bayer to ensure "a better life" for its customers? Bayer would have to weigh whether these complications and further concessions required by the government authorities still made the deal worthwhile.

Case Question

Was this bold strategic move the right decision for Bayer to ensure "a better life" for its customers? (Word Count: 500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started