Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bayes Enterprises offers 10 and 1 newly issued share for each share of Finsbury Plc. There are 1 million shares in Bayes and 600,000 shares

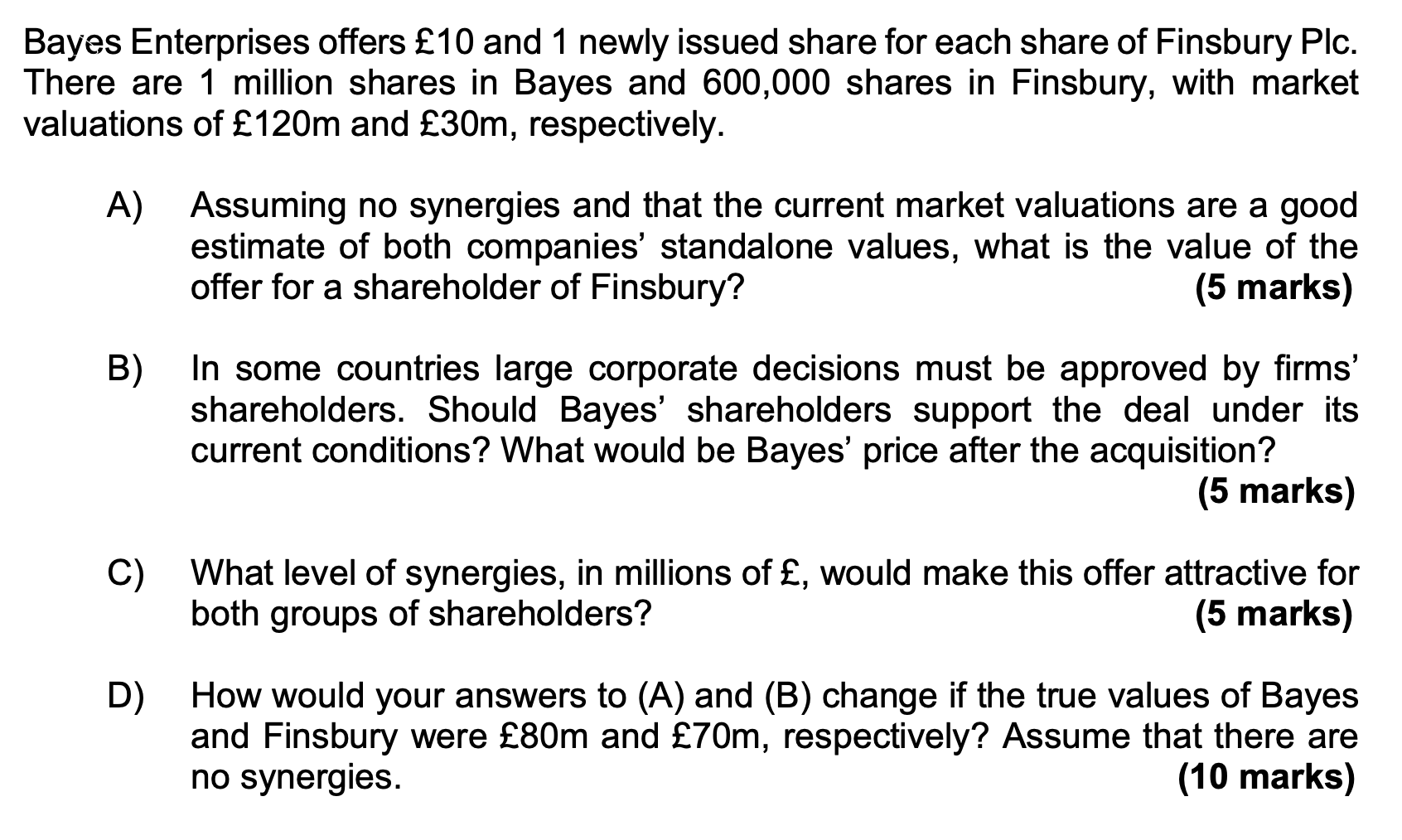

Bayes Enterprises offers 10 and 1 newly issued share for each share of Finsbury Plc. There are 1 million shares in Bayes and 600,000 shares in Finsbury, with market valuations of 120m and 30m, respectively. A) Assuming no synergies and that the current market valuations are a good estimate of both companies' standalone values, what is the value of the offer for a shareholder of Finsbury? (5 marks) B) In some countries large corporate decisions must be approved by firms' shareholders. Should Bayes' shareholders support the deal under its current conditions? What would be Bayes' price after the acquisition? (5 marks) C) What level of synergies, in millions of , would make this offer attractive for both groups of shareholders? (5 marks) D) How would your answers to (A) and (B) change if the true values of Bayes and Finsbury were 80m and 70m, respectively? Assume that there are no synergies. (10 marks)

Bayes Enterprises offers 10 and 1 newly issued share for each share of Finsbury Plc. There are 1 million shares in Bayes and 600,000 shares in Finsbury, with market valuations of 120m and 30m, respectively. A) Assuming no synergies and that the current market valuations are a good estimate of both companies' standalone values, what is the value of the offer for a shareholder of Finsbury? (5 marks) B) In some countries large corporate decisions must be approved by firms' shareholders. Should Bayes' shareholders support the deal under its current conditions? What would be Bayes' price after the acquisition? (5 marks) C) What level of synergies, in millions of , would make this offer attractive for both groups of shareholders? (5 marks) D) How would your answers to (A) and (B) change if the true values of Bayes and Finsbury were 80m and 70m, respectively? Assume that there are no synergies. (10 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started