Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bb BUS 310 Notes X Bb Practice Final X Bb Collaborate X Bb Take Test: Bus 3 X CH14.pdf: FINA X |Q sinking fund

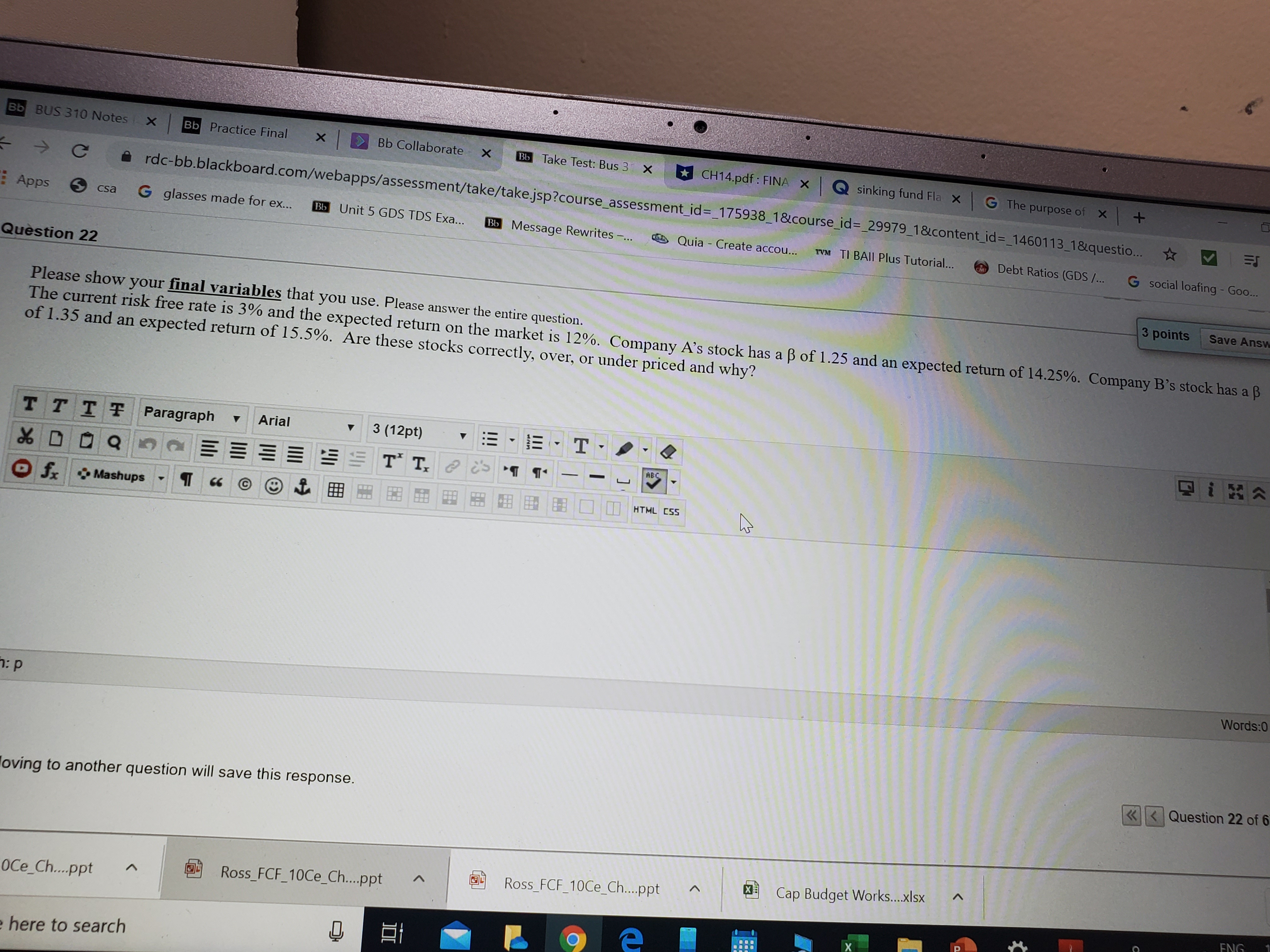

Bb BUS 310 Notes X Bb Practice Final X Bb Collaborate X Bb Take Test: Bus 3 X CH14.pdf: FINA X |Q sinking fund Flax G The purpose of x+ C rdc-bb.blackboard.com/webapps/assessment/take/take.jsp?course_assessment_id=_175938_1&course_id=_29979_1&content_id=_1460113_1&questio... ET Apps csa G glasses made for ex... Bb Unit 5 GDS TDS Exa... Bb Message Rewrites -... Quia - Create accou... TVM TI BAII Plus Tutorial... Debt Ratios (GDS/... G social loafing - Goo... Question 22 3 points Save Answ The current risk free rate is 3% and the expected return on the market is 12%. Company A's stock has a of 1.25 and an expected return of 14.25%. Company B's stock has a of 1.35 and an expected return of 15.5%. Are these stocks correctly, over, or under priced and why? Please show your final variables that you use. Please answer the entire question. XO 70 TTTT Paragraph Arial 3 (12pt) ET ABC a fx Mashups TT T T. i TO HTML CSS h: P Moving to another question will save this response. OCe_Ch....ppt e here to search Ross FCF 10Ce_Ch....ppt ^ EI Ross FCF 10Ce_Ch....ppt e > X Cap Budget Works....xlsx ^ X 4pd Words:0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started