Question

BBB company has $54 million of current assets and $58 million of noncurrent assets. It forecasts an EBIT of $10.4 million and pays income taxes

BBB company has $54 million of current assets and $58 million of noncurrent assets. It forecasts an EBIT of $10.4 million and pays income taxes at a 35% rate. Short-term bank notes carry a 5% interest rate, and the company can issue long-term bonds at 7%. The company has set a target debt ratio of 45%.

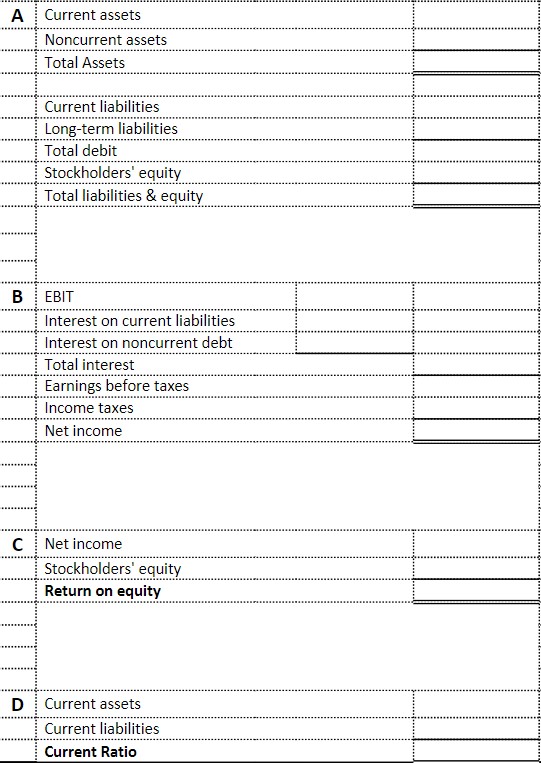

Required: A. For a maturity mix of 60% current and 40% long-term debt, prepare the company's abbreviated balance sheet. B. For a maturity mix of 60% current and 40% long-term debt, prepare the company's financial half of its income statement. C. Based on the financial statements above, calculate the return on equity ratio in order to evaluate the company's risk and return. D. Based on the financial statements above, calculate the current ratio in order to evaluate the company's risk and return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started