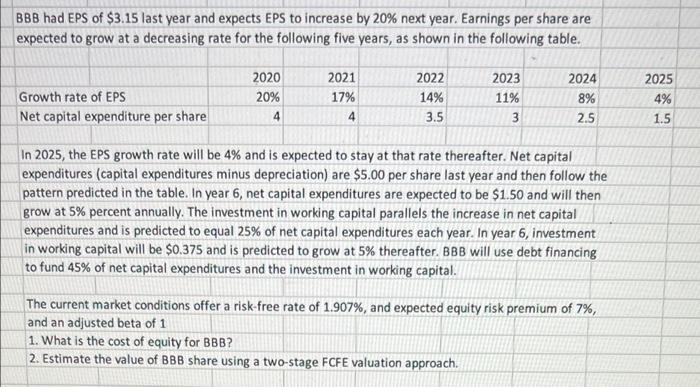

BBB had EPS of $3.15 last year and expects EPs to increase by 20% next year. Earnings per share are expected to grow at a decreasing rate for the following five years, as shown in the following table. Growth rate of EPS Net capital expenditure per share 2020 20% 4 2021 17% 4 2022 14% 3.5 2023 11% 3 2024 8% 2.5 2025 4% 1.5 In 2025, the EPS growth rate will be 4% and is expected to stay at that rate thereafter. Net capital expenditures (capital expenditures minus depreciation) are $5.00 per share last year and then follow the pattern predicted in the table. In year 6, net capital expenditures are expected to be $1.50 and will then grow at 5% percent annually. The investment in working capital parallels the increase in net capital expenditures and is predicted to equal 25% of net capital expenditures each year. In year 6, investment in working capital will be $0.375 and is predicted to grow at 5% thereafter. BBB will use debt financing to fund 45% of net capital expenditures and the investment in working capital. The current market conditions offer a risk-free rate of 1.907%, and expected equity risk premium of 7%, and an adjusted beta of 1 1. What is the cost of equity for BBB? 2. Estimate the value of BBB share using a two-stage FCFE valuation approach. BBB had EPS of $3.15 last year and expects EPs to increase by 20% next year. Earnings per share are expected to grow at a decreasing rate for the following five years, as shown in the following table. Growth rate of EPS Net capital expenditure per share 2020 20% 4 2021 17% 4 2022 14% 3.5 2023 11% 3 2024 8% 2.5 2025 4% 1.5 In 2025, the EPS growth rate will be 4% and is expected to stay at that rate thereafter. Net capital expenditures (capital expenditures minus depreciation) are $5.00 per share last year and then follow the pattern predicted in the table. In year 6, net capital expenditures are expected to be $1.50 and will then grow at 5% percent annually. The investment in working capital parallels the increase in net capital expenditures and is predicted to equal 25% of net capital expenditures each year. In year 6, investment in working capital will be $0.375 and is predicted to grow at 5% thereafter. BBB will use debt financing to fund 45% of net capital expenditures and the investment in working capital. The current market conditions offer a risk-free rate of 1.907%, and expected equity risk premium of 7%, and an adjusted beta of 1 1. What is the cost of equity for BBB? 2. Estimate the value of BBB share using a two-stage FCFE valuation approach