Question

BBBB Construction Corporation, a domestic corporation, has the following data for 2021 taxable year: Gross income, Phil. P100,000,000 Gross income, USA 50,000,000 Gross income, Japan

BBBB Construction Corporation, a domestic corporation, has the following data for 2021 taxable year:

Gross income, Phil. | P100,000,000 |

Gross income, USA | 50,000,000 |

Gross income, Japan | 50,000,000 |

Expenses, Phil. | 30,000,000 |

Expenses, USA | 20,000,000 |

Expenses, Japan | 10,000,000 |

Foreign income tax credit | 2,500,000 |

Other income: | |

Dividend from San Miguel Corp., a domestic corp. | 7,000,000 |

Dividend from Ford Motors (RFC; income within) | 12,000,000 |

Gain on sale of shares of a domestic corporation sold listed and traded thru PSE | 15,000,000 |

Royalty income (classified as active income), Philippines | 5,000,000 |

Royalty income, USA | 10,000,000 |

Interest income on peso bank deposit | 8,000,000 |

Interest income on FCDS deposit | 3,000,000 |

Interest from receivables in the Philippines | 6,000,000 |

Rent income, land in USA | 25,000,000 |

Rent income, Building in the Philippines | 10,000,000 |

The Company also sold a condominium classified as capital asset for P200,000,000. The cost of the Condominium is P100,000,000 while its Zonal Value is P300,000,000.

The Company's total assets excluding the condominium sold and the land on which the business office building is situated amounted to P100,000,000.

Based on the information above, answer the following:

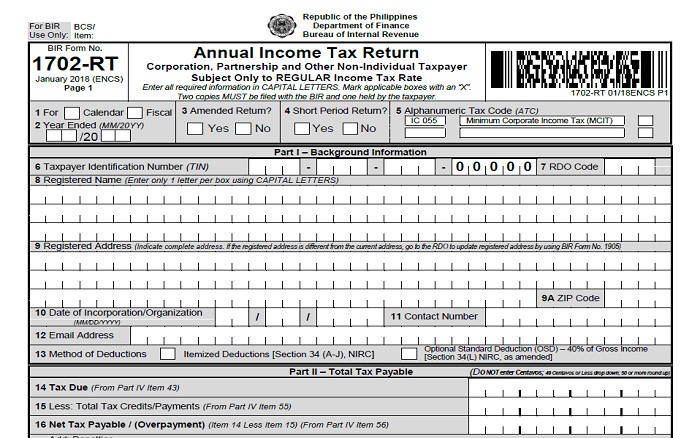

- How much is the amount in line item 16 of BIR Form No. 1702 - RT in 2021?

- How much is the final withholding tax on passive income in 2021?

For BIR BCS/ Use Only: Item: BIR Form No. 1702-RT January 2018 (ENCS) Page 1 1 For Calendar 2 Year Ended (MM/20YY) /20 Annual Income Tax Return Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate Enter all required information in CAPITAL LETTERS. Mark applicable boxes with an "X". Two copies MUST be filed with the BIR and one held by the taxpayer Fiscal 3 Amended Retur? Yes No 6 Taxpayer Identification Number (TIN) 8 Registered Name (Enter only 1 letter per box using CAPITAL LETTERS) 1 I I I 1 10 Date of Incorporation/Organization (MMDD/YYYY) 12 Email Address 13 Method of Deductions Republic of the Philippines Department of Finance. Bureau of Internal Revenue 1 4 Short Period Return? 5 Alphanumeric Tax Code (ATC) Minimum Corporate Income Tax (MCIT) Yes No IC 055 Part I-Background Information I 9 Registered Address (Indicate complete address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) I 1 I 1 Itemized Deductions [Section 34 (A-J), NIRC] Part II - Total Tax Payable 14 Tax Due (From Part IV Item 43) 15 Less: Total Tax Credits/Payments (From Part IV Item 55) 16 Net Tax Payable / (Overpayment) (Item 14 Less Item 15) (From Part IV Item 56) 1702-RT 01/18ENCS P1 0 0 0 0 0 7 RDO Code I 11 Contact Number II 1 1 I L I I I I 9A ZIP Code 1 JI I Optional Standard Deduction (OSD) -40% of Gross income [Section 34(L) NIRC, as amended] (DO NOT enter Centavos; cos or Less drop down 50 or more round up 1 1 For BIR BCS/ Use Only: Item: BIR Form No. 1702-RT January 2018 (ENCS) Page 1 1 For Calendar 2 Year Ended (MM/20YY) /20 Annual Income Tax Return Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate Enter all required information in CAPITAL LETTERS. Mark applicable boxes with an "X". Two copies MUST be filed with the BIR and one held by the taxpayer Fiscal 3 Amended Retur? Yes No 1 I I 6 Taxpayer Identification Number (TIN) 8 Registered Name (Enter only 1 letter per box using CAPITAL LETTERS) I 1 10 Date of Incorporation/Organization (MMDD/YYYY) 12 Email Address 13 Method of Deductions Republic of the Philippines Department of Finance. Bureau of Internal Revenue 1 4 Short Period Return? 5 Alphanumeric Tax Code (ATC) Minimum Corporate Income Tax (MCIT) Yes No IC 055 Part I - Background Information I 9 Registered Address (Indicate complete address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) I 1 I 1 Itemized Deductions [Section 34 (A-J), NIRC] Part II - Total Tax Payable 14 Tax Due (From Part IV Item 43) 15 Less: Total Tax Credits/Payments (From Part IV Item 55) 16 Net Tax Payable / (Overpayment) (Item 14 Less Item 15) (From Part IV Item 56) 1702-RT 01/18ENCS P1 0 0 0 0 0 7 RDO Code I 11 Contact Number II 1 1 I L I I I I 9A ZIP Code 1 JI I Optional Standard Deduction (OSD) -40% of Gross income [Section 34(L) NIRC, as amended] (DO NOT enter Centavos; cos or Less drop down 50 or more round up 1 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Computation of BIR Form 1702 RT for BBBB Construction Corporation for TY 2021 1 Gross Income a Phili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started