Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BBF315/05 Risk Management May 2023 Assignment 2 Question 1 (a) Risk management is sometimes described as the process of identifying and evaluating the trade-off

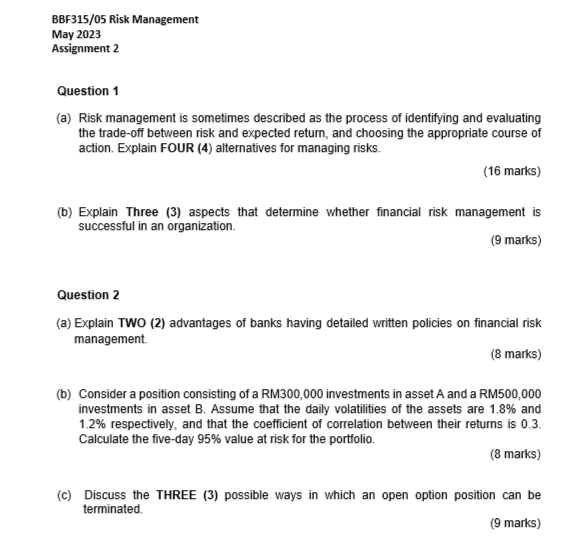

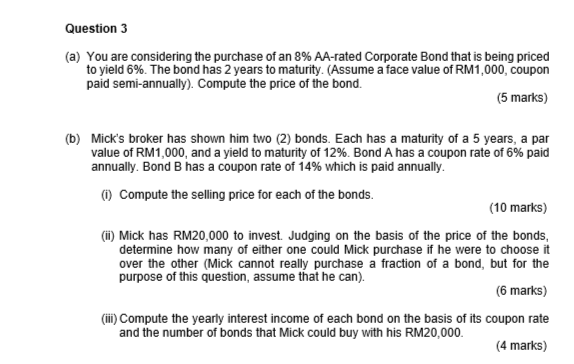

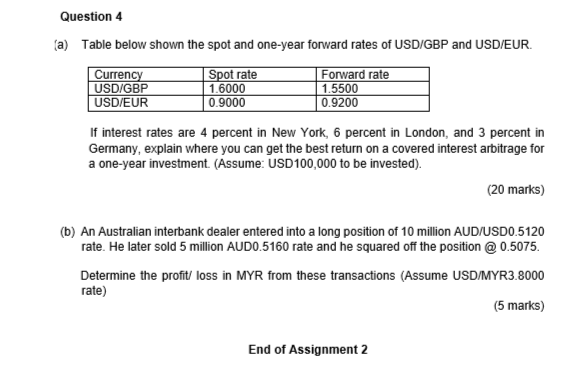

BBF315/05 Risk Management May 2023 Assignment 2 Question 1 (a) Risk management is sometimes described as the process of identifying and evaluating the trade-off between risk and expected return, and choosing the appropriate course of action. Explain FOUR (4) alternatives for managing risks. (16 marks) (b) Explain Three (3) aspects that determine whether financial risk management is successful in an organization. (9 marks) Question 2 (a) Explain TWO (2) advantages of banks having detailed written policies on financial risk management. (8 marks) (b) Consider a position consisting of a RM300,000 investments in asset A and a RM500,000 investments in asset B. Assume that the daily volatilities of the assets are 1.8% and 1.2% respectively, and that the coefficient of correlation between their returns is 0.3. Calculate the five-day 95% value at risk for the portfolio. (8 marks) (c) Discuss the THREE (3) possible ways in which an open option position can be terminated. (9 marks) Question 3 (a) You are considering the purchase of an 8% AA-rated Corporate Bond that is being priced to yield 6%. The bond has 2 years to maturity. (Assume a face value of RM1,000, coupon paid semi-annually). Compute the price of the bond. (5 marks) (b) Mick's broker has shown him two (2) bonds. Each has a maturity of a 5 years, a par value of RM1,000, and a yield to maturity of 12%. Bond A has a coupon rate of 6% paid annually. Bond B has a coupon rate of 14% which is paid annually. (i) Compute the selling price for each of the bonds. (10 marks) (ii) Mick has RM20,000 to invest. Judging on the basis of the price of the bonds, determine how many of either one could Mick purchase if he were to choose it over the other (Mick cannot really purchase a fraction of a bond, but for the purpose of this question, assume that he can). (6 marks) (iii) Compute the yearly interest income of each bond on the basis of its coupon rate and the number of bonds that Mick could buy with his RM20,000. (4 marks) Question 4 (a) Table below shown the spot and one-year forward rates of USD/GBP and USD/EUR. Currency USD/GBP USD/EUR Spot rate 1.6000 0.9000 Forward rate 1.5500 0.9200 If interest rates are 4 percent in New York, 6 percent in London, and 3 percent in Germany, explain where you can get the best return on a covered interest arbitrage for a one-year investment. (Assume: USD100,000 to be invested). (20 marks) (b) An Australian interbank dealer entered into a long position of 10 million AUD/USD0.5120 rate. He later sold 5 million AUD0.5160 rate and he squared off the position @ 0.5075. Determine the profit/ loss in MYR from these transactions (Assume USD/MYR3.8000 rate) End of Assignment 2 (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started