Answered step by step

Verified Expert Solution

Question

1 Approved Answer

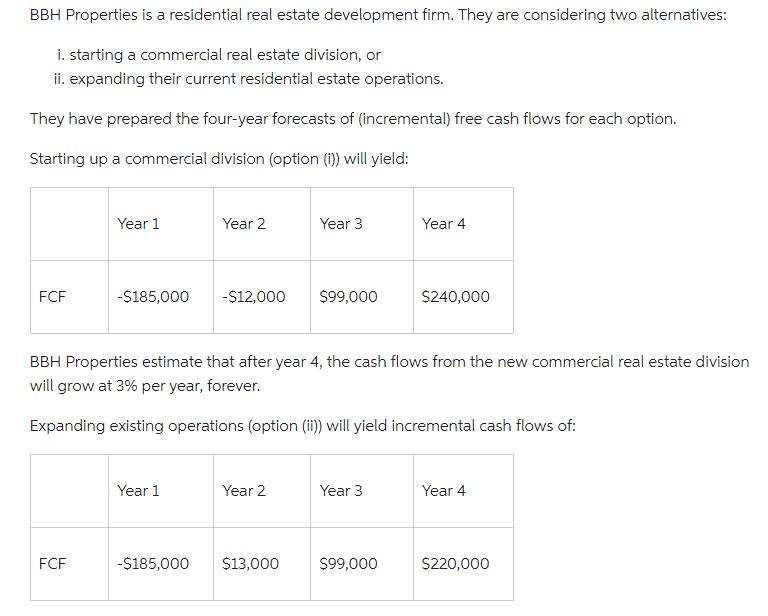

BBH Properties is a residential real estate development firm. They are considering two alternatives: i. starting a commercial real estate division, or ii. expanding

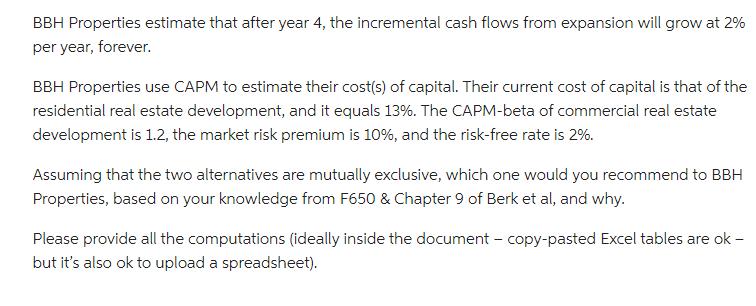

BBH Properties is a residential real estate development firm. They are considering two alternatives: i. starting a commercial real estate division, or ii. expanding their current residential estate operations. They have prepared the four-year forecasts of (incremental) free cash flows for each option. Starting up a commercial division (option (i)) will yield: FCF Year 1 FCF -$185,000 Year 1 Year 2 -$185,000 -$12,000 BBH Properties estimate that after year 4, the cash flows from the new commercial real estate division will grow at 3% per year, forever. Expanding existing operations (option (ii)) will yield incremental cash flows of: Year 2 Year 3 $13,000 $99,000 Year 3 Year 4 $99,000 $240,000 Year 4 $220,000 BBH Properties estimate that after year 4, the incremental cash flows from expansion will grow at 2% per year, forever. BBH Properties use CAPM to estimate their cost(s) of capital. Their current cost of capital is that of the residential real estate development, and it equals 13%. The CAPM-beta of commercial real estate development is 1.2, the market risk premium is 10%, and the risk-free rate is 2%. Assuming that the two alternatives are mutually exclusive, which one would you recommend to BBH Properties, based on your knowledge from F650 & Chapter 9 of Berk et al, and why. Please provide all the computations (ideally inside the document - copy-pasted Excel tables are ok - but it's also ok to upload a spreadsheet).

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started