Answered step by step

Verified Expert Solution

Question

1 Approved Answer

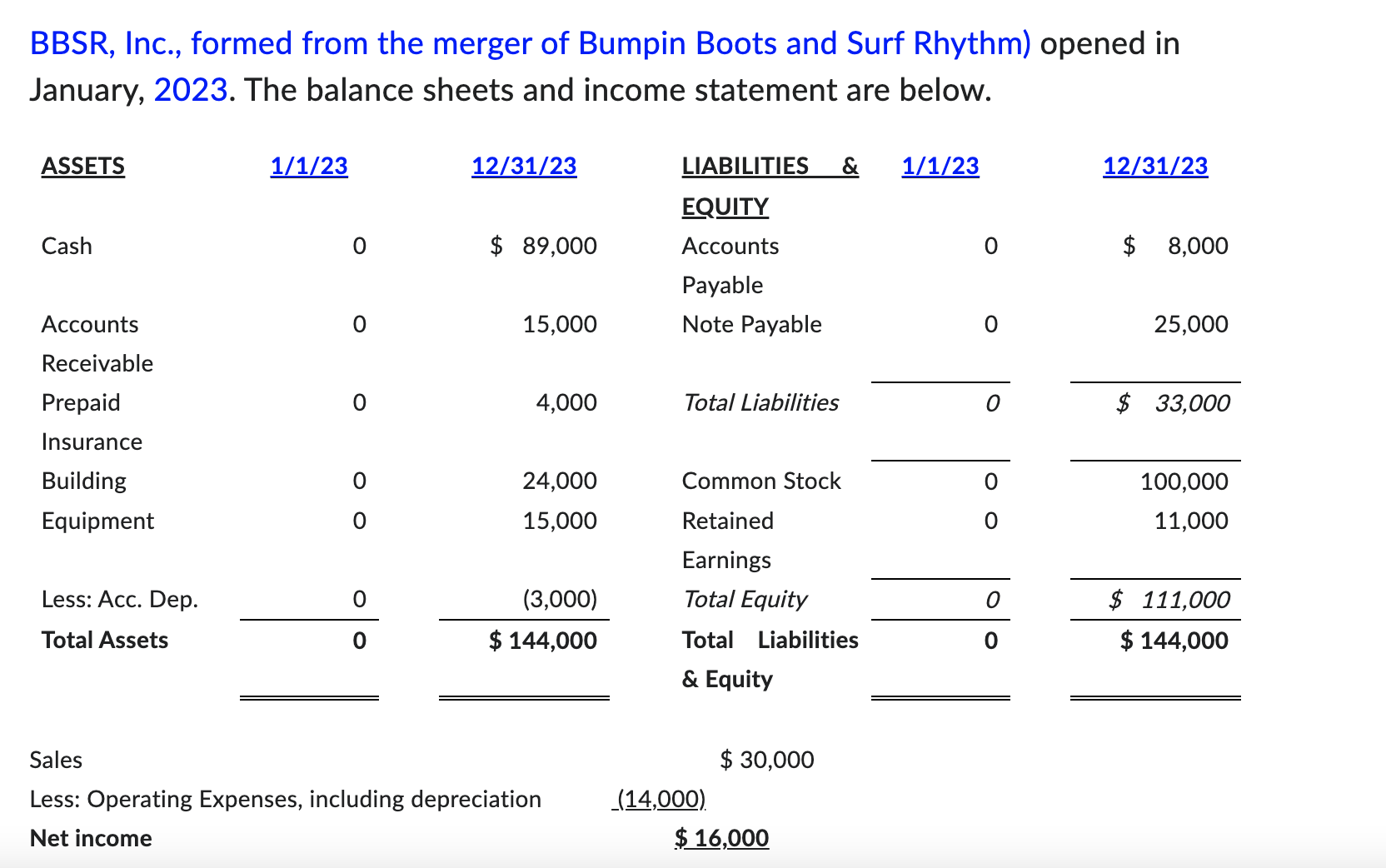

BBSR, Inc., formed from the merger of Bumpin Boots and Surf Rhythm) opened in January, 2023. The balance sheets and income statement are below.

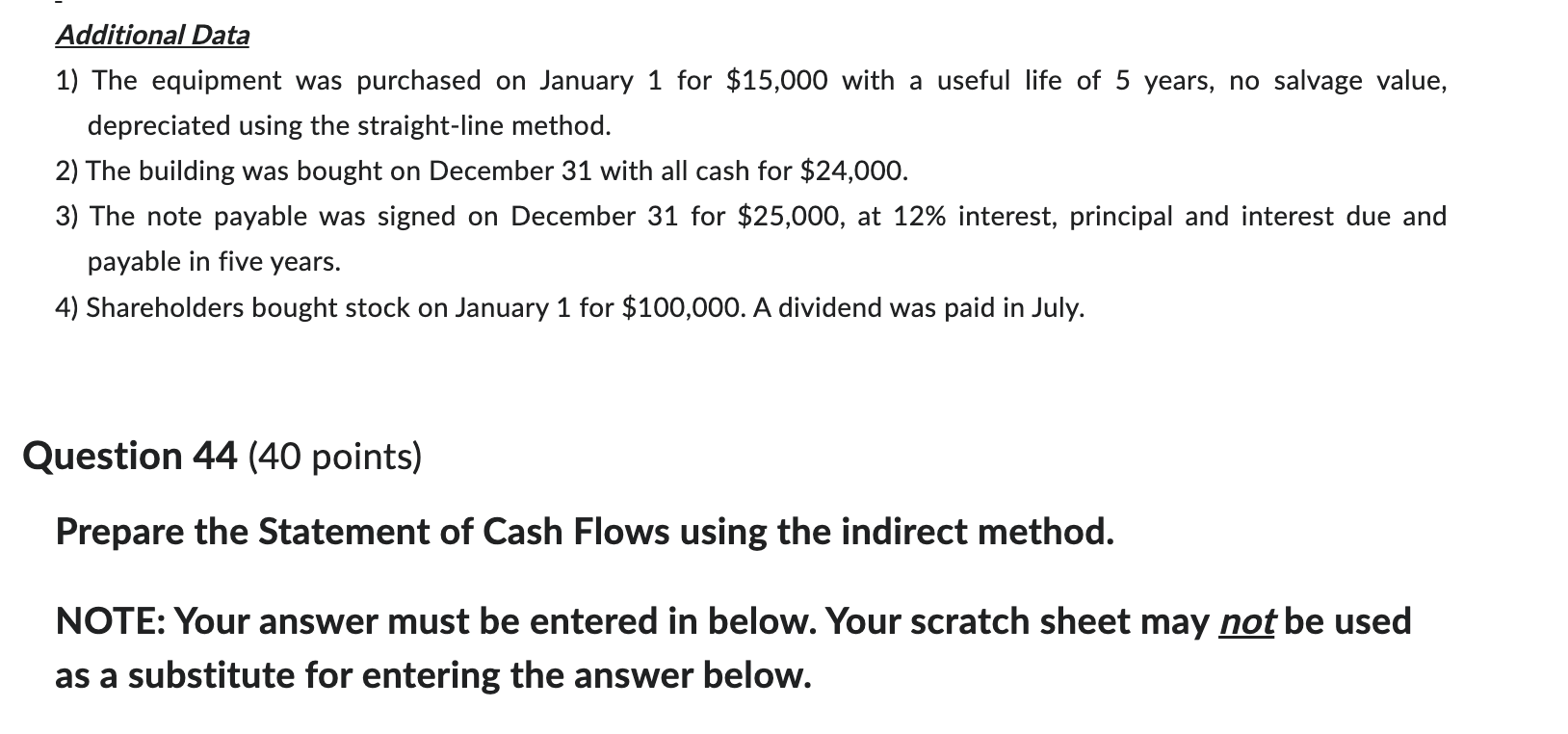

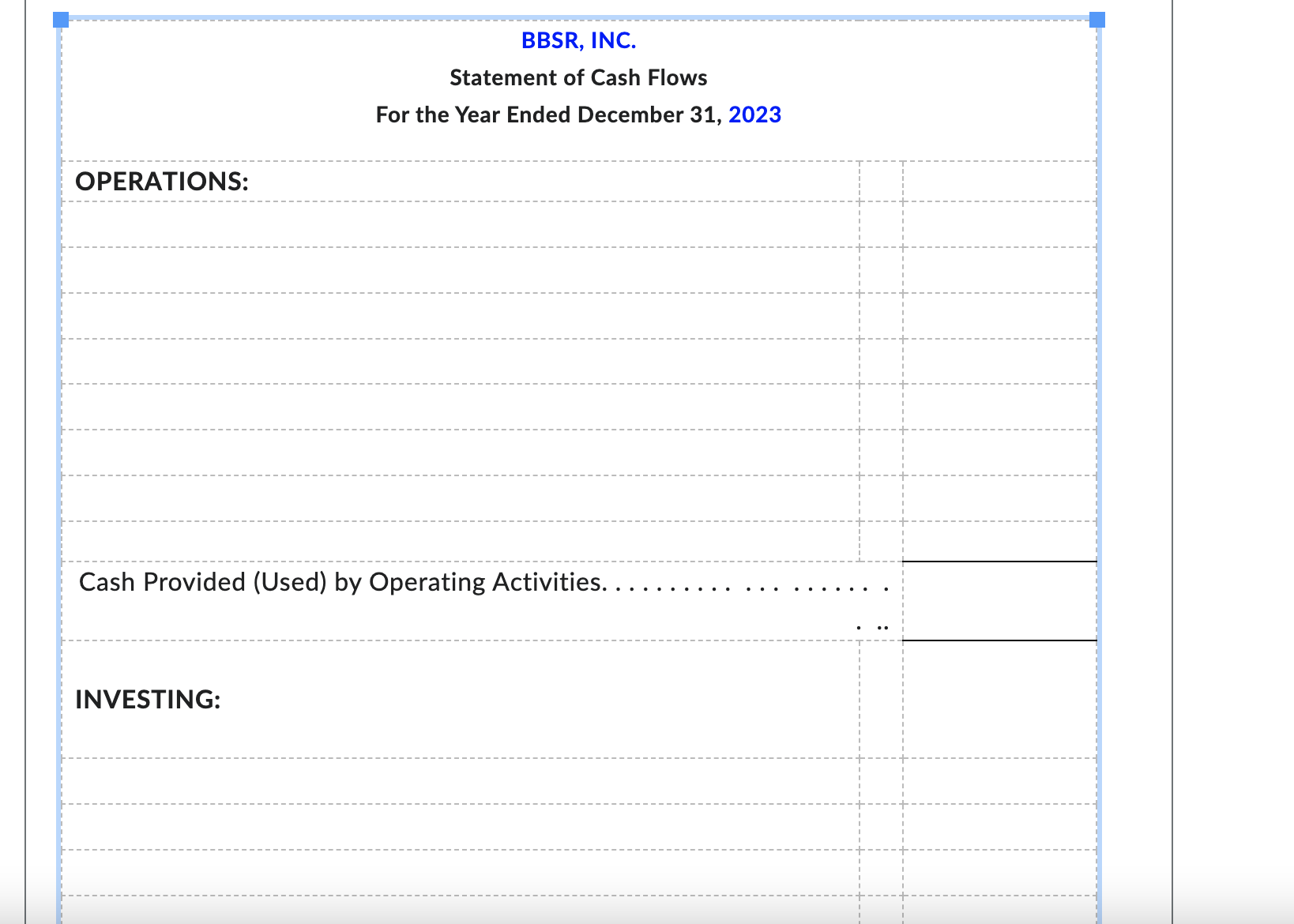

BBSR, Inc., formed from the merger of Bumpin Boots and Surf Rhythm) opened in January, 2023. The balance sheets and income statement are below. ASSETS 1/1/23 12/31/23 LIABILITIES & 1/1/23 12/31/23 EQUITY Cash 0 $ 89,000 Accounts 0 $ 8,000 Accounts 0 15,000 Payable Note Payable 0 25,000 Receivable Prepaid 0 4,000 Total Liabilities $ 33,000 Insurance Building 0 24,000 Common Stock 0 Equipment 15,000 Retained 100,000 11,000 Earnings Less: Acc. Dep. 0 (3,000) Total Equity 0 $ 111,000 Total Assets $144,000 Total Liabilities $144,000 & Equity Sales $ 30,000 Less: Operating Expenses, including depreciation (14,000) Net income $16,000 Additional Data 1) The equipment was purchased on January 1 for $15,000 with a useful life of 5 years, no salvage value, depreciated using the straight-line method. 2) The building was bought on December 31 with all cash for $24,000. 3) The note payable was signed on December 31 for $25,000, at 12% interest, principal and interest due and payable in five years. 4) Shareholders bought stock on January 1 for $100,000. A dividend was paid in July. Question 44 (40 points) Prepare the Statement of Cash Flows using the indirect method. NOTE: Your answer must be entered in below. Your scratch sheet may not be used as a substitute for entering the answer below. OPERATIONS: BBSR, INC. Statement of Cash Flows For the Year Ended December 31, 2023 Cash Provided (Used) by Operating Activities. INVESTING: Cash Provided (Used) from Investing Activities FINANCING: Cash Provided (Used) by Financing Activities.. NET INCREASE (DECREASE) IN CASH. Beginning Cash.. Ending Cash....... $ 89,000 11.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cash provided used by operating a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started