Answered step by step

Verified Expert Solution

Question

1 Approved Answer

be $440,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $861,000 from

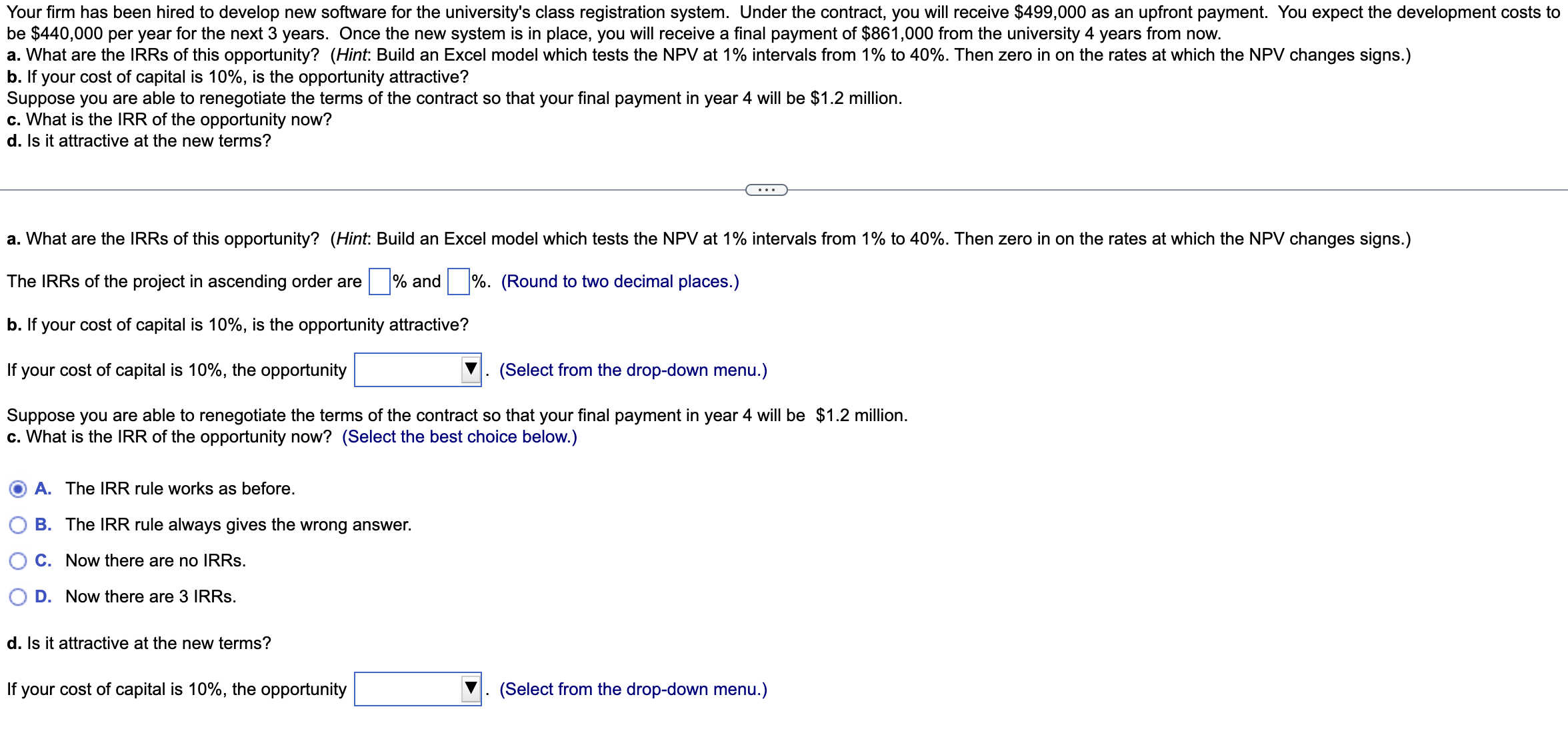

be $440,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $861,000 from the university 4 years from now. b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? The IRRs of the project in ascending order are % and %. (Round to two decimal places.) b. If your cost of capital is 10%, is the opportunity attractive? If your cost of capital is 10%, the opportunity (Select from the drop-down menu.) Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? (Select the best choice below.) A. The IRR rule works as before. B. The IRR rule always gives the wrong answer. C. Now there are no IRRs. D. Now there are 3 IRRs. d. Is it attractive at the new terms? If your cost of capital is 10%, the opportunity (Select from the drop-down menu.)

be $440,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $861,000 from the university 4 years from now. b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? The IRRs of the project in ascending order are % and %. (Round to two decimal places.) b. If your cost of capital is 10%, is the opportunity attractive? If your cost of capital is 10%, the opportunity (Select from the drop-down menu.) Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? (Select the best choice below.) A. The IRR rule works as before. B. The IRR rule always gives the wrong answer. C. Now there are no IRRs. D. Now there are 3 IRRs. d. Is it attractive at the new terms? If your cost of capital is 10%, the opportunity (Select from the drop-down menu.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started