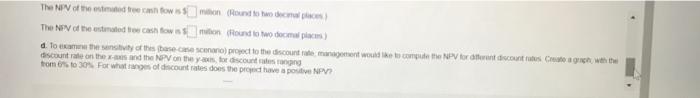

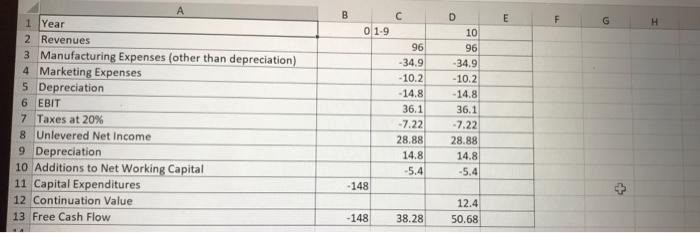

Be Industries is an automobile manufacture Management is currently evaluating a proposal to build a will manufacturer weight trucks Bower plans to use a cost of capital of 11.8% to evaluate this project Based on extensive research the prepared the following cremental tree cath tow protons On milions of our m a. For this buse-case scenario what is the NPV of the plant to manufacture light trucks? b. Besed on input from the marketing department, Boor is uncertain about its revenue forecast in particular management would to the instity of the NPV to the revenue assumptions What is the NPV of this project it revenues we 10% higher than forecast? What is the NPV it venues are 10% lower than forecast? c. Rather than assuming that cash flows for the project are constant management would be to explore the sertivity of its analysis to possible growth in and operating expenses Specifically management would like to assume that revenues, manufacturing expenses and marketing expenses are as given in the table for your and grow by year every year starting in your 2 Management also plans to assume that the capital expenditures and therefore depreciation addition to working capital and contention c. Rather than assuming that cash fows for this project are constant management would like to explore the sentity of its sesto post growthree and operating CON UN / Wonderwertest? expenses Specifically management would like to assume that revenue manufacturing expenses and marketing expenses was given in the table for your and grow by your every year sting in your Management plans to me that the battlepende and the detections to working and con vale romantily specified in the table What is the other devetomow the changes and operating experts grow by 0 per year than by d. To examine the sensitivity of this sort to the discount on would like to come the NPV for contre graph with discount rate on them and the NPV on they for discount es tanging from 5 to 30% Forwaanges of discount does the positive a. For this base-case scenario what is the NPV at the plant to manufacturers? The NPV of the estimated tree cash flow milion Round to two decal places b. Based on input from the marketing department uncertan bout its foc in particular o came the sensity of the NPV to the revenue assumptions What is the NPV of the project are 10% higher than forecast? What is the NPV trene 10 lower than forces The NPV of the show on IR The NW of the estimated cash flow Smion (Round to two decapo The NIV of the strechow in Rund to w domaces) c. Rather than assuming that shows for this projecte constantment to explore the sensity of its sto possible growthree and operating expenses. Specifically management would like to me that revenues manufacturing expenses and ingepas given in the table for year and grow by per year every year starting in year 2 Management plans to me that the colpends and therefore directionations to working capital and condition Valumnasty specified in the table What is the NPV of this project under the seriesumption How does the change the events and operating expenses grow by per other than by 32 The NPV of the town on The NPV of the estimated to show on Round to complcm) d. To exam the stvo the base sceno)proct to the discount management would be complete NPV for different discount Car with discount rate on the and the NPV on they for discount from 0 to 30% For whate of discount does the prodhave a positive NPV d. To examine the many of the base conectado) powd to the count, management would take to complete NPV tortovent discountates. Cette gue with the discount sute on the xx and the NPV on the pas for discount estanging from 0 to 30% For what ranges of discount rates does the project have a positive NPV) The NPV is positive for discount rates below the IRR of Round to one decimal place) B E "11 F G 0 1.9 A 1 Year 2 Revenues 3 Manufacturing Expenses (other than depreciation) 4 Marketing Expenses 5 Depreciation 6 EBIT 7 Taxes at 20% 8 Unlevered Net Income 9 Depreciation 10 Additions to Net Working Capital 11 Capital Expenditures 12 Continuation Value 13 Free Cash Flow 96 -34.9 - 10.2 -14.8 36.1 -7.22 28.88 14.8 -5.4 D 10 96 34.9 - 10.2 -14.8 36.1 -7.22 28.88 14.8 -5.4 - 148 + 12.4 50.68 -148 38.28