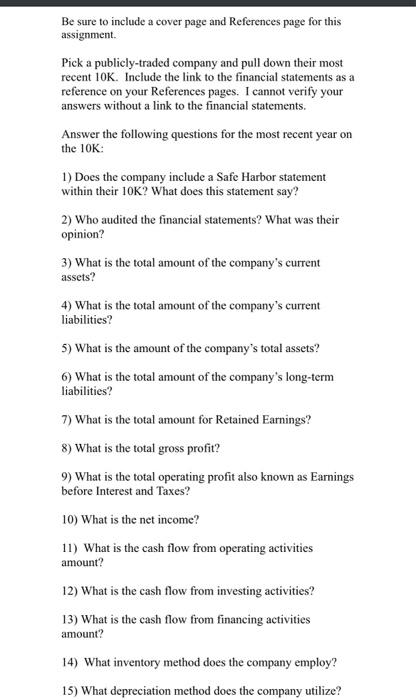

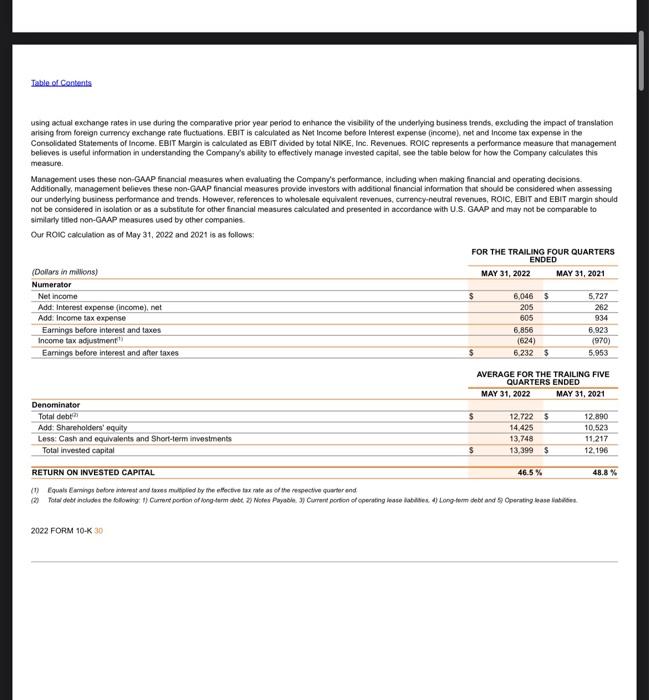

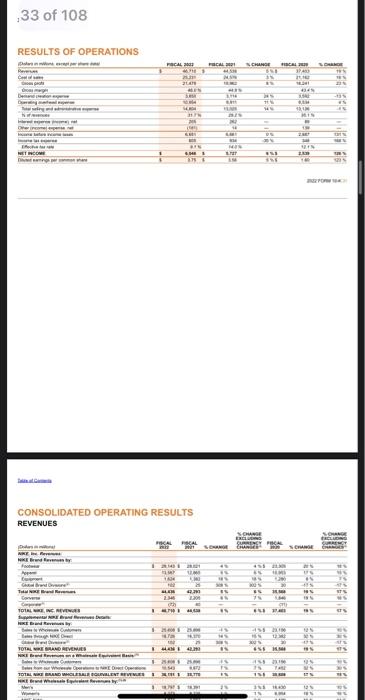

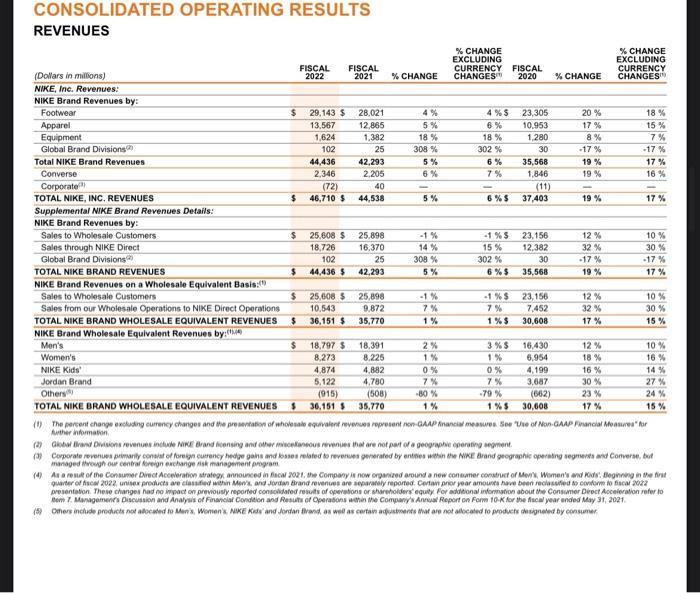

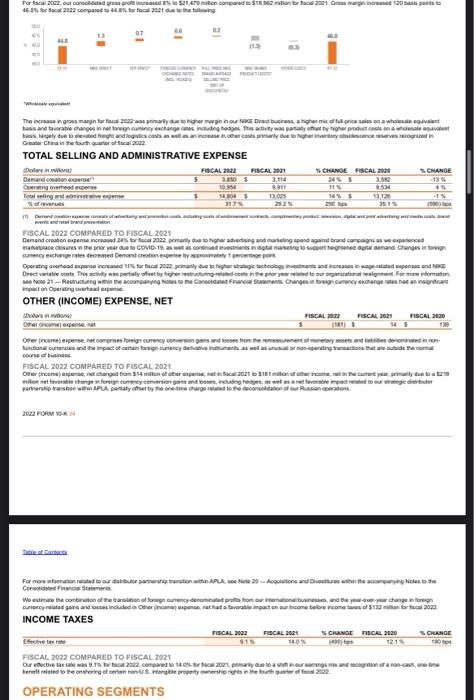

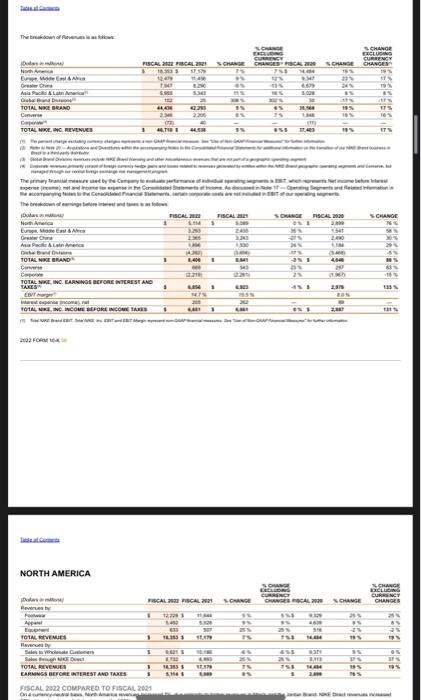

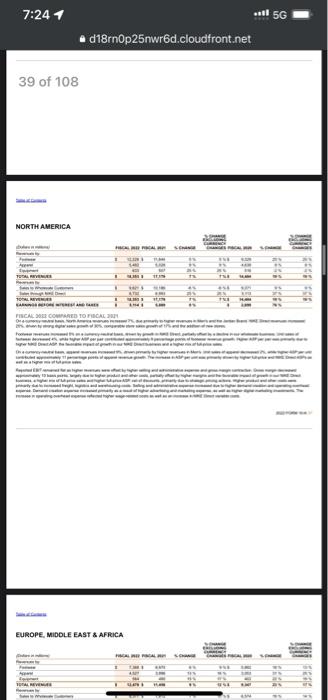

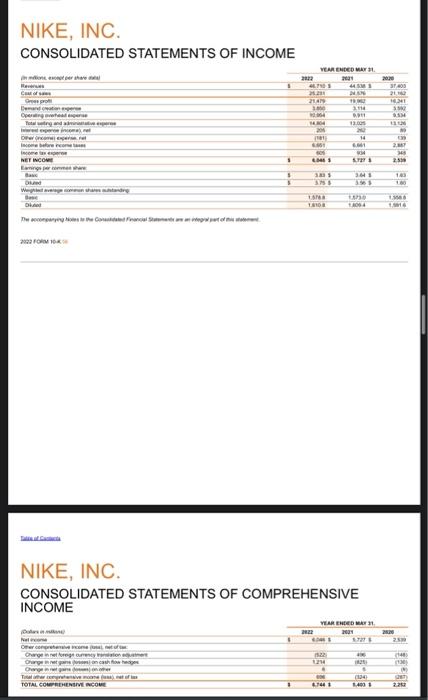

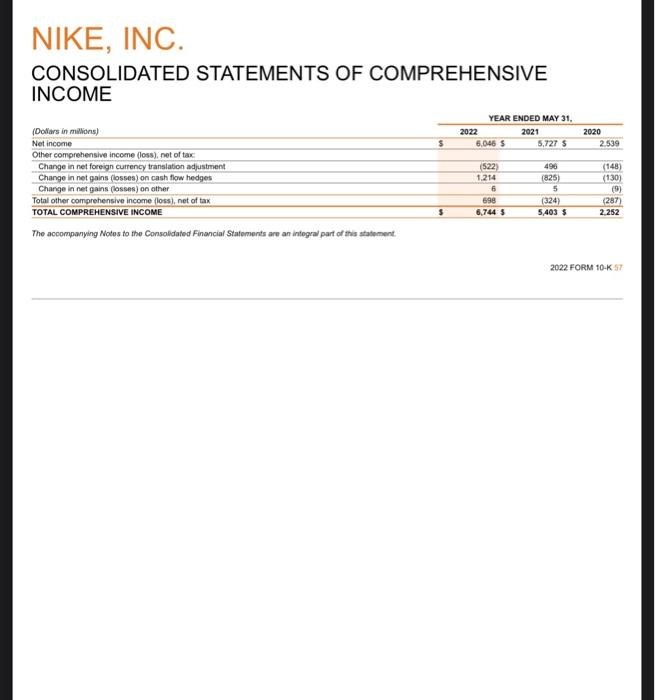

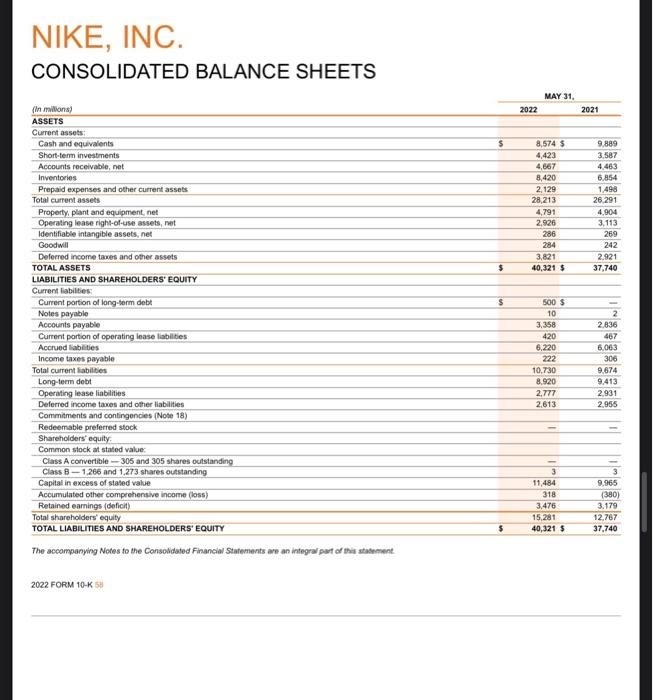

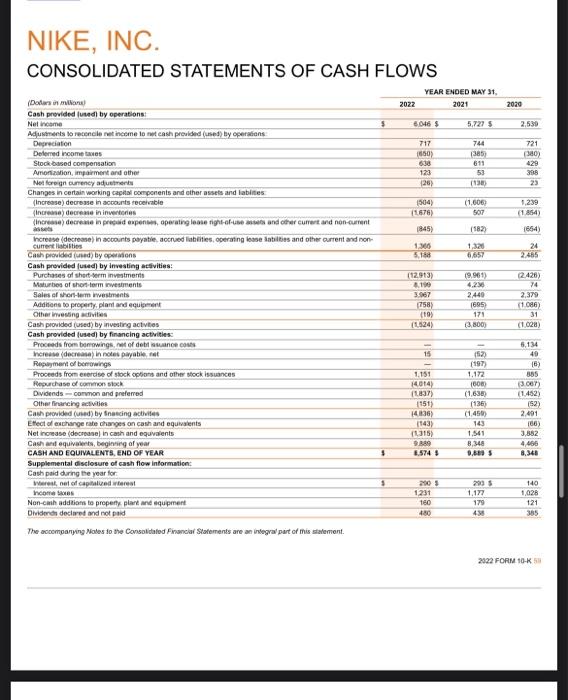

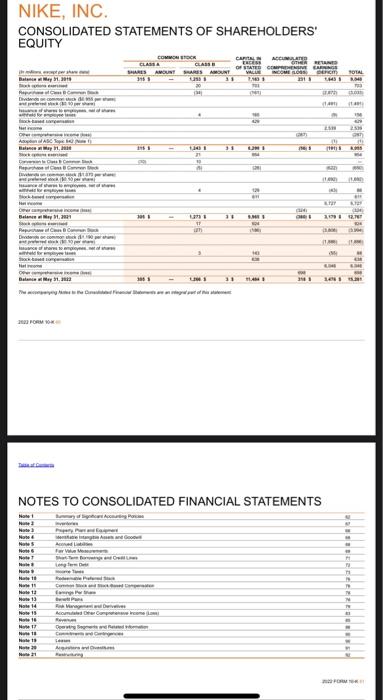

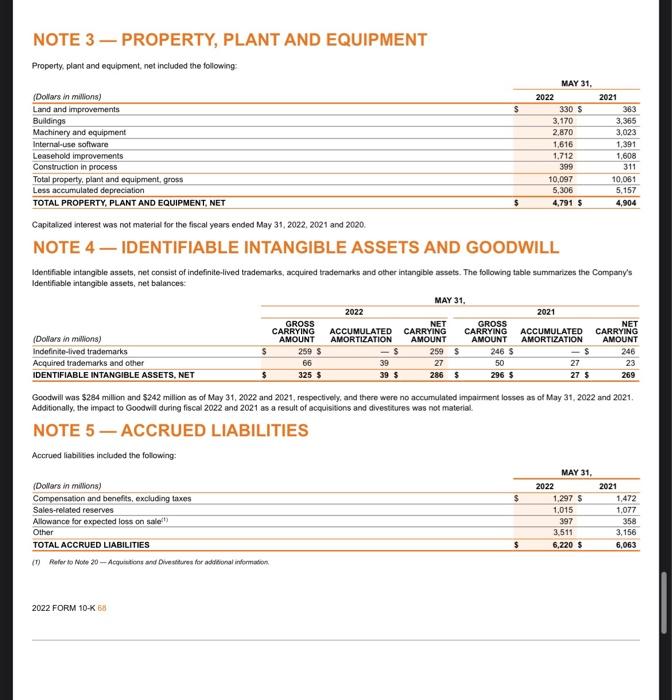

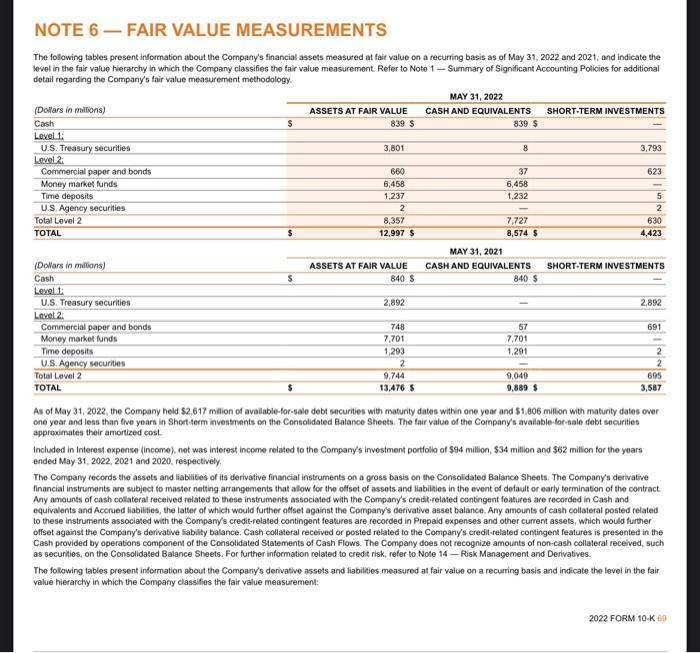

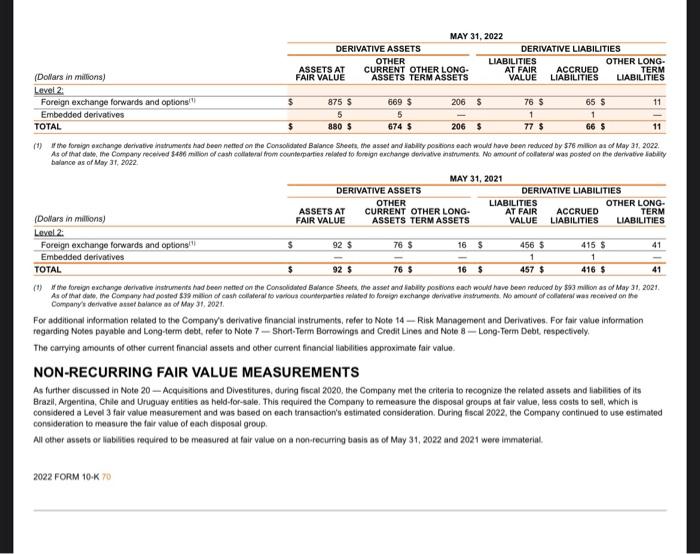

Be sure to include a cover page and References page for this assignment. Pick a publicly-traded company and pull down their most recent 10K. Include the link to the financial statements as a reference on your References pages. I cannot verify your answers without a link to the financial statements. Answer the following questions for the most recent year on the 10K : 1) Does the company include a Safe Harbor statement within their 10K? What does this statement say? 2) Who audited the financial statements? What was their opinion? 3) What is the total amount of the company's current assets? 4) What is the total amount of the company's current liabilities? 5) What is the amount of the company's total assets? 6) What is the total amount of the company's long-term liabilities? 7) What is the total amount for Retained Earnings? 8) What is the total gross profit? 9) What is the total operating profit also known as Earnings before Interest and Taxes? 10) What is the net income? 11) What is the cash flow from operating activities amount? 12) What is the cash flow from investing activities? 13) What is the cash flow from financing activities amount? 14) What inventory method does the company employ? 15) What depreciation method does the company utilize? using actual exchange rates in use during the comparative peior year period to enhance the visiblity of the underlying business trends. exckuding the impact of translation arising from foreign currency exchange rate fluctuations. EBIT is calculated as Net Income before Interest expense (income). net and income tax expense in the Consoldated Statements of lncome. EBIT Margin is calculated as EBIT divided by total NIKE, Inc. Revenues. ROIC represents a performance measure that management believes is useful informatien in understanding the Company's ability to effectively manage irwested capital, see the table below for how the Company calculates this measure. Management uses these non-GAAP financial measures when evaluating the Company's performance, including when making financial and operating decisions. Additionaly, management believes these noe-GAAP financial measures provide investors with aditional financial information that should be considered when assessing our underhing business performance and trends. However, references to wholesale equivalent revenues, currency-neutral revenues, ROIC, EBIT and EBIT margin should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with U.S. GAAP and may not be comparable to similarty titled non-GAAP measures used by other companies. Our RONC calculation as of May 31, 2022 and 2021 is as follows: FOR THE TRAILNG FOUR QUARTERS (1) Cquals Camings betore interest and fexses muliplied by the effoctive tax rate as of the cespective quarter end 2022 FOPM 1030 33 of 108 RFSEJ TS OF PERATIONS fiennteinange CONSOLIDATED OPERATING RESULTS REVENUES CONSOLIDATED OPERATING RESULTS REVENUES fiether information managed twewat ou centrai krwigh exchange sisk management program. (5) Gremor CFina in the bouth ovater of 5acal \$eas. TOTAL SELLING AND ADMINISTRATIVE EXPENSE course of twahses. FISCML 2022 COMPARED TO FBSCAL. 2521 a6a2 forw whis Gersoldised Francia Statements. INCOME TAXES 7yin of Pandonn INCOME TAXES FHSCAL 2022 GOMHAHE TO FISCAL 2021 ataz Foed the a 1ede alfore NORTH AMERICA NORTH AMERICA. Wr. Hien ty EUROPE, MIDDLE EAST \& AFFICA NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 2022 FORM 10-K NIKE, INC. CONSOLIDATED BALANCE SHEETS NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS The acoompanging Nates to the Consolitaled Finsnciar Stofernents are an insegral part of mis sfatement. NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 3 - PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, net included the following: Capitalzed interest was not material for the fiscal years ended May 31, 2022, 2021 and 2020. NOTE 4 - IDENTIFIABLE INTANGIBLE ASSETS AND GOODWILL Identifiable intangible assets, net consist of indefinite-lived trademarks, acquired trademarks and other intangible assets. The following table summarizes the Company's Identifiable intangible assets, net balances: Goodwill was $284 million and $242 million as of May 31, 2022 and 2021, respectively, and there were no accurnulated impairment losses as of May 31,2022 and 2021. Additionally, the impact to Goodwit during fiscal 2022 and 2021 as a result of acquisitions and divestitures was not material. NOTE 5 - ACCRUED LIABILITIES Accrued liabilites included the following: NOTE 6 - FAIR VALUE MEASUREMENTS The following tables present information about the Company's financial assets measured at fait value on a recurring basis as of May 31,2022 and 2021 , and indicate the lovel in the fair value hierarchy in which the Company classifies the fair value measurement. Refer to Note 1 - Summary of Significant Accounting Policies for additional detail regarding the Company's fair value measurement methodology. As of May 31, 2022, the Company held $2,617 milion of available-for-sale debt securities with maturity dates within one year and $1,806 millon with maturity dates over one year and less than five years in Short-term investments on the Consolidated Ealance Sheets. The fair value of the Company's available-tor-sale debt securities approximates their amortized cost. Included in interest expense (income), net was interest income related to the Company's investment portiolio of $94 million, \$34 million and $62 million for the years ended May 31, 2022, 2021 and 2020, respectively. The Company records the assets and liablites of its derivative financial instruments on a gross basis on the Consoldated Balance Sheets. The Company's derivative financial instruments are subject to master netting arrangements that allow for the offset of assets and liabilies in the event of default or early termination of the contract. Any amounts of cash collateral received related to these instruments associated with the Company's cresit-reiated contingent features are recorded in Cash and equivalents and Acerued liabilities, the latter of which would further oftset against the Company's derivative asset balance. Any amounts of cash collateral posted related to these instruments associated with the Company's credit-related contingent features are recorded in Prepaid expenses and other current assets, which would further offset against the Company's derivative liabily balance. Cash collateral received or posted related to the Company's credit-related contingent features is presented in the Cash provided by operations componen of the Consolidated Statements of Cash Flows. The Company does not recognize amounts of non-cash collateral received, such as securities, on the Consclidated Balance Steets. For further information related to credit risk, refer to Note 14 - Risk Management and Derivatives. The following tables present information about the Company's derivative assets and fiabilties measured at fair value on a recurring basis and indicate the level in the fair value hierarchy in which the Company classifies the fair value measurement: MAY 31, 2022 balance as of May 3 r, 2022 . Company'r derivatre aster balunce as of May 31,2024 For additional information related to the Company's derivative financial instruments, refer to Note 14 - Risk Management and Derivatives. For fair value information regarding Notes payable and Long-term debt, refer to Note 7 - Short-Term Borrowings and Credit Lines and Note 8 - Leng-Term Debt, respectively. The carying amouns of ether current financial assets and other current financial liablities approximate fair value. NON-RECURRING FAIR VALUE MEASUREMENTS As further discussed in Note 20 - Acquisaions and Divestitures, during fiscal 2020, the Company met the criteria to recognize the related assets and liabilities of its Brazil, Argentina, Chle and Uruguay entities as held-for-sale. This required the Company to remeasure the disposal groups at fair value, less costs to sell, which is considered a Level 3 fair value meesurement and was based on each transaction's estimated consideration. During fiscal 2022 , the Company continued to use estimated consideration to measure the fair value of each disposal group. All other assets or liablites reguired to be measured at fair value on a non-fecurring basis as of May 31,2022 and 2021 were immaterial. Be sure to include a cover page and References page for this assignment. Pick a publicly-traded company and pull down their most recent 10K. Include the link to the financial statements as a reference on your References pages. I cannot verify your answers without a link to the financial statements. Answer the following questions for the most recent year on the 10K : 1) Does the company include a Safe Harbor statement within their 10K? What does this statement say? 2) Who audited the financial statements? What was their opinion? 3) What is the total amount of the company's current assets? 4) What is the total amount of the company's current liabilities? 5) What is the amount of the company's total assets? 6) What is the total amount of the company's long-term liabilities? 7) What is the total amount for Retained Earnings? 8) What is the total gross profit? 9) What is the total operating profit also known as Earnings before Interest and Taxes? 10) What is the net income? 11) What is the cash flow from operating activities amount? 12) What is the cash flow from investing activities? 13) What is the cash flow from financing activities amount? 14) What inventory method does the company employ? 15) What depreciation method does the company utilize? using actual exchange rates in use during the comparative peior year period to enhance the visiblity of the underlying business trends. exckuding the impact of translation arising from foreign currency exchange rate fluctuations. EBIT is calculated as Net Income before Interest expense (income). net and income tax expense in the Consoldated Statements of lncome. EBIT Margin is calculated as EBIT divided by total NIKE, Inc. Revenues. ROIC represents a performance measure that management believes is useful informatien in understanding the Company's ability to effectively manage irwested capital, see the table below for how the Company calculates this measure. Management uses these non-GAAP financial measures when evaluating the Company's performance, including when making financial and operating decisions. Additionaly, management believes these noe-GAAP financial measures provide investors with aditional financial information that should be considered when assessing our underhing business performance and trends. However, references to wholesale equivalent revenues, currency-neutral revenues, ROIC, EBIT and EBIT margin should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with U.S. GAAP and may not be comparable to similarty titled non-GAAP measures used by other companies. Our RONC calculation as of May 31, 2022 and 2021 is as follows: FOR THE TRAILNG FOUR QUARTERS (1) Cquals Camings betore interest and fexses muliplied by the effoctive tax rate as of the cespective quarter end 2022 FOPM 1030 33 of 108 RFSEJ TS OF PERATIONS fiennteinange CONSOLIDATED OPERATING RESULTS REVENUES CONSOLIDATED OPERATING RESULTS REVENUES fiether information managed twewat ou centrai krwigh exchange sisk management program. (5) Gremor CFina in the bouth ovater of 5acal \$eas. TOTAL SELLING AND ADMINISTRATIVE EXPENSE course of twahses. FISCML 2022 COMPARED TO FBSCAL. 2521 a6a2 forw whis Gersoldised Francia Statements. INCOME TAXES 7yin of Pandonn INCOME TAXES FHSCAL 2022 GOMHAHE TO FISCAL 2021 ataz Foed the a 1ede alfore NORTH AMERICA NORTH AMERICA. Wr. Hien ty EUROPE, MIDDLE EAST \& AFFICA NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 2022 FORM 10-K NIKE, INC. CONSOLIDATED BALANCE SHEETS NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS The acoompanging Nates to the Consolitaled Finsnciar Stofernents are an insegral part of mis sfatement. NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 3 - PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, net included the following: Capitalzed interest was not material for the fiscal years ended May 31, 2022, 2021 and 2020. NOTE 4 - IDENTIFIABLE INTANGIBLE ASSETS AND GOODWILL Identifiable intangible assets, net consist of indefinite-lived trademarks, acquired trademarks and other intangible assets. The following table summarizes the Company's Identifiable intangible assets, net balances: Goodwill was $284 million and $242 million as of May 31, 2022 and 2021, respectively, and there were no accurnulated impairment losses as of May 31,2022 and 2021. Additionally, the impact to Goodwit during fiscal 2022 and 2021 as a result of acquisitions and divestitures was not material. NOTE 5 - ACCRUED LIABILITIES Accrued liabilites included the following: NOTE 6 - FAIR VALUE MEASUREMENTS The following tables present information about the Company's financial assets measured at fait value on a recurring basis as of May 31,2022 and 2021 , and indicate the lovel in the fair value hierarchy in which the Company classifies the fair value measurement. Refer to Note 1 - Summary of Significant Accounting Policies for additional detail regarding the Company's fair value measurement methodology. As of May 31, 2022, the Company held $2,617 milion of available-for-sale debt securities with maturity dates within one year and $1,806 millon with maturity dates over one year and less than five years in Short-term investments on the Consolidated Ealance Sheets. The fair value of the Company's available-tor-sale debt securities approximates their amortized cost. Included in interest expense (income), net was interest income related to the Company's investment portiolio of $94 million, \$34 million and $62 million for the years ended May 31, 2022, 2021 and 2020, respectively. The Company records the assets and liablites of its derivative financial instruments on a gross basis on the Consoldated Balance Sheets. The Company's derivative financial instruments are subject to master netting arrangements that allow for the offset of assets and liabilies in the event of default or early termination of the contract. Any amounts of cash collateral received related to these instruments associated with the Company's cresit-reiated contingent features are recorded in Cash and equivalents and Acerued liabilities, the latter of which would further oftset against the Company's derivative asset balance. Any amounts of cash collateral posted related to these instruments associated with the Company's credit-related contingent features are recorded in Prepaid expenses and other current assets, which would further offset against the Company's derivative liabily balance. Cash collateral received or posted related to the Company's credit-related contingent features is presented in the Cash provided by operations componen of the Consolidated Statements of Cash Flows. The Company does not recognize amounts of non-cash collateral received, such as securities, on the Consclidated Balance Steets. For further information related to credit risk, refer to Note 14 - Risk Management and Derivatives. The following tables present information about the Company's derivative assets and fiabilties measured at fair value on a recurring basis and indicate the level in the fair value hierarchy in which the Company classifies the fair value measurement: MAY 31, 2022 balance as of May 3 r, 2022 . Company'r derivatre aster balunce as of May 31,2024 For additional information related to the Company's derivative financial instruments, refer to Note 14 - Risk Management and Derivatives. For fair value information regarding Notes payable and Long-term debt, refer to Note 7 - Short-Term Borrowings and Credit Lines and Note 8 - Leng-Term Debt, respectively. The carying amouns of ether current financial assets and other current financial liablities approximate fair value. NON-RECURRING FAIR VALUE MEASUREMENTS As further discussed in Note 20 - Acquisaions and Divestitures, during fiscal 2020, the Company met the criteria to recognize the related assets and liabilities of its Brazil, Argentina, Chle and Uruguay entities as held-for-sale. This required the Company to remeasure the disposal groups at fair value, less costs to sell, which is considered a Level 3 fair value meesurement and was based on each transaction's estimated consideration. During fiscal 2022 , the Company continued to use estimated consideration to measure the fair value of each disposal group. All other assets or liablites reguired to be measured at fair value on a non-fecurring basis as of May 31,2022 and 2021 were immaterial