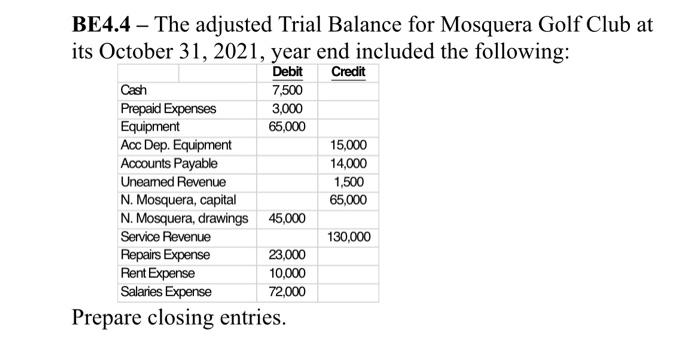

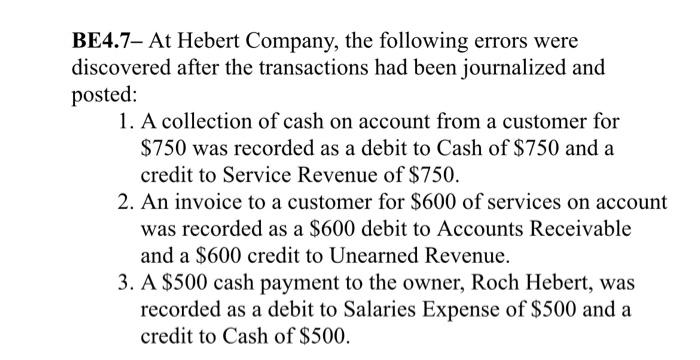

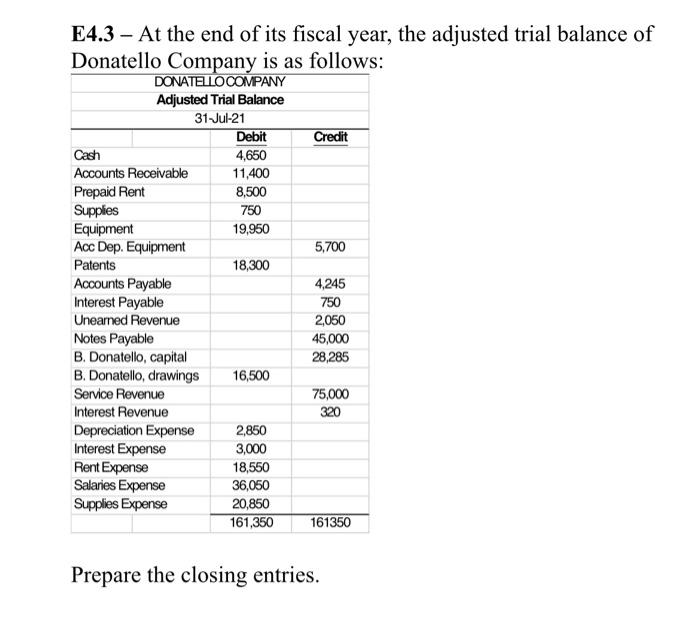

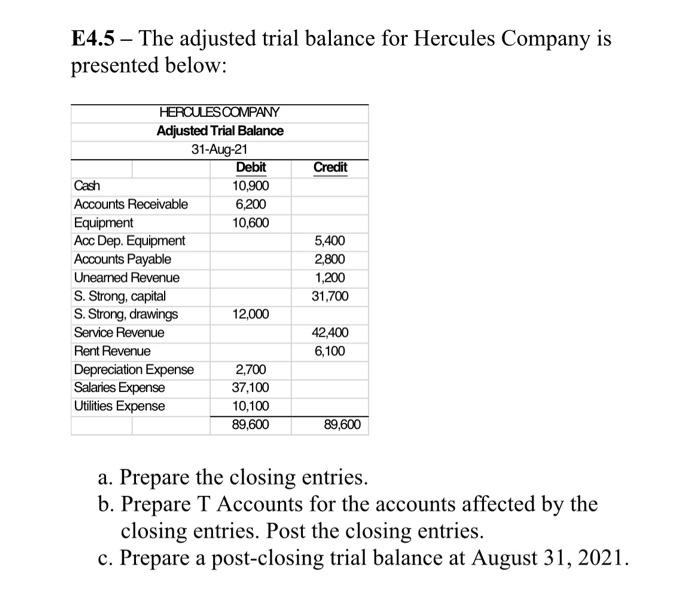

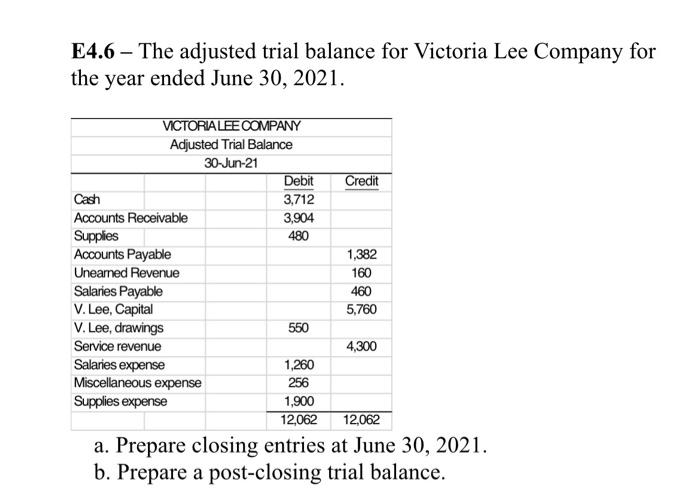

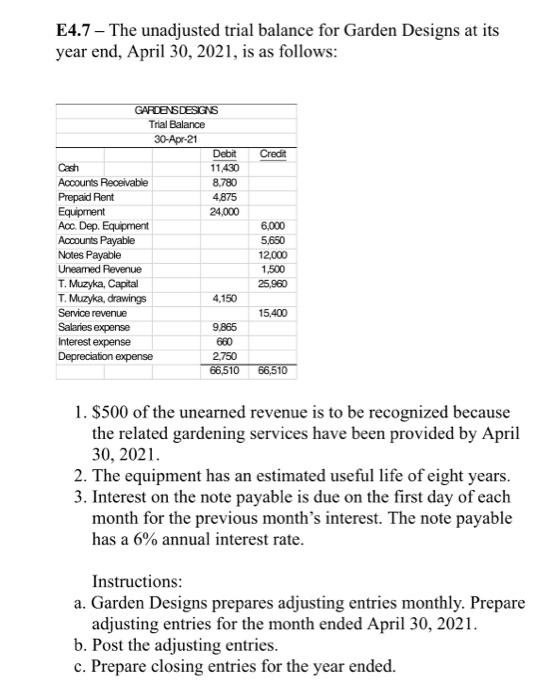

BE4.4 - The adjusted Trial Balance for Mosquera Golf Club at its October 31, 2021, year end included the following: Debit Credit Cash 7,500 Prepaid Expenses 3,000 Equipment 65,000 Acc Dep. Equipment 15,000 Accounts Payable 14,000 Uneamed Revenue 1,500 N. Mosquera, capital 65,000 N. Mosquera, drawings 45,000 Service Revenue 130,000 Repairs Expense 23,000 Rent Expense 10,000 Salaries Expense 72,000 Prepare closing entries. BE4.7- At Hebert Company, the following errors were discovered after the transactions had been journalized and posted: 1. A collection of cash on account from a customer for $750 was recorded as a debit to Cash of $750 and a credit to Service Revenue of $750. 2. An invoice to a customer for $600 of services on account was recorded as a $600 debit to Accounts Receivable and a $600 credit to Unearned Revenue. 3. A $500 cash payment to the owner, Roch Hebert, was recorded as a debit to Salaries Expense of $500 and a credit to Cash of $500. E4.3 - At the end of its fiscal year, the adjusted trial balance of Donatello Company is as follows: DONATELLO COMPANY Adjusted Trial Balance 31-Jul-21 Debit Credit Cash 4,650 Accounts Receivable 11,400 Prepaid Rent 8,500 Supples 750 Equipment 19,950 Acc Dep. Equipment 5,700 Patents 18,300 Accounts Payable 4,245 Interest Payable 750 Unearned Revenue 2,050 Notes Payable 45,000 B. Donatello, capital 28,285 B. Donatello, drawings 16,500 Service Revenue 75,000 Interest Revenue 320 Depreciation Expense 2,850 Interest Expense 3,000 Rent Expense 18,550 Salaries Expense 36,050 Supplies Expense 20,850 161,350 161350 Prepare the closing entries. E4.5 The adjusted trial balance for Hercules Company is presented below: Credit HERCULES COMPANY Adjusted Trial Balance 31-Aug-21 Debit Cash 10,900 Accounts Receivable 6,200 Equipment 10,600 Acc Dep. Equipment Accounts Payable Unearned Revenue S. Strong, capital S. Strong, drawings 12,000 Service Revenue Rent Revenue Depreciation Expense 2,700 Salaries Expense 37,100 Utilities Expense 10,100 89,600 5,400 2,800 1,200 31,700 42,400 6,100 89,600 a. Prepare the closing entries. b. Prepare T Accounts for the accounts affected by the closing entries. Post the closing entries. c. Prepare a post-closing trial balance at August 31, 2021. E4.6 - The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2021. VICTORIA LEE COMPANY Adjusted Trial Balance 30-Jun-21 Debit Credit Cash 3,712 Accounts Receivable 3,904 Supplies 480 Accounts Payable 1,382 Unearned Revenue 160 Salaries Payable 460 V. Lee, Capital 5,760 V. Lee, drawings 550 Service revenue 4,300 Salaries expense 1,260 Miscellaneous expense 256 Supplies expense 1,900 12,062 12,062 a. Prepare closing entries at June 30, 2021. b. Prepare a post-closing trial balance. E4.7 - The unadjusted trial balance for Garden Designs at its year end, April 30, 2021, is as follows: Credit GARDENS DESIGNS Trial Balance 30-Apr-21 Debit Cash 11.430 Accounts Receivable 8.780 Prepaid Rent 4.875 Equipment 24,000 Acc Dep. Equipment Accounts Payable Notes Payable Unearned Revenue T. Muzyka, Capital T. Muzyka, drawings 4.150 Service revenue Salaries expense 9.865 Interest expense 680 Depreciation expense 2,750 66,510 6,000 5,650 12,000 1,500 25,960 15,400 66,510 1. $500 of the unearned revenue is to be recognized because the related gardening services have been provided by April 30, 2021. 2. The equipment has an estimated useful life of eight years. 3. Interest on the note payable is due on the first day of each month for the previous month's interest. The note payable has a 6% annual interest rate. Instructions: a. Garden Designs prepares adjusting entries monthly. Prepare adjusting entries for the month ended April 30, 2021. b. Post the adjusting entries. c. Prepare closing entries for the year ended