Answered step by step

Verified Expert Solution

Question

1 Approved Answer

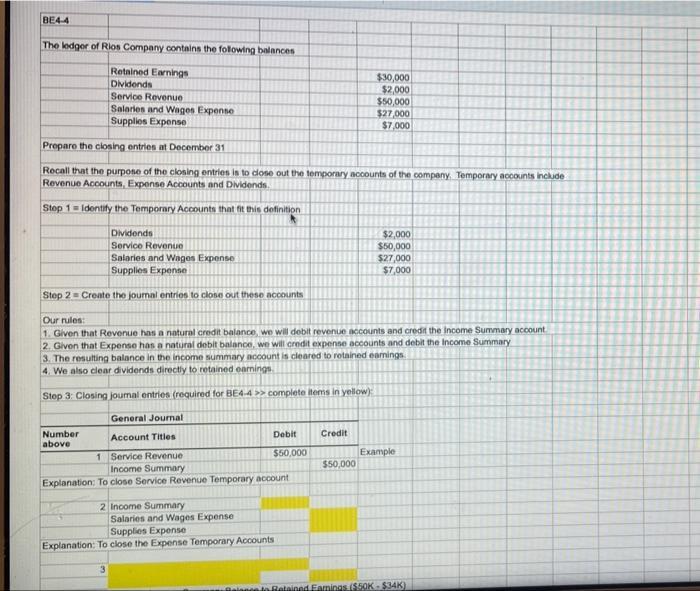

BE4-4 The lodger of Rios Company contains the following balances Retained Earnings Dividends Service Revenue Salaries and Wages Expense Supplies Expense Prepare the closing

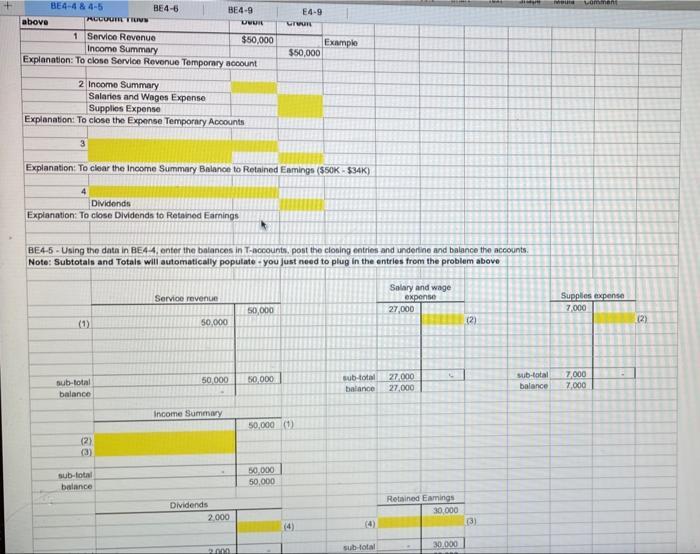

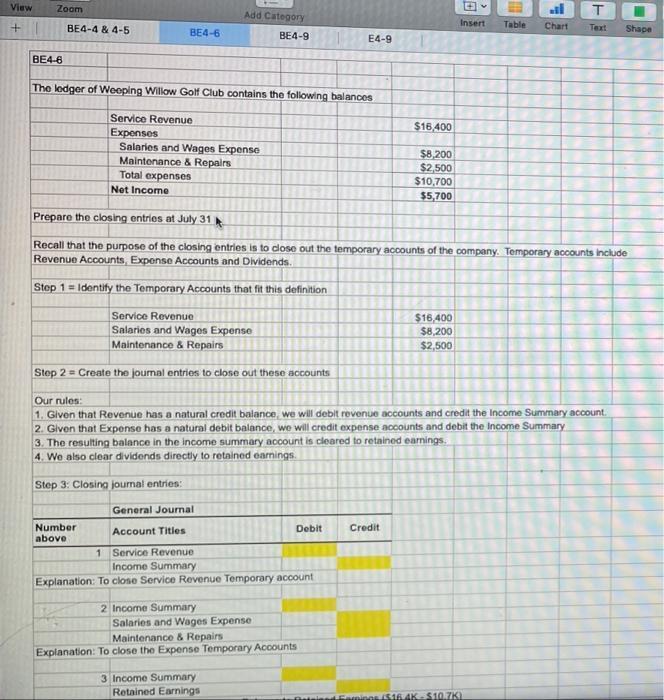

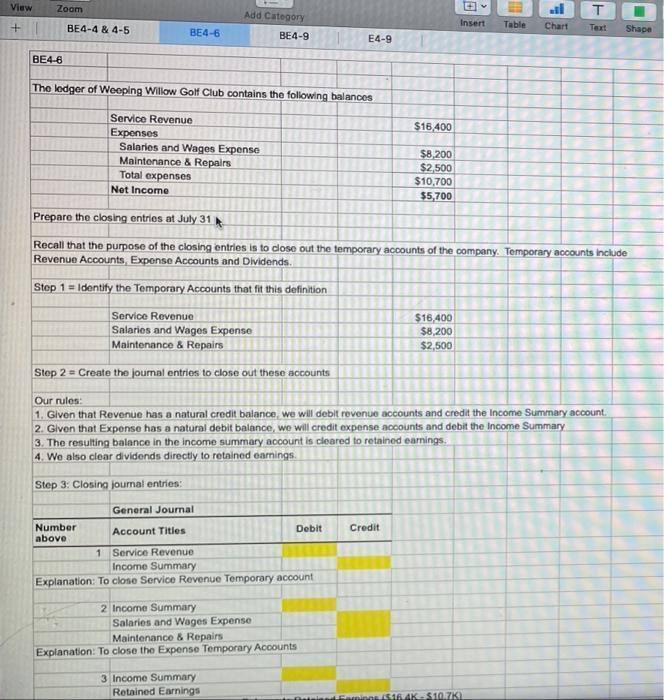

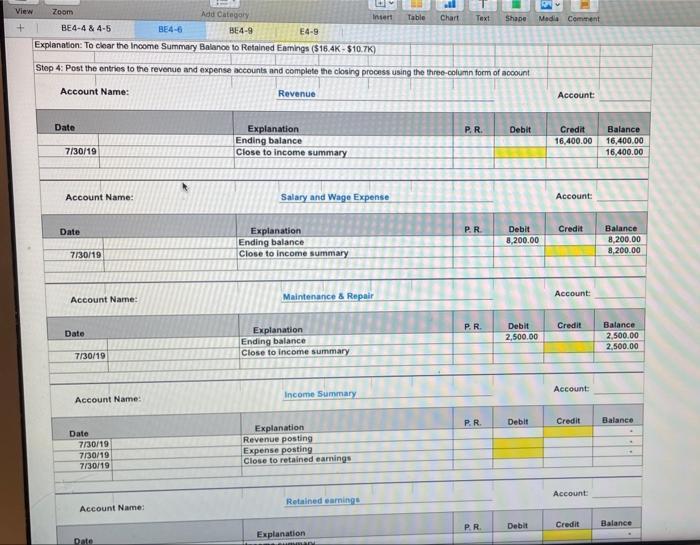

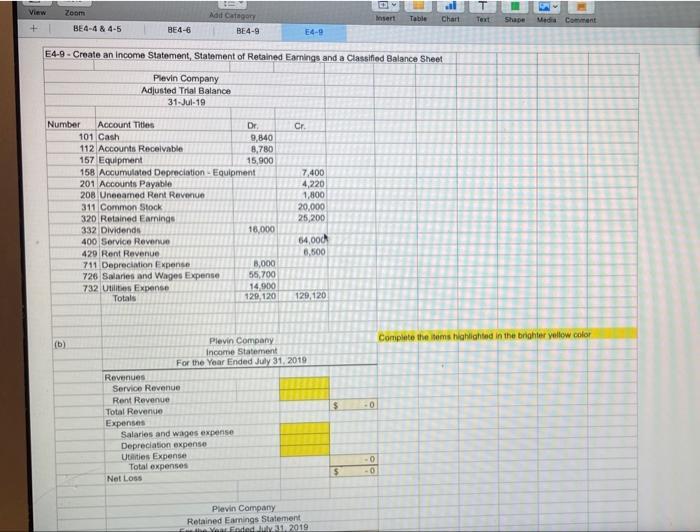

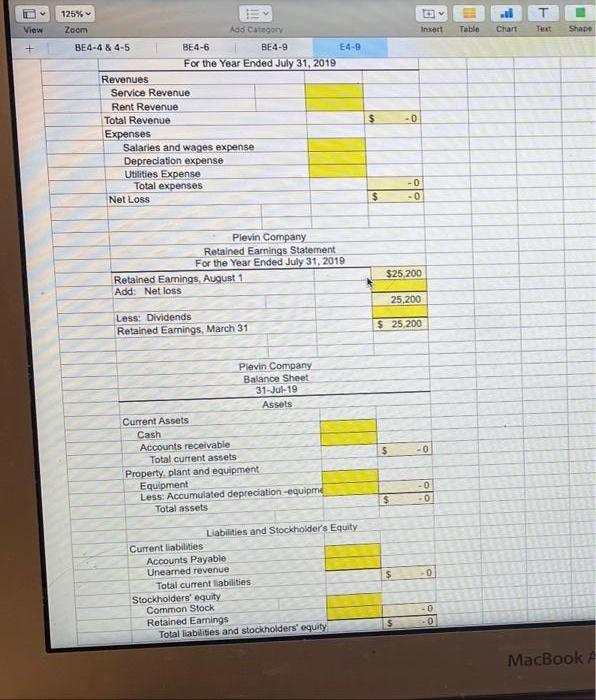

BE4-4 The lodger of Rios Company contains the following balances Retained Earnings Dividends Service Revenue Salaries and Wages Expense Supplies Expense Prepare the closing entries at December 31 Recall that the purpose of the closing entries is to close out the temporary accounts of the company. Temporary accounts include Revenue Accounts, Expense Accounts and Dividends. Step 1 Identify the Temporary Accounts that fit this definition Dividends Service Revenue Salaries and Wages Expense Supplies Expense Step 2 Create the journal entries to close out these accounts Step 3: Closing joumal entries (required for BE4-4>> complete items in yellow): General Journal Account Titles 1 Service Revenue Income Summary Explanation: To close Service Revenue Temporary account Our rules: 1. Given that Revenue has a natural credit balance, we will debit revenue accounts and credit the income Summary account 2. Given that Expense has a natural debit balance, we will credit expense accounts and debit the Income Summary 3. The resulting balance in the income summary account is cleared to retained earnings 4. We also clear dividends directly to retained earnings Number above 2 Income Summary Salaries and Wages Expense Supplies Expense Explanation: To close the Expense Temporary Accounts 3 Debit $50,000 $30,000 $2,000 $50,000 $27,000 $7,000 Credit $50,000 $2,000 $50,000 $27,000 $7,000 Example Retained Earnings ($50K-$34K) above BE4-4 & 4-5 ACCOUM TILV 1 Service Revenue Income Summary Explanation: To close Service Revenue Temporary account 4 BE4-6 2 Income Summary Salaries and Wages Expense Supplies Expense Explanation: To close the Expense Temporary Accounts Dividends Explanation: To close Dividends to Retained Earnings sub-total balance (2) (3) sub-total balance BE4-9 Explanation: To clear the Income Summary Balance to Retained Eamings ($50K-$34K) Service revenue 50,000 50,000 Income Summary DVOR 14 BE4-5-Using the data in BE4-4, enter the balances in T-accounts, post the closing entries and underline and balance the accounts. Note: Subtotals and Totals will automatically populate-you just need to plug in the entries from the problem above Dividends $50,000 2,000 2.000 50,000 50,000 Grun E4-9 $50,000 50,000 50,000 50,000 (1) Example (4) sub-total balance sub-total Salary and wage expense 27,000 27,000 27,000 Retained Eamings 30,000 . 30.000 (2) dodge (3) sub-total balance moun Lomment Supplies expense 7,000 7,000 7,000 (2) View + Zoom BE4-6 BE4-4 & 4-5 BE4-6 The ledger of Weeping Willow Golf Club contains the following balances H Service Revenue Expenses Salaries and Wages Expense Maintenance & Repairs Total expenses Net Income Number above Add Category BE4-9 Service Revenue Salaries and Wages Expense Maintenance & Repairs Step 2 = Create the journal entries to close out these accounts Step 3: Closing journal entries: General Journal Account Titles 1 Service Revenue Income Summary Explanation: To close Service Revenue Temporary account 2 Income Summary Salaries and Wages Expense E4-9 Prepare the closing entries at July 31 Recall that the purpose of the closing entries is to close out the temporary accounts of the company. Temporary accounts include Revenue Accounts, Expense Accounts and Dividends. Step 1= Identify the Temporary Accounts that fit this definition 3 Income Summary Retained Earnings Debit Maintenance & Repairs Explanation: To close the Expense Temporary Accounts $16,400 Our rules: 1. Given that Revenue has a natural credit balance, we will debit revenue accounts and credit the Income Summary account. 2. Given that Expense has a natural debit balance, we will credit expense accounts and debit the Income Summary 3. The resulting balance in the income summary account is cleared to retained earnings. 4. We also clear dividends directly to retained earnings. $8,200 $2,500 $10,700 $5,700 Credit $16,400 $8,200 $2,500 Insert Table Faripos($16.4K-$10.7K Chart T Text Shape View + Zoom BE4-6 BE4-4 & 4-5 BE4-6 The ledger of Weeping Willow Golf Club contains the following balances H Service Revenue Expenses Salaries and Wages Expense Maintenance & Repairs Total expenses Net Income Number above Add Category BE4-9 Service Revenue Salaries and Wages Expense Maintenance & Repairs Step 2 = Create the journal entries to close out these accounts Step 3: Closing journal entries: General Journal Account Titles 1 Service Revenue Income Summary Explanation: To close Service Revenue Temporary account 2 Income Summary Salaries and Wages Expense E4-9 Prepare the closing entries at July 31 Recall that the purpose of the closing entries is to close out the temporary accounts of the company. Temporary accounts include Revenue Accounts, Expense Accounts and Dividends. Step 1= Identify the Temporary Accounts that fit this definition 3 Income Summary Retained Earnings Debit Maintenance & Repairs Explanation: To close the Expense Temporary Accounts $16,400 Our rules: 1. Given that Revenue has a natural credit balance, we will debit revenue accounts and credit the Income Summary account. 2. Given that Expense has a natural debit balance, we will credit expense accounts and debit the Income Summary 3. The resulting balance in the income summary account is cleared to retained earnings. 4. We also clear dividends directly to retained earnings. $8,200 $2,500 $10,700 $5,700 Credit $16,400 $8,200 $2,500 Insert Table Faripos($16.4K-$10.7K Chart T Text Shape View + Zoom Account Name: Add Category BE4-9 BE4-4 & 4-5 BE4-6 Explanation: To clear the Income Summary Balance to Retained Eamings ($16.4K-$10.7K) Step 4: Post the entries to the revenue and expense accounts and complete the closing process using the three-column form of account Revenue Date 7/30/19 Account Name: Date 7/30/19 Account Name: Date 7/30/19 Account Name: Date 7/30/19 7/30/19 7/30/19 Account Name: Date E4-9 Explanation Ending balance Close to income summary Salary and Wage Expense Explanation Ending balance Close to income summary Maintenance & Repair Explanation Ending balance Close to income summary Income Summary Explanation Revenue posting Expense posting Close to retained earnings Retained earnings Explanation L Insert Table Chart usap Text Shape P. R. P.R. P.R. H P.R. P.R. Debit Debit 8,200.00 Media Comment Debit 2,500.00 Debit Debit Account: Credit 16,400.00 Account: Credit Account: Credit Account: Credit Account: Credit Balance 16,400.00 16,400.00 Balance 8,200.00 8,200.00 Balance 2,500.00 2,500.00 Balance Balance View Zoom + BE4-4 & 4-5 (b) Number Account Titles 101 Cash 112 Accounts Receivable 157 Equipment 158 Accumulated Depreciation 201 Accounts Payable 208 Uneeamed Rent Revenue 311 Common Stock 320 Retained Earnings 332 Dividends 400 Service Revenue Revenues BE4-6 E4-9-Create an income Statement, Statement of Retained Earnings and a Classified Balance Sheet Plevin Company Adjusted Trial Balance 31-Jul-19 429 Rent Revenue 711 Depreciation Expense 726 Salaries and Wages Expense 732 Utilities Expense Totals Total Revenue Service Revenue Rent Revenue Expenses Add Category BE4-9 Net Loss Utilities Expense Total expenses Salaries and wages expense Depreciation expense. Dr. Equipment 9,840 8,780 15,900 16,000 E4-9 8,000 55,700 14,900 129,120 Cr. 7,400 4,220 1,800 20,000 25,200 Plevin Company Income Statement For the Year Ended July 31, 2019 64,000 6,500 129,120. Pievin Company Retained Earnings Statement E the Year Ended July 31, 2019 $ $ D Insert Table -0 -0 -0 Chart + Text Shape Media Comment Complete the items highlighted in the brighter yellow color View 125% Zoom BE4-4 & 4-5 Revenues Service Revenue Rent Revenue Total Revenue Expenses Add Category BE4-6 BE4-9 For the Year Ended July 31, 2019 Salaries and wages expense Depreciation expense Utilities Expense Total expenses Net Loss Retained Earnings, August 1 Add: Net loss Plevin Company Retained Earnings Statement For the Year Ended July 31, 2019 Less: Dividends Retained Earnings, March 31 Current Assets Cash Accounts receivable Total current assets Property, plant and equipment Pievin Company Balance Sheet 31-Jul-19 Assets Equipment Less: Accumulated depreciation -equipme Total assets Current liabilities Liabilities and Stockholder's Equity Accounts Payable Unearned revenue Total current liabilities Stockholders' equity Common Stock E4-9 Retained Earnings Total liabilities and stockholders' equity $ $ $ -0 $25,200 25,200 $ 25,200 $ -0 -0 $ 5 Insert Table -0 -0 -0 -0 -0 -0 . Chart Text Shape MacBook A

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started