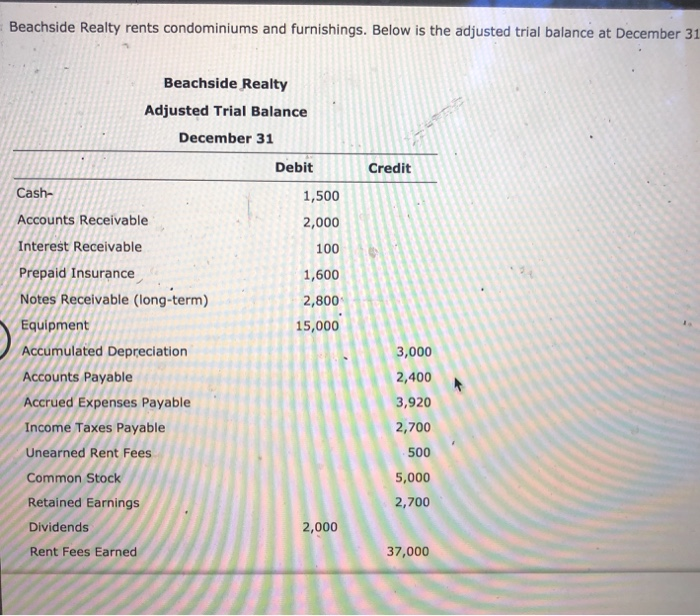

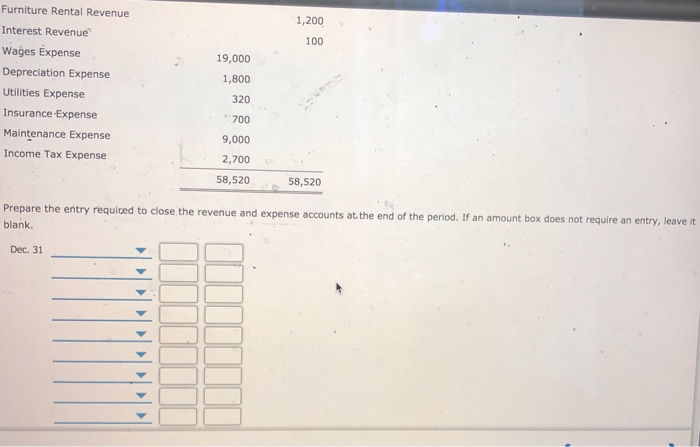

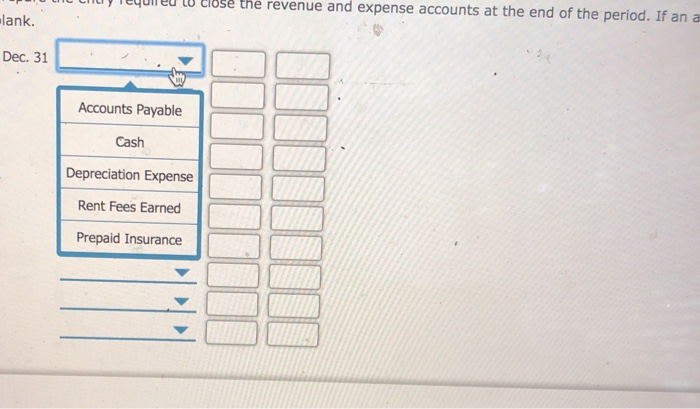

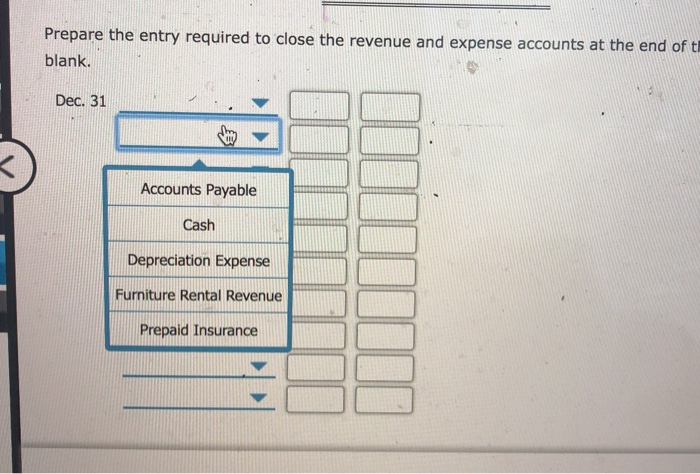

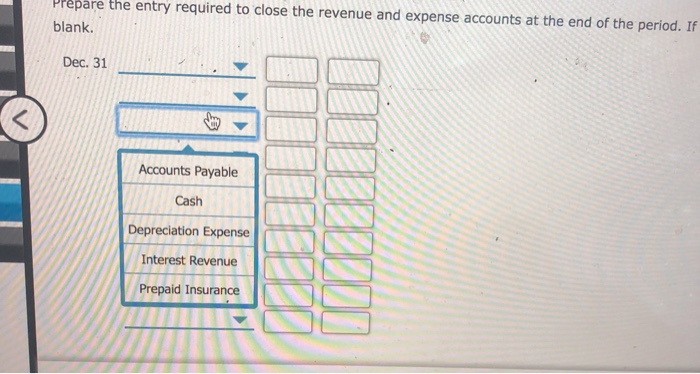

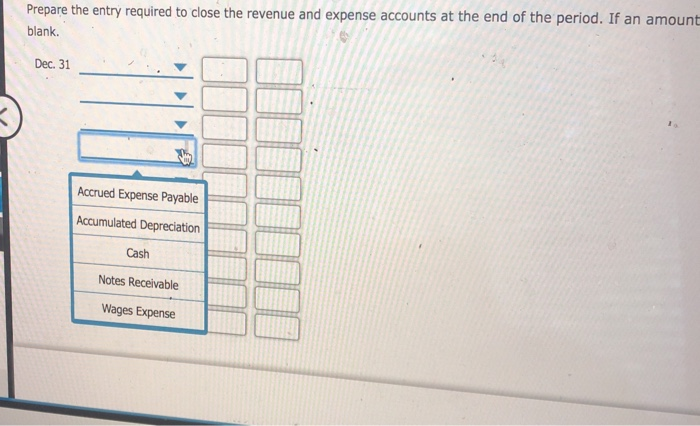

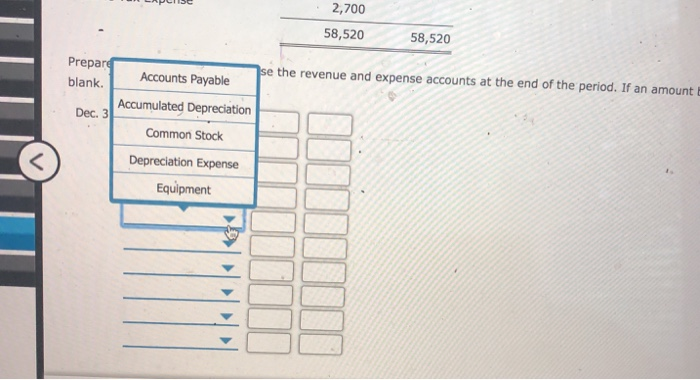

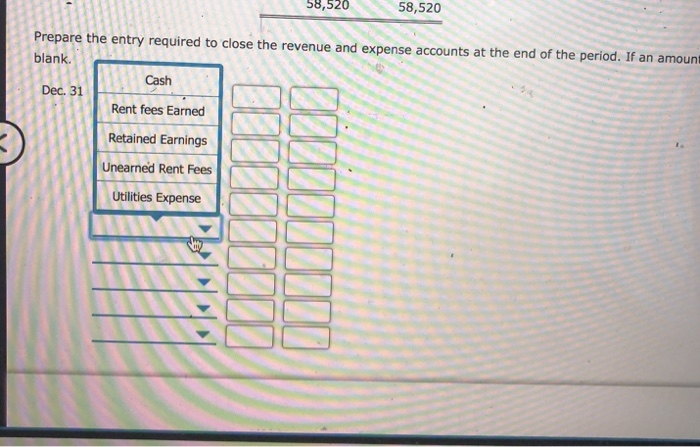

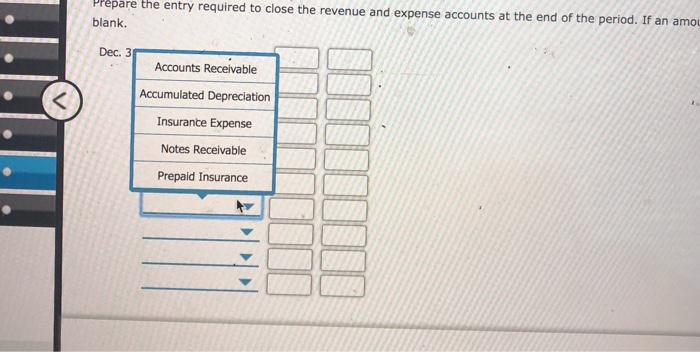

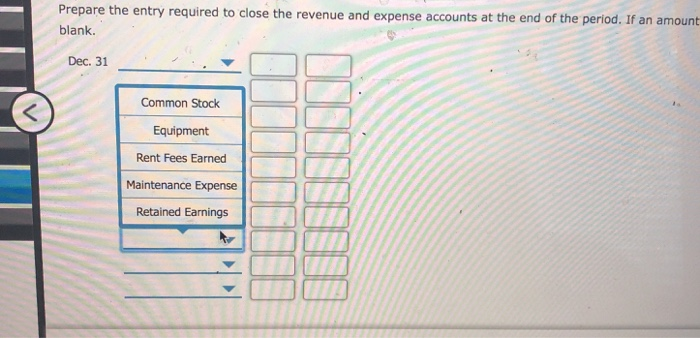

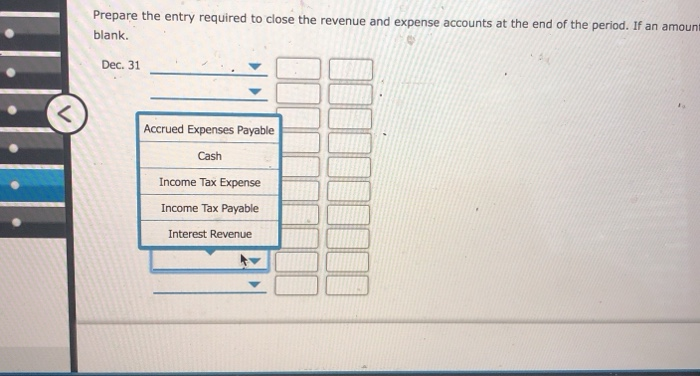

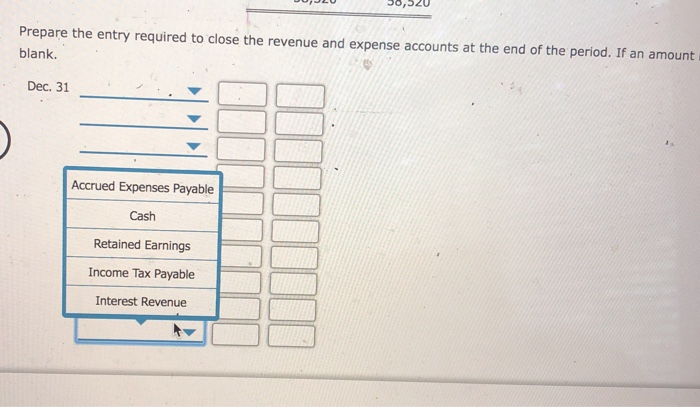

Beachside Realty rents condominiums and furnishings. Below is the adjusted trial balance at December 31. Beachside Realty Adjusted Trial Balance December 31 Credit Debit Cash- 1,500 Accounts Receivable 2,000 Interest Receivable 100 Prepaid Insurance 1,600 2,800 Notes Receivable (long-term) Equipment 15,000 Accumulated Depreciation 3,000 Accounts Payable 2,400 Accrued Expenses Payable 3,920 Income Taxes Payable 2,700 500 Unearned Rent Fees Common Stock 5,000 Retained Earnings 2,700 Dividends 2,000 Rent Fees Earned 37,000 Furniture Rental Revenue 1,200 Interest Revenue 100 Wages Expense 19,000 Depreciation Expense 1,800 Utilities Expense 320 Insurance-Expense 700 Maintenance Expense 9,000 Income Tax Expense 2,700 58,520 58,520 Prepare the entry requiced to close the revenue and expense accounts at the end of the period. If an amount box does not require an entry, leave it blank. Dec. 31 e the revenue and expense accounts at the end of the period. If an a lank. Dec. 31 Accounts Payable Cash Depreciation Expense Rent Fees Earned Prepaid Insurance Prepare the entry required to close the revenue and expense accounts at the end of t blank. Dec. 31 Accounts Payable Cash Depreciation Expense Furniture Rental Revenue Prepaid Insurance 2,700 58,520 58,520 Prepare se the revenue and expense accounts at the end of the period. If an amount Accounts Payable blank. Accumulated Depreciation Dec. 3 Common Stock Depreciation Expense Equipment 58,520 58,520 Prepare the entry required to close the revenue and expense accounts at the end of the period. If an amount blank. Cash Dec. 31 Rent fees Earned Retained Earnings Unearned Rent Fees Utilities Expense Prepare the entry required to close the revenue and expense accounts at the end of the period. If an amoL blank. Dec. 3 Accounts Receivable Accumulated Depreciation Insurance Expense Notes Receivable Prepaid Insurance Prepare the entry required to close the revenue and expense accounts at the end of the period. If an amount blank. Dec. 31 Common Stock Equipment Rent Fees Earned Maintenance Expense Retained Earnings Prepare the entry required to close the revenue and expense accounts at the end of the period. If an amount blank. Dec. 31 Accrued Expenses Payable Cash Income Tax Expense Income Tax Payable Interest Revenue Prepare the entry required to close the revenue and expense accounts at the end of the period. If an amount blank. Dec. 31 Accrued Expenses Payable Cash Retained Earnings Income Tax Payable Interest Revenue