Question

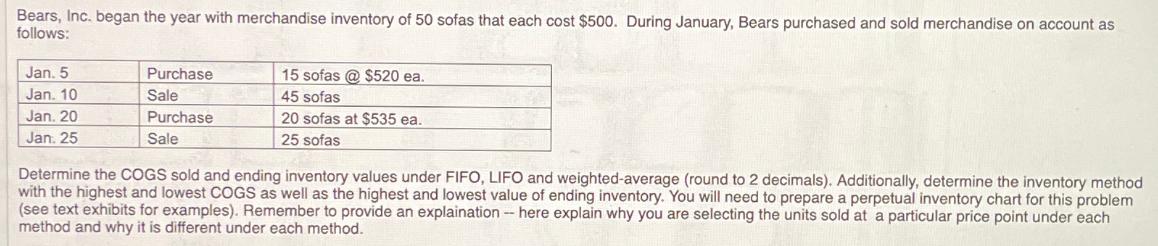

Bears, Inc. began the year with merchandise inventory of 50 sofas that each cost $500. During January, Bears purchased and sold merchandise on account

Bears, Inc. began the year with merchandise inventory of 50 sofas that each cost $500. During January, Bears purchased and sold merchandise on account as follows: Jan. 5 Purchase 15 sofas @ $520 ea. Jan. 10 Jan. 20 Sale Purchase Sale 45 sofas 20 sofas at $535 ea. 25 sofas Jan. 25 Determine the COGS sold and ending inventory values under FIFO, LIFO and weighted-average (round to 2 decimals). Additionally, determine the inventory method with the highest and lowest COGS as well as the highest and lowest value of ending inventory. You will need to prepare a perpetual inventory chart for this problem (see text exhibits for examples). Remember to provide an explaination - here explain why you are selecting the units sold at a particular price point under each method and why it is different under each method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

4th Edition

978-0133251241, 9780133427516, 133251241, 013342751X, 978-0133255584

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App