Answered step by step

Verified Expert Solution

Question

1 Approved Answer

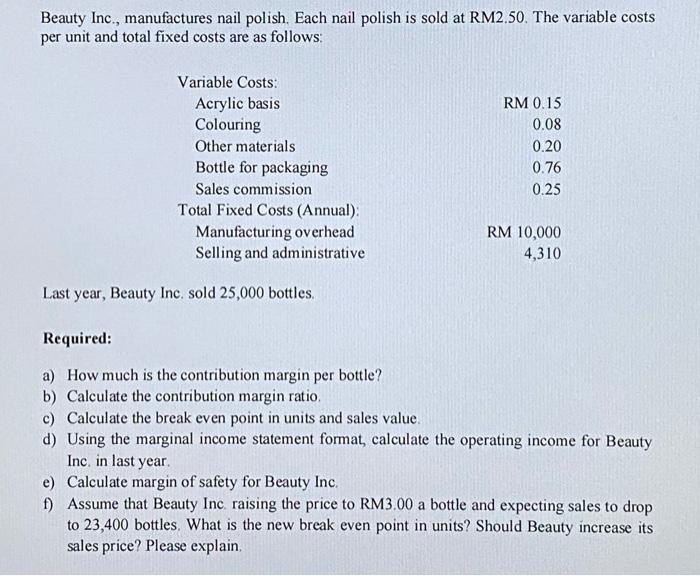

Beauty Inc., manufactures nail polish. Each nail polish is sold at RM2.50. The variable costs per unit and total fixed costs are as follows:

Beauty Inc., manufactures nail polish. Each nail polish is sold at RM2.50. The variable costs per unit and total fixed costs are as follows: Variable Costs: Acrylic basis Colouring Other materials Bottle for packaging Sales commission Total Fixed Costs (Annual): Manufacturing overhead Selling and administrative Last year, Beauty Inc. sold 25,000 bottles. RM 0.15 0.08 0.20 0.76 0.25 RM 10,000 4,310 Required: a) How much is the contribution margin per bottle? b) Calculate the contribution margin ratio. c) Calculate the break even point in units and sales value. d) Using the marginal income statement format, calculate the operating income for Beauty Inc. in last year. e) Calculate margin of safety for Beauty Inc. f) Assume that Beauty Inc. raising the price to RM3.00 a bottle and expecting sales to drop to 23,400 bottles. What is the new break even point in units? Should Beauty increase its sales price? Please explain.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a The contribution margin per bottle can be calculated as follows Total variable cost per bottle RM 015 RM 008 RM 020 RM 076 RM 025 RM 144 Contributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started