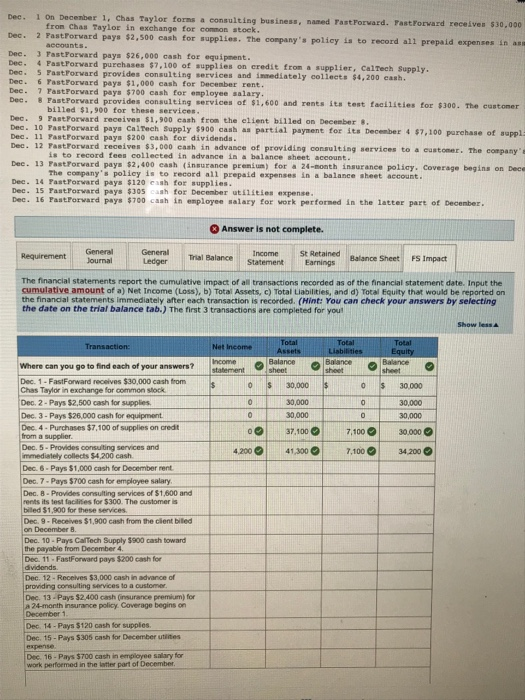

bec. 1 On Decenber 1, chas Taylor forms a consulting business, naned FastForvard. Fastrorvard recesven 530,000 fron Chas Taylor in exchange for common stoek. 2,500 cash for supplies. The conpany's policy is to record all prepaid expenses in ass Dec. 3 FastForvard pays $26,000 cash for equipment. Dee. 4 PastPorvard purchases $7,100 of aupplies on credit from a supplier, cairech Supply. Dec. 5 PastForvard provides consulting services and innediately colleets $4,200 eash Dec. 6 FastForvard pays $1,000 cash for Decenber rent 7 FastPorvard pays $700 cash for employee salary Dee. rastrorvard provides consulting services of si,600 and rents its test facilieies tor $300. The eustoner billed $1,900 for these services Dec. 9 PastForward receives $1,900 eash from the elient billed on December s. Dec. 10 Pastrorward pays Caltech Supply $900 cash as partial payment for its Decenmber 4 $7,100 parehase of suppl. Dec. 11 PastForvard pays $200 cash for dividends Dec. 12 Pastrorvard receives $3,000 eash in advance of providing consulting services to a eustomer. The conpany is to record fees collected in advance in a balance sheet account Dec. 13 Fastrorvard pays $2,400 eash (insurance premium) for a 24-moath insurance policy. Coverage begins on Dece Dec. 14 PastForvard pays $120 eash for supplies Dec. 15 FastForward pays $305 cash for December utilities expense. Dec. 16 FastForvard pays $700 cash in enployee salary for vork performed in the latter part of December. The conpany's policy is to record all prepaid expenses in a balance sheet account. 0 Answer is not complete. General LedgerTrial Balance n Income St Retained Balance Sheet rs Impact Statement Earnings Requirement General Journal The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the cumulative amount of a) Net Income (Loss), b) Total Assets, c) Total Liabilities, and d) Total Equity that would be reported on the financial statements immediately after each transaction is recorded. (Hint: You can check your answers by selecting the date on the trial balance tab.) The first 3 transactions are completed for you Transaction Where can you go to find each of your answers? Dec. 1- FastForward receives $30,000 cash from Chas Taylor in exchange for common stock 30,000 0,000 30,000 30,000 30,000 30,000 37,100 7,100 30,.000 4.200 413007,10034200 Dec. 2 - Pays $2,500 cash for supplies. Dec. 3- Pays $26,000 cash for equipment Dec. 4- Purchases $7,100 of supplies on credt from a supplier Dec. 5- Provides consulting services and mmediately collects $4.200 cash Dec. 6 Pays $1,000 cash for December rent Dec. 7- Pays $700 cash for employee salary Dec. 8- Provides consulting services of $1,600 and rents its test facilites for $300. The oustomer is billed $1,900 for these services Dec. 9 , Receives $1,900 cash from the client bited on December 8. Dec. 10- Pays CalTech Supply $900 cash toward the payable from December 4 Dec. 11 FastForward pays $200 cash for dividends Dec. 12-Receives $3,000 cash in advance of providing consulting services to Dec. 13-Pays $2.400 cash (nsurance premium) for a 24-month insurance policy. Coverage begins on a customer Dec. 14 - Pays $120 cash for supples. Dec. 15- Pays $305 cash for December utines expense Dec. 16- Pays $700 cash in employee sallary for work perfoemed in the latter part of December