Answered step by step

Verified Expert Solution

Question

1 Approved Answer

because the 1973 Agreement was a modification and extension of the 1954 Agreement. C. Conclusion We conclude that Gulf possesses an economic interest in

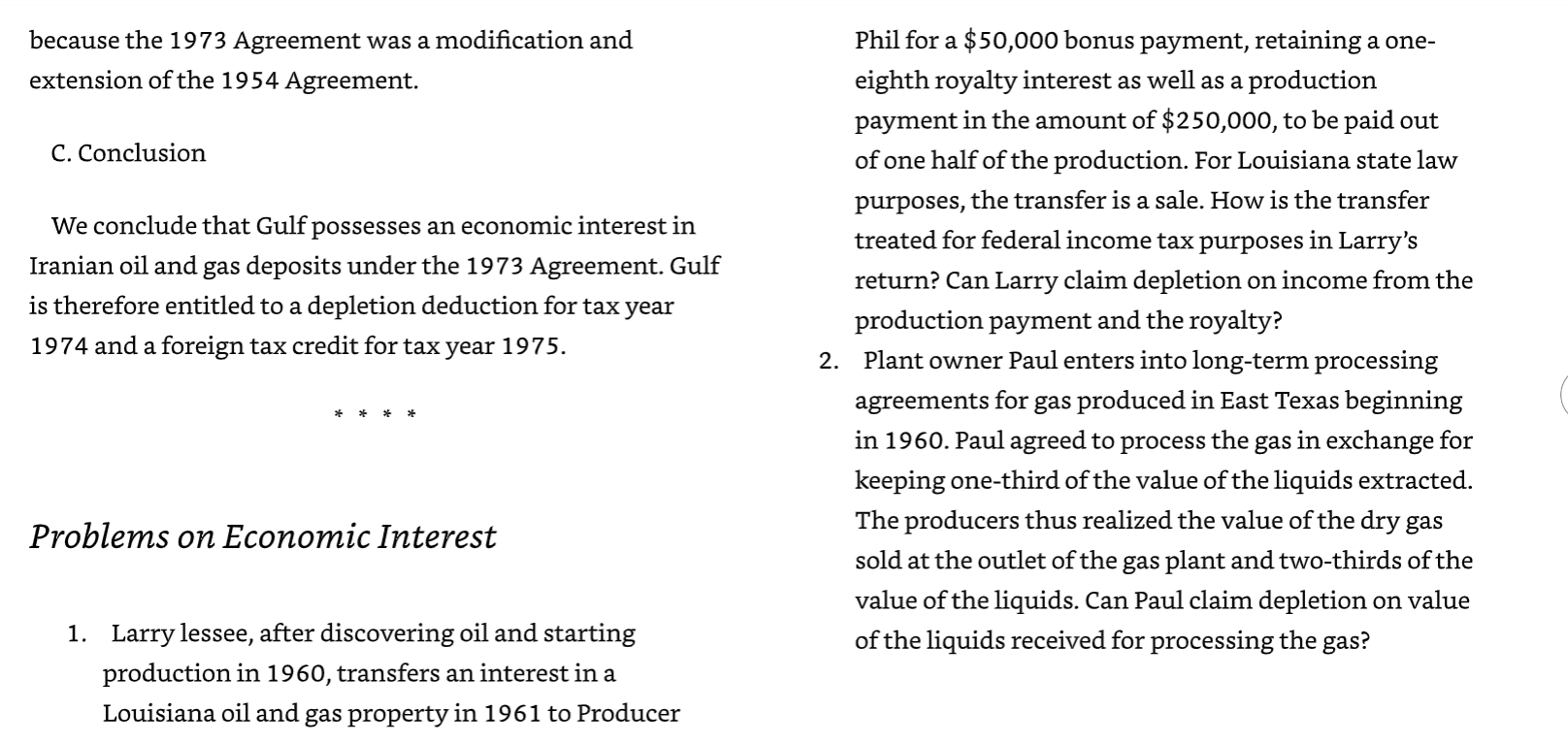

because the 1973 Agreement was a modification and extension of the 1954 Agreement. C. Conclusion We conclude that Gulf possesses an economic interest in Iranian oil and gas deposits under the 1973 Agreement. Gulf is therefore entitled to a depletion deduction for tax year 1974 and a foreign tax credit for tax year 1975. Problems on Economic Interest 1. Larry lessee, after discovering oil and starting production in 1960, transfers an interest in a Louisiana oil and gas property in 1961 to Producer Phil for a $50,000 bonus payment, retaining a one- eighth royalty interest as well as a production payment in the amount of $250,000, to be paid out of one half of the production. For Louisiana state law purposes, the transfer is a sale. How is the transfer treated for federal income tax purposes in Larry's return? Can Larry claim depletion on income from the production payment and the royalty? 2. Plant owner Paul enters into long-term processing agreements for gas produced in East Texas beginning in 1960. Paul agreed to process the gas in exchange for keeping one-third of the value of the liquids extracted. The producers thus realized the value of the dry gas sold at the outlet of the gas plant and two-thirds of the value of the liquids. Can Paul claim depletion on value of the liquids received for processing the gas?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started