Answered step by step

Verified Expert Solution

Question

1 Approved Answer

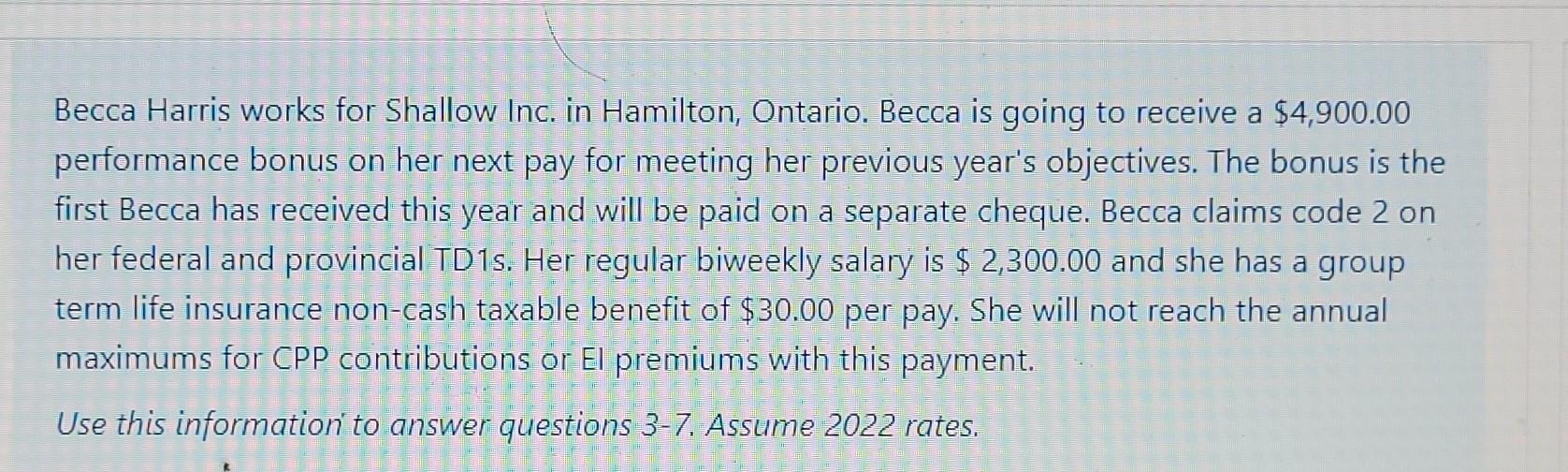

Becca Harris works for Shallow Inc. in Hamilton, Ontario. Becca is going to receive a $4,900.00 performance bonus on her next pay for meeting her

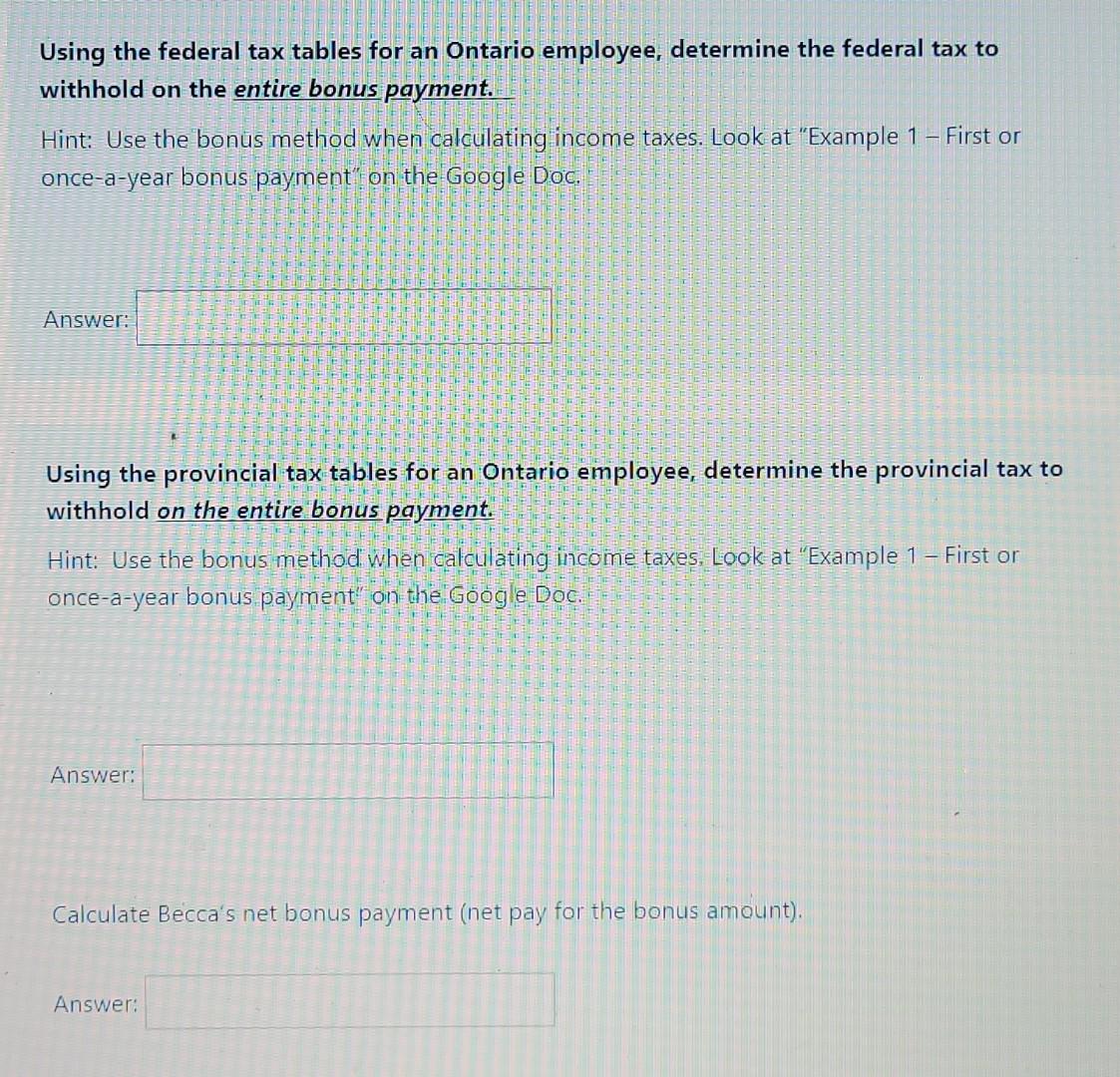

Becca Harris works for Shallow Inc. in Hamilton, Ontario. Becca is going to receive a $4,900.00 performance bonus on her next pay for meeting her previous year's objectives. The bonus is the first Becca has received this year and will be paid on a separate cheque. Becca claims code 2 on her federal and provincial TD1s. Her regular biweekly salary is $ 2,300.00 and she has a group term life insurance non-cash taxable benefit of $30.00 per pay. She will not reach the annual maximums for CPP contributions or El premiums with this payment. Use this information to answer questions 3-7. Assume 2022 rates. Using the federal tax tables for an Ontario employee, determine the federal tax to withhold on the entire bonus payment. Hint: Use the bonus method when calculating income taxes. Look at "Example 1 - First or once-a-year bonus payment' on the Google Doc. Answer: Using the provincial tax tables for an Ontario employee, determine the provincial tax to withhold on the entire bonus payment. Hint: Use the bonus method when calculating income taxes. Look at "Example 1 - First or once-a-year bonus payment' on the Google Doc. Answer: Calculate Becca's net bonus payment (net pay for the bonus amount)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started