Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beck Company introduced a new product three years ago. Beck uses standard costing to account for the costs. The predetermined fixed overhead rate is

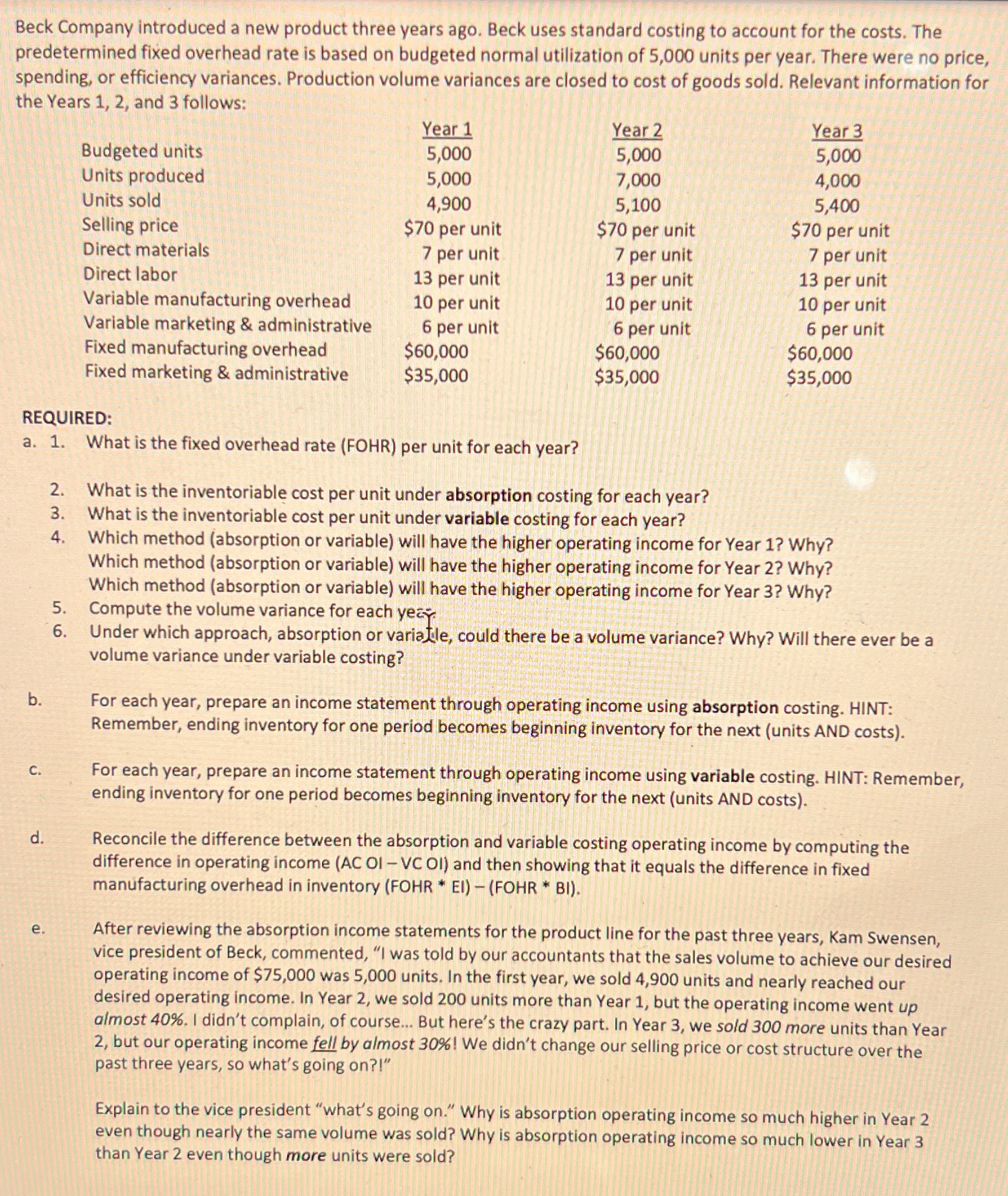

Beck Company introduced a new product three years ago. Beck uses standard costing to account for the costs. The predetermined fixed overhead rate is based on budgeted normal utilization of 5,000 units per year. There were no price, spending, or efficiency variances. Production volume variances are closed to cost of goods sold. Relevant information for the Years 1, 2, and 3 follows: Year 1 Year 2 Year 3 Budgeted units 5,000 5,000 5,000 Units produced Units sold 5,000 7,000 4,000 4,900 5,100 5,400 Selling price $70 per unit $70 per unit $70 per unit Direct materials 7 per unit 7 per unit 7 per unit Direct labor 13 per unit 13 per unit 13 per unit Variable manufacturing overhead 10 per unit 10 per unit 10 per unit Variable marketing & administrative 6 per unit 6 per unit Fixed manufacturing overhead Fixed marketing & administrative $60,000 $35,000 $60,000 $35,000 6 per unit $60,000 $35,000 REQUIRED: a. 1. What is the fixed overhead rate (FOHR) per unit for each year? b. C. d. e. 234 5. 6. What is the inventoriable cost per unit under absorption costing for each year? What is the inventoriable cost per unit under variable costing for each year? Which method (absorption or variable) will have the higher operating income for Year 1? Why? Which method (absorption or variable) will have the higher operating income for Year 2? Why? Which method (absorption or variable) will have the higher operating income for Year 3? Why? Compute the volume variance for each year Under which approach, absorption or variable, could there be a volume variance? Why? Will there ever be a volume variance under variable costing? For each year, prepare an income statement through operating income using absorption costing. HINT: Remember, ending inventory for one period becomes beginning inventory for the next (units AND costs). For each year, prepare an income statement through operating income using variable costing. HINT: Remember, ending inventory for one period becomes beginning inventory for the next (units AND costs). Reconcile the difference between the absorption and variable costing operating income by computing the difference in operating income (AC OI - VC OI) and then showing that it equals the difference in fixed manufacturing overhead in inventory (FOHR EI)-(FOHR BI). After reviewing the absorption income statements for the product line for the past three years, Kam Swensen, vice president of Beck, commented, "I was told by our accountants that the sales volume to achieve our desired operating income of $75,000 was 5,000 units. In the first year, we sold 4,900 units and nearly reached our desired operating income. In Year 2, we sold 200 units more than Year 1, but the operating income went up almost 40%. I didn't complain, of course... But here's the crazy part. In Year 3, we sold 300 more units than Year 2, but our operating income fell by almost 30%! We didn't change our selling price or cost structure over the past three years, so what's going on?!" Explain to the vice president "what's going on." Why is absorption operating income so much higher in Year 2 even though nearly the same volume was sold? Why is absorption operating income so much lower in Year 3 than Year 2 even though more units were sold?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1 The fixed overhead rate FOHR per unit for each year is calculated by dividing the total fixed overhead cost by the budgeted units Year 1 FOHR Fixed manufacturing overhead Budgeted units 600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d65ae617b4_967447.pdf

180 KBs PDF File

663d65ae617b4_967447.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started