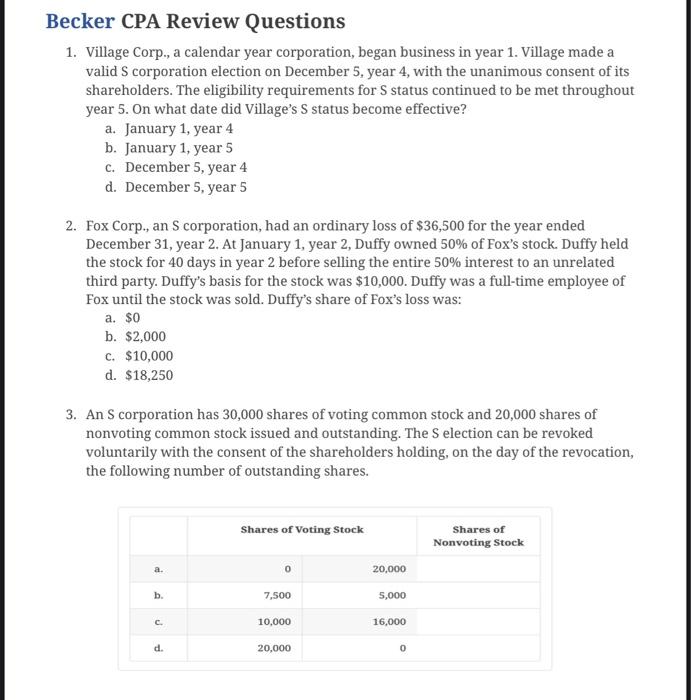

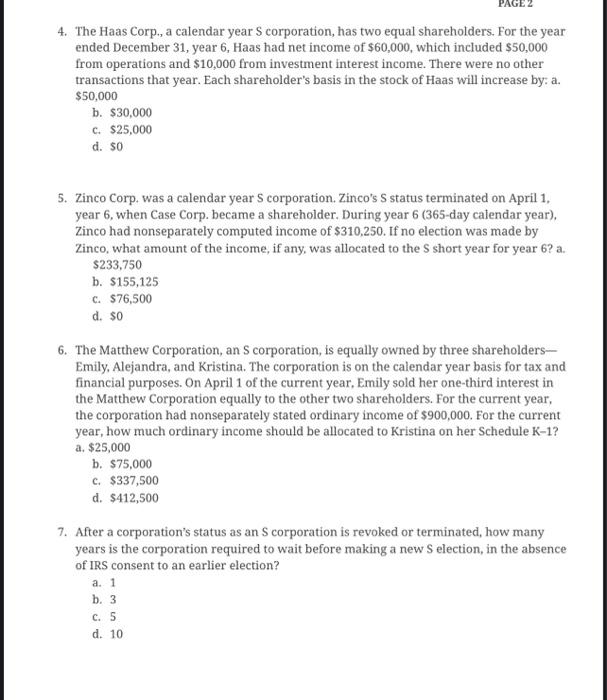

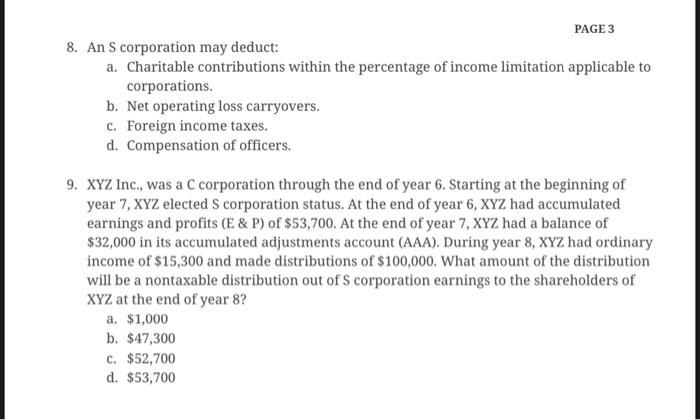

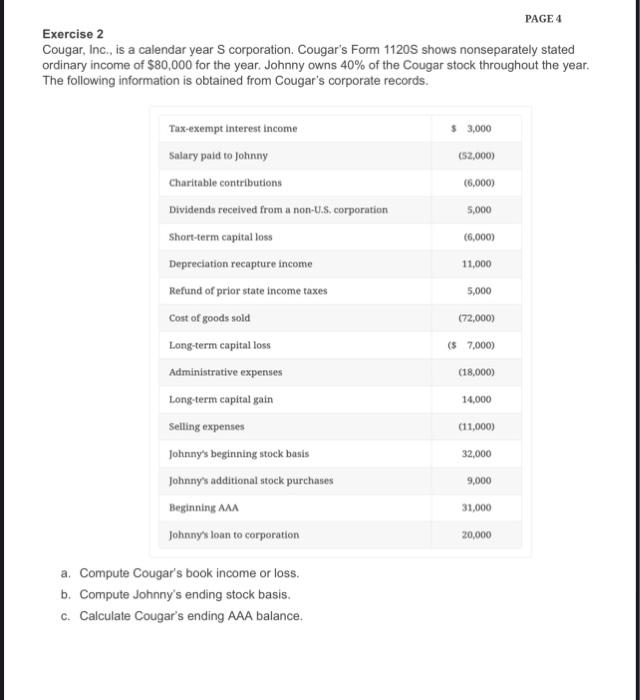

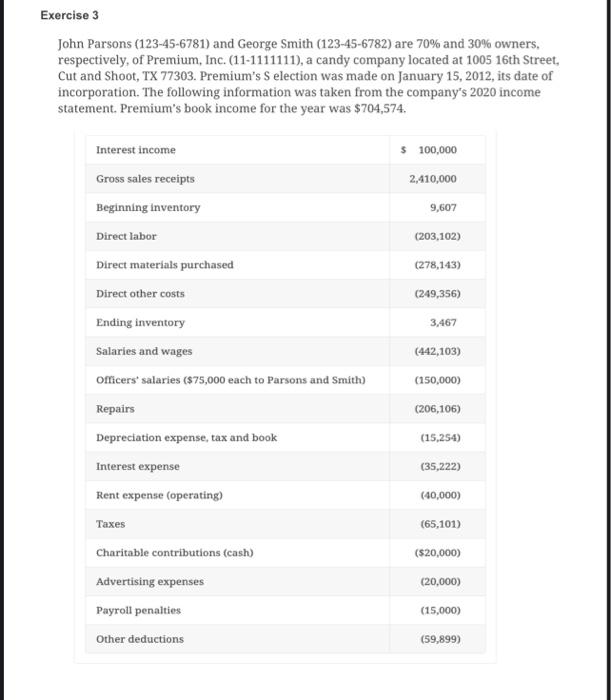

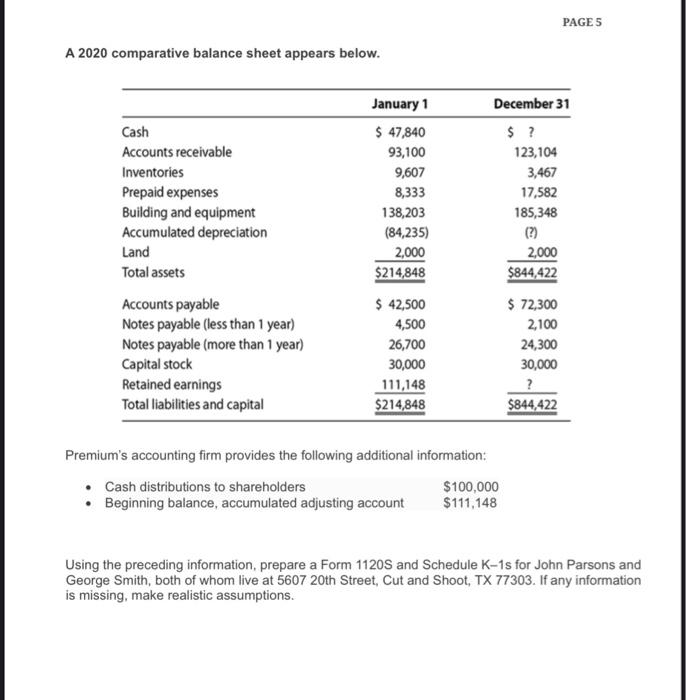

Becker CPA Review Questions 1. Village Corp., a calendar year corporation, began business in year 1. Village made a valid S corporation election on December 5 , year 4 , with the unanimous consent of its shareholders. The eligibility requirements for S status continued to be met throughout year 5 . On what date did Village's S status become effective? a. January 1 , year 4 b. January 1 , year 5 c. December 5 , year 4 d. December 5 , year 5 2. Fox Corp., an S corporation, had an ordinary loss of $36,500 for the year ended December 31, year 2. At January 1, year 2, Duffy owned 50% of Fox's stock. Duffy held the stock for 40 days in year 2 before selling the entire 50% interest to an unrelated third party. Duffy's basis for the stock was $10,000. Duffy was a full-time employee of Fox until the stock was sold. Duffy's share of Fox's loss was: a. $0 b. $2,000 c. $10,000 d. $18,250 3. An S corporation has 30,000 shares of voting common stock and 20,000 shares of nonvoting common stock issued and outstanding. The S election can be revoked voluntarily with the consent of the shareholders holding, on the day of the revocation, the following number of outstanding shares. 4. The Haas Corp., a calendar year S corporation, has two equal shareholders. For the year ended December 31 , year 6 , Haas had net income of $60,000, which included $50,000 from operations and $10,000 from investment interest income. There were no other transactions that year. Each shareholder's basis in the stock of Haas will increase by: a. $50,000 b. $30,000 c. $25,000 d. $0 5. Zinco Corp. was a calendar year S corporation. Zinco's S status terminated on April 1 , year 6, when Case Corp. became a shareholder. During year 6 (365-day calendar year). Zinco had nonseparately computed income of $310,250. If no election was made by Zinco, what amount of the income, if any, was allocated to the S short year for year 6 ? a. $233,750 b. $155,125 c. $76,500 d. $0 6. The Matthew Corporation, an S corporation, is equally owned by three shareholdersEmily, Alejandra, and Kristina. The corporation is on the calendar year basis for tax and financial purposes. On April 1 of the current year, Emily sold her one-third interest in the Matthew Corporation equally to the other two shareholders. For the current year, the corporation had nonseparately stated ordinary income of $900,000. For the current year, how much ordinary income should be allocated to Kristina on her Schedule K-1? a. $25,000 b. $75,000 c. $337,500 d. $412,500 7. After a corporation's status as an S corporation is revoked or terminated, how many years is the corporation required to wait before making a new S election, in the absence of IRS consent to an earlier election? a. 1 b. 3 c. 5 d. 10 8. An S corporation may deduct: a. Charitable contributions within the percentage of income limitation applicable to corporations. b. Net operating loss carryovers. c. Foreign income taxes. d. Compensation of officers. 9. XYZ Inc., was a C corporation through the end of year 6 . Starting at the beginning of year 7, XYZ elected S corporation status. At the end of year 6,XYZ had accumulated earnings and profits (E \& P) of $53,700. At the end of year 7,XYZ had a balance of $32,000 in its accumulated adjustments account (AAA). During year 8 , XYZ had ordinary income of $15,300 and made distributions of $100,000. What amount of the distribution will be a nontaxable distribution out of S corporation earnings to the shareholders of XYZ at the end of year 8 ? a. $1,000 b. $47,300 c. $52,700 d. $53,700 Exercise 2 Cougar, Inc., is a calendar year S corporation. Cougar's Form 1120S shows nonseparately stated ordinary income of $80,000 for the year. Johnny owns 40% of the Cougar stock throughout the year. The following information is obtained from Cougar's corporate records. a. Compute Cougar's book income or loss. b. Compute Johnny's ending stock basis. c. Calculate Cougar's ending AAA balance. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium's S election was made on January 15, 2012, its date of incorporation. The following information was taken from the company's 2020 income statement. Premium's book income for the year was $704,574. A 2020 comparative balance sheet appears below. Premium's accounting firm provides the following additional information: Using the preceding information, prepare a Form 1120S and Schedule K-1s for John Parsons and George Smith, both of whom live at 5607 20th Street, Cut and Shoot, TX 77303. If any information is missing, make realistic assumptions