Answered step by step

Verified Expert Solution

Question

1 Approved Answer

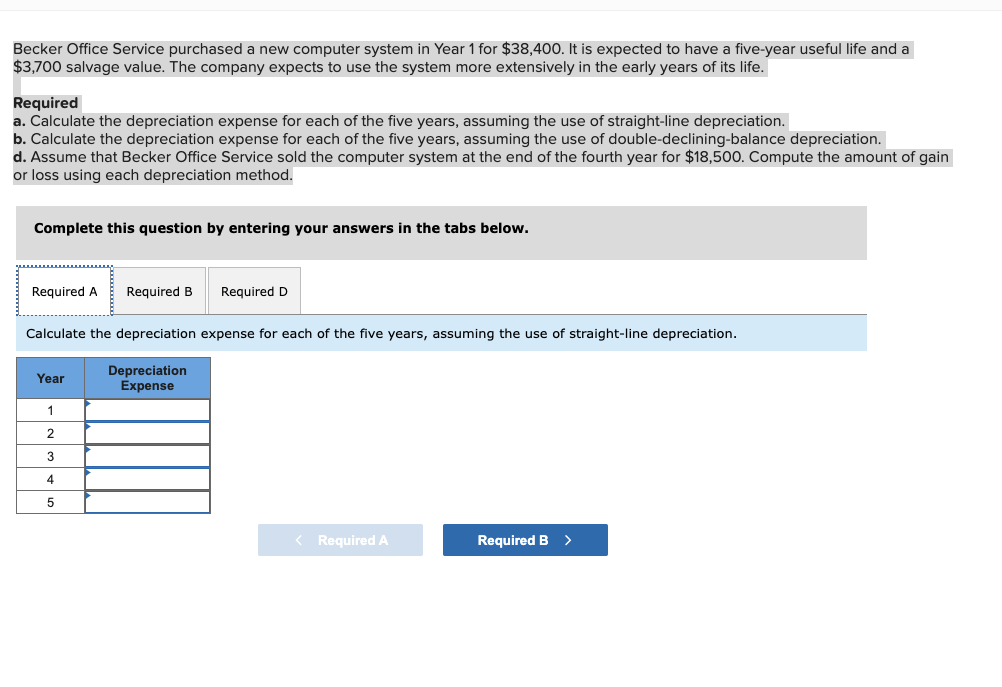

Becker Office Service purchased a new computer system in Year 1 for $ 3 8 , 4 0 0 . It is expected to have

Becker Office Service purchased a new computer system in Year for $ It is expected to have a fiveyear useful life and a $ salvage value. The company expects to use the system more extensively in the early years of its life.

Required

a Calculate the depreciation expense for each of the five years, assuming the use of straightline depreciation.

b Calculate the depreciation expense for each of the five years, assuming the use of doubledecliningbalance depreciation.

d Assume that Becker Office Service sold the computer system at the end of the fourth year for $ Compute the amount of gain or loss using each depreciation method.Becker Office Service purchased a new computer system in Year for $ It is expected to have a fiveyear useful life and a

$ salvage value. The company expects to use the system more extensively in the early years of its life.

Required

a Calculate the depreciation expense for each of the five years, assuming the use of straightline depreciation.

b Calculate the depreciation expense for each of the five years, assuming the use of doubledecliningbalance depreciation.

d Assume that Becker Office Service sold the computer system at the end of the fourth year for $ Compute the amount of gain

or loss using each depreciation method.

Complete this question by entering your answers in the tabs below.

Calculate the depreciation expense for each of the five years, assuming the use of straightline depreciation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started