Question

Becker Products Company produces three products from a joint source. A single raw material is introduced into Process I from which products A, B, and

Becker Products Company produces three products from a joint source. A single raw material is introduced into Process I from which products A, B, and C emerge. Product A is considered to be a byproduct and is sold immediately after split-off. Products B and C are processed further in Process II and Process III, respectively, before they are sold as Butine and Cantol.

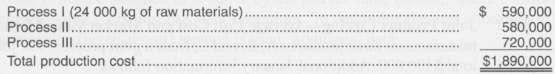

Production costs for February are as follows:

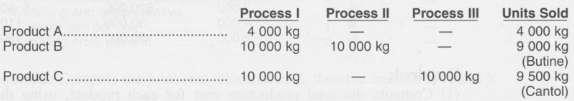

The number of units (kg) of product produced and sold in February is as follows:

The average price per unit sold in February for each of the products is as follows:

Product A .................... $ 15 per kg

Butine ....................... 130

Cantol ...................... 120

There were no inventories of intermediate products B and C at the beginning or end of February and there was no waste or spoilage in any of the processes. The by-product is not accounted for separately; instead, revenue from sales of the by-product is treated as a deduction from joint cost.

Required:

(1) Calculate the cost of the finished goods inventories if the average unit cost method of joint cost allocation is used.

(2) Calculate the value of cost of goods sold if the market value method of joint cost allocation is used. Round allocated joint cost to nearest one thousand dollars.

(3) The company controller argues that the market value method of allocation is the most accurate way to allocate joint cost. The president replies that the average unit cost method is simpler and easier to understand, especially if he has to make a decision about whether to drop a product or continue to process it. The controller claims that using the market value method to analyze a drop or continue decision would be better. Respond to both the president's and controller's comments, and briefly explain the reasons for allocating joint cost.

Process I (24 000 kg of raw materials). Process II.. Process IlI. 590,000 580,000 720,000 $1,890,000 Total production cost..

Step by Step Solution

3.62 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Average unit cost method Joint cost of 590000 less 60000 byproduct credit 15 4 000 kg 530000 53000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started