Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U-Pick Fruit Corp., a C Corporation, was formed many years ago as a you pick farm where customers can pick various types of fruits

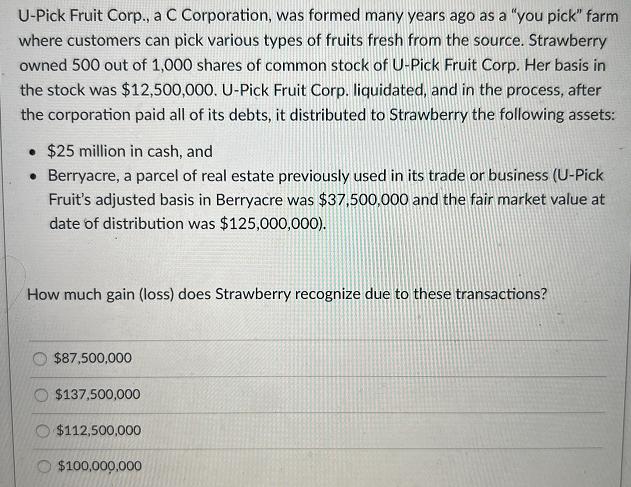

U-Pick Fruit Corp., a C Corporation, was formed many years ago as a "you pick" farm where customers can pick various types of fruits fresh from the source. Strawberry owned 500 out of 1,000 shares of common stock of U-Pick Fruit Corp. Her basis in the stock was $12,500,000. U-Pick Fruit Corp. liquidated, and in the process, after the corporation paid all of its debts, it distributed to Strawberry the following assets: $25 million in cash, and Berryacre, a parcel of real estate previously used in its trade or business (U-Pick Fruit's adjusted basis in Berryacre was $37,500,000 and the fair market value at date of distribution was $125,000,000). How much gain (loss) does Strawberry recognize due to these transactions? $87,500,000 $137,500,000 $112,500,000 $100,000,000

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate a realized gain or loss take the difference of total cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started