Question

Hedged Forecasted Sale Bectel, Inc. expects to sell merchandise for C$1,000,000 to a Canadian customer at the end of November, 2020. In anticipation of this

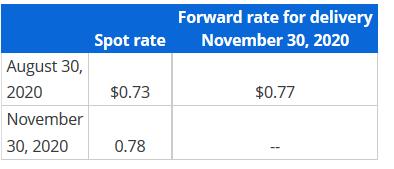

Hedged Forecasted Sale Bectel, Inc. expects to sell merchandise for C$1,000,000 to a Canadian customer at the end of November, 2020. In anticipation of this forecasted transaction, on August 30, 2020, Bectel sold C$1,000,000 forward for delivery on November 30, 2020. Bectel made the sale as expected on November 30, and settled the forward contract. Relevant exchange rates ($/C$) are as follows:

Required

Prepare the journal entries made by Bectel on November 30 concerning the above events. Assume Bectel is a calendar-year company. There are 4 total entries.

Forward rate for delivery Spot rate November 30, 2020 August 30, 2020 $0.73 $0.77 November 30, 2020 0.78

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required solution journal entries as required Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e33ee0d368_182322.pdf

180 KBs PDF File

635e33ee0d368_182322.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started