Answered step by step

Verified Expert Solution

Question

1 Approved Answer

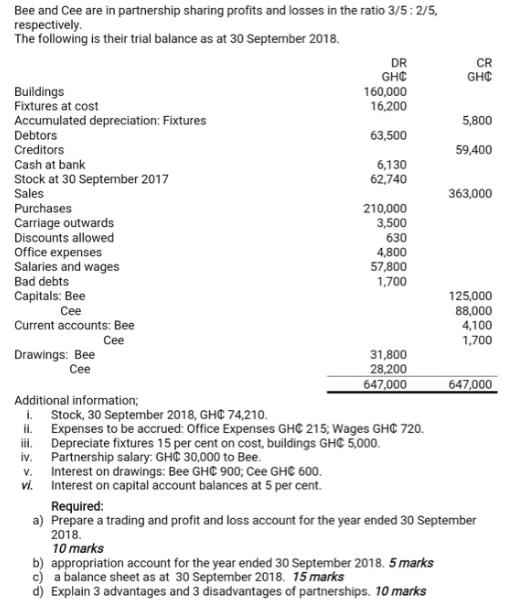

Bee and Cee are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively. The following is their trial balance as at

Bee and Cee are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively. The following is their trial balance as at 30 September 2018. Buildings Fixtures at cost Accumulated depreciation: Fixtures Debtors Creditors Cash at bank Stock at 30 September 2017 Sales Purchases Carriage outwards Discounts allowed Office expenses Salaries and wages Bad debts Capitals: Bee Cee Current accounts: Bee Drawings: Bee Cee Cee Additional information; i. Stock, 30 September 2018, GHC 74,210. DR GHC CR GHC 160,000 16,200 5,800 63,500 59,400 6,130 62,740 363,000 210,000 3,500 630 4,800 57,800 1,700 125,000 88,000 4,100 1,700 31,800 28,200 647,000 647,000 ii. Expenses to be accrued: Office Expenses GHC 215; Wages GHC 720. iii. Depreciate fixtures 15 per cent on cost, buildings GHC 5,000. iv. Partnership salary: GHC 30,000 to Bee. v. Interest on drawings: Bee GHC 900; Cee GHC 600. vi. Interest on capital account balances at 5 per cent. Required: a) Prepare a trading and profit and loss account for the year ended 30 September 2018. 10 marks b) appropriation account for the year ended 30 September 2018. 5 marks c) a balance sheet as at 30 September 2018. 15 marks d) Explain 3 advantages and 3 disadvantages of partnerships. 10 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Trading and Profit Loss Account for the year ended 30 September 2018 Sales GHC 363000 Less Opening S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started