Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bee's Landscaping specializes in selling manure for plants. The company sells a bag of manure for $1,200 each which includes a margin of 20%

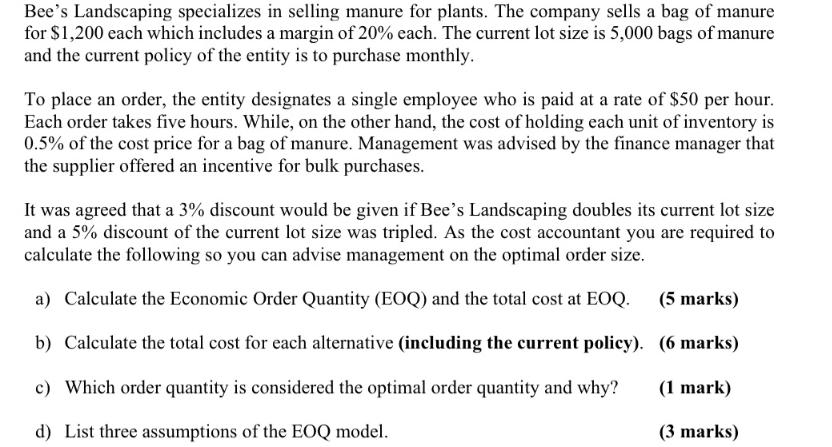

Bee's Landscaping specializes in selling manure for plants. The company sells a bag of manure for $1,200 each which includes a margin of 20% each. The current lot size is 5,000 bags of manure and the current policy of the entity is to purchase monthly. To place an order, the entity designates a single employee who is paid at a rate of $50 per hour. Each order takes five hours. While, on the other hand, the cost of holding each unit of inventory is 0.5% of the cost price for a bag of manure. Management was advised by the finance manager that the supplier offered an incentive for bulk purchases. It was agreed that a 3% discount would be given if Bee's Landscaping doubles its current lot size and a 5% discount of the current lot size was tripled. As the cost accountant you are required to calculate the following so you can advise management on the optimal order size. a) Calculate the Economic Order Quantity (EOQ) and the total cost at EOQ. b) Calculate the total cost for each alternative (including the current policy). c) Which order quantity is considered the optimal order quantity and why? d) List three assumptions of the EOQ model. (5 marks) (6 marks) (1 mark) (3 marks)

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the Economic Order Quantity EOQ and the total cost at EOQ To calculate the Economic Orde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started